Welcome to the world of finance! If you’ve ever wondered how to navigate the often mystifying realm of financial statements, this article is here to guide you. So, how to read financial statements for beginners? Fear not, we will demystify the jargon and complexities surrounding these essential documents. By the end of this article, you’ll be equipped with the knowledge and confidence to delve into financial statements like a pro. Let’s dive in!

Understanding financial statements may seem daunting at first, but with a little guidance, you’ll soon realize they hold the key to unlocking valuable insights about a company’s financial health and performance. By analyzing income statements, balance sheets, and cash flow statements, you can gain a comprehensive understanding of a company’s profitability, assets, debts, and cash flow. With this knowledge, you can make informed decisions when it comes to investing, lending, or even starting your own business.

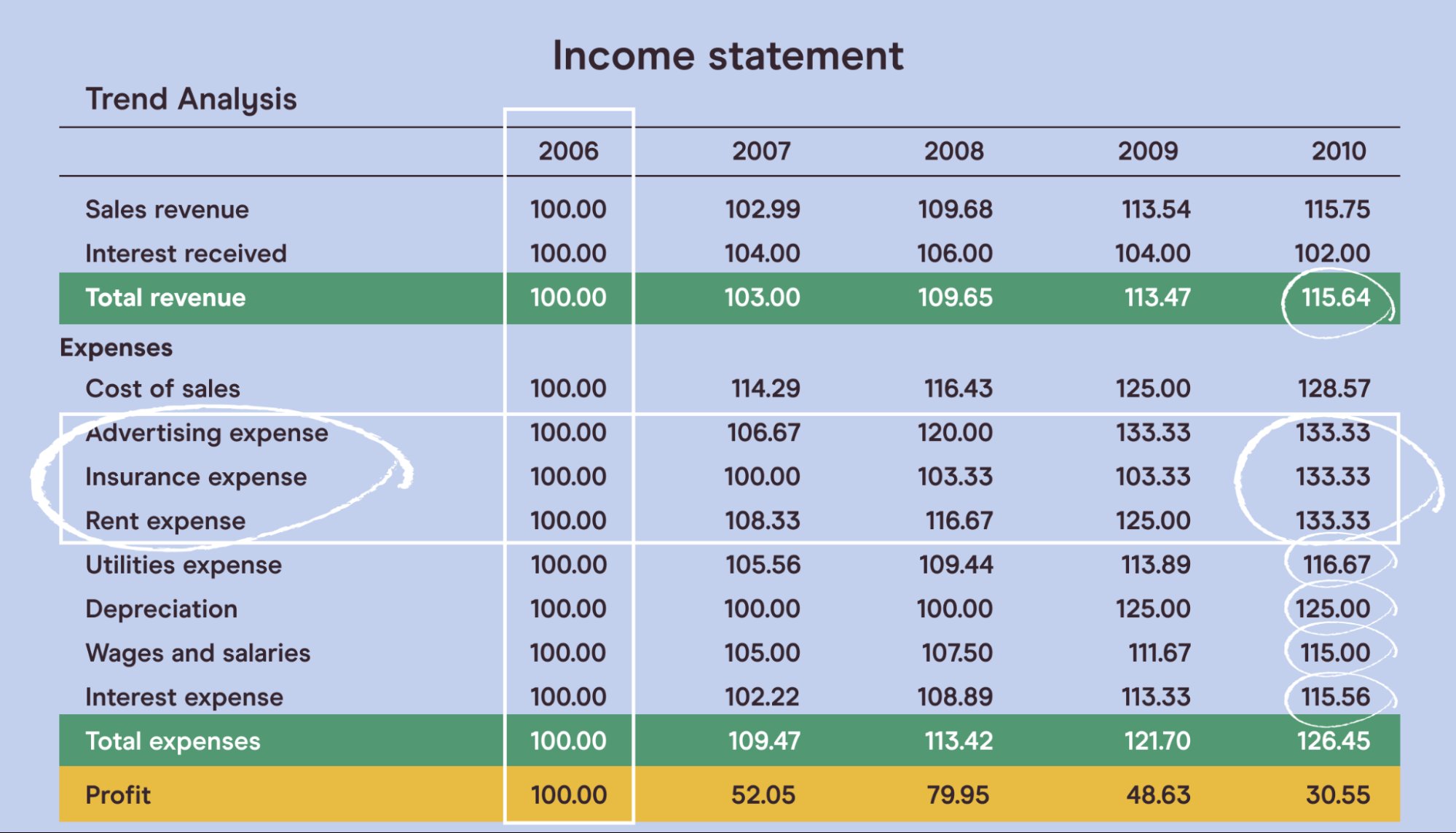

So, where do we begin? Let’s start by exploring the income statement. This financial statement provides a snapshot of a company’s revenues, expenses, and net income over a specific period. It allows you to assess a company’s profitability and its ability to generate consistent earnings. By analyzing revenue trends, cost of goods sold, operating expenses, and net income, you can evaluate how effectively a company manages its resources and generates profits.

