Looking to save money on your first apartment? We’ve got you covered! Moving into your own place is an exciting milestone, but it can also be a budget-busting experience if you’re not careful. Luckily, there are plenty of tips and tricks to help you keep your expenses in check, without sacrificing comfort or style. In this article, we’ll show you how to save money on your first apartment, from finding affordable deals on rent to cutting down on utility costs. So, if you’re ready to make the most of your budget and create a cozy home without breaking the bank, read on!

How to Save Money on Your First Apartment

Moving into your first apartment can be an exciting and liberating experience. However, it can also come with its fair share of financial challenges. From hefty security deposits to utility bills, the costs can quickly add up. But don’t worry! By following some smart money-saving strategies, you can make your first apartment experience more affordable and less stressful. In this article, we will explore various tips and tricks to help you save money on your first apartment.

Create a Budget and Track Expenses

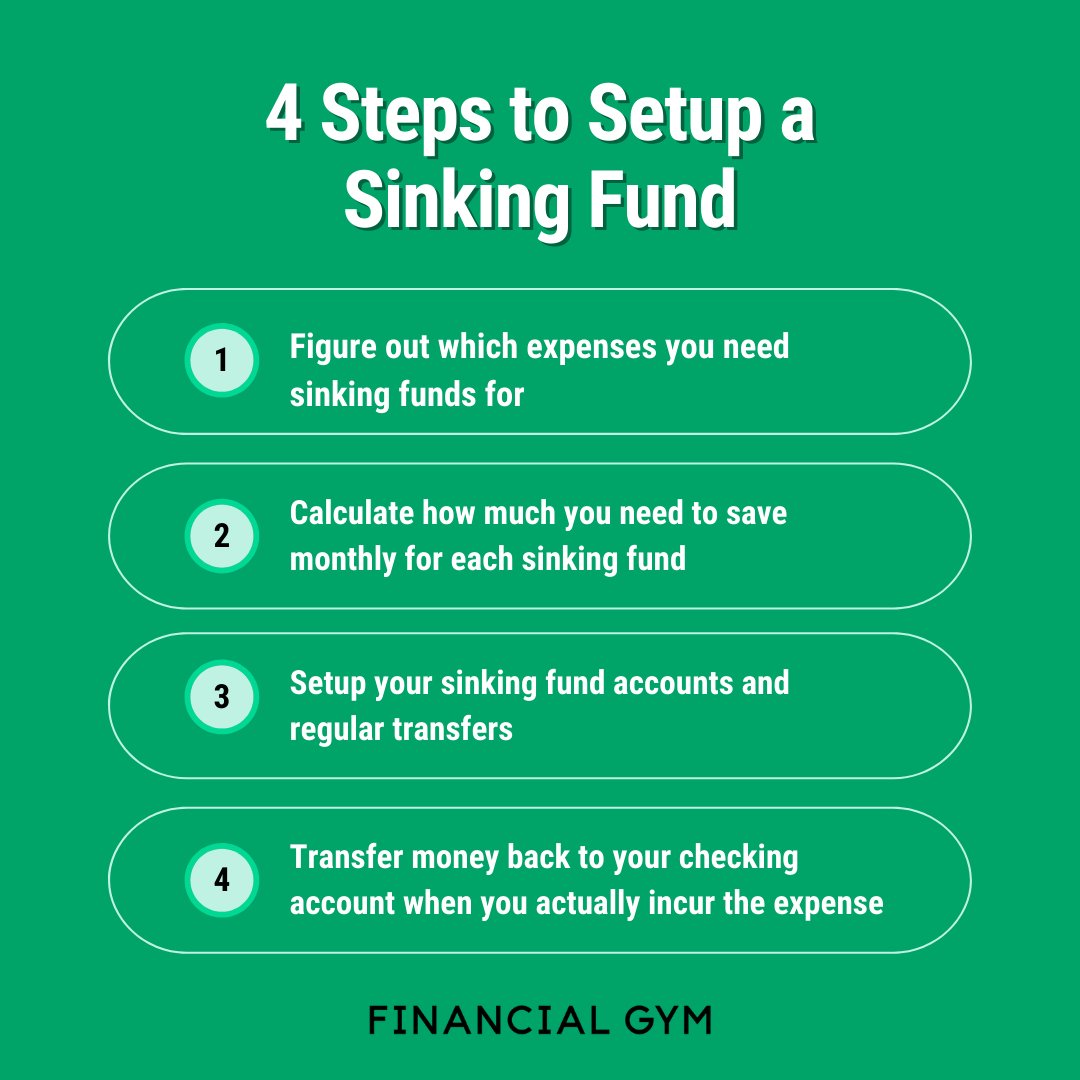

One of the most crucial steps in saving money on your first apartment is to create a budget. It provides a clear overview of your income and expenses, enabling you to identify areas where you can cut back. Here’s how to create an effective budget:

- Start by calculating your monthly income after taxes.

- List all your necessary expenses, such as rent, utilities, groceries, and transportation.

- Subtract your expenses from your income to determine how much you have left for discretionary spending and savings.

Once you have a budget in place, track your expenses using budgeting apps or spreadsheets. Monitoring your spending habits will help you identify areas where you can cut costs and save money.

Find an Affordable Apartment

The key to saving money on your first apartment starts with finding an affordable rental. Here are some tips to consider:

- Set a realistic budget for your monthly rent. Experts suggest spending no more than 30% of your income on housing.

- Consider location carefully. Apartments located further away from city centers or popular neighborhoods tend to be more affordable.

- Look for apartments with shared living spaces. Renting a room in a shared apartment can significantly reduce your monthly expenses.

- Take advantage of rental websites and apps to compare prices and find the best deals.

Remember that finding an affordable apartment doesn’t mean sacrificing safety or comfort. With thorough research and patience, you can find a place that meets both your budget and your needs.

Save on Moving Costs

Moving into your first apartment often comes with numerous expenses. However, with some careful planning, you can save money on your moving costs. Consider the following tips:

- Ask friends or family for help instead of hiring professional movers. They may be willing to assist you with packing, loading, and unloading.

- Use second-hand boxes and packing materials. Check local grocery stores and online marketplaces for free or inexpensive supplies.

- Opt for a DIY move instead of hiring a moving truck. If you have access to a vehicle, it may be more affordable to make multiple trips.

- Compare prices from different moving companies to ensure you get the best deal.

By being resourceful and planning ahead, you can significantly reduce your moving expenses and save money for other essential items.

Reduce Utility Bills

Utility bills can quickly eat into your monthly budget. However, there are several ways to reduce your energy and water consumption:

- Invest in energy-efficient appliances. Look for appliances with the ENERGY STAR label, as they are designed to use less energy.

- Unplug electronics when not in use. Many devices continue to consume energy even when turned off.

- Switch to LED light bulbs, as they are more energy-efficient and have a longer lifespan compared to traditional incandescent bulbs.

- Be conscious of your water usage. Take shorter showers, fix leaky faucets promptly, and only run the dishwasher or washing machine with full loads.

Implementing these simple changes can significantly lower your utility bills, saving you money in the long run.

Minimize Furniture and Decor Expenses

Furnishing and