Looking to negotiate better terms on a car lease? You’ve come to the right place! In this article, we’ll guide you through practical tips and strategies to help you get the best deal possible. Whether you’re a first-time leaser or looking to upgrade your existing lease, understanding the negotiation process is key. By honing your negotiation skills and being prepared, you can potentially save money, secure more favorable terms, and drive away in the car of your dreams. So, let’s dive in and learn how to negotiate better terms on a car lease.

How to Negotiate Better Terms on a Car Lease

Introduction

Leasing a car can be a great option for those who don’t want the long-term commitment and financial responsibility of owning a vehicle. However, negotiating the terms of a car lease can be a daunting task. From understanding leasing jargon to knowing how to negotiate the price and terms, there are several factors to consider. In this article, we will guide you through the process of negotiating better terms on a car lease, giving you the confidence to secure a deal that suits your needs and budget.

Understanding Car Leasing Basics

Before diving into the negotiation process, it’s essential to familiarize yourself with the basics of car leasing. Here are a few key terms you need to understand:

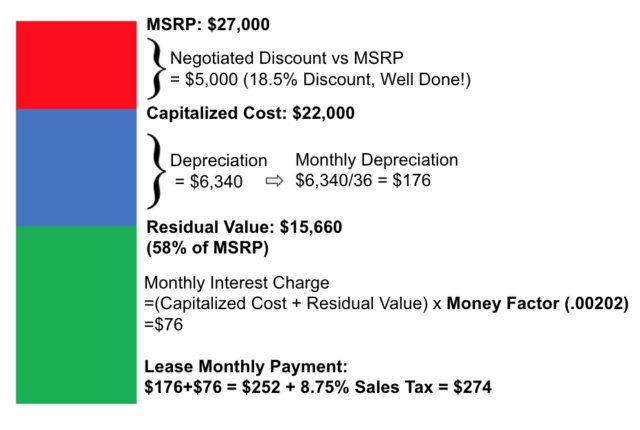

- Capitalized Cost: This is the negotiated price of the vehicle you want to lease.

- Residual Value: It refers to the estimated value of the vehicle at the end of the lease.

- Money Factor: Similar to an interest rate, the money factor determines the finance charge on your lease.

- Lease Term: The lease term represents the length of the agreement, typically measured in months.

Research and Compare Lease Offers

Before stepping into a dealership, it’s crucial to research and compare lease offers from different dealers. Here’s what you should do:

- Research online to find dealerships that offer the specific make and model you’re interested in leasing.

- Compare the lease terms, such as the monthly payments, down payment, mileage limitations, and lease duration.

- Consider the overall cost of the lease, including any additional fees or charges.

- Read customer reviews and ratings to gather insights on the dealership’s reputation and customer service.

Consider Your Budget and Needs

To negotiate better terms on a car lease, it’s crucial to understand your budget and needs. Consider the following factors:

- Monthly Payment: Determine the maximum monthly payment you can afford without straining your finances.

- Down Payment: Decide whether you want to make a down payment upfront or roll it into the monthly payments.

- Mileage Limitations: Estimate your annual mileage and ensure the lease terms provide an allowance that suits your needs.

- Lease Duration: Determine how long you want to lease the vehicle and find a term that aligns with your preferences.

Timing is Key

Understanding the right time to lease a car can give you an advantage during negotiations. Consider the following timing tips:

- Choose to lease a car towards the end of the month or quarter when dealerships are more likely to offer better deals to meet their sales targets.

- Look for lease specials during holiday seasons or when new vehicle models are about to be released.

- Consider leasing an outgoing model year vehicle as dealerships often offer more attractive incentives and discounts to clear inventory.

Prepare for Negotiations

Proper preparation can significantly improve your chances of negotiating better lease terms. Here’s what you can do:

- Know the Vehicle’s Value: Research the market value and invoice price of the vehicle you want to lease to have a realistic understanding of its worth.

- Check Current Lease Offers: Stay updated on any ongoing lease incentives or special offers provided by the vehicle manufacturer.

- Get Pre-approved: Consider getting pre-approved for a lease by a third-party lender to have a bargaining chip during negotiations.

- Inspect the Vehicle: Before finalizing the lease, thoroughly inspect the vehicle for any damages or issues that could affect its value.

Mastering the Negotiation Process

Negotiating with the dealership can be intimidating, but with these tips, you can approach it with confidence:

- Focus on the Total Cost: Instead of getting caught up in monthly payments, negotiate the total cost of the lease, including any fees, taxes, and extra options.

- Negotiate the Capitalized Cost: Try to lower the negotiated price of the vehicle to reduce your monthly payments.

