Are you wondering how to save for retirement while in debt? It may seem like a challenging task, but rest assured, it’s not impossible. By taking a proactive approach and making smart financial decisions, you can work towards a secure retirement while managing your debt. In this article, we will explore practical strategies to help you balance saving for the future with paying off your debts. So, let’s dive in and find out how to save for retirement while in debt, without compromising your financial stability.

How to Save for Retirement While in Debt

Introduction

Saving for retirement is a crucial financial goal that everyone should strive for. However, many individuals find themselves facing the challenge of dealing with debt while also trying to save for their future. It can be overwhelming to balance the need to pay off debt and the desire to prepare for retirement. But fear not, as there are strategies you can employ to effectively save for retirement while in debt. In this article, we will explore various methods and tips to navigate this dual challenge and secure your financial future.

Assess Your Debt Situation

Before diving into retirement savings strategies, it’s important to assess your debt situation to gain a clear understanding of what you’re dealing with. Start by gathering all the information related to your debts, including outstanding balances, interest rates, and minimum monthly payments. This will help you create a roadmap for managing your debt effectively.

- Make a list of all your debts, including credit card balances, loans, and mortgages.

- Note down the interest rates associated with each debt.

- Calculate the total amount of debt you owe.

Create a Budget

To make progress towards both debt repayment and retirement savings, it’s crucial to have a realistic and well-structured budget. A budget allows you to track your income and expenses, making it easier to allocate funds towards debt payments and retirement savings. Here are the steps to create a budget:

- Track Your Income: Start by calculating your monthly income after taxes. Include all sources of income, such as your salary, side gig earnings, and investment returns.

- Identify Essential Expenses: List out your essential expenses, such as rent/mortgage payments, utilities, groceries, transportation, and healthcare. These are the necessities that you must cover each month.

- Account for Non-Essential Expenses: Review your spending habits and identify areas where you can reduce discretionary expenses. Consider cutting back on dining out, entertainment, and unnecessary subscriptions.

- Allocate Funds for Debt Payments: Determine how much you can realistically afford to put towards your debt payments each month. Prioritize paying off high-interest debts first.

- Allocate Funds for Retirement Savings: Set aside a portion of your income for retirement savings. Even if it’s a small amount initially, it will grow over time.

Pay Off High-Interest Debt First

When you’re juggling debt repayment and retirement savings, it’s essential to prioritize high-interest debt. High-interest debts, such as credit card balances, can quickly accumulate and hinder your financial progress. By focusing on paying off these debts first, you’ll save money on interest payments and free up more funds for retirement savings in the long run.

- List out all your debts and arrange them in descending order based on interest rates.

- Allocate the minimum monthly payments for all debts.

- Devote any additional funds towards paying off the debt with the highest interest rate.

- Once the highest-interest debt is paid off, move on to the next one on the list. Repeat this process until all high-interest debts are eliminated.

Consider Debt Consolidation or Refinancing

If you have multiple debts with high interest rates, debt consolidation or refinancing might be suitable options to consider. These strategies can help simplify your debt repayment process and potentially lower your overall interest payments.

Debt Consolidation:

Debt consolidation involves combining multiple debts into a single loan or credit line with a lower interest rate. This allows you to make a single monthly payment instead of managing multiple debts separately. It can streamline your debt repayment process and potentially save you money on interest.

- Research debt consolidation options, such as personal loans or balance transfer credit cards.

- Compare interest rates, fees, and repayment terms to find the most favorable option for your situation.

- Apply for the consolidation option that suits your needs.

- Once approved, use the consolidated loan or credit line to pay off all your high-interest debts.

- Focus on repaying the consolidated loan as per the agreed terms.

Refinancing:

Refinancing involves replacing an existing loan with a new loan that offers better terms, such as a lower interest rate or longer repayment period. This strategy is commonly used for mortgages or student loans, but it can also be applied to other forms of debt.

- Research refinancing options available for your specific types of debt.

- Compare interest rates, fees, and terms to determine if refinancing will provide financial benefits.

- Apply for the refinancing option that suits your needs.

- Once approved, use the new loan to pay off the existing debt.

- Focus on repaying the refinanced loan based on the new terms.

Take Advantage of Employer-Sponsored Retirement Plans

If your employer offers a retirement savings plan, such as a 401(k) or 403(b), take full advantage of it. Employer-sponsored plans often come with benefits like matching contributions, which can significantly boost your retirement savings.

- Enroll in your employer’s retirement plan as soon as you’re eligible.

