Are you dreaming of owning your own home but find the prospect of saving for a down payment daunting? Well, fear not! I have the solution for you. In this blog article, I will show you exactly how to save for a down payment in one year. Yes, you read that right – just one year! Saving for a down payment may seem like a challenging task, but with the right strategies and a little bit of discipline, you can make it happen. So, let’s dive in and learn how to save for a down payment in one year.

How to Save for a Down Payment in One Year

Saving for a down payment on a house can seem like a daunting task, especially if you’re on a tight budget or have other financial obligations. However, with careful planning, determination, and some smart strategies, it is possible to save enough money for a down payment within a year. In this article, we will provide you with a detailed guide on how to save for a down payment in one year, step by step. So, let’s get started!

1. Set a Realistic Savings Goal

Before you begin saving, it’s important to determine the amount of money you’ll need for your down payment. A down payment typically ranges from 5% to 20% of the home’s purchase price. Calculate the down payment amount you require based on the price range of the homes you are interested in. Once you have a target amount in mind, you can break it down to determine how much you need to save each month.

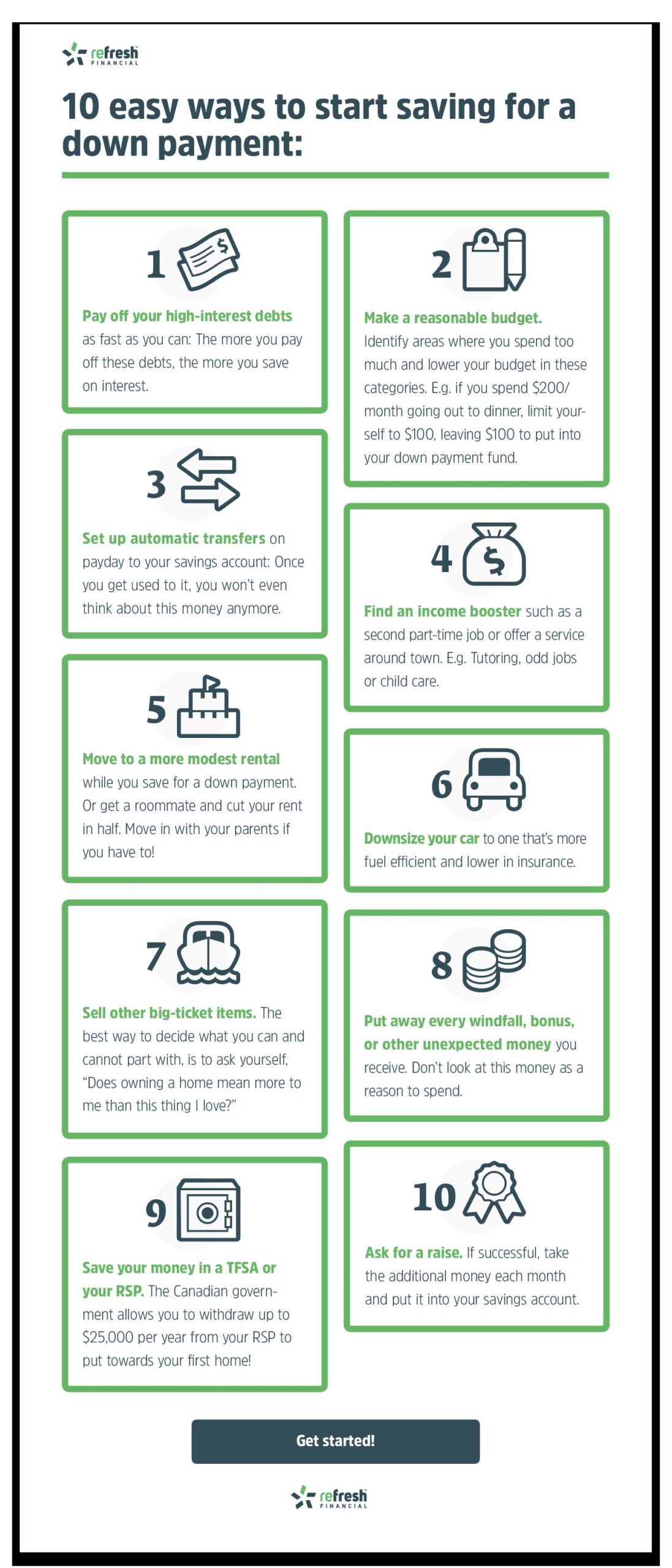

2. Create a Budget and Cut Expenses

Creating a budget is crucial to saving money effectively. Look closely at your income and expenses to understand where your money is going each month. Identify areas where you can cut back or eliminate unnecessary spending. Consider reducing discretionary expenses like eating out, entertainment, and shopping. Look for opportunities to save on monthly bills such as utilities and subscriptions. By making small changes to your spending habits, you can free up more money to save for your down payment.

