When it comes to preparing for end-of-life financial needs, it’s essential to have a plan in place. Many people may find themselves unsure of where to begin or how to navigate this sensitive topic. But fear not, for in this article, we will guide you through the steps on how to prepare for end-of-life financial needs. From organizing important documents to understanding insurance policies and exploring options for estate planning, we’ll equip you with the knowledge and confidence to handle this crucial aspect of life. So, let’s delve into the practical ways to ensure financial security and peace of mind for you and your loved ones.

How to Prepare for End-of-Life Financial Needs

Introduction

Preparing for end-of-life financial needs is an important aspect of financial planning that often gets overlooked. While it may not be the most pleasant topic to think about, having a plan in place can provide peace of mind and ensure that your loved ones are taken care of when you’re no longer able to do so yourself. In this article, we will explore various strategies and considerations to help you prepare for end-of-life financial needs.

Understanding the Importance of End-of-Life Financial Planning

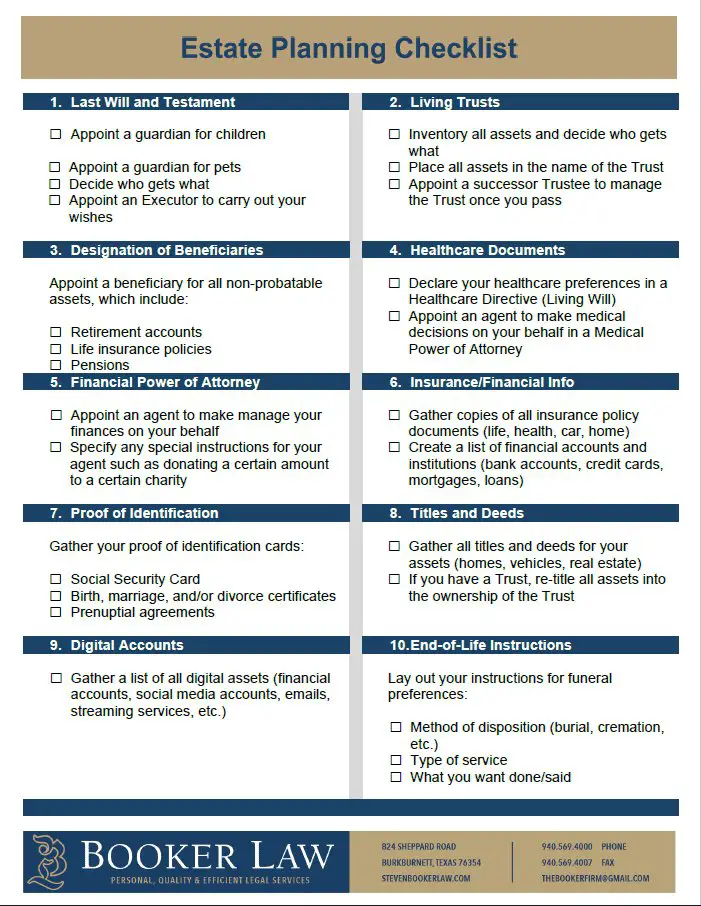

End-of-life financial planning involves making decisions about how your assets and financial affairs will be managed after your passing. It encompasses various elements, including estate planning, wills, trusts, and beneficiary designations. Here are some key reasons why you should prioritize end-of-life financial planning:

- Ensuring your assets are distributed according to your wishes: By creating a comprehensive estate plan, you can specify how your assets should be distributed and avoid any potential conflicts or disputes among family members.

- Protecting your loved ones’ financial security: Planning for end-of-life financial needs can help alleviate the financial burden on your loved ones. It allows you to establish provisions for their financial well-being, such as setting up trusts or life insurance policies.

