Want to know how to negotiate lower interest rates on your debt? Look no further! In this article, we will guide you through proven strategies to help you lower your interest rates and save money. Whether you’re dealing with credit card debt, student loans, or a mortgage, understanding the negotiation process is crucial. By mastering the art of negotiation, you can take control of your financial situation and potentially reduce the burden of high interest rates. So, let’s dive in and discover how to negotiate lower interest rates on debt!

How to Negotiate Lower Interest Rates on Debt

Debt can be a burden that weighs you down, especially when you’re faced with high interest rates. Fortunately, there are strategies you can use to negotiate lower interest rates on your debt. By understanding the negotiation process, preparing yourself, and effectively communicating with your creditors or lenders, you can potentially save a significant amount of money in interest payments. In this article, we will explore a variety of tactics and tips to help you successfully negotiate lower interest rates on your debt.

1. Understand Your Current Interest Rates

Before you can begin negotiating for lower interest rates, it’s crucial to have a clear understanding of your current rates. Start by gathering all the necessary information about your debts, including the interest rates, balances, and terms. Create a comprehensive list that includes each creditor or lender, the type of debt (e.g., credit card, personal loan, mortgage), and the corresponding interest rates.

Organizing this information will allow you to see the bigger picture and prioritize which debts to focus on first. It will also help you determine if the current interest rates are reasonable or if they are higher than average. This knowledge will be essential when negotiating with your creditors or lenders.

2. Research and Compare Interest Rates

Once you have a clear understanding of your current interest rates, take some time to research and compare the prevailing interest rates in the market. This step is particularly important if you have been with the same creditor or lender for a significant period, as interest rates may have changed since you initially took on the debt.

Look for financial institutions, credit unions, or online lenders that offer similar types of loans or credit products. Explore their interest rates and terms to get a sense of what is currently available. Armed with this information, you will have a basis for negotiation and be better prepared to make a compelling case for lower interest rates.

