Are you ready to equip others with the valuable knowledge of financial literacy? Look no further! In this blog article, we will guide you on how to prepare a financial literacy workshop that will engage, educate, and empower participants. Whether you’re a teacher, entrepreneur, or simply passionate about financial education, this step-by-step guide will help you create a workshop that leaves a lasting impact. So, let’s dive in and explore the key elements involved in preparing a financial literacy workshop that inspires and enlightens.

How to Prepare a Financial Literacy Workshop

Financial literacy is a critical skill that everyone should possess to manage their personal finances effectively. However, many people lack the necessary knowledge and understanding of financial concepts. As a result, organizing a financial literacy workshop can make a significant impact on individuals and empower them to make informed financial decisions. This article will guide you through the process of preparing a successful financial literacy workshop and equipping participants with valuable financial skills.

1. Define your Objectives

Before diving into the preparation process, it is essential to define clear objectives for your financial literacy workshop. Ask yourself:

– What specific financial topics do you want to cover?

– Who is your target audience?

– What outcomes do you want to achieve at the end of the workshop?

Setting concrete objectives will help you structure the workshop content and ensure that participants gain the desired knowledge and skills.

2. Determine the Workshop Format

There are various workshop formats to choose from, depending on the objectives and target audience. Consider the following options:

– Lecture-style workshop: This format involves a presenter or expert delivering information on financial literacy topics through presentations and speeches.

– Interactive workshop: Incorporate activities, case studies, and group discussions to engage participants actively.

– Hands-on workshop: Give participants practical exercises and tasks to apply their financial knowledge in real-life scenarios.

Deciding on the workshop format will depend on the objectives, time constraints, and the resources available.

3. Research Relevant Financial Topics

To create a comprehensive and informative workshop, research and select relevant financial topics that align with your objectives. Here are some commonly covered subjects to consider:

