Are you in your 40s and worried about saving for retirement? Don’t despair! In this blog article, we’ll explore practical strategies and proven tips on how to save for retirement in your 40s. Whether you’ve just started thinking about it or are looking to amp up your savings, we’ve got you covered. Saving for retirement may seem daunting, but with the right approach, it’s entirely achievable. So, let’s dive straight into the world of retirement savings and discover how you can secure a comfortable future for yourself. Ready? Let’s get started!

How to Save for Retirement in Your 40s

Welcome to our comprehensive guide on how to save for retirement in your 40s. Your 40s are a crucial time to make significant progress towards securing a comfortable retirement. With approximately two decades left to work, it’s important to take strategic steps to maximize your savings and ensure a financially secure future. In this article, we will explore various strategies, tips, and considerations to help you make the most of your retirement savings in your 40s. Let’s dive in!

Assess Your Current Financial Situation

Before you embark on your retirement saving journey, it’s essential to assess your current financial situation. This step will give you a clear understanding of where you stand financially and help you determine how much you need to save for retirement.

Here are some key aspects to consider:

- Calculate your net worth: Assess your assets (such as investments, real estate, and savings) and subtract your liabilities (such as mortgages, loans, and credit card debt). This will give you a clear picture of your overall financial health.

- Analyze your cash flow: Review your income and expenses to identify areas where you can cut back and allocate more towards retirement savings.

- Review your existing retirement accounts: Take stock of your current retirement accounts, such as 401(k)s or IRAs. Evaluate their performance and consider consolidating them if necessary.

Set Clear Retirement Goals

Having well-defined retirement goals will help you stay focused and motivated throughout your savings journey. Consider the following factors when setting your retirement goals:

- Lifestyle expectations: Think about the type of lifestyle you envision during retirement. Will you travel extensively? Downsize your home? Understanding your lifestyle goals will help you estimate the amount you need to save.

- Retirement age: Determine the age at which you plan to retire. This will impact the number of years you have left to save and the amount you’ll need to accumulate.

- Inflation and healthcare costs: Factor in potential inflation and rising healthcare costs when setting your retirement savings goal. These expenses can significantly impact your financial well-being in retirement.

Maximize Contributions to Retirement Accounts

One of the most effective ways to save for retirement in your 40s is to maximize contributions to your retirement accounts. Take advantage of tax-advantaged accounts such as 401(k)s, IRAs, or Roth IRAs. Here’s how:

- Contribute to your employer-sponsored 401(k): Contribute the maximum amount allowed by your employer’s plan, especially if they offer matching contributions. Aim to contribute at least 10-15% of your income.

- Consider opening an IRA or Roth IRA: If you don’t have access to a 401(k) or want additional retirement savings, open an Individual Retirement Account (IRA) or Roth IRA. Contribute the maximum allowable amount each year.

- Catch-up contributions: If you’re behind on your retirement savings, take advantage of catch-up contributions available for individuals aged 50 and older.

Diversify Your Investment Portfolio

A well-diversified investment portfolio can help protect your retirement savings from market volatility and optimize your returns. Here are some key points to consider:

- Asset allocation: Determine an appropriate asset allocation based on your risk tolerance and time horizon. Consider diversifying across stocks, bonds, real estate, and other investment options.

- Rebalance periodically: Regularly review and rebalance your portfolio to maintain your desired asset allocation. This ensures you’re not overly exposed to a particular asset class.

- Consider professional advice: If you’re unsure about managing your investment portfolio, seek advice from a qualified financial advisor who can help you make informed decisions.

Explore Additional Retirement Savings Options

While retirement accounts like 401(k)s and IRAs are popular options, there are other avenues to boost your retirement savings. Consider the following:

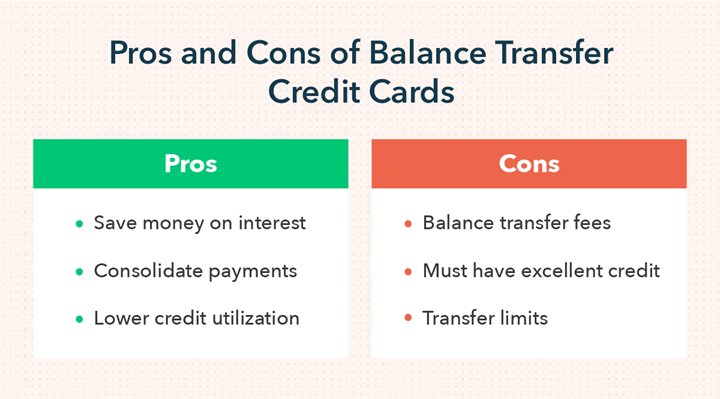

- Taxable investment accounts: If you’ve maxed out your contributions to tax-advantaged retirement accounts, consider opening a taxable investment account. They offer flexibility and can supplement your retirement savings.