- Contribute enough to take full advantage of any employer matching contributions. This is essentially free money.

- Review the investment options available in the plan and choose investments that align with your risk tolerance and retirement goals.

- Increase your contribution rate whenever possible, especially as you pay off your debts.

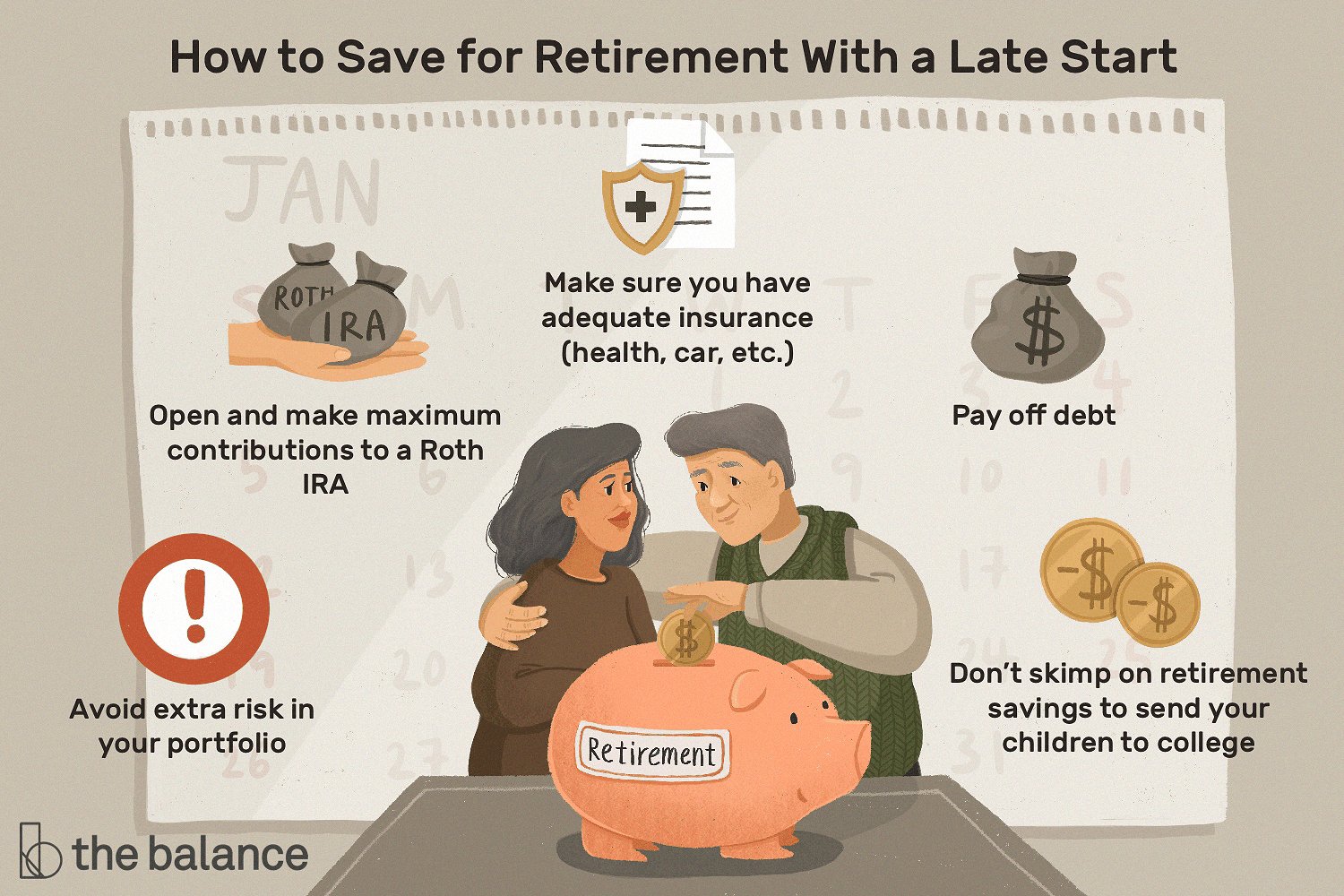

Explore Individual Retirement Accounts (IRAs)

In addition to employer-sponsored retirement plans, consider opening an Individual Retirement Account (IRA). IRAs provide tax advantages and a wide range of investment options to help you grow your retirement savings.

- Research the different types of IRAs available, such as Traditional IRAs and Roth IRAs.

- Consider your current tax situation and determine the best IRA option for you.

- Choose a reputable financial institution to open an IRA account.

- Contribute to your IRA regularly, even if it’s a small amount at first. Consistency is key.

- Monitor and adjust your investments within the IRA based on your risk tolerance and retirement goals.

Automate Your Savings and Debt Payments

To ensure consistency in your savings and debt repayment efforts, automate your contributions and payments. Automating these processes eliminates the risk of forgetting or delaying payments, making it easier to stay on track.

- Set up automatic transfers from your paycheck to your retirement savings accounts.

- Arrange automatic monthly payments towards your debts.

- Ensure you have sufficient funds in your accounts to cover these scheduled transfers and payments.

- Regularly review and adjust the automated amounts as needed.

Monitor Your Progress and Adjust Accordingly

As you implement your debt repayment and retirement savings strategies, it’s crucial to monitor your progress regularly and make adjustments as necessary. Life circumstances and financial goals may change over time, so it’s important to stay flexible and adapt your approach as needed.

- Track your debt balances and retirement savings on a regular basis.

- Review your budget periodically to ensure it still aligns with your financial goals.

- Make adjustments to your debt repayment strategy based on your progress and changes in interest rates.

- Revisit your retirement savings contributions and investment allocations as your income and financial situation improve.

Saving for retirement while in debt may seem challenging, but with the right strategies and discipline, it’s possible to make progress on both fronts. Start by assessing your debt situation, creating a realistic budget, and prioritizing high-interest debt repayment. Take advantage of employer-sponsored retirement plans and explore individual retirement accounts to maximize your savings potential. Automate your contributions and payments to maintain consistency, and regularly monitor your progress to make necessary adjustments. Remember, every step you take towards debt freedom and retirement savings is a step closer to a secure financial future.

How To Save For Retirement AND Pay Off Debt | Jazz After Dark

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. How can I save for retirement while in debt?

While being in debt can make saving for retirement challenging, it is still possible to make progress. Here are a few strategies you can consider:

2. Should I pay off my debt before saving for retirement?

It depends on the type of debt you have and its interest rate. Generally, it is a good idea to prioritize high-interest debts, such as credit card debt, before focusing on retirement savings. However, it is essential to strike a balance and contribute a portion of your income towards retirement savings.

3. Can I contribute to retirement accounts while paying off debt?

Absolutely! Contributing to retirement accounts, such as a 401(k) or an IRA, can still be beneficial even if you have debt. By making regular contributions, you are taking advantage of compound interest and potential employer matching (in the case of a 401(k)). Just make sure to consider your debt obligations and financial goals when deciding how much to contribute.

4. Are there any retirement saving options specifically designed for individuals in debt?

While there are no specific retirement savings options exclusively for individuals in debt, certain approaches can help. For example, you can explore debt consolidation strategies, refinancing options, or seeking professional advice to manage your debt effectively. By reducing your debt burden, you can free up more funds for retirement savings.

5. Should I consider downsizing or cutting expenses to save more?

Downsizing or cutting expenses can be effective strategies to free up extra income for retirement savings. Evaluate your budget, identify non-essential expenses, and consider making necessary adjustments to redirect those savings towards your retirement goals. Every dollar saved adds up over time.

6. What if I can only afford to save a small amount each month?

Even small contributions can make a difference in the long run. Start by saving whatever amount you can comfortably afford and consistently increase it over time as your financial situation improves. The key is to establish a habit of saving for retirement, regardless of the initial amount.

7. Are there any tax advantages to saving for retirement while in debt?

Contributions to retirement accounts, such as a traditional 401(k) or a traditional IRA, are typically tax-deductible. By reducing your taxable income, you may be eligible to receive certain tax advantages. However, it is advisable to consult a tax professional to understand your specific situation and any potential tax benefits.

8. What if I’m struggling to balance debt repayment and retirement savings?

If you find it challenging to balance both debt repayment and retirement savings, it may be helpful to seek professional financial advice. Experienced financial advisors can help you create a personalized plan that prioritizes your debt repayment while also ensuring adequate retirement savings.

Final Thoughts

Saving for retirement while in debt can be a daunting task, but it is not impossible. By adopting smart financial strategies, individuals can work towards their retirement goals while managing their debt effectively. Firstly, creating a budget and tracking expenses can help identify areas where spending can be reduced and redirected towards retirement savings. Secondly, prioritizing debt repayment can prevent it from becoming a long-term financial burden. Lastly, exploring investment options such as a 401(k) or IRA can provide opportunities for growth while saving for retirement. With careful planning and discipline, it is possible to save for retirement while in debt.