– Budgeting and saving techniques

– Understanding credit and managing debt

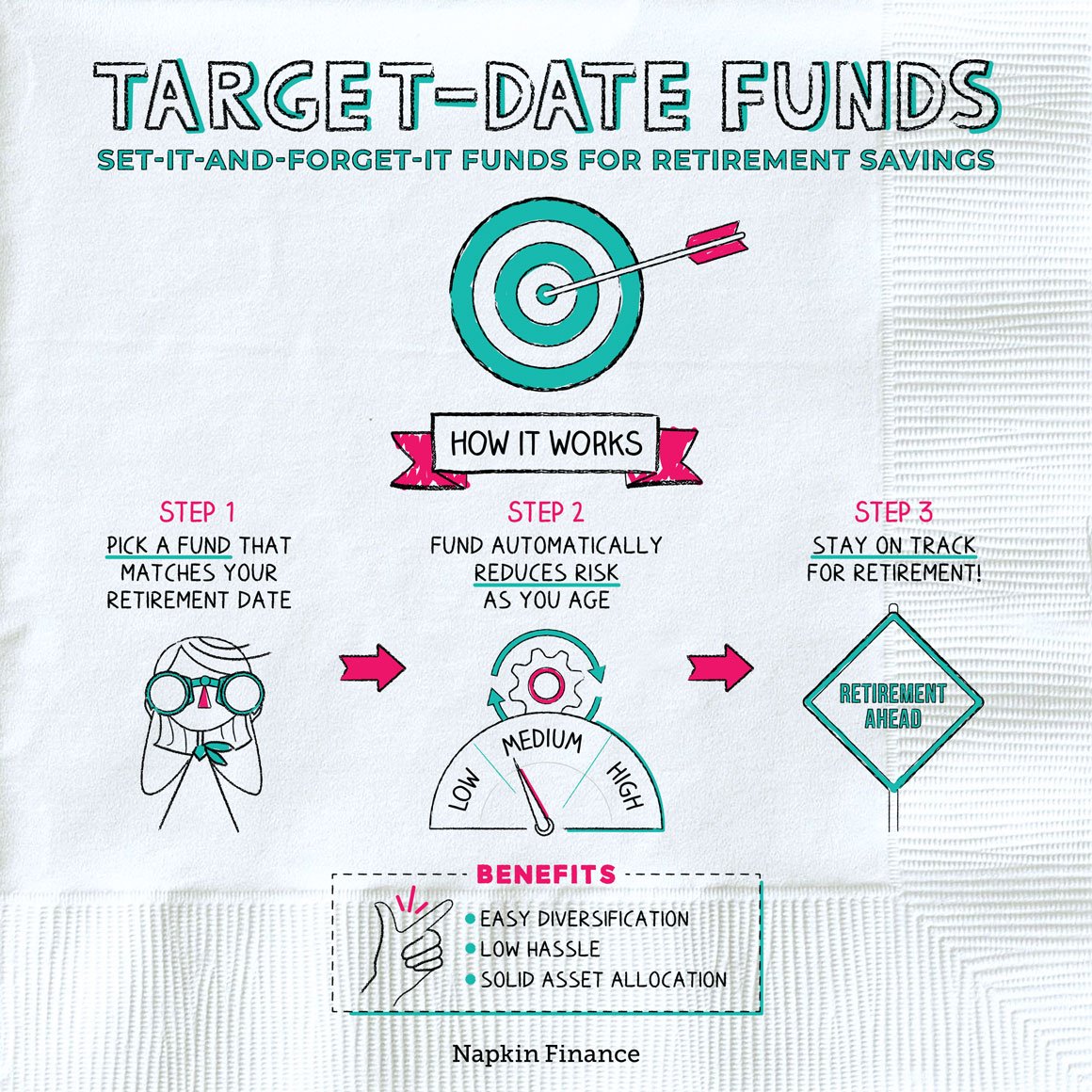

– Investing basics and strategies

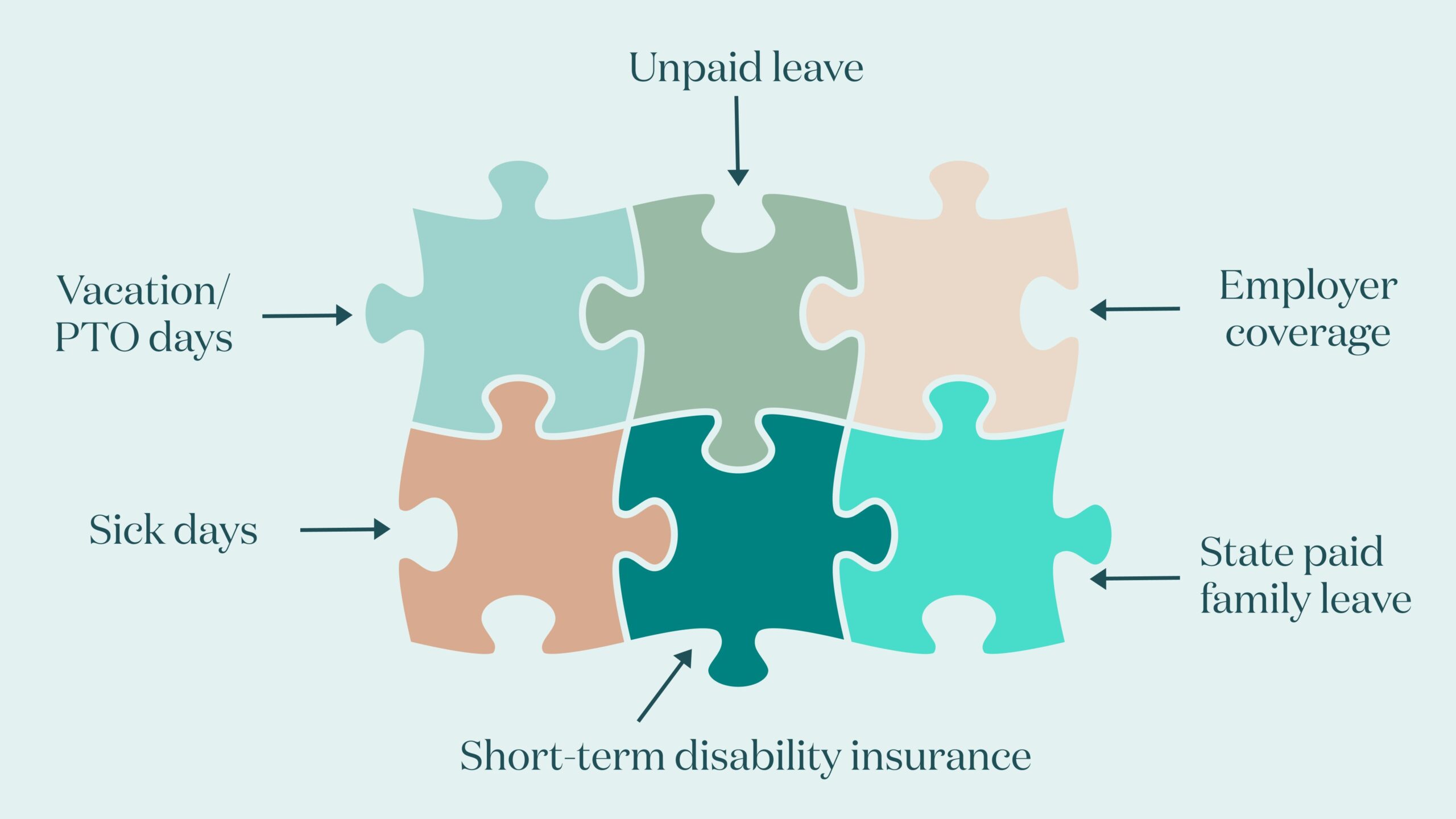

– Retirement planning and long-term financial goals

– Financial risk assessment and insurance

– Tax planning and filing

Choose topics that are most relevant to your target audience and aim to provide a well-rounded understanding of personal finance.

4. Develop Engaging Workshop Content

Once you have identified the financial topics to cover, it’s time to develop engaging and informative content. Here are some tips to make your workshop content effective:

– Use clear and concise language: Avoid jargon and complex terms to ensure participants understand the concepts easily.

– Provide real-life examples: Illustrate financial concepts with relatable examples and case studies to make them more tangible and relatable.

– Include visuals: Incorporate charts, graphs, and infographics to visually represent financial data and concepts, making them easier to digest.

– Break content into sections: Divide the content into manageable sections to help participants follow along and grasp each topic effectively.

– Ensure interactivity: Incorporate activities, quizzes, and short exercises throughout the workshop to engage participants actively and reinforce learning.

5. Prepare Workshop Materials

To deliver a successful financial literacy workshop, you need to prepare the necessary materials. Here’s a list of essential materials to consider:

– Presentation slides: Create visually appealing slides to support your workshop content and keep participants engaged.

– Handouts: Provide participants with printed or digital handouts summarizing key points, resources, and additional information for future reference.

– Worksheets: Develop worksheets and exercises to help participants practice applying the financial concepts learned during the workshop.

– Evaluation forms: Create evaluation forms or surveys to gather feedback from participants about the workshop’s effectiveness and areas for improvement.

Ensure that all materials are organized and readily available before the workshop to ensure a smooth facilitation process.

6. Arrange for Guest Speakers or Experts

To add depth and variety to your workshop, consider inviting guest speakers or experts in the field of personal finance. Guest speakers can share their expertise, provide unique insights, and answer participants’ questions. Look for professionals in finance, financial planning, or related industries who can contribute to the workshop’s overall value.

