Are you in your 20s and wondering how to save for retirement? Don’t worry, I’ve got you covered. Saving for retirement might seem like a distant goal, but it’s never too early to start planning for your future. In this article, we’ll explore some practical tips and strategies that can help you build a solid financial foundation and secure a comfortable retirement. So, if you’re ready to take control of your financial future and set yourself up for a stress-free retirement, keep reading!

How to Save for Retirement in Your 20s

Retirement may seem like a distant event when you’re in your 20s, but it’s never too early to start planning and saving for the future. In fact, the earlier you start, the better off you’ll be in the long run. This article will guide you through the steps and strategies to effectively save for retirement in your 20s, ensuring a financially secure future.

Why Start Saving for Retirement in Your 20s?

Before diving into the saving strategies, it’s important to understand why starting early is crucial. Here are a few compelling reasons:

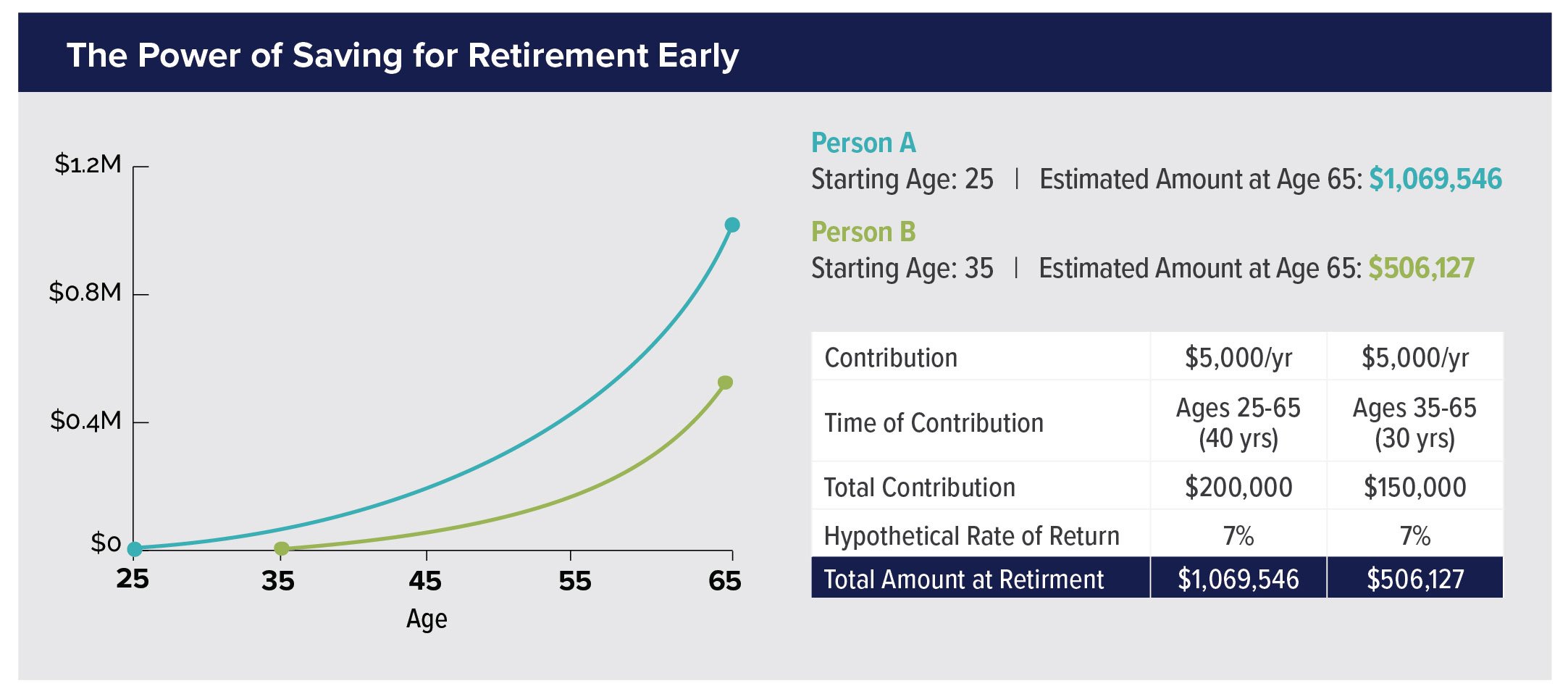

- Compound Interest: By starting in your 20s, you can take full advantage of the power of compound interest. This means your money can grow exponentially over time, thanks to the interest earned on both your original savings and the accumulated interest.

