Thinking about buying a house? One of the biggest challenges you’ll face is saving for a down payment. But fret not! I’m here to guide you on how to save for a down payment on a house. Saving for a down payment requires discipline and smart financial planning. In this article, we’ll explore practical strategies to help you reach your savings goal faster. So, if you’re ready to turn your dream of homeownership into a reality, let’s dive in!

How to Save for a Down Payment on a House

Saving for a down payment on a house can be a daunting task, but with the right strategies and discipline, it is possible to achieve your goal. Buying a house is a big financial commitment, and having enough money for a down payment is crucial to secure a mortgage and ultimately become a homeowner. In this comprehensive guide, we will explore various methods and tips to help you save for a down payment on a house.

1. Set a Realistic Down Payment Goal

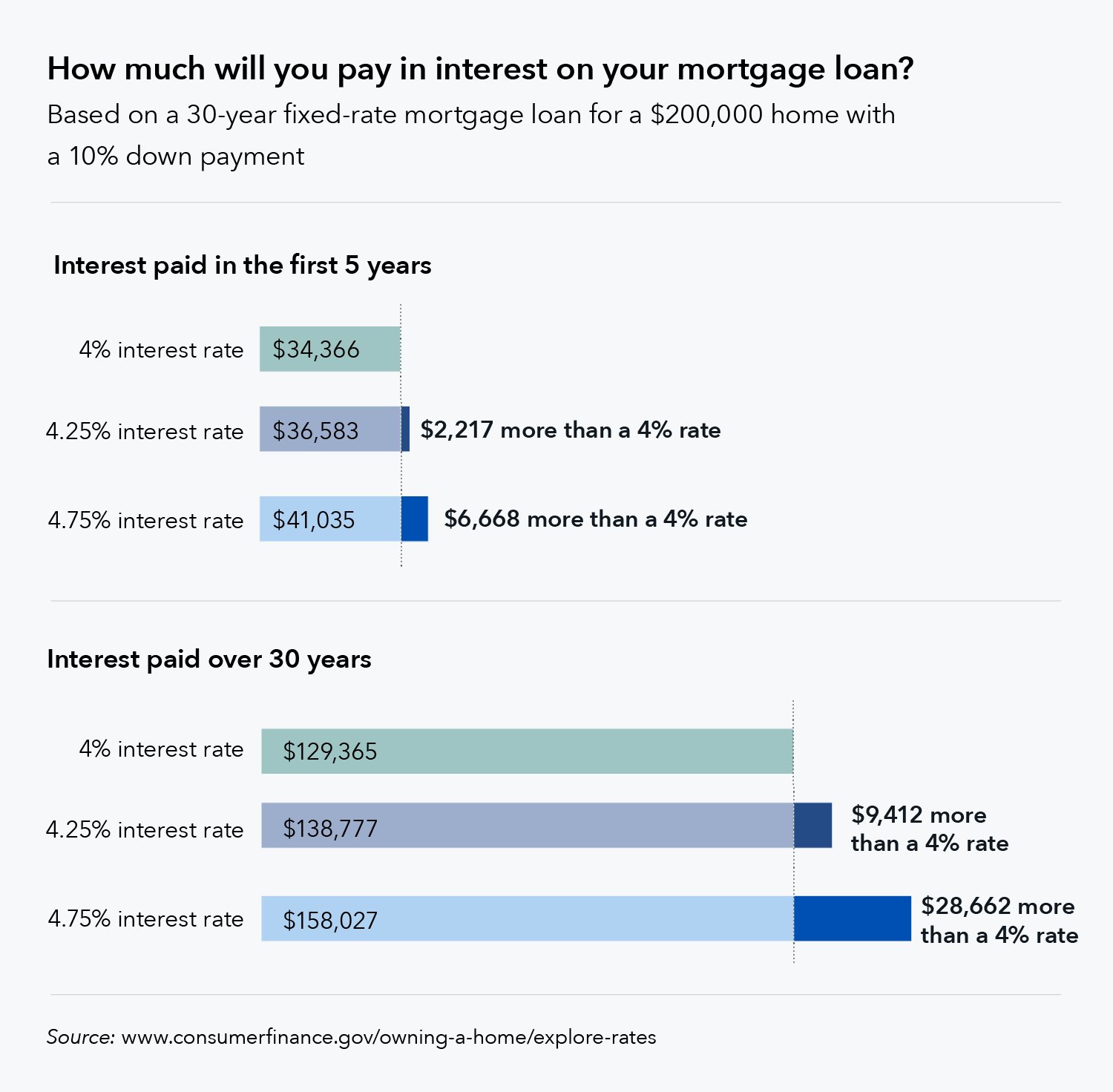

Before you start saving, it’s important to determine how much you need to save for a down payment. Generally, it is recommended to save at least 20% of the home’s purchase price to avoid private mortgage insurance (PMI) and obtain more favorable loan terms. However, in some cases, you may be able to make a smaller down payment, depending on the type of mortgage you qualify for.

To set a realistic down payment goal, consider the following factors:

- The price range of homes you are interested in

- Your desired monthly mortgage payment

- Your current monthly budget and expenses

- Your timeline for buying a house

Once you have a clear picture of your financial situation and goals, you can determine the specific amount you need to save.

2. Create a Budget and Track Your Expenses

Creating a budget is an essential step in saving for a down payment. Start by tracking your monthly expenses and categorizing them into different areas such as housing, transportation, groceries, entertainment, and savings. This will help you identify areas where you can cut back and save more.

Consider the following tips to create a budget that prioritizes your down payment savings:

- Review your expenses and look for non-essential items you can reduce or eliminate

- Consider downsizing your current living arrangements to save on rent or mortgage payments

- Cut back on discretionary spending, such as eating out or subscription services

- Explore ways to save on utilities, insurance, and other monthly bills

By creating a budget and tracking your expenses, you will have a better understanding of where your money is going and how much you can allocate towards your down payment savings.

3. Automate Your Savings

One effective way to save for a down payment is to automate your savings. Set up an automatic transfer from your checking account to a separate savings account dedicated solely to your down payment fund. By automating your savings, you ensure that a portion of your income goes directly towards your goal without the temptation to spend it elsewhere.

