Are you searching for a practical guide on how to prepare a 5-year financial plan? Look no further! In this article, we will dive straight into the steps you need to take to create a comprehensive financial roadmap for the next five years. Whether you’re aiming to save for a major purchase, pay off debt, or build wealth, a well-planned financial strategy is essential. By the end of this article, you’ll have all the tools and knowledge to confidently craft your 5-year financial plan, ensuring a secure and prosperous future. So let’s get started!

How to Prepare a 5-Year Financial Plan

Introduction

Planning your finances is an essential step towards achieving your financial goals. A 5-year financial plan provides a roadmap to help you make informed decisions about your money, investments, and savings over the next five years. By setting clear objectives, evaluating your current financial situation, and projecting future income and expenses, you can create a solid foundation for financial success. In this article, we will guide you through the process of preparing a comprehensive 5-year financial plan.

1. Determine Your Financial Goals

Before diving into creating a financial plan, it’s important to define your financial goals. Start by considering both your short-term and long-term objectives. Short-term goals might include saving for a vacation or paying off debt, while long-term goals could involve saving for retirement or purchasing a home. Once you have a clear understanding of what you want to achieve, you can proceed to the next steps.

1.1 Prioritize Your Goals

Not all goals carry the same level of importance, so it’s crucial to prioritize them. Evaluate which goals are most critical for your financial well-being and assign them a higher priority. This will help you allocate your resources more effectively and focus your efforts on achieving the goals that matter most to you.

1.2 Make Your Goals Specific and Measurable

To increase the chances of achieving your goals, make them specific and measurable. For example, instead of stating a vague goal like “save money,” define the exact amount you want to save within a specific timeframe. This way, you’ll have a clear target to work towards.

1.3 Set Realistic and Attainable Goals

While it’s important to set ambitious goals, it’s equally crucial to be realistic. Setting unattainable goals can lead to frustration and demotivation. Assess your financial situation and determine what is achievable within the next five years. Remember, it’s better to achieve smaller goals than to set unrealistic expectations and fall short.

2. Evaluate Your Current Financial Situation

Before moving forward with your 5-year financial plan, you need to have a thorough understanding of your current financial situation. This evaluation will serve as the foundation for your plan and help you identify areas for improvement. Consider the following steps:

2.1 Calculate Your Net Worth

Calculating your net worth involves taking stock of your assets (property, investments, savings) and subtracting your liabilities (debt, loans). This figure represents your overall financial health and can help you gauge your progress over time. Update your net worth regularly to track changes and adjustments needed in your financial plan.

2.2 Assess Your Income and Expenses

Analyze your income sources and assess your expenses over the past year. Categorize your expenses into fixed (e.g., rent, utilities) and variable (e.g., entertainment, dining out). This evaluation will provide insights into your spending habits and assist in budgeting for the future.

2.3 Review Your Debt and Credit Score

Examine your outstanding debts, including credit card balances, loans, and mortgages. Take note of interest rates, monthly payments, and due dates. Additionally, check your credit score and identify any potential issues that may impact your ability to secure loans or obtain favorable interest rates in the future.

3. Create a Budget

A budget is a crucial component of any financial plan as it allows you to allocate your income towards your goals and manage your expenses effectively. Follow these steps to create and maintain a budget:

3.1 Track Your Spending

Start by tracking your expenses for a few months to understand where your money is going. Use banking apps, expense tracking tools, or simply keep a record manually. This exercise will help you identify areas where you can cut back and save more.

3.2 Determine Your Income

Calculate your total monthly income, including salary, bonuses, investments, and any other sources of income. Make sure to account for taxes and deductions to get an accurate estimate of your disposable income.

3.3 Allocate Your Income

Based on your goals and existing financial commitments, allocate your income accordingly. Prioritize essential expenses such as housing, utilities, and debt repayment. Set aside savings for emergencies and allocate funds towards each of your financial goals.

3.4 Regularly Review and Adjust Your Budget

A budget is not set in stone. Regularly review your budget to ensure it aligns with your goals and financial situation. Adjustments may be necessary as circumstances change or unexpected expenses arise. Flexibility and adaptability are key to maintaining a realistic and effective budget.