- Long Investment Horizon: Starting early provides you with a longer investment horizon, allowing you to ride out market fluctuations and potentially earn higher returns on your investments.

- Flexibility: Saving early gives you more flexibility and options in the future. You’ll have a larger nest egg to rely on, which can provide greater security and allow you to pursue other goals without financial stress.

1. Set Clear Retirement Goals

Before you start saving for retirement, it’s essential to have clear goals in mind. Determine the lifestyle you envision for your retirement years and the age at which you would like to retire. These goals will serve as a compass to guide your savings strategy.

Consider factors such as:

- Your desired retirement age

- Your estimated life expectancy

- Your expected retirement lifestyle

- Healthcare expenses

- Other financial obligations

Having a clear vision of your retirement goals will help you calculate how much you need to save and how aggressively you should invest.

2. Create a Budget and Track Expenses

Creating a budget is an essential step for effective retirement savings. It helps you understand your income, expenses, and how much you can save each month. By tracking your expenses, you’ll identify areas where you can cut back and allocate more towards retirement savings.

Here are some tips for creating a budget:

- Calculate your monthly income after taxes.

- List all your essential expenses, such as rent, utilities, groceries, and debt payments.

- Track your discretionary spending, including entertainment, dining out, and shopping.

- Identify areas where you can reduce spending and allocate those savings towards retirement.

