Starting a new business is an exciting endeavor, full of potential and endless possibilities. However, one crucial aspect that often gets overlooked in the midst of enthusiasm is financial preparation. To set yourself up for success, it is essential to have a solid financial plan in place right from the start. In this article, we will explore practical steps on how to prepare financially for a new business. Whether you have already started your venture or are still in the planning stages, these tips will help you navigate the financial landscape and ensure a strong foundation for your business. So, let’s dive in and discover how to prepare financially for a new business!

How to Prepare Financially for a New Business

Starting a new business can be an exciting and rewarding venture, but it requires careful financial planning to ensure success. From setting a budget to securing funding, there are several important steps you should take to prepare yourself financially for the journey ahead. In this article, we will discuss various strategies and considerations to help you navigate the financial aspect of starting a new business.

Create a Comprehensive Business Plan

Before diving into the financial aspects, it is crucial to develop a comprehensive business plan. This plan will serve as a roadmap for your new venture and will help you understand its financial requirements. Here are some key sections to include in your business plan:

- Executive Summary: Provide an overview of your business, its mission, and primary objectives.

- Market Analysis: Conduct thorough market research to identify potential customers, competitors, and industry trends.

- Products or Services: Clearly define the products or services you plan to offer and explain how they fulfill market needs.

- Marketing and Sales Strategy: Outline your plans for reaching and attracting customers, including pricing, advertising, and distribution channels.

- Organization and Management: Describe the structure of your business and the roles and responsibilities of key team members.

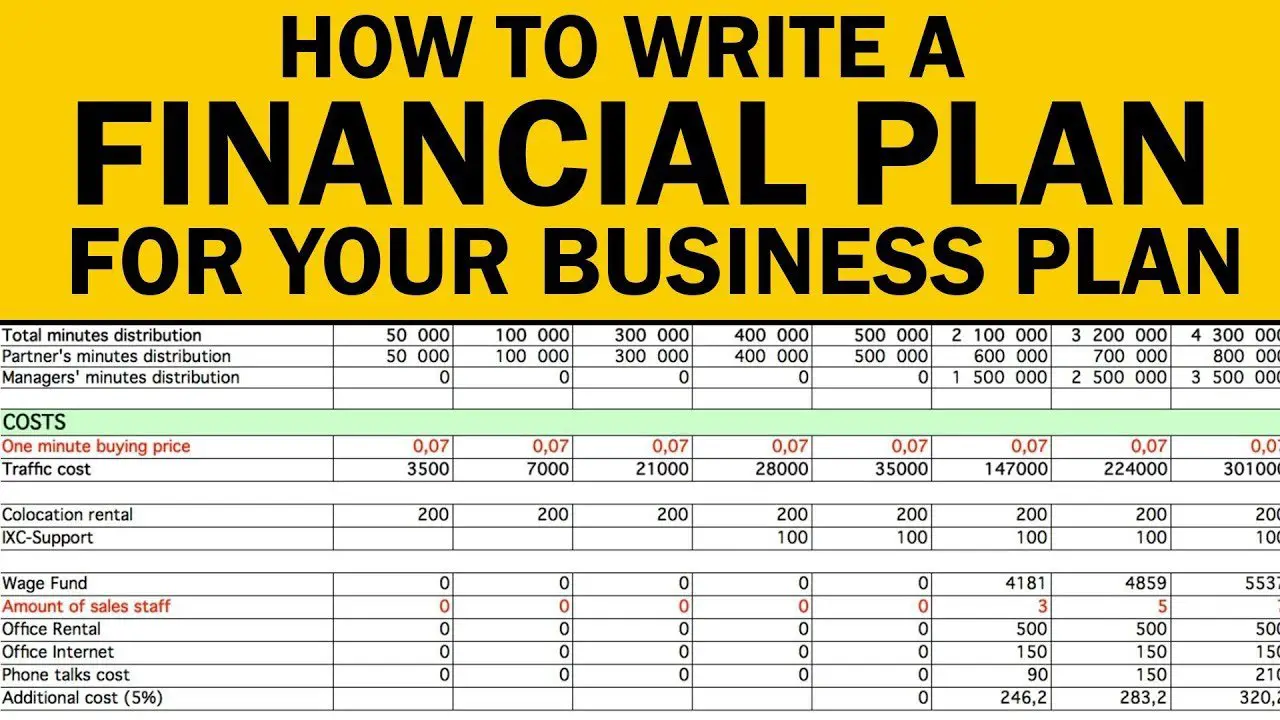

- Financial Projections: Provide detailed financial forecasts, including sales projections, expenses, and cash flow analysis.

