Are you wondering how to prepare financially for unpaid internships? Don’t worry, we’ve got you covered. In this article, we will guide you through practical steps to ensure you’re financially equipped to make the most of your internship experience. From budgeting and resourceful saving techniques to exploring alternate income streams, we will help you navigate the financial challenges that come with unpaid internships. So, whether you’re a student seeking valuable work experience or a career changer looking to break into a new industry, read on to learn how to prepare financially for unpaid internships.

How to Prepare Financially for Unpaid Internships

Unpaid internships can provide invaluable experience and help kickstart your career. However, they can also pose financial challenges, especially if you’re not prepared. In this article, we will discuss strategies and tips on how to prepare for unpaid internships financially. By following these steps, you can ensure a smoother transition into an unpaid internship while managing your finances effectively.

Evaluate Your Financial Situation

Before diving into an unpaid internship, it’s essential to evaluate your current financial situation. Understanding where you stand financially will help you make informed decisions and plan ahead. Here are some steps to help you assess your financial position:

- Create a budget: Take the time to track your income and expenses to get a clear picture of your financial inflows and outflows. This will help you identify areas where you can cut back and save.

- Review your savings: Determine how much money you have in your savings account and consider how long it can sustain you without earning an income. This will give you an idea of how urgently you need to secure paid work alongside your unpaid internship.

- Assess your debts: Understand your existing debts, such as student loans or credit card debt. Consider how these payments will impact your ability to cover living expenses during the unpaid internship period.

Explore Financial Assistance and Grants

While unpaid internships may not provide a paycheck, there are often financial assistance options available. Research and explore grants, scholarships, or subsidies that can help lessen the financial burden during your unpaid internship. Here are a few avenues to consider:

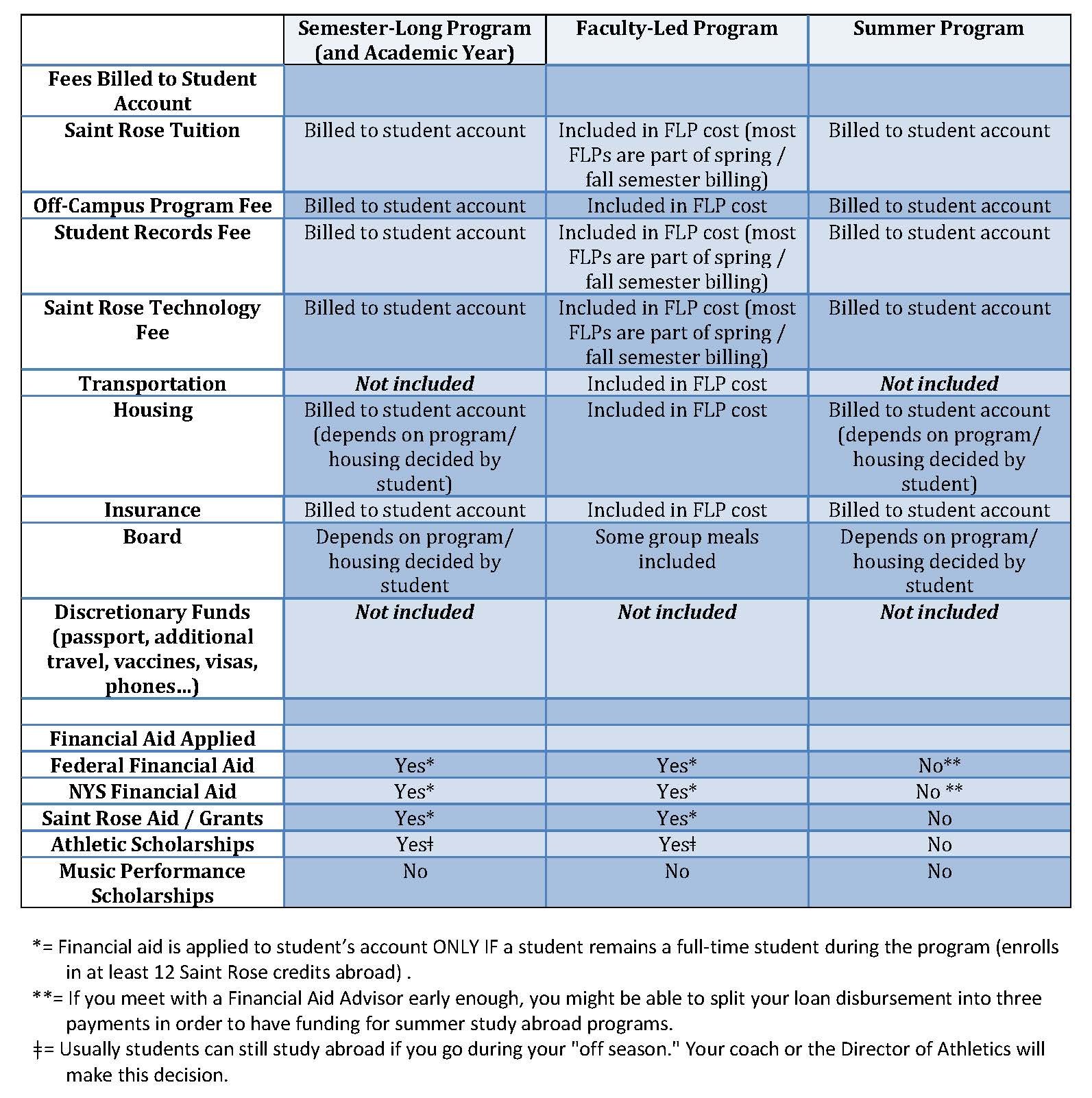

1. College or University Grants

Many educational institutions offer grants or stipends specifically for students participating in unpaid internships. Reach out to your college or university’s career center or financial aid office to inquire about any available opportunities. They can provide guidance on how to apply and the eligibility requirements.

2. External Scholarships and Grants

Numerous organizations provide scholarships and grants for students undertaking unpaid internships. Research online platforms, professional associations, and non-profit organizations relevant to your field of interest. These external sources may have funding options for students like you. Make sure to thoroughly review the application requirements and deadlines.

3. Non-Profit and Government Programs

Certain non-profit organizations and government departments offer programs that financially support individuals participating in unpaid internships. Research and reach out to these organizations to explore whether you qualify for any assistance programs. Examples include AmeriCorps, VISTA, or the Peace Corps.

Create a Financial Contingency Plan

To ensure a smooth financial journey during your unpaid internship, it’s crucial to create a contingency plan. This plan should outline various strategies to manage your expenses and secure additional income. Consider the following steps:

1. Cut Back on Expenses

Reducing your expenses is an effective way to stretch your budget during an unpaid internship. Here are some tips to help you cut back:

- Assess your subscriptions: Review your monthly subscriptions and consider canceling or temporarily suspending non-essential services like streaming platforms or gym memberships.

- Explore free alternatives: Look for free alternatives to activities you enjoy, such as using public parks instead of paying for fitness classes or organizing potluck dinners with friends instead of dining out.

- Save on groceries: Opt for cost-effective meal planning, buying generic brands, using coupons, and cooking at home rather than eating out.

2. Seek Part-Time Employment

While juggling an unpaid internship, consider taking up part-time employment to supplement your income. Here are a few options to explore:

- On-campus jobs: Check with your college or university for part-time job opportunities on campus. These positions are often flexible and take into account your academic commitments.

- Gig economy: Consider joining gig economy platforms like Uber, Lyft, or food delivery services. These platforms allow you to work on your schedule and earn additional income.

- Freelancing: Leverage your skills and offer freelance services within your field. Websites like Fiverr and Upwork provide platforms to showcase your capabilities and connect with potential clients.

3. Explore Remote Internship Opportunities

In today’s digital age, remote internships have become more prevalent. Consider exploring remote internship opportunities that align with your career goals. Remote internships offer flexibility and eliminate the need to relocate or incur additional expenses. Research online job platforms, company websites, or connect with your college’s career center for remote internship listings.

Network and Leverage Connections

Networking is a valuable tool that can assist you in finding paid opportunities or securing financial assistance during your unpaid internship. Here’s how you can leverage your connections:

- Reach out to alumni: Connect with alumni from your college or university who work in your desired field. They may offer guidance, mentorship, or even know of paid internship opportunities.

