Do you find yourself worrying about the future and how to handle unforeseen financial emergencies? Look no further! In this blog article, we will guide you through the process of preparing a financial contingency plan, helping you gain peace of mind and confidence in your financial future. By proactively creating a plan to navigate potential financial challenges, you can ensure that you have a solid foundation to rely on when unexpected expenses arise. So, let’s dive in and learn how to prepare a financial contingency plan that will safeguard your financial well-being.

How to Prepare a Financial Contingency Plan

Introduction

In today’s unpredictable economic environment, it is essential for individuals and businesses alike to have a financial contingency plan in place. A financial contingency plan is a set of strategies and actions designed to mitigate the impact of unexpected events or financial hardships. By preparing for the unexpected, you can protect yourself, your family, or your business from potential financial crises. In this article, we will explore the steps involved in preparing a comprehensive financial contingency plan and provide you with practical tips to safeguard your financial well-being.

1. Assess Your Current Financial Situation

Before creating a financial contingency plan, it is crucial to assess your current financial situation. This evaluation will help you identify potential risks and areas of vulnerability. Consider the following aspects when conducting this assessment:

1.1 Evaluate Your Income and Expenses

- Review your sources of income and determine their reliability.

- Track your monthly expenses and identify areas where you can reduce or eliminate unnecessary spending.

- Calculate your monthly savings and determine how long you can sustain your current lifestyle in case of a financial emergency.

1.2 Analyze Your Debts and Liabilities

- Make a list of all your outstanding debts, including credit card balances, loans, and mortgages.

- Assess the interest rates and repayment terms for each debt.

- Determine the impact of your debts on your overall financial stability.

2. Build an Emergency Fund

2.1 Set a Savings Goal

To prepare for unexpected expenses or income loss, it is crucial to establish an emergency fund. The general rule of thumb is to save at least three to six months’ worth of living expenses. Calculate your monthly expenses and set a realistic savings goal based on your financial situation.

2.2 Create a Monthly Savings Plan

- Analyze your budget to identify areas where you can allocate money towards savings.

- Automate your savings by setting up automatic transfers from your checking account to your emergency fund.

- Consider reducing discretionary expenses to increase your savings rate.