Developing a well-thought-out business plan will not only help you secure funding but also enable you to make informed financial decisions.

Assess Your Financial Situation

Before stepping into the world of entrepreneurship, it is important to assess your personal financial situation. Understanding your current financial standing will give you a realistic perspective on the resources you have available to invest in your business. Consider the following factors:

- Savings and Assets: Evaluate your personal savings and assets that can be used to fund your business. This may include personal savings, investments, or property that can be sold to generate capital.

- Debts and Expenses: Take into account any outstanding debts or recurring expenses you have. It is crucial to have a clear picture of your financial obligations to manage them effectively while starting your new business.

- Credit Score: Your credit score plays a crucial role when applying for business loans or seeking financing options. Check your credit score and take steps to improve it if necessary.

By thoroughly assessing your financial situation, you can determine how much additional funding you may need and what resources you can allocate towards your new business.

Establish a Realistic Budget

One of the most important aspects of preparing financially for a new business is creating a realistic budget. A well-planned budget will help you allocate your resources effectively and track your business’s financial health. Here are some steps to consider when establishing your budget:

- Identify Startup Costs: Determine the upfront costs required to launch your business, such as equipment, licenses, permits, marketing expenses, and legal fees.

- Estimate Ongoing Expenses: Project your monthly expenses, including rent, utilities, inventory, salaries, and any other recurring costs.

- Forecast Revenue: Based on your market analysis and pricing strategy, estimate your projected sales and revenue. Be realistic and conservative in your estimations.

- Consider Contingencies: Set aside a portion of your budget as a contingency fund to account for unexpected expenses or slow initial sales.

Regularly review and adjust your budget as your business grows to ensure that your financial plans remain aligned with your goals and objectives.

Explore Funding Options

Securing adequate funding is often a crucial step in starting a new business. While self-financing may be an option for some entrepreneurs, most new businesses require additional capital. Here are some common funding options to consider:

- Small Business Loans: Approach banks or financial institutions that offer small business loans. Prepare a strong loan application by including your business plan, financial projections, and any collateral you can offer.

- Grants and Government Programs: Research grants and programs available for small businesses through government agencies or nonprofit organizations. These funding options may have specific eligibility criteria, so make sure you thoroughly understand the requirements.

- Angel Investors and Venture Capitalists: Consider seeking funding from angel investors or venture capitalists who are interested in investing in promising startups. Prepare a compelling pitch and be prepared to give up some equity in your business.

- Crowdfunding: Utilize online crowdfunding platforms to raise funds from a large number of people who are interested in your business concept. Offer rewards or equity in return for their contributions.

It is important to thoroughly research and compare different funding options to find the one that best suits your needs and aligns with your overall business objectives.

Monitor and Manage Cash Flow

Effective cash flow management is vital for the success of any business, especially new ventures. Poor cash flow can lead to financial instability and make it difficult to meet your financial obligations. Here are some tips to help you monitor and manage your cash flow effectively:

- Create Cash Flow Projections: Regularly forecast your expected cash inflows and outflows to identify potential cash flow gaps. This will allow you to take proactive measures to address any shortfalls before they affect your business.

- Invoice and Payment Management: Implement efficient invoicing and payment systems to ensure timely receipt of payments from customers. Consider offering discounts for early payments or implementing penalties for late payments.

- Control Expenses: Regularly review your expenses and look for ways to reduce costs without compromising the quality of your products or services. Negotiate with suppliers for better pricing or explore alternative vendors.