4. Plan for Major Expenses and Life Events

Within a 5-year timeframe, major expenses and life events are likely to occur. Planning for these events in advance will prevent financial stress and ensure you’re prepared. Some key events to consider include:

4.1 Homeownership

If purchasing a home is one of your goals, start planning early. Research the housing market, save for a down payment, and consider mortgage options available to you. Factor in additional costs like property taxes, maintenance, and insurance.

4.2 Education

If you or your dependents plan to pursue higher education, estimate the costs associated with tuition, books, accommodation, and living expenses. Explore available scholarships, grants, and education savings plans to alleviate the financial burden.

4.3 Marriage or Family Planning

Getting married or starting a family requires financial planning. Consider factors such as wedding costs, healthcare expenses, and childcare expenses when creating your 5-year financial plan.

4.4 Retirement

Even if retirement seems far off, it’s never too early to start saving for it. Research retirement savings accounts, such as a 401(k) or an individual retirement account (IRA), and contribute regularly. Aim to maximize employer-matching contributions if available.

5. Review and Adjust Regularly

A 5-year financial plan is not a one-time endeavor; it requires regular review and adjustment. Life circumstances, financial markets, and personal goals can change over time, necessitating modifications to your plan. Consider the following actions:

5.1 Track Your Progress

Regularly monitor your progress towards your financial goals. Review your net worth, savings, and investments to ensure you are on track. Celebrate milestones along the way to stay motivated.

5.2 Reassess Your Goals

Revisit your financial goals periodically to determine if they still align with your aspirations. As priorities change or new opportunities arise, adjust your goals accordingly. Remember, flexibility is key to successful financial planning.

5.3 Consult with Professionals

When in doubt, seek advice from financial professionals. Accountants, financial advisors, or certified financial planners can offer expert guidance and help optimize your financial plan based on your specific circumstances.

5.4 Stay Informed

Keep yourself updated on financial news, market trends, and changes in regulations that may impact your investments or financial decisions. Being well-informed will enable you to make educated choices and adapt to market dynamics.

Creating a 5-year financial plan is a proactive approach to managing your finances and achieving your goals. By following the steps outlined in this article, you can gain clarity about your financial situation, set realistic goals, and create a roadmap for the next five years. Remember, financial planning is an ongoing process, and regular review and adjustments are essential. Stay committed, stay informed, and take control of your financial future.

How to Craft a 5 Year Plan | Brian Tracy

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How do I prepare a 5-year financial plan?

To prepare a 5-year financial plan, follow these steps:

1. Start by setting specific financial goals for each year of the plan.

2. Assess your current financial situation, including income, expenses, assets, and debts.

3. Create a budget to track your income and expenses, ensuring that you allocate enough funds towards your goals.

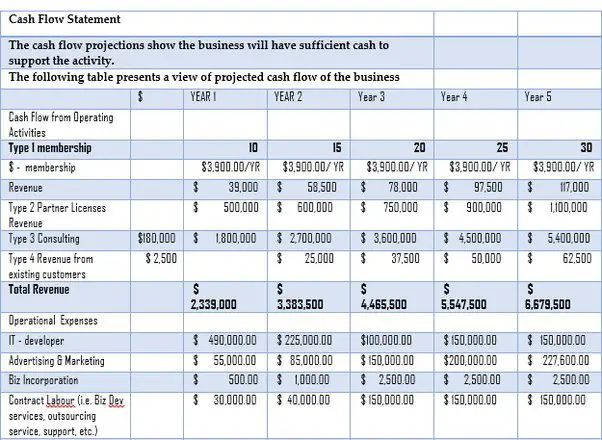

4. Review and analyze your cash flow to determine if you have enough funds to meet your goals each year.

5. Consider potential financial risks and plan for them by setting aside an emergency fund.

6. Identify investment opportunities that align with your financial goals and risk tolerance.

7. Regularly monitor and review your progress, making adjustments as needed to stay on track.

8. Seek professional advice if needed, especially if you have complex financial situations or investment options.

What are the benefits of having a 5-year financial plan?

Having a 5-year financial plan offers several benefits, including:

1. Clear direction: It provides a roadmap for achieving your financial goals over a defined period.

2. Improved financial discipline: By having a plan, you are more likely to stick to a budget and make smart financial decisions.

3. Better decision-making: It helps you make informed choices about spending, saving, investing, and debt management.

4. Increased financial security: Planning ahead allows you to build an emergency fund and protect yourself from unexpected expenses.