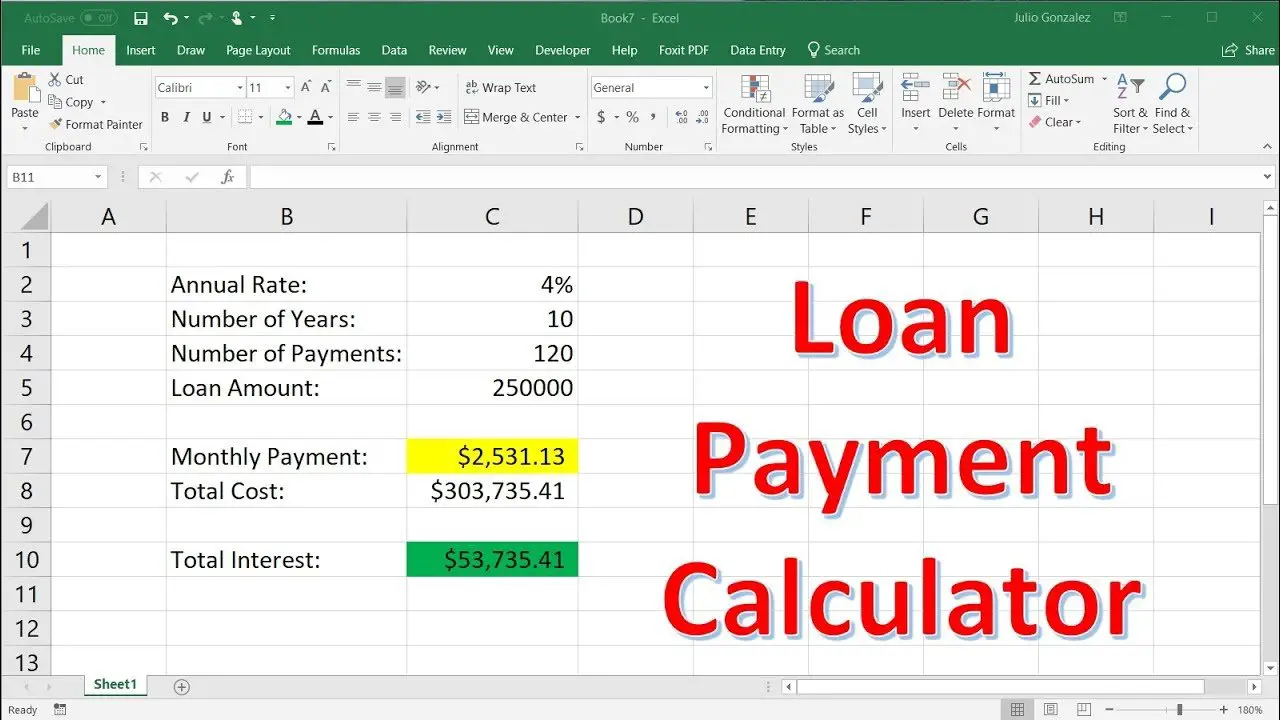

- Consider using budgeting apps or spreadsheets to streamline the process.

Regularly reviewing your budget will help you stay on track and make adjustments as needed.

3. Take Advantage of Workplace Retirement Plans

If your employer offers a retirement plan, such as a 401(k) or 403(b), it’s a fantastic opportunity to save for the future. These plans allow you to contribute a portion of your salary on a pre-tax basis, meaning your contributions are deducted from your paycheck before taxes are applied.

Here’s why workplace retirement plans are worth considering:

- Employer Matching: Some employers offer a matching contribution, where they will match a percentage of your contributions. This is essentially free money that can significantly boost your retirement savings.

- Tax Advantages: Contributions to these plans are tax-deductible, reducing your taxable income for the year. Additionally, your investments grow tax-free until you start withdrawing during retirement.

- Automatic Contributions: Contributions are typically deducted automatically from your paycheck, making it a convenient and consistent way to save.

Contribute at least enough to receive the maximum employer match, as it’s a guaranteed return on your investment.

4. Start an Individual Retirement Account (IRA)

In addition to workplace retirement plans, opening an Individual Retirement Account (IRA) is another great option to save for retirement. IRAs offer unique advantages and are available to anyone with earned income.

There are two types of IRAs to consider:

- Traditional IRA: Contributions to a Traditional IRA are tax-deductible, reducing your taxable income for the year. You’ll pay taxes on the contributions and earnings when you withdraw them during retirement.

- Roth IRA: Contributions to a Roth IRA are made with after-tax dollars, meaning they are not tax-deductible. However, your withdrawals during retirement are tax-free, including the earnings.

Opening and contributing to an IRA is relatively straightforward. Research different providers, compare fees, and choose the one that aligns with your investment goals and risk tolerance. Aim to maximize your annual contributions to take full advantage of the potential tax benefits and growth opportunities.

5. Diversify Your Investment Portfolio

While saving for retirement, it’s important to invest your money wisely to maximize growth. Diversifying your investment portfolio is key to mitigating risks and achieving long-term success.

Consider the following options for diversifying your investments:

- Stocks: Investing in stocks provides the potential for high returns, but it’s also associated with higher risks. Consider a mix of large-cap, mid-cap, and small-cap stocks to balance growth and stability.

- Bonds: Bonds are generally less risky than stocks and provide steady income through interest payments. Look into government bonds, corporate bonds, and municipal bonds to diversify your fixed-income investments.

- Real Estate: Investing in real estate can provide regular income through rental properties or real estate investment trusts (REITs). It’s an excellent way to diversify your portfolio beyond traditional stocks and bonds.

- Mutual Funds and ETFs: Mutual funds and exchange-traded funds (ETFs) allow you to invest in a diversified portfolio with a single investment. They typically track specific market indices, sectors, or investment strategies.

Consult with a financial advisor or do thorough research before making investment decisions. Consider your risk tolerance, investment goals, and time horizon to determine the right mix of investments.

6. Minimize Debt and High-Interest Payments

Paying off high-interest debt should be a priority when saving for retirement. The interest on debts such as credit cards and personal loans can eat into your savings potential.

Follow these steps to minimize debt and interest payments:

- Create a Repayment Plan: List all your debts and create a repayment plan. Prioritize higher interest debts first, while making minimum payments on other debts.