7. Promote and Market the Workshop

To attract participants to your financial literacy workshop, dedicate time and effort to promote and market the event. Consider the following strategies:

– Create a compelling workshop title and description.

– Use social media platforms, email newsletters, and websites to spread the word about the workshop.

– Collaborate with local community organizations, schools, or businesses for mutual promotion.

– Leverage personal networks and ask attendees to refer others who may benefit from the workshop.

Maximize the exposure of your financial literacy workshop to ensure a good turnout and reach a broader audience.

8. Arrange Logistics and Set Up the Venue

To ensure a seamless workshop experience, pay attention to the logistics and venue setup. Consider the following aspects:

– Choose a suitable venue that accommodates the number of participants comfortably and provides necessary equipment.

– Test audiovisual equipment, projectors, and microphones before the workshop to avoid technical difficulties.

– Arrange seating in a way that encourages interaction and engagement among participants.

– Provide refreshments, if possible, to keep participants energized throughout the workshop.

Taking care of logistics will contribute to a well-organized and professional workshop environment.

9. Facilitate the Workshop Effectively

As the facilitator of the financial literacy workshop, your role is crucial in delivering the content and engaging participants. Consider the following tips to ensure an effective workshop:

– Start with an introduction and overview of the workshop objectives.

– Clearly communicate the workshop agenda and schedule to participants.

– Encourage questions and discussions throughout the workshop to foster engagement.

– Pace the workshop appropriately, allowing time for activities, breaks, and audience participation.

– Be attentive to participants’ needs and address any confusion or concerns promptly.

– Emphasize the practical application of financial concepts and provide guidance on resources for further learning.

10. Follow-up and Evaluation

After the workshop concludes, it’s essential to follow up with participants and evaluate the workshop’s effectiveness. Consider the following post-workshop activities:

– Collect feedback from participants through evaluation forms or surveys to gain insights for future improvements.