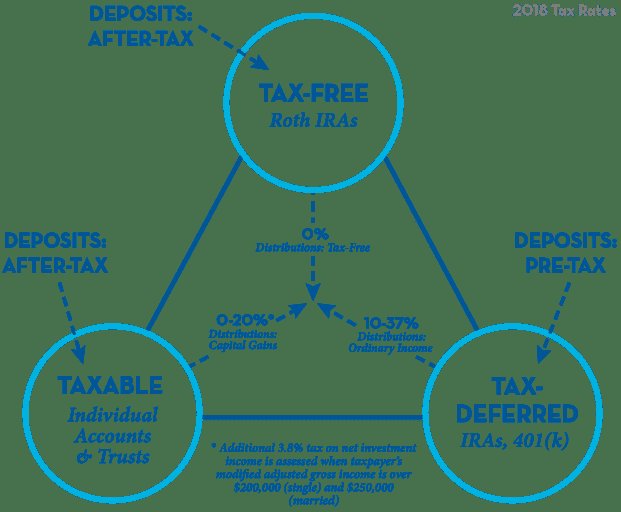

- Minimizing estate taxes: Proper planning can help minimize the tax burden on your estate, ensuring that more of your assets go to your intended beneficiaries rather than the government.

- Avoiding probate: By utilizing tools like trusts, you can potentially avoid the probate process, which can be time-consuming, costly, and subject to public scrutiny.

- Providing for dependents and special needs individuals: If you have dependents or loved ones with special needs, thoughtful financial planning can ensure they are taken care of even when you’re no longer around.

Key Steps to Prepare for End-of-Life Financial Needs

Now that we understand the importance of end-of-life financial planning, let’s delve into the key steps you can take to ensure your financial affairs are in order:

Step 1: Evaluate your current financial situation

Before planning for end-of-life financial needs, it’s crucial to have a clear understanding of your current financial situation. Consider the following aspects:

- Review your assets and liabilities: Take stock of your assets, including bank accounts, investments, properties, and personal belongings. Also, consider your debts and outstanding loans.

- Assess your income and expenses: Evaluate your sources of income and expenses to determine your cash flow. This analysis will help you assess how much you can allocate towards your end-of-life financial plan.