3. Assess Your Creditworthiness

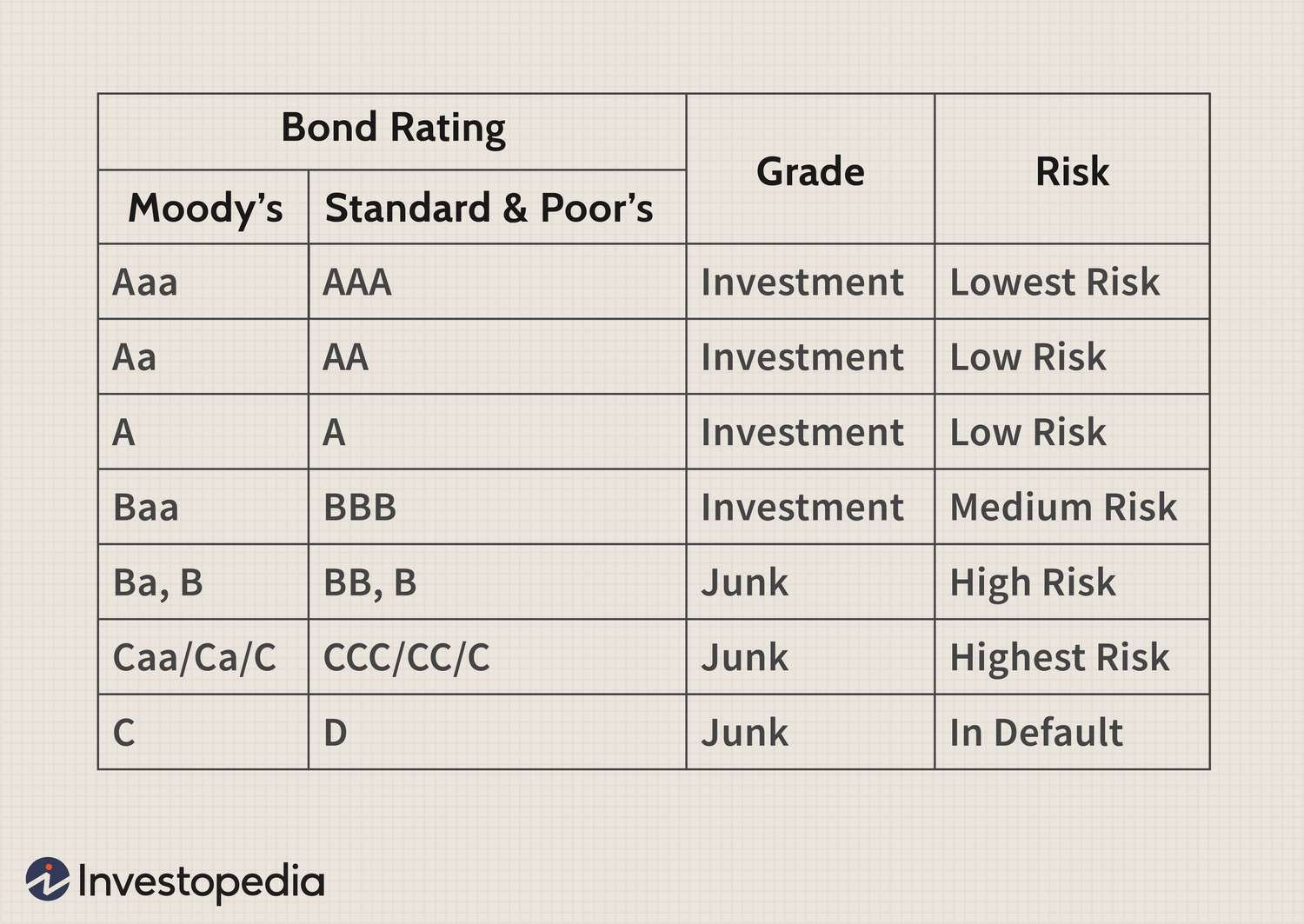

Your creditworthiness plays a crucial role in negotiating lower interest rates. Creditors and lenders often offer better rates to borrowers with excellent credit scores and a proven track record of responsible financial behavior. Therefore, it’s essential to assess your creditworthiness before approaching your creditors or lenders.

Obtain copies of your credit reports from the major credit bureaus and review them for any errors or inaccuracies. Address any issues or discrepancies by contacting the credit bureaus and providing the necessary documentation. Additionally, make sure you have a clear understanding of your credit score, as this will help you gauge your bargaining power and anticipate how your creditors or lenders may perceive you during negotiations.

4. Prepare a Strong Negotiation Strategy

Preparation is key when it comes to negotiating lower interest rates on debt. Take the time to develop a strong negotiation strategy that outlines your objectives, key talking points, and potential alternatives. Here are some elements to consider:

- Know your ideal outcome: Determine the specific interest rate reduction you are seeking and the maximum monthly payment you can afford.

- Highlight your history: Emphasize your good payment history, loyalty to the creditor or lender, and any positive changes in your financial situation.

- Showcase your research: Share your findings from comparing interest rates in the market and explain why a lower rate is fair and reasonable.

- Consider alternatives: Prepare alternatives such as balance transfers, debt consolidation, or refinancing options to present in case negotiation fails.

- Stay calm and confident: Practice your negotiation points and maintain a calm and confident demeanor during the negotiation process.

5. Initiate Contact with Creditors or Lenders

With your preparation complete, it’s time to initiate contact with your creditors or lenders. Start by reaching out to their customer service departments via phone or email. When contacting them, be sure to:

- Be polite and professional: Approach the conversation with respect and professionalism, as this will increase the likelihood of a positive outcome.

- Explain your situation: Clearly articulate your desire to negotiate lower interest rates and briefly explain your financial circumstances.

- Present your case: Discuss your research and the alternatives you have considered, highlighting why a lower interest rate would be mutually beneficial.

- Listen actively: Give the creditor or lender an opportunity to respond and listen carefully to their counteroffer or suggestions.