- Health Savings Accounts (HSAs): If you have a high-deductible health plan, contribute to an HSA. HSAs provide triple tax advantages and can serve as a savings vehicle for healthcare expenses in retirement.

- Real estate investments: Investing in real estate can provide additional income streams and potential capital appreciation. Consider rental properties or real estate investment trusts (REITs) as part of your retirement savings strategy.

Manage Debt and Expenses

Reducing debt and managing expenses are integral to saving for retirement. Here are some tips to help you get started:

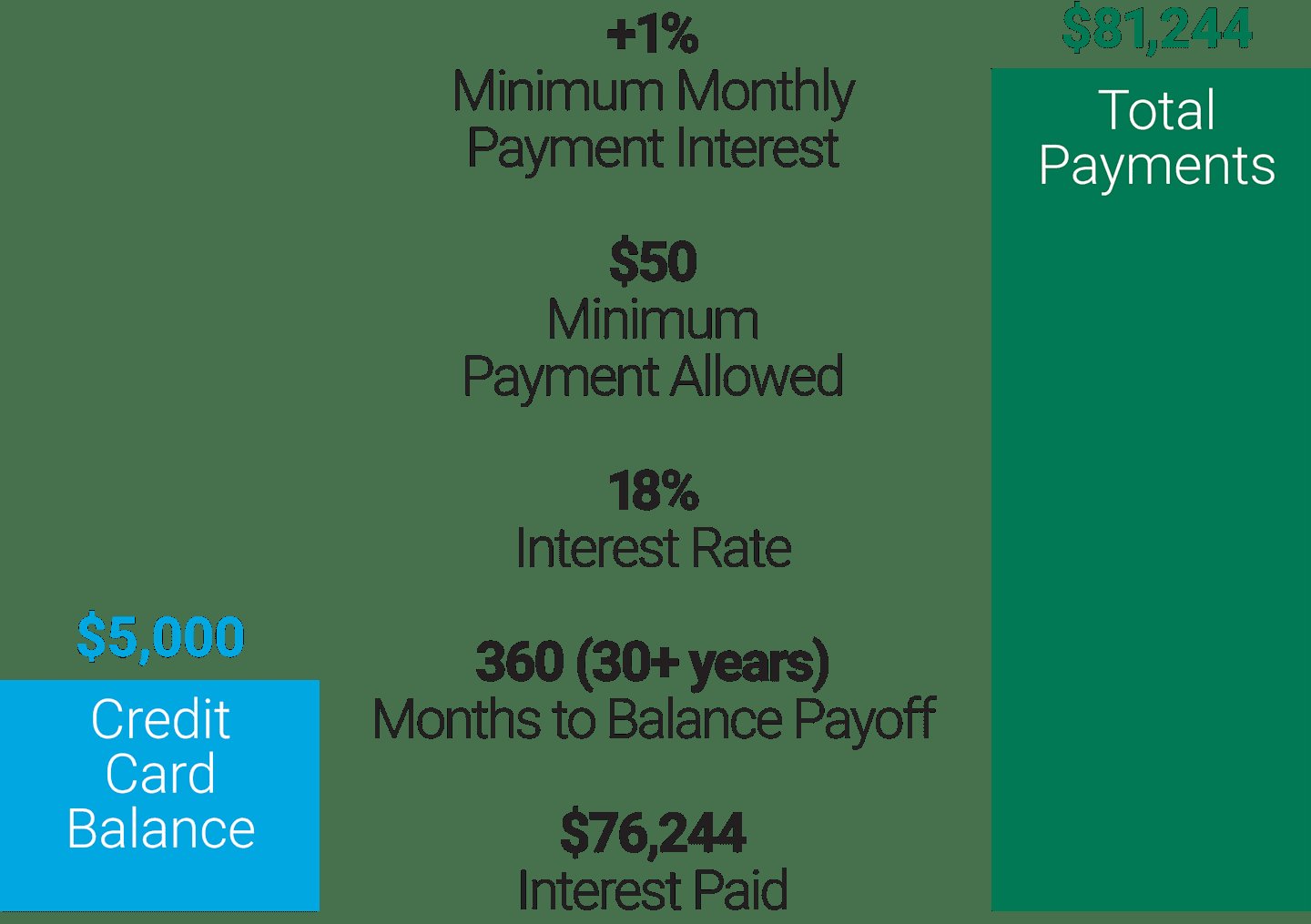

- Tackle high-interest debt: Prioritize paying off high-interest debt, such as credit cards or personal loans. The interest charges can eat into your retirement savings if left unattended.