Consider the following tips to make the most of automated savings:

- Set up automatic transfers to align with your pay schedule

- Start with a small amount and gradually increase the transfer as you adjust to the reduced income

- Choose a high-yield savings account to maximize your savings through interest

Automating your savings takes away the stress of manually saving and ensures consistency in reaching your down payment goal.

4. Trim Your Expenses

To accelerate your down payment savings, it’s important to find ways to trim your expenses. By cutting back on unnecessary costs, you can free up more money to put towards your down payment fund.

Consider the following strategies to trim your expenses:

- Review your monthly subscriptions and cancel those you don’t use

- Shop for discounts and use coupons when making purchases

- Reduce dining out and cook meals at home

- Lower your energy consumption by practicing energy-saving habits

- Consider downsizing your vehicle or using public transportation

Every little saving counts, and by being mindful of your expenses, you can make significant progress towards your down payment goal.

5. Increase Your Income

Finding ways to increase your income can greatly accelerate your down payment savings. Consider taking on extra work, exploring side hustles, or seeking promotions or career advancements that come with higher salaries.

Here are some ideas to increase your income:

- Freelance or consult in your area of expertise

- Rent out a spare room in your current residence

- Start a small business or sell goods or services online

- Take on part-time or seasonal work

- Invest in personal development and acquire new skills to enhance your marketability

By increasing your income, you can allocate more money towards your down payment savings and reach your goal faster.

6. Explore Down Payment Assistance Programs

In addition to your personal savings, there are various down payment assistance programs available that can help you bridge the gap. These programs are often provided by state and local governments, as well as non-profit organizations, and can provide grants, loans, or other forms of assistance to eligible homebuyers.

Research and explore the down payment assistance programs in your area to see if you qualify. Some programs may have income or other eligibility requirements, so be sure to thoroughly understand the terms and conditions before applying.

7. Prioritize Saving Over Debt Repayment

While it is important to manage your debts responsibly, prioritizing your down payment savings over debt repayment can help you achieve your goal sooner. This doesn’t mean neglecting your debts entirely, but rather finding a balance between debt repayment and saving for a down payment.