5. Identifying opportunities: A financial plan helps you identify investment opportunities and take advantage of them at the right time.

6. Peace of mind: With a solid plan in place, you can have peace of mind knowing that your financial future is being taken care of.

How often should I review and update my 5-year financial plan?

It is recommended to review and update your 5-year financial plan at least once a year. However, certain life events may warrant revisiting and adjusting your plan more frequently. Examples include a change in employment, significant increase or decrease in income, marriage, divorce, birth, or death in the family. Regularly reviewing and updating your plan ensures that it remains relevant and aligned with your current financial situation and goals.

What factors should I consider when creating a 5-year financial plan?

When creating a 5-year financial plan, consider the following factors:

1. Financial goals: Set specific, measurable, attainable, relevant, and time-bound (SMART) goals for each year of the plan.

2. Income and expenses: Analyze your current income and expenses to determine how much you can allocate towards your goals.

3. Cash flow: Assess your cash flow to ensure that you have enough funds to cover your expenses while saving for your goals.

4. Risk tolerance: Evaluate your comfort level with risk to determine the investment options that align with your goals.

5. Financial risks: Take into account potential financial risks, such as job loss, medical emergencies, or market fluctuations, and plan accordingly.

6. Time horizon: Consider the time it will take to achieve each goal and adjust your investment strategy accordingly.

7. Tax implications: Take into account the tax implications of your financial decisions to optimize your overall financial plan.

8. Professional advice: If needed, consult with a financial advisor to get expert guidance tailored to your specific circumstances.

How can I track my progress towards my financial goals within a 5-year plan?

To track your progress towards your financial goals within a 5-year plan, consider these steps:

1. Monitor your spending and saving patterns regularly to ensure that you’re staying on track.

2. Compare your actual progress against the targets set in your plan to identify any gaps.

3. Use financial management tools and apps to help you track your income, expenses, and investments.

4. Review your plan periodically and make adjustments if necessary, such as increasing your savings rate or reassessing your investment strategy.

5. Celebrate milestones along the way to stay motivated and acknowledge your achievements.

6. Consider seeking guidance from a financial advisor who can provide objective feedback and help you stay accountable.

What are some common mistakes to avoid when preparing a 5-year financial plan?

When preparing a 5-year financial plan, it’s important to avoid the following common mistakes:

1. Setting unrealistic goals: Ensure that your financial goals are achievable within the given timeframe and align with your income and resources.

2. Not accounting for inflation: Consider the impact of inflation on your expenses and adjust your plan accordingly to maintain purchasing power.

3. Ignoring emergency savings: Failing to allocate funds for unexpected expenses can derail your plan. Set aside an emergency fund to protect against unforeseen circumstances.

4. Neglecting risk management: Assess and address potential risks such as income loss, disability, or health issues through appropriate insurance coverage or contingency plans.

5. Failing to regularly review and update: Life circumstances and financial goals may change, so revisiting your plan annually or after major life events is essential.

6. Overlooking professional advice: Consult with a financial advisor to gain valuable insights tailored to your situation and receive guidance on complex financial matters.

7. Neglecting emotional factors: Consider how your emotions may impact financial decisions and ensure that your plan accounts for both rational and emotional aspects.

8. Letting short-term fluctuations derail your long-term plan: Stay focused on long-term goals and avoid making impulsive decisions based on short-term market volatility.

Can I prepare a 5-year financial plan on my own, or should I consult a professional?

Preparing a 5-year financial plan can be done on your own, especially if your financial situation is relatively straightforward. However, consulting a professional, such as a financial advisor or planner, can provide added insights, expertise, and guidance tailored to your specific circumstances. They can help you navigate complex financial matters, optimize your plan, and provide objective advice to keep you on track towards your goals. The decision to seek professional assistance ultimately depends on your comfort level, complexity of your financial situation, and the need for specialized expertise.

Final Thoughts

In conclusion, preparing a 5-year financial plan is essential for securing your financial future. Start by setting clear goals and priorities, taking into account your income, expenses, and savings. Create a budget that aligns with your goals and regularly review and adjust it as needed. Consider diversifying your investments to minimize risk and maximize potential returns. Track your progress and make necessary adjustments along the way. Seeking professional advice can also be beneficial in developing a comprehensive financial plan. By following these steps and taking a proactive approach, you can effectively prepare a 5-year financial plan that will lead you towards financial stability and success.