- Attend career fairs and events: Participate in industry-specific career fairs and networking events to meet professionals and potential employers. Building connections can lead to paid internships or job opportunities.

- Utilize online platforms: Leverage professional networking platforms such as LinkedIn to expand your network. Connect with professionals in your field and engage in relevant conversations or join industry-specific groups to stay updated on potential opportunities.

Consider Alternative Housing Options

Housing costs can be a significant expense during an unpaid internship. Exploring alternative housing options can help reduce your financial burden. Here are a few options to consider:

1. Sublet or Rent a Room

Instead of signing a full lease agreement, consider subletting or renting a room. Websites like Airbnb, Craigslist, or local Facebook housing groups can help you find short-term housing options at a lower cost. Make sure to research the safety and reputation of potential landlords or roommates before committing to any arrangement.

2. Find Roommates

Sharing living expenses with roommates can significantly reduce your housing costs. Reach out to fellow interns, classmates, or utilize online platforms specifically designed for finding roommates, such as Roommates.com or RoomieMatch.com. Living with roommates not only helps with costs but can also provide a support system during your internship.

3. Explore Commuting Options

If your internship location allows, consider living in an area with a lower cost of living and commuting to your internship site. Research public transportation options or calculate the feasibility of commuting by car. Moving to a less expensive area can help you save on rent and other living expenses.

Preparing financially for unpaid internships is essential to ensure a positive experience without unnecessary financial stress. By evaluating your financial situation, exploring financial assistance options, creating a contingency plan, networking, and considering alternative housing options, you can successfully navigate the challenges of an unpaid internship. Remember, while unpaid internships may not provide immediate monetary rewards, the skills and experience gained can prove invaluable in your future career.

How to Find Funding for Unpaid Internships

Frequently Asked Questions

Frequently Asked Questions (FAQs)

Question 1: How can I financially prepare for an unpaid internship?

Answer: Financially preparing for an unpaid internship requires careful planning and budgeting. Here are some steps you can take:

Question 2: Can I still work a part-time job while doing an unpaid internship?

Answer: Yes, you can work a part-time job while doing an unpaid internship to supplement your income. However, make sure to manage your time effectively to balance both commitments.

Question 3: Are there any scholarships or grants available for unpaid internships?

Answer: Yes, there are scholarships and grants specifically designed for students undertaking unpaid internships. Research and apply for such opportunities to alleviate financial burdens.

Question 4: What are some alternative ways to cover expenses during an unpaid internship?

Answer: Consider options such as finding a roommate to share accommodation costs, utilizing public transportation, cooking meals at home instead of eating out, and seeking out free or low-cost recreational activities.

Question 5: How can I create a realistic budget for my time as an unpaid intern?

Answer: Start by listing all your essential expenses like rent, utilities, transportation, and groceries. Then prioritize your spending, cut unnecessary costs, and allocate a budget for entertainment and personal expenses.

Question 6: Can I negotiate for compensation or benefits during an unpaid internship?

Answer: While unpaid internships generally do not offer monetary compensation or benefits, it is possible to negotiate for certain perks like transportation reimbursements, professional development opportunities, or flexible working hours.

Question 7: Should I consider taking out a loan to cover my expenses during an unpaid internship?

Answer: Taking out a loan should be carefully considered as it can lead to long-term financial obligations. Explore other options like part-time work, scholarships, or grants before resorting to loans.

Question 8: Is it advisable to use credit cards to finance expenses during an unpaid internship?

Answer: The use of credit cards should be approached cautiously. While they can be helpful in certain situations, be mindful of interest rates and ensure you can pay off the balance in a timely manner to avoid accumulating debt.

Final Thoughts

To prepare financially for unpaid internships, there are several steps you can take. Firstly, create a budget to understand your expenses and prioritize saving money. Cut back on non-essential expenses and find ways to save, such as cooking at home instead of eating out. Additionally, consider part-time work or freelancing to supplement your income. Research and apply for scholarships, grants, or financial aid specific to internships. Don’t overlook the value of networking and building relationships, as they can lead to paid opportunities in the future. By taking these proactive measures, you can better navigate the financial challenges that come with unpaid internships.