Consider the following strategies to manage your debts while saving for a down payment:

- Focus on paying off high-interest debts first

- Consolidate your debts to lower interest rates and simplify repayment

- Explore options to refinance or negotiate better loan terms

- Allocate a portion of your income towards both debt repayment and down payment savings

Finding the right balance between debt repayment and saving will depend on your individual financial situation and goals.

8. Review and Adjust Your Savings Strategy Regularly

As you progress towards your down payment goal, it’s important to regularly review and adjust your savings strategy. Life circumstances, financial goals, and market conditions can change, and it’s essential to adapt your savings plan accordingly.

Consider the following factors when reviewing and adjusting your savings strategy:

- Changes in income or expenses

- Changes in your timeline for buying a house

- Shifts in the real estate market

- New opportunities for increasing income or saving on expenses

By staying proactive and regularly reassessing your savings strategy, you can ensure that you are on track to achieve your down payment goal.

Saving for a down payment on a house requires discipline, planning, and a bit of sacrifice. By setting a realistic goal, creating a budget, automating your savings, trimming expenses, increasing your income, exploring down payment assistance programs, prioritizing savings over debt repayment, and regularly reviewing your strategy, you can make significant progress towards achieving your dream of homeownership. Remember, every penny saved brings you one step closer to unlocking the doors of your new home. Start saving today and watch your down payment fund grow!

What's the Best Way to Save for a Mortgage Downpayment?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. How much money should I save for a down payment on a house?

The amount of money you should save for a down payment on a house depends on various factors, including the price of the house you want to purchase and the type of loan you qualify for. Generally, it is recommended to save around 20% of the purchase price to avoid private mortgage insurance (PMI).

2. How can I start saving for a down payment?

To start saving for a down payment on a house, you can follow these steps:

- Create a budget and identify areas where you can cut expenses.

- Set up a separate savings account specifically for your down payment funds.

- Automate your savings by setting up automatic transfers from your paycheck to the savings account.

- Explore ways to increase your income, such as taking on a side job or freelancing.

3. How long does it typically take to save for a down payment?

The time it takes to save for a down payment on a house can vary depending on your individual circumstances, including your income, expenses, and saving habits. On average, it can take several years to save enough for a down payment.

4. Are there any government programs available to help with down payment savings?

Yes, there are various government programs that can assist you with down payment savings, such as the Federal Housing Administration (FHA) loans, U.S. Department of Agriculture (USDA) loans, and the Department of Veterans Affairs (VA) loans. These programs often have specific eligibility requirements, so it’s important to research and understand them before applying.

5. Should I consider using a down payment assistance program?

Down payment assistance programs can be beneficial if you’re struggling to save for a down payment. These programs provide grants or loans to help cover a portion of the down payment and sometimes even closing costs. However, it’s crucial to carefully review the terms and conditions of these programs before committing.

6. Are there any strategies for saving more effectively?

Yes, here are a few strategies to save more effectively for a down payment:

- Reduce unnecessary expenses and prioritize saving.

- Save any windfalls or unexpected extra income you receive.

- Consider downsizing your current living arrangements or finding a more affordable rental.

- Investigate potential grants or subsidies available for first-time homebuyers.

7. Can I use funds from my retirement account for a down payment?

In certain situations, you may be able to use funds from your retirement account for a down payment on a house. However, it is important to consult with a financial advisor and understand the potential consequences, such as taxes and penalties, before making this decision.

8. What are some alternative options for a down payment on a house?

If you’re struggling to save for a down payment on a house, there are alternative options you can consider, such as:

- Seeking financial assistance from family or friends.

- Exploring rent-to-own or lease-purchase agreements.

- Looking into shared equity or co-ownership arrangements.

- Researching affordable housing programs in your area.

Final Thoughts

Saving for a down payment on a house is no easy task, but with determination and smart financial planning, it is achievable. Start by creating a budget and cutting back on unnecessary expenses. Look for ways to increase your income, such as taking on a side hustle or freelancing. Consider automating your savings by setting up automatic transfers to a separate savings account. Explore government programs and assistance options that can help you save for a down payment. Stay focused on your goal and stay disciplined with your spending. With consistent effort and a clear plan, you can successfully save for a down payment on a house.