Are you a single parent looking for ways to save money? We’ve got you covered! Managing finances can be tough, but with a few simple strategies, you can ease the burden and make your hard-earned money go further. In this article, we will share practical tips on how to save money as a single parent, helping you create a more stable financial future for you and your children. So, whether you’re struggling to make ends meet or simply want to stretch your budget, keep reading for valuable insights on how to save money as a single parent.

How to Save Money as a Single Parent

Being a single parent comes with its own set of challenges, and managing finances effectively is often at the top of the list. Juggling the responsibilities of parenting, work, and household expenses can be overwhelming, but with some careful planning and smart choices, it’s possible to save money and secure a better financial future. In this article, we will explore various strategies and tips to help single parents save money and achieve financial stability.

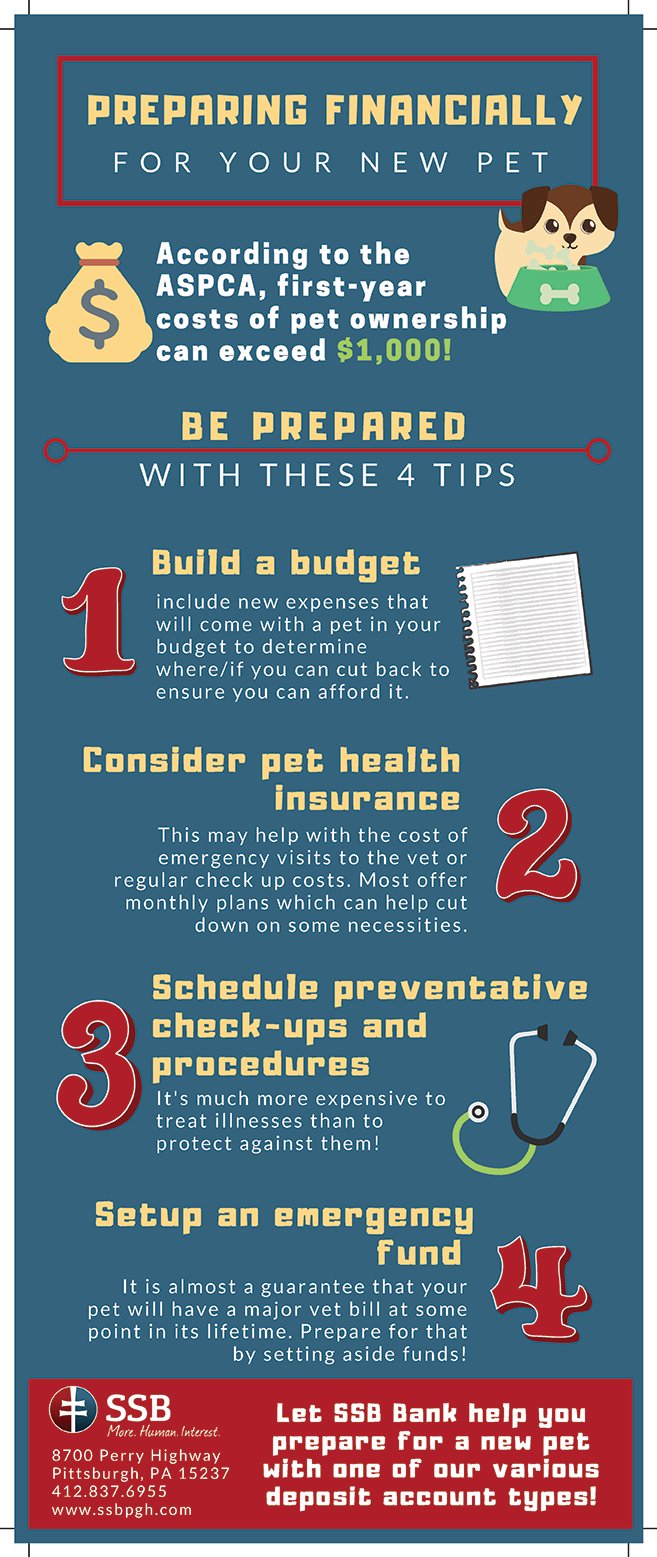

Create a Budget and Track Expenses

One of the first steps towards saving money as a single parent is creating a budget. A budget allows you to see where your money is going and helps you identify areas where you can cut back on expenses. Here’s how you can get started:

- Track your income: Begin by listing all sources of income, including your salary, child support, or any government assistance.