2.3 Choose the Right Savings Account

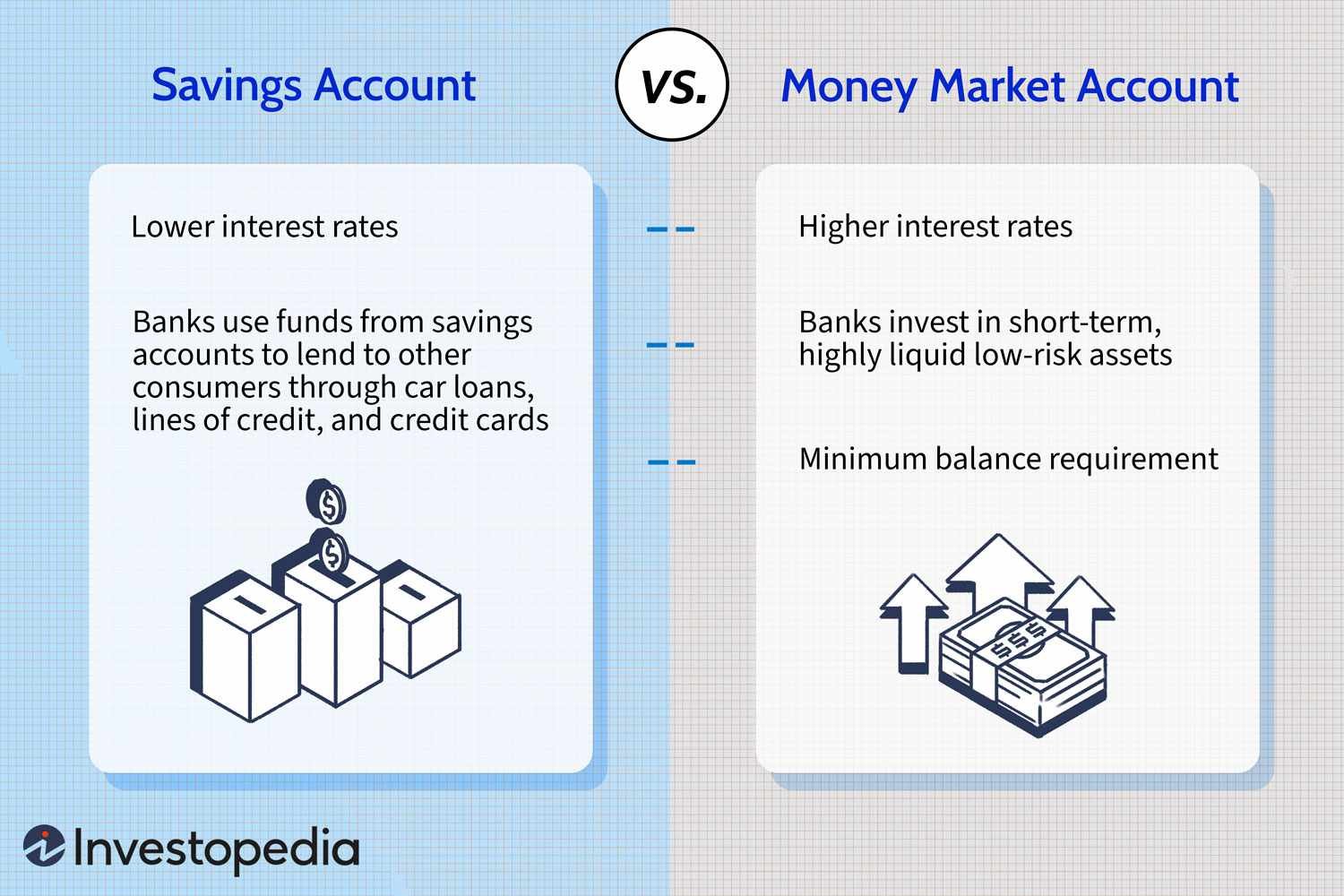

When building an emergency fund, it is important to choose the right savings account. Look for accounts that offer competitive interest rates, low fees, and easy access to your funds. Consider options such as high-yield savings accounts, money market accounts, or certificates of deposit (CDs) depending on your financial goals and risk tolerance.

3. Obtain Adequate Insurance Coverage

3.1 Review Your Current Insurance Policies

- Assess your existing insurance coverage, including health, life, auto, home, and business insurance policies.

- Review the terms, coverage limits, and deductibles to ensure they align with your current needs.

- Consider any potential gaps in coverage and explore additional policies or endorsements that may be necessary.

3.2 Evaluate the Need for Disability or Long-Term Care Insurance

Depending on your circumstances, it may be crucial to consider disability or long-term care insurance. These policies provide financial protection in case of a disability or the need for extended medical assistance. Evaluate your risk factors and discuss your options with a qualified insurance professional.

3.3 Protect Your Assets with Property Insurance

If you own valuable assets such as a home, car, or business property, it is essential to have adequate property insurance. Review your policy to ensure it covers potential risks, such as natural disasters, theft, or liability claims. Update your coverage as needed to protect your assets.

4. Diversify Your Investments

4.1 Understand the Importance of Diversification

Diversifying your investments is crucial to minimize risk and protect your portfolio from market volatility. By spreading your investments across different asset classes, sectors, and geographic regions, you reduce the impact of a single investment’s poor performance on your overall portfolio.

4.2 Consult with a Financial Advisor

To effectively diversify your investments, seek guidance from a qualified financial advisor. They will help you assess your risk tolerance, investment goals, and time horizon. A financial advisor can recommend a balanced portfolio that aligns with your needs and helps shield you from potential financial shocks.

4.3 Regularly Review and Rebalance Your Portfolio

Once you have diversified your investments, it is important to regularly review and rebalance your portfolio. Market conditions and your personal circumstances may change over time, affecting the performance and risk profile of your investments. Rebalance your portfolio periodically to ensure it remains aligned with your financial goals.

5. Reduce Financial Dependence

5.1 Pay off Debts

Reducing your financial dependence on credit is essential to enhance your financial resilience. Prioritize paying off high-interest debts and focus on becoming debt-free. Consider strategies such as the debt snowball or debt avalanche method to accelerate your debt repayment.