- Create a budget: Develop a budget that aligns your income with your expenses. Identify areas where you can reduce spending and allocate those savings towards retirement.

- Downsize and cut unnecessary expenses: Consider downsizing your home or cutting unnecessary expenses like dining out or subscription services. Redirecting those savings into retirement accounts can significantly contribute to your nest egg.

Stay Informed and Seek Professional Guidance

Retirement planning can be complex, and staying informed is crucial. Here are some ways to enhance your knowledge:

- Read retirement planning resources: Stay updated with the latest retirement planning strategies, investment trends, and tax regulations.

- Attend workshops or seminars: Participate in workshops or seminars conducted by financial experts to gain valuable insights and tips.

- Consult a financial advisor: If you feel overwhelmed or need personalized guidance, consult a financial advisor who specializes in retirement planning. They can provide tailored advice based on your unique circumstances.

In conclusion, saving for retirement in your 40s requires a strategic approach and consistent effort. By assessing your financial situation, setting clear goals, maximizing contributions, diversifying your investment portfolio, exploring additional savings options, managing debt, and staying informed, you can significantly improve your retirement prospects. Remember, it’s never too late to start saving for a secure and comfortable retirement. Start implementing these strategies today, and your future self will thank you!

How to invest for retirement in your 40s.

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. How can I start saving for retirement in my 40s?

Saving for retirement in your 40s may require a more proactive approach. Start by evaluating your current financial situation and setting specific retirement goals. Consider contributing to a retirement account, such as a 401(k) or an IRA, and take advantage of any employer matching programs available to you.

2. Should I prioritize paying off debt or saving for retirement in my 40s?

It’s essential to find the right balance between paying off debt and saving for retirement in your 40s. While reducing high-interest debt is important, you should also aim to contribute to your retirement accounts. Consider creating a budget to allocate funds toward both goals, focusing on paying off high-interest debt first.

3. What investment options should I consider when saving for retirement in my 40s?

When saving for retirement in your 40s, it’s important to diversify your portfolio to mitigate risk. Consider investing in a mix of stocks, bonds, and mutual funds based on your risk tolerance and long-term goals. Consulting with a financial advisor can help you make informed investment decisions.

4. Can I catch up on retirement savings if I started late in my 40s?

Yes, it’s possible to catch up on retirement savings even if you started late in your 40s. Take advantage of catch-up contributions allowed for individuals aged 50 and above. Additionally, consider increasing your savings rate and potentially making lifestyle adjustments to allocate more funds toward retirement.

5. How much should I aim to save for retirement in my 40s?

While the exact amount may vary depending on individual circumstances, financial experts generally recommend aiming to save at least 15% of your annual income for retirement in your 40s. Adjust this percentage based on your specific goals, desired retirement age, and other factors such as current savings and projected expenses.

6. Are there any tax advantages to saving for retirement in my 40s?

Yes, there can be tax advantages to saving for retirement in your 40s. Contributing to tax-advantaged retirement accounts such as a 401(k) or an IRA can offer potential tax deductions or tax-free growth, depending on the type of account. Consult with a tax professional to understand how these advantages apply to your situation.

7. What if I experience financial setbacks while saving for retirement in my 40s?

Financial setbacks can happen, but it’s important to remain committed to your retirement savings goals. Review your budget, identify areas where you can cut expenses, and consider increasing your income through side gigs or additional work. Reassess your priorities and adjust your savings plan accordingly to continue making progress.

8. Should I seek advice from a financial advisor when saving for retirement in my 40s?

Seeking advice from a financial advisor can be beneficial when saving for retirement in your 40s. An advisor can help you create a personalized retirement plan, assess your current financial situation, provide investment recommendations, and offer guidance on maximizing your retirement savings.

Final Thoughts

In your 40s, it’s crucial to prioritize saving for retirement. Start by creating a budget, cutting unnecessary expenses, and directing that money towards retirement accounts. Maximize your contributions to employer-sponsored plans like 401(k)s and take advantage of any matching contributions. Diversify your investments, considering a mix of stocks, bonds, and other assets based on your risk tolerance. Stay disciplined and regularly review and adjust your retirement plan. Also, explore additional income streams and consider working for a few extra years if necessary. By following these steps, you can effectively save for retirement in your 40s and secure a stable financial future.