- Track your expenses: Make a comprehensive list of all your monthly expenses, such as rent/mortgage, utilities, groceries, transportation, childcare, and any other recurring payments.

- Identify non-essential expenses: Identify areas where you could cut back or eliminate expenses. This could include dining out, entertainment subscriptions, or unnecessary shopping.

- Allocate funds: Once you have a clear picture of your income and expenses, allocate funds for necessary expenses, savings, and emergency funds.

By regularly tracking your expenses, you can stay on top of your finances and make informed decisions about where to cut back.

Reduce Housing Costs

Housing is often one of the largest monthly expenses for single parents. Consider the following strategies to reduce your housing costs:

- Downsize: If you have more space than you need, downsizing to a smaller home or apartment can significantly reduce your monthly housing expenses.

- Consider roommates: Sharing a living space with a roommate or another single parent can help split the rent and utilities, easing the financial burden.

- Explore housing assistance programs: Research local housing assistance programs that may provide subsidies or rental assistance for single parents.

- Refinance or negotiate your mortgage: If you own a home, consider refinancing your mortgage or negotiating with your lender for better terms.

Reducing housing costs can free up a significant portion of your income that could be put towards savings or other essential expenses.

Minimize Childcare Costs

Childcare costs can be a major financial burden for single parents. These tips can help you reduce childcare expenses without compromising your child’s well-being:

- Explore government subsidies: Research government programs that provide financial assistance for childcare expenses. Eligibility criteria and benefits vary by location, so check with local agencies for more information.

- Consider co-op childcare: Co-op childcare involves forming a group with other parents to share childcare responsibilities. This can significantly reduce costs while still ensuring your child’s care.

- Flexible work arrangements: If possible, explore flexible work arrangements such as working from home or adjusting your work schedule to minimize the need for full-time childcare.

- Seek support from family and friends: Reach out to trusted family members or friends who may be able to help with childcare responsibilities.

By exploring these options and being proactive, you can find affordable childcare solutions that meet your needs.

Save on Groceries and Meal Planning

Groceries are another significant expense for single parents. Implementing these strategies can help you save money on food and meal planning:

- Create a meal plan: Plan your meals in advance and make a shopping list based on the ingredients you need. This can help you avoid impulsive purchases and reduce food waste.

- Shop smart: Look for deals, use coupons, and compare prices to get the best value for your money. Consider purchasing generic or store-brand products, as they are often cheaper without compromising quality.

- Buy in bulk: Buying non-perishable items in bulk can save you money in the long run. Just make sure you have enough storage space.

- Cook at home: Eating out regularly can be expensive. By cooking meals at home, you not only save money but also have better control over the nutritional value of your family’s diet.

By adopting these practices, you can significantly reduce your grocery expenses while ensuring your family’s nutritional needs are met.

Save on Utilities

Utilities, such as electricity, water, and internet, can contribute to your monthly expenses. Here are some tips to save on utility costs:

- Conserve energy: Turn off lights when not in use, unplug electronics, use energy-efficient appliances, and adjust your thermostat to save on heating and cooling costs.

- Water conservation: Install water-saving fixtures, fix any leaks promptly, and encourage your family to be mindful of water usage.

- Compare service providers: Research different service providers and compare prices to ensure you are getting the best rates for your internet, cable, and phone services. Consider bundling services for additional discounts.

By implementing these energy-saving practices, you can reduce your utility bills and save money over time.

Take Advantage of Government Assistance

As a single parent, you may be eligible for various government assistance programs. Here are some resources to explore:

- Child Tax Credit: Check if you qualify for the Child Tax Credit, a tax benefit that provides financial support for families with children.