- Consider Multiple Dealerships: Don’t settle for the first offer you receive. Compare multiple offers and use them as leverage to negotiate better terms.

- Beware of Upsells: Dealerships may try to sell additional services or add-ons. Evaluate them carefully and only opt for what you truly need.

- Understand the Residual Value: Negotiate a higher residual value, as it directly affects the monthly payments and potential purchase price at the end of the lease.

- Be Open to Alternatives: If the leasing terms are not ideal, consider exploring different makes, models, or lease options that could better suit your budget and needs.

Finalizing the Lease Agreement

Once you’ve negotiated the terms to your satisfaction, it’s time to finalize the lease agreement. Consider the following steps:

- Review the lease contract thoroughly, ensuring that all negotiated terms are accurately reflected.

- Pay attention to the details, including the lease term, mileage limitations, fees, and any penalties.

- Ask questions if something is unclear or if you need further clarification.

- Sign the lease contract only when you are fully satisfied with the terms and understand your obligations as a lessee.

Negotiating better terms on a car lease requires research, preparation, and effective communication. By understanding the fundamentals of car leasing, comparing offers, considering your budget and needs, and mastering the negotiation process, you can secure a lease agreement that works in your favor. Remember, timing, knowledge, and assertiveness are key to achieving a favorable outcome. So, go ahead, apply these strategies, and drive away in your leased car with confidence. Happy negotiating!

How to Negotiate The LOWEST Car Lease Payment (Step by Step)

Frequently Asked Questions

Frequently Asked Questions (FAQs)

Question 1: How can I negotiate better terms on a car lease?

When negotiating better terms on a car lease, consider the following strategies:

- Research the market value of the car you want to lease to have a baseline for negotiations.

- Compare lease deals from multiple dealerships to find the best offers.

- Be prepared to negotiate the price, down payment, monthly payments, mileage limits, and lease duration.

- Consider leasing during a promotional period or at the end of the model year when dealerships may have better incentives.

- Maintain a good credit score to qualify for lower interest rates and better lease terms.

- Be willing to walk away if the terms are not favorable – there are always other options available.

Question 2: Can I negotiate the price of a car when leasing?

Yes, you can negotiate the price of a car when leasing. The capitalized cost, also known as the negotiated or agreed-upon price, is one of the primary factors that influence your monthly payments. By negotiating a lower purchase price, you can reduce the overall cost of the lease.

Question 3: Should I negotiate the monthly payment or the total cost when leasing a car?

It is generally more effective to negotiate the total cost of the lease rather than focusing solely on the monthly payment. By negotiating the overall cost, including the purchase price, fees, and interest rates, you have a better chance of securing more favorable terms for the lease.

Question 4: Are there any fees that I can negotiate when leasing a car?

While some fees associated with a car lease are non-negotiable, there are others that you may be able to negotiate or even have waived. These fees could include the acquisition fee, documentation fee, and dealer fees. It is recommended to discuss these fees with the dealership and try to negotiate them down if possible.

Question 5: How can I negotiate the mileage limit on a car lease?

When negotiating the mileage limit on a car lease, you can consider a few strategies:

- Estimate your annual mileage needs and negotiate a higher mileage allowance upfront.

- Pay for additional miles in advance at a lower rate, if available.

- Explore options for lower mileage leases or leases with flexible mileage terms.

Question 6: Can I negotiate the lease duration?

While the lease duration is often determined by the leasing company, it may still be possible to negotiate this aspect. Some dealerships may offer shorter or longer lease terms, depending on their inventory and current promotions. Discussing your needs and preferences with the dealership can help you explore your options.

Question 7: Is it advisable to lease a car at the end of the model year?

Leasing a car at the end of the model year can be advantageous in terms of negotiating better terms. Dealerships may have incentives to clear out inventory and make room for new models. This can result in more favorable lease offers, discounted prices, or additional benefits.

Question 8: How does having a good credit score help in negotiating better lease terms?

A good credit score can play a significant role in negotiating better lease terms. With a higher credit score, you are seen as a lower-risk lessee, allowing you to qualify for lower interest rates, reduced fees, and more favorable lease conditions. It is essential to check and maintain a good credit score before entering lease negotiations.

Final Thoughts

When negotiating better terms on a car lease, preparation is key. Start by researching the average lease terms and rates for the specific make and model you are interested in. This will give you a baseline for negotiations. Next, gather information on any current lease incentives or promotions being offered by the dealership or manufacturer. Armed with this knowledge, approach the negotiation process confidently and be prepared to negotiate the monthly payment, lease duration, mileage limits, and any additional fees or charges. Remember to remain assertive, yet polite, and be willing to walk away if the terms do not meet your needs. By following these steps and being proactive in your approach, you can successfully negotiate better terms on your car lease.