3. Automate Your Savings

Automating your savings can make a significant difference in reaching your down payment goal. Set up automatic transfers from your paycheck or checking account to a separate savings account dedicated solely to your down payment. By doing this, you’ll ensure that a portion of your income is set aside without you having to remember to do it manually. Treat your savings like any other bill or expense, making it a priority each month.

4. Explore Down Payment Assistance Programs

Research down payment assistance programs that may be available in your area. These programs are designed to help first-time homebuyers by offering grants, loans, or subsidies to assist with down payment and closing costs. Each program has its own eligibility criteria, so check if you qualify for any of these programs. Taking advantage of such programs can significantly reduce the amount of money you need to save on your own.

5. Boost Your Income

Increasing your income can expedite your savings process. Consider taking on a side hustle or part-time job to earn extra money that can be directed towards your down payment. Explore possibilities such as freelancing, tutoring, pet sitting, or driving for a ride-sharing service. Additionally, you could ask for a raise or seek better job opportunities that offer higher pay. Any additional income you generate can go directly into your down payment savings.

6. Save Windfalls and Tax Refunds

When unexpected financial windfalls come your way, such as bonuses, tax refunds, or cash gifts, resist the temptation to splurge on non-essential items. Instead, deposit these windfalls directly into your down payment savings account. While it can be tempting to spend these windfalls on vacations or luxury items, prioritizing your long-term goal of homeownership will bring you closer to achieving your down payment target.

7. Reduce or Consolidate High-Interest Debts

High-interest debts like credit card balances can hinder your ability to save for a down payment. Take steps to reduce or consolidate these debts to make more money available for saving. Consider paying off high-interest debts with the highest monthly payments first. Another option is to consolidate multiple debts into a single loan with a lower interest rate. By reducing your debt burden, you’ll have more room in your budget to allocate towards your down payment savings.

8. Investigate Cost-Saving Measures

As you save for your down payment, look for ways to reduce your current living expenses. Consider downsizing to a smaller apartment, finding a roommate to split rent costs, or negotiating lower insurance premiums. Evaluate your transportation costs and explore alternative options like carpooling, public transportation, or biking. These cost-saving measures may seem small, but when combined, they can add up to significant savings over time.

9. Track Your Progress and Stay Motivated

Keep a close eye on your progress towards your down payment goal. Regularly review your savings account balance and track how much you’ve saved each month. Celebrate milestones along the way to keep yourself motivated. Consider creating a visual representation of your progress, such as a savings thermometer or a chart, to visually see your savings grow. Keeping your eyes on the prize will help you stay committed to your goal.

10. Stay Disciplined and Avoid Temptations

Saving for a down payment requires discipline and dedication. Avoid unnecessary temptations that may sabotage your savings efforts. Stay focused on your goal and remind yourself of the long-term benefits of homeownership. Surround yourself with a supportive network of friends and family who understand your financial objectives and can provide encouragement when faced with temptation. Remember, the sacrifices you make now will pay off in the future.

By following these steps and implementing smart savings strategies, you can successfully save for a down payment within a year. Stay committed, remain focused, and don’t be discouraged by any setbacks along the way. With determination and perseverance, you’ll be well on your way to achieving your dream of homeownership. Good luck on your savings journey!

What's the Best Way to Save for a Mortgage Downpayment?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How can I save for a down payment in one year?

1. Set a specific savings goal for your down payment and determine the amount you need to save each month to reach it.

What are some effective strategies to save for a down payment in one year?

2. Create a monthly budget and identify areas where you can cut expenses to allocate more money towards savings.

3. Consider taking on a part-time job or freelancing to increase your income and accelerate your savings.

4. Automate your savings by setting up automatic transfers from your checking account to a separate savings account earmarked for your down payment.

Should I prioritize paying off debt or saving for a down payment?

5. It depends on your individual circumstances. Generally, it’s recommended to focus on paying off high-interest debt first, such as credit card debt, before aggressively saving for a down payment.

Are there any government programs or incentives that can help me save for a down payment?

6. Yes, some government programs offer assistance to first-time homebuyers, such as down payment assistance programs or grants. Research and explore these options to see if you qualify.

How can I stay motivated to save for a down payment in one year?

7. Keep your goal in mind and visualize the benefits of homeownership. Consider creating a vision board or regularly reviewing listings of homes you aspire to own.

8. Celebrate milestones along the way, such as reaching a certain percentage of your savings goal, to stay motivated and maintain momentum.

Final Thoughts

Saving for a down payment in one year requires discipline and strategic planning. Firstly, set a realistic budget and cut down on unnecessary expenses. Track your spending and find areas where you can make savings. Consider increasing your income through side gigs or a part-time job. Set up a separate savings account specifically for your down payment and automate regular contributions. Prioritize saving over discretionary spending and make sacrifices when necessary. Lastly, explore opportunities for additional assistance such as government programs or gifts from family. By adopting these strategies and staying focused, you can achieve your goal of saving for a down payment in one year.