- Consider Consolidation or Refinancing: If possible, consolidate multiple debts into one loan with a lower interest rate. Refinancing options are also worth exploring.

- Avoid New Debt: Minimize new debt by being mindful of your spending habits. Stick to your budget and avoid unnecessary purchases.

By reducing debt and interest payments, you’ll have more disposable income to allocate towards retirement savings.

7. Continuously Monitor and Adjust Your Retirement Plan

Retirement planning is an ongoing process. As you progress through your 20s and beyond, it’s crucial to regularly review and adjust your retirement plan. Life circumstances, financial goals, and market conditions may change.

Consider the following factors when monitoring and adjusting your retirement plan:

- Life Events: Significant life events such as marriage, having children, or changing careers can impact your financial situation and retirement goals.

- Market Performance: Keep an eye on market trends and performance. Adjust your investment portfolio as needed to align with changing market conditions.

- Increasing Contributions: As your income grows, consider increasing your retirement contributions to stay on track with your goals.

Regularly consult with a financial advisor to ensure you’re making informed decisions and optimizing your retirement savings strategy.

Saving for retirement in your 20s sets the foundation for a financially secure future. By setting clear goals, creating a budget, taking advantage of workplace retirement plans and IRAs, diversifying your investments, minimizing debt, and continuously monitoring your retirement plan, you’ll be well on your way to building a robust retirement nest egg.

7 Financial Goals to Achieve in Your 20's (LIFE CHANGING!)

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How can I save for retirement in my 20s?

Saving for retirement in your 20s is a smart financial move. Here are some frequently asked questions about how to get started:

1. How much should I be saving for retirement in my 20s?

The general rule of thumb is to save at least 10-15% of your income for retirement. However, if you can save more, that’s even better. Starting early allows your money to compound over time.

2. Should I contribute to a 401(k) or an IRA?

Both 401(k) and IRA are great retirement savings options. If your employer offers a 401(k) match, contribute enough to take full advantage of the match. If not, consider opening an IRA and contribute to it consistently.

3. What if I have student loans to pay off in my 20s?

It’s important to strike a balance between saving for retirement and paying off your student loans. Allocate a portion of your income towards both goals. Explore options like income-driven repayment plans for your student loans to make the payments more manageable.

4. Is it wise to invest in stocks in my 20s for retirement?

Investing in stocks can be a good strategy for long-term growth, especially when you have many years until retirement. However, it’s essential to do thorough research and consider consulting with a financial advisor to make informed investment decisions.

5. How can I budget effectively in my 20s to save for retirement?

Creating a budget and tracking your expenses is crucial for saving for retirement. Start by identifying your income and fixed expenses, then prioritize your retirement savings. Cut back on discretionary spending and find ways to save more.

6. Can I start a retirement savings account if I have a low income in my 20s?

Yes, even a small contribution to a retirement savings account can make a difference in the long run. Look into options like a Roth IRA, which allows tax-free withdrawals in retirement, and consider automated contributions to make saving easier.

7. Should I be concerned about market volatility in my 20s?

While market volatility is a natural part of investing, it’s important to stay focused on your long-term goals. Avoid making knee-jerk reactions to market fluctuations and maintain a diversified investment portfolio to mitigate risk.

8. What if I change jobs in my 20s? What happens to my retirement savings?

If you change jobs, you have a few options for your retirement savings. You can roll over your 401(k) into an IRA or transfer it to your new employer’s retirement plan. Both options allow you to keep your savings growing tax-deferred.

Remember, saving for retirement in your 20s is a long-term commitment. The earlier you start, the more time your money has to grow, so it’s never too early to begin planning for your future.

Final Thoughts

Saving for retirement in your 20s may seem daunting, but it is essential for securing your financial future. Start by creating a budget and identifying areas where you can cut back on expenses. Consider automating your savings by setting up regular contributions to a retirement account. Take advantage of employer-sponsored retirement plans like 401(k)s and contribute at least enough to receive the maximum employer match. Additionally, educate yourself about different investment options and consider diversifying your portfolio. By starting early and being consistent, you can harness the power of compounding and set yourself up for a comfortable retirement.