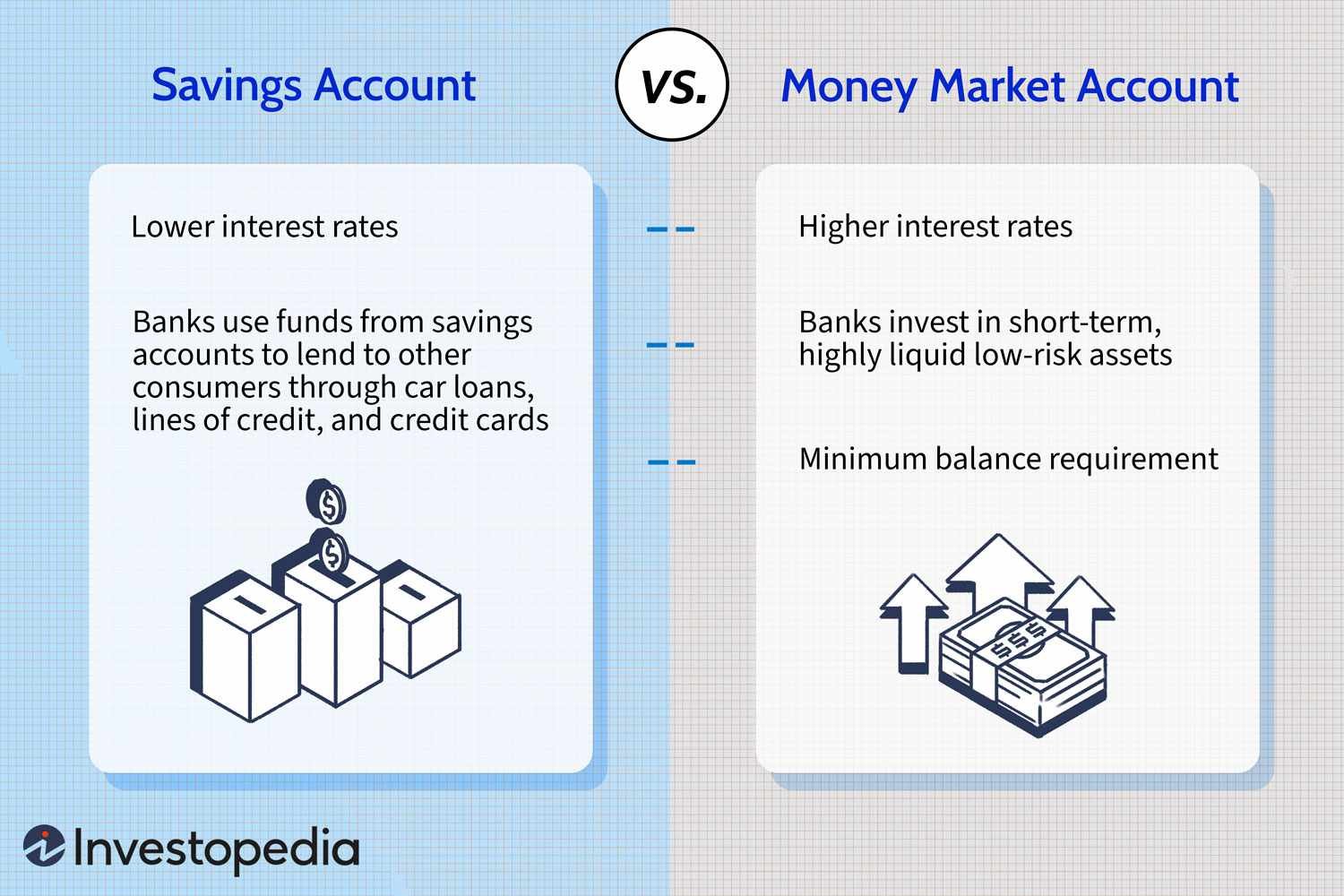

- Review your insurance coverage: Understand what types of insurance policies you have and evaluate whether they are sufficient to cover your end-of-life expenses.

Step 2: Create or update your will and estate plan

Financial Planning 101 (By Age) – The Complete Guide to Winning Financially

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is the importance of preparing for end-of-life financial needs?

Preparing for end-of-life financial needs is crucial as it ensures that you have the necessary funds to cover medical expenses, funeral costs, and any outstanding debts. It also provides financial security for your loved ones during a difficult time.

How early should I start preparing for end-of-life financial needs?

It is advisable to start preparing for end-of-life financial needs as soon as possible. Ideally, it is best to start in your 40s or 50s, but it’s never too late to begin. The earlier you start, the more time you have to accumulate savings and make necessary arrangements.

What are the key steps to prepare for end-of-life financial needs?

1. Assess your current financial situation.

2. Estimate future expenses related to medical care, funeral arrangements, and outstanding debts.

3. Consider purchasing life insurance or exploring other financial products.

4. Create a will and establish a power of attorney.

5. Consult with a financial advisor to discuss investment and savings strategies.

What are the benefits of having life insurance for end-of-life financial needs?

Life insurance provides a financial safety net for your loved ones after you pass away. It can help cover funeral costs, outstanding debts, and provide income replacement for your dependents. Life insurance ensures that your family is not burdened with financial difficulties during a difficult time.

Should I consider setting up a trust for end-of-life financial needs?

Setting up a trust can be a wise decision when preparing for end-of-life financial needs. A trust allows you to designate how your assets will be distributed and managed after your passing. It can provide protection and control over your assets while minimizing the potential for conflicts among beneficiaries.

What are some common mistakes to avoid when preparing for end-of-life financial needs?

1. Procrastinating on making necessary arrangements.

2. Underestimating future expenses and not budgeting accordingly.

3. Failing to review and update financial plans regularly, especially after major life events.

4. Not consulting with professionals such as financial advisors and estate planning attorneys.

5. Ignoring the importance of having adequate life insurance coverage.

What documents should I gather to prepare for end-of-life financial needs?

Gather the following documents:

1. Will or living trust

2. Life insurance policies

3. Retirement account statements

4. Bank account information

5. Investment account statements

6. Property deeds or titles

7. Social Security information

8. Health insurance policies

Are there any government programs or benefits available to assist with end-of-life financial needs?

Yes, there are government programs and benefits that can provide financial assistance during end-of-life needs. Examples include Social Security survivor benefits, veterans’ benefits, and Medicaid. It is recommended to research and understand the eligibility criteria and application process for each program.

Final Thoughts

Properly preparing for end-of-life financial needs is of utmost importance to ensure a smooth transition and alleviate any potential burdens on your loved ones. Start by creating a comprehensive estate plan that includes a will, power of attorney, and advanced healthcare directive. Regularly review and update this plan as necessary. Consider investing in long-term care insurance to cover healthcare costs and explore options for estate tax planning. Prioritize open and honest communication with your family about your financial wishes and seek professional advice when needed. By taking these proactive steps, you can effectively prepare for end-of-life financial needs and provide peace of mind for both yourself and your loved ones.