- Build Relationships with Suppliers: Cultivate good relationships with your suppliers and negotiate favorable payment terms. This can help you manage your cash flow better by extending payment deadlines when needed.

By actively monitoring and managing your cash flow, you can ensure the financial stability and sustainability of your new business.

Seek Professional Financial Advice

Navigating the financial aspects of starting a new business can be complex. Consider seeking guidance from a professional accountant or financial advisor who specializes in small businesses. They can provide valuable insights and help you make informed financial decisions.

A financial advisor can assist you with:

- Budgeting and Financial Planning: An advisor can help you create a comprehensive budget and financial plan that aligns with your business goals.

- Funding Options: They can guide you through the process of exploring and securing funding, helping you understand the pros and cons of different options.

- Tax Planning and Compliance: A qualified accountant can ensure that your business is compliant with tax regulations and help you optimize your tax strategy.

- Financial Analysis and Reporting: They can assist you in analyzing your financial statements and generating reports to assess the health of your business.

Remember, investing in professional financial advice can save you time, money, and unnecessary stress in the long run.

In conclusion, thorough financial preparation is vital when starting a new business. By creating a comprehensive business plan, assessing your financial situation, establishing a realistic budget, exploring funding options, managing cash flow, and seeking professional advice, you can position yourself for success. Remember, financial planning is an ongoing process, so regularly review and adjust your strategies as your business grows and evolves.

How to Write a Financial Plan for Your Business Plan in 2023

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. What are the key considerations for financial preparation when starting a new business?

When preparing financially for a new business, it’s essential to consider factors such as creating a detailed business plan, estimating startup costs, securing funding sources, setting a budget, and establishing a financial cushion for unexpected expenses.

2. How can I estimate the startup costs for my new business?

To estimate startup costs, you can create a list of all the necessary expenses, including equipment, inventory, licenses, permits, marketing, website development, legal fees, and initial salaries. Researching industry averages and seeking advice from professionals can help ensure accuracy in your estimations.

3. What are the different sources of funding available for new businesses?

New businesses can explore multiple funding options, such as self-financing, loans from banks or credit unions, angel investors, venture capitalists, crowdfunding platforms, and government grants or subsidies.

4. How can I create a realistic budget for my new business?

To create a realistic budget, start by forecasting your income and expenses. Take into account fixed costs (rent, utilities, salaries) and variable costs (supplies, marketing). Regularly review and adjust your budget to reflect any changes in your business operations.

5. Is it important to establish a financial cushion for unexpected expenses?

Yes, establishing a financial cushion is crucial. Unexpected expenses can arise in business, such as equipment breakdowns, legal issues, or sudden changes in market conditions. Setting aside a portion of your funds for emergencies can help you navigate these situations without jeopardizing the stability of your business.

6. Should I consider hiring a professional accountant or bookkeeper?

Hiring a professional accountant or bookkeeper can be advantageous, especially if you are not confident in your financial management skills. They can provide guidance on tax obligations, help analyze your financial statements, and ensure you maintain accurate and compliant records.

7. What are some strategies to improve cash flow in a new business?

To improve cash flow, you can consider strategies such as reducing expenses, negotiating favorable payment terms with suppliers, offering discounts for early payment, incentivizing prompt customer payments, and regularly monitoring and managing accounts receivable and accounts payable.

8. How important is it to regularly track and review financial performance?

Regularly tracking and reviewing your financial performance is vital to ensure your business stays on track. This allows you to identify any financial challenges, make informed decisions, and take timely actions to improve profitability and sustainability.

Final Thoughts

In summary, preparing financially for a new business requires careful planning and effective strategies. Firstly, conducting thorough market research and creating a detailed business plan are crucial steps. This will help identify potential expenses, estimate revenue streams, and attract investors or secure loans. Secondly, creating a separate business bank account and tracking expenses diligently is essential for maintaining financial organization. Additionally, implementing a budget and regularly reviewing financial statements will ensure effective resource allocation. Lastly, considering alternative funding options like crowdfunding or seeking partnerships can provide additional financial support. By following these steps and remaining proactive, entrepreneurs can set their businesses up for financial success.