Next up, we have the balance sheet. Think of it as a financial snapshot of a company at a specific point in time. It presents a company’s assets, liabilities, and shareholders’ equity. By examining the balance sheet, you can assess a company’s liquidity, leverage, and overall financial position. Understanding the components of a balance sheet, such as current assets, long-term liabilities, and equity, gives you valuable insights into a company’s stability, financial health, and capacity to meet obligations.

Finally, we’ll delve into the cash flow statement. This statement tracks the cash inflows and outflows of a company during a specific period. By analyzing operating activities, investing activities, and financing activities, you can determine how a company generates and uses cash. This information is crucial for assessing a company’s ability to fund its operations, invest in growth, and repay debts.

Now that you understand the importance of financial statements and have a general idea of what to look for, it’s time to roll up your sleeves and start digging into the numbers. Remember, practice makes perfect, and the more you familiarize yourself with financial statements, the more confident you’ll become in analyzing and interpreting them.

So, if you’ve been wondering how to read financial statements for beginners, look no further! This comprehensive guide will equip you with the knowledge and skills needed to navigate the world of financial statements with ease. Get ready to embark on a journey of financial literacy and gain the confidence to make informed decisions. Let’s get started!

How to Read Financial Statements for Beginners

Understanding financial statements is essential for anyone looking to gain insights into a company’s financial health. Whether you are a beginner investor, an entrepreneur, or simply someone curious about the financial side of businesses, this guide will walk you through the basics of reading financial statements. In this article, we will cover the three main financial statements — the balance sheet, income statement, and cash flow statement — and break down their components step by step.

1. The Balance Sheet

The balance sheet provides a snapshot of a company’s financial position at a specific point in time. It presents a summary of assets, liabilities, and shareholder equity. By analyzing a balance sheet, you can assess a company’s solvency, liquidity, and overall financial stability.

1.1 Assets

Assets represent what a company owns and include both tangible and intangible items. On the balance sheet, assets are usually categorized into current and non-current assets.

- Current assets: These are assets that are expected to be converted into cash or used up within one year. Examples include cash, accounts receivable, inventory, and short-term investments.

- Non-current assets: These are long-term assets that are not expected to be converted into cash within one year. They include property, plant, and equipment, intangible assets like patents or trademarks, and long-term investments.

1.2 Liabilities

Liabilities represent a company’s obligations or debts. Similar to assets, liabilities are divided into current and non-current categories.

- Current liabilities: These are debts that are due within one year. Examples include accounts payable, short-term loans, and accrued expenses.

- Non-current liabilities: These are long-term debts that are not due within one year. They may include long-term loans, bonds payable, and lease obligations.

1.3 Shareholder Equity

Shareholder equity, also known as owners’ equity or stockholders’ equity, represents the residual interest in the company’s assets after deducting liabilities. It is the amount that would be left for shareholders if all liabilities were settled. Shareholder equity includes common stock, preferred stock, retained earnings, and additional paid-in capital.

2. The Income Statement

The income statement, also called the profit and loss statement, provides an overview of a company’s revenues, expenses, gains, and losses over a specific period. It shows whether a company generated a profit or incurred a loss during that time.

2.1 Revenue

Revenue represents the total amount of money earned by a company from its primary operations. It includes sales revenue, fees earned, interest income, and any other income generated.

2.2 Expenses

Expenses are the costs incurred by a company in running its business operations. They include various categories such as cost of goods sold, research and development expenses, marketing expenses, employee salaries, and administrative costs.

2.3 Gross Profit and Operating Income

Subtracting the cost of goods sold from revenue gives us the gross profit, which indicates the profitability directly related to the production and sale of goods or services. Operating income, also called operating profit, is the result of subtracting operating expenses (such as salaries, rent, and depreciation) from the gross profit.