5.2 Explore Additional Income Sources

Diversifying your income sources can provide a safety net during financial emergencies. Consider taking up a side gig, freelancing, or starting a small business to generate additional income. Explore opportunities aligned with your skills and interests to maximize your earning potential.

6. Regularly Review and Update Your Plan

A financial contingency plan is not a one-time effort. Regularly review and update your plan to adapt to changing circumstances, goals, and priorities. Consider scheduling an annual or biannual review to ensure your plan remains relevant and effective.

By following these steps and creating a comprehensive financial contingency plan, you can protect yourself and your loved ones from unexpected financial challenges. Remember that preparation and proactive measures are key to mitigating the impact of unforeseen events. Start today by assessing your financial situation, building an emergency fund, obtaining adequate insurance coverage, diversifying your investments, reducing financial dependence, and regularly reviewing and updating your plan. With a solid financial contingency plan in place, you can face the future with confidence and peace of mind.

Creating a Financial Contingency Plan

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a financial contingency plan?

A financial contingency plan is a proactive strategy that helps individuals and organizations prepare for potential financial disruptions or emergencies. It outlines steps to be taken to minimize the impact of unexpected events and maintain financial stability.

Why is it important to have a financial contingency plan?

Having a financial contingency plan is crucial because it provides a roadmap for navigating unforeseen financial challenges. It allows individuals and organizations to be better prepared, minimize the impact of disruptions, and ensure the continuity of financial well-being.

How do I start preparing a financial contingency plan?

To start preparing a financial contingency plan, follow these steps:

1. Assess potential risks: Identify potential risks such as job loss, medical emergencies, or economic downturns that could impact your finances.

2. Set emergency funds: Save an adequate amount of money to cover at least three to six months of living expenses in case of financial emergencies.

3. Analyze insurance coverage: Review your insurance policies to ensure adequate coverage for potential risks.

4. Create a budget: Develop a comprehensive budget that incorporates savings, investments, and expenses to maintain financial stability.

5. Diversify income sources: Explore additional income streams or investment opportunities to reduce reliance on a single source of income.

Should I consult a financial advisor when preparing a financial contingency plan?

While not mandatory, consulting a financial advisor can be beneficial when preparing a financial contingency plan. They can provide valuable insights, help analyze your financial situation, and suggest appropriate strategies based on your specific needs and objectives.

Can a financial contingency plan be revised or updated?

Yes, a financial contingency plan should be regularly reviewed, revised, and updated to reflect changes in your financial situation or potential risks. It is important to adapt the plan as circumstances evolve to ensure its effectiveness.

What are some common mistakes to avoid when creating a financial contingency plan?

When creating a financial contingency plan, avoid the following common mistakes:

1. Underestimating potential risks: Conduct a thorough risk assessment to avoid overlooking potential threats.

2. Neglecting insurance coverage: Ensure you have adequate insurance coverage to protect against unexpected events.

3. Failing to save for emergencies: Establish an emergency fund to cushion against financial shocks.

4. Not diversifying income sources: Relying solely on a single income source can increase vulnerability during disruptions.

5. Ignoring regular plan reviews: Regularly review and update your financial contingency plan to align with changing circumstances.

Can a financial contingency plan help during economic downturns?

Yes, a well-prepared financial contingency plan can help navigate financial challenges during economic downturns. It provides a framework to minimize the impact of a recession, such as having emergency funds and diversifying income sources.

What resources can I use to learn more about preparing a financial contingency plan?

To expand your knowledge about preparing a financial contingency plan, you can consult reputable financial websites, books on personal finance, attend workshops or seminars, and engage with financial professionals. These resources can provide valuable insights and guidance.

Final Thoughts

In conclusion, preparing a financial contingency plan is crucial for maintaining stability and mitigating potential risks. Firstly, it is important to thoroughly assess your current financial situation, including income, expenses, and liabilities. Next, identify potential risks such as job loss, medical emergencies, or economic downturns. Based on this analysis, establish a savings fund to cover for unexpected expenses and create a budget to ensure disciplined spending. Additionally, consider diversifying your sources of income and exploring insurance options for added protection. Lastly, review and update your contingency plan regularly to adapt to changing circumstances. By following these steps, you can effectively prepare a financial contingency plan that safeguards your financial well-being.