6. Negotiate, Compromise, and Document Agreements

Once you have initiated contact and presented your case, the negotiation process begins. It’s important to remember that negotiation is a two-way street, and compromises may be necessary to reach an agreement. Here are some negotiation tips to keep in mind:

- Be flexible: Be open to compromises that may include shorter repayment terms or other adjustments that can benefit both parties.

- Ask for a supervisor or manager: If the initial representative is unable to meet your request, politely ask to speak with a supervisor or manager who may have more authority to negotiate.

- Get the agreement in writing: Once you have reached an agreement, ask for written confirmation that outlines the new interest rate and any other terms or conditions discussed.

7. Follow Up and Track Changes

After successfully negotiating lower interest rates, it’s crucial to keep track of any changes made and ensure they are implemented correctly. Monitor your account statements, payment schedules, and interest charges to confirm that the agreed-upon changes have been applied.

If you notice any discrepancies or errors, contact your creditor or lender immediately to rectify the situation. Maintaining open communication and actively monitoring your account will help you stay on top of your progress and ensure the negotiated interest rates are being honored.

Remember, negotiating lower interest rates on debt requires patience, persistence, and effective communication skills. By following these strategies and tips, you can increase your chances of successfully reducing the burden of high interest rates and improving your financial well-being.

How to negotiate a lower credit card interest rate

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How can I negotiate lower interest rates on my debt?

1. Can I negotiate lower interest rates with my credit card company?

Yes, you can negotiate lower interest rates with your credit card company. Start by calling the customer service number on the back of your credit card and ask if they can lower your interest rate. Explain your financial situation and provide any supporting documentation if necessary.

Are there any specific strategies I can use to negotiate lower interest rates on my debt?

2. Should I mention the possibility of transferring my balance to another credit card?

Yes, mentioning the possibility of transferring your balance to another credit card with a lower interest rate can give you leverage during negotiations. If your current credit card company sees that you are considering switching to a competitor, they may be more willing to offer you a lower interest rate to keep your business.

3. Is it better to negotiate with a supervisor or a regular customer service representative?

While regular customer service representatives can often assist with negotiating interest rates, supervisors may have more authority and flexibility in making decisions. If you are not making progress with a regular representative, politely ask to speak with a supervisor.

4. How can I improve my chances of success when negotiating lower interest rates?

One way to improve your chances of success is to have a good payment history with the creditor. If you have been making regular payments on time and have a positive credit history, the creditor may be more inclined to consider your request for a lower interest rate.

Can I negotiate lower interest rates on other types of debt?

5. Can I negotiate lower interest rates on my mortgage?

It is possible to negotiate lower interest rates on your mortgage. Contact your lender and explain your situation. They may be willing to modify the terms of your mortgage, including the interest rate, to make it more manageable for you.

6. Is it possible to negotiate lower interest rates on student loans?

While it may be more challenging to negotiate lower interest rates on student loans, it is worth exploring your options. Contact your loan servicer or lender and inquire about any available programs or options for lowering your interest rates.

What other factors should I consider when negotiating lower interest rates?

7. Should I be prepared to offer a lump sum payment in exchange for a lower interest rate?

Offering a lump sum payment in exchange for a lower interest rate can be a possible negotiation strategy. If you have a sum of money available to pay off a portion of your debt, the creditor may be willing to lower your interest rate as an incentive for receiving immediate payment.

8. Can I utilize the services of a professional debt negotiator to help me with negotiating lower interest rates?

Yes, you can seek the services of a professional debt negotiator to help you with negotiating lower interest rates. These professionals have experience dealing with creditors and may have established relationships that can be beneficial in negotiations.

Final Thoughts

To negotiate lower interest rates on debt, start by gathering information about your current interest rates and comparing them to current market rates. Then, contact your creditors and explain your financial situation, emphasizing your willingness to repay the debt. Be prepared to provide evidence of your ability to make regular payments. During negotiations, remain persistent and be open to compromises such as extended payment terms or lump-sum settlements. Remember to stay calm and polite throughout the process. By taking these steps, you can increase your chances of successfully negotiating lower interest rates on your debt.