2.4 Net Income

Net income, often referred to as the bottom line, represents the final profit or loss after accounting for all revenues, expenses, gains, and losses. It reflects the overall profitability of a company.

3. The Cash Flow Statement

The cash flow statement provides information about the cash inflows and outflows of a company during a specific period. It helps analyze a company’s ability to generate cash and its cash management practices.

3.1 Operating Activities

Operating activities include cash flows from day-to-day business operations, such as cash received from customers and payments to suppliers and employees. It also includes interest and dividend income received and interest paid.

3.2 Investing Activities

Investing activities involve the purchase or sale of long-term assets or investments. Examples include acquiring or selling property, plant, and equipment, purchasing or selling stocks, or making loans to other entities.

3.3 Financing Activities

Financing activities represent cash flows related to raising capital or repaying debt. They include proceeds from issuing or repurchasing shares, taking on or repaying loans or bonds, and payment of dividends.

3.4 Net Cash Flow

The net cash flow shows the overall change in a company’s cash balance during a particular period. It is calculated by summing the cash flows from operating, investing, and financing activities.

Understanding and interpreting financial statements is a valuable skill that allows you to evaluate the financial health of a company and make informed decisions. By comprehending the components of the balance sheet, income statement, and cash flow statement, you can gain insights into a company’s assets, liabilities, revenue, expenses, and cash flows. This knowledge enables you to assess profitability, solvency, and liquidity, which are crucial factors in determining the financial viability of a business. With this guide, beginners can now confidently read and analyze financial statements, empowering them to make informed financial decisions.

FINANCIAL STATEMENTS: all the basics in 8 MINS!

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How do I read financial statements as a beginner?

When reading financial statements as a beginner, start by familiarizing yourself with the basic components of the statements. These include the balance sheet, income statement, and cash flow statement. Understand the purpose of each statement and the information it provides about a company’s financial health.

What is the purpose of a balance sheet?

A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It shows the company’s assets, liabilities, and shareholders’ equity, providing information about its net worth and financial health.

How can I interpret the income statement?

The income statement, also known as the profit and loss statement, shows a company’s revenues, expenses, and net income over a specific period. To interpret it, focus on the revenue sources, cost of goods sold, operating expenses, and net income. This statement helps understand the profitability of a company.

What does the cash flow statement tell me?

The cash flow statement tracks the flow of cash into and out of a company. It provides information on the company’s operating, investing, and financing activities. By analyzing the cash flow statement, you can assess the company’s ability to generate cash and manage its operations effectively.

What are key financial ratios to consider when reading financial statements?

Some key financial ratios to consider include the current ratio, which measures a company’s short-term liquidity; the debt-to-equity ratio, which indicates the company’s leverage; and the return on equity (ROE), which shows how effectively the company is utilizing shareholders’ equity. These ratios help evaluate a company’s financial performance.

Are there any common pitfalls to avoid when reading financial statements?

Yes, some common pitfalls to watch out for include not considering the context of the industry, relying solely on one financial statement without considering others, and not comparing the company’s financial performance with its competitors. It’s essential to take a holistic approach and consider multiple factors when analyzing financial statements.

Where can I find resources to learn more about reading financial statements?

There are several resources available for beginners to learn more about reading financial statements. Online courses, books, and tutorials provided by reputable institutions or financial experts can be excellent sources of knowledge. Additionally, financial websites and forums can provide valuable insights and discussions on the topic.

Can I rely solely on financial statements to make investment decisions?

While financial statements offer crucial information about a company’s financial health, they should not be the sole basis for investment decisions. It’s essential to consider other factors such as industry trends, competitive analysis, management quality, and overall market conditions before making investment decisions.

Final Thoughts

Understanding financial statements can be overwhelming for beginners, but with some basic knowledge, it becomes more manageable. Start by familiarizing yourself with the three main types of financial statements: the balance sheet, income statement, and cash flow statement. These statements provide valuable insights into a company’s financial health and performance. Begin by analyzing the balance sheet to grasp the company’s assets, liabilities, and equity. Then, move to the income statement to gain an understanding of revenue, expenses, and profitability. Finally, review the cash flow statement to assess the company’s cash inflows and outflows. By following these steps and taking the time to interpret the numbers, beginners can confidently navigate financial statements and make more informed decisions. So, if you are a beginner looking to understand financial statements, remember to start with the basics and take it step by step.