– Share additional resources, recommended readings, or online tools to help participants continue their financial education journey.

– Offer follow-up sessions or continued learning opportunities for participants who may have more questions or want to deepen their knowledge.

Taking these steps will ensure that participants leave the workshop with the necessary tools and resources to continue building their financial literacy.

Preparing a financial literacy workshop requires careful planning, engaging content, and effective facilitation. By following these steps, you can make a significant impact on participants’ financial knowledge and empower them to make informed financial decisions. Remember, the journey to financial literacy begins with education, and your workshop can play a vital role in setting individuals on the path to financial well-being.

Designing Financial Literacy Workshops & Training

Frequently Asked Questions

Frequently Asked Questions (FAQs)

Q: What is a financial literacy workshop?

A: A financial literacy workshop is a session or program designed to provide individuals with the necessary knowledge and skills to make informed financial decisions and manage their personal finances effectively.

Q: How can I prepare for a financial literacy workshop?

A: To prepare for a financial literacy workshop, follow these steps:

1. Define the workshop objectives and target audience.

2. Research and gather relevant information and resources on financial literacy topics.

3. Develop a structured workshop agenda and outline.

4. Create engaging presentation materials, including visual aids and interactive activities.

5. Determine the workshop duration and choose a suitable venue.

6. Advertise and promote the workshop to attract participants.

7. Prepare evaluation forms to gather feedback and assess the workshop’s effectiveness.

8. Practice and rehearse your presentation to ensure a smooth delivery.

Q: What topics should be covered in a financial literacy workshop?

A: When planning a financial literacy workshop, consider including topics such as:

– Budgeting and saving

– Understanding credit and debt

– Investing basics

– Retirement planning

– Insurance and risk management

– Setting financial goals

– Managing student loans

– Avoiding financial scams and identity theft

Q: How long should a financial literacy workshop be?

A: The duration of a financial literacy workshop depends on various factors, including the depth of content, target audience, and available time. Generally, workshops can range from a few hours to full-day sessions. It’s important to strike a balance between covering essential information and maintaining participants’ engagement.

Q: What teaching methods can be used in a financial literacy workshop?

A: Effective teaching methods for financial literacy workshops may include:

– Interactive presentations

– Group discussions

– Case studies and real-life examples

– Hands-on activities and simulations

– Q&A sessions

– Sharing personal finance success stories

– Providing relevant resources and take-home materials

Q: How can I make a financial literacy workshop interactive and engaging?

A: Here are some tips to make your financial literacy workshop interactive and engaging:

– Incorporate interactive activities and games to reinforce learning.

– Encourage participants to share their financial experiences and ask questions.

– Use multimedia tools such as videos, infographics, and quizzes.

– Break the workshop into smaller sessions with short breaks in between.

– Provide opportunities for participants to apply what they’ve learned through practical exercises.

– Offer incentives or prizes for active participation.

Q: Are there any resources or tools available to support financial literacy workshops?

A: Yes, numerous resources and tools can support financial literacy workshops. Some examples include:

– Online financial education platforms and courses

– Budgeting and financial planning apps

– Worksheets and templates for budgeting and goal setting

– Educational videos on personal finance topics

– Websites offering articles and guides on various financial topics

– Local community organizations that provide financial counseling and workshops

Q: How can I evaluate the effectiveness of a financial literacy workshop?

A: To evaluate the effectiveness of a financial literacy workshop, consider the following methods:

– Distribute evaluation forms to participants to gather their feedback on the workshop content, delivery, and overall experience.

– Assess the participants’ knowledge and skills before and after the workshop through pre and post-tests or surveys.

– Track participants’ progress over time by conducting follow-up surveys or interviews.

– Analyze the participation and engagement levels during the workshop activities.

– Monitor long-term outcomes, such as participants’ financial behaviors and decision-making.

Final Thoughts

In conclusion, preparing a financial literacy workshop involves several key steps. First, identify your target audience and their specific needs and goals. Next, develop a comprehensive curriculum that covers fundamental financial topics such as budgeting, investing, and debt management. Consider incorporating interactive activities and real-life examples to enhance engagement. Collaborate with experts or financial professionals to bring valuable insights and credibility to the workshop. Finally, promote the workshop through various channels and ensure participants have access to relevant resources and materials. By following these steps, you can effectively prepare a financial literacy workshop that empowers individuals to improve their financial well-being.