- Supplemental Nutrition Assistance Program (SNAP): SNAP offers food assistance to low-income individuals and families, helping them afford nutritious food.

- Temporary Assistance for Needy Families (TANF): TANF provides cash assistance to low-income families, offering financial support for basic needs.

- Healthcare subsidies: Investigate if you qualify for healthcare subsidies or Medicaid, which can provide affordable healthcare coverage for you and your children.

Research the eligibility criteria and application processes for these programs and take advantage of the assistance that you may qualify for.

Build an Emergency Fund

Unforeseen expenses can quickly derail your financial stability. Having an emergency fund can provide a safety net during challenging times. Consider these strategies to build an emergency fund:

- Automate savings: Set up an automatic transfer from your checking account to a separate savings account each month. This ensures consistent savings without having to remember to transfer the money manually.

- Start small: Begin by saving a small portion of your income consistently and gradually increase the amount as your financial situation improves.

- Reduce debt: Paying off high-interest debt, such as credit cards, can free up more money to contribute towards your emergency fund.

Having an emergency fund provides peace of mind and protects you from financial hardship during unexpected situations.

Seek Community Resources and Support

Many communities offer resources and support for single parents. These resources can help you save money and access additional assistance. Consider the following:

- Local community centers: Community centers often host affordable or free activities for children, such as sports programs, arts and crafts, and educational workshops.

- Parenting support groups: Joining a parenting support group can provide emotional support and valuable information on local resources and programs available for single parents.

- Local libraries: Libraries offer free access to books, educational materials, and even entertainment, such as movie rentals or streaming services.

- Thrift stores and consignment shops: Explore thrift stores and consignment shops for affordable clothing, furniture, and household items.

By tapping into community resources and support, you can find cost-effective solutions and connect with other single parents facing similar challenges.

Remember, saving money as a single parent requires discipline, planning, and conscious decision-making. It’s important to continuously reassess your financial situation and make adjustments as needed. With determination and perseverance, you can successfully save money, provide for your family, and achieve financial stability as a single parent.

HOW I BUDGET AS A SINGLE MOM | HOW TO SAVE MONEY

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. How can I save money as a single parent?

Saving money as a single parent can be challenging, but it is certainly possible. Here are some tips to help you:

2. What are some budgeting strategies for single parents?

Budgeting is an effective way to manage your finances. Consider the following strategies:

3. Are there any government programs or financial assistance available for single parents?

Yes, there are various government programs and financial assistance options that can provide support to single parents. Some of these include:

4. How can I reduce my utility bills as a single parent?

Lowering your utility bills can significantly impact your monthly expenses. Here are some ways to achieve this:

5. What are some affordable meal planning ideas for single parents?

Meal planning can save you money on groceries and reduce food waste. Consider the following ideas:

6. How can I save on childcare costs as a single parent?

Childcare expenses can be quite high, but there are ways to save money in this area. Here are some suggestions:

7. How can I maximize my tax savings as a single parent?

As a single parent, you may be eligible for certain tax benefits. Here are a few tips to help you maximize your tax savings:

8. Are there any strategies for saving on healthcare costs as a single parent?

Healthcare expenses can be a significant burden for single parents. Here are some strategies to reduce these costs:

Final Thoughts

To save money as a single parent, it’s essential to prioritize expenses, plan a budget, and take advantage of cost-saving strategies. Start by analyzing your monthly expenses and identifying areas where you can cut back, such as dining out less frequently or canceling unnecessary subscriptions. Researching and utilizing government assistance programs and community resources can also help alleviate financial burdens. Moreover, purchasing items in bulk, shopping for sales, and using coupons can make a significant difference in your overall spending. Additionally, seeking cheaper alternatives and cost-effective options for childcare and recreational activities can provide substantial savings. By implementing these strategies and being mindful of your spending, you can successfully navigate the financial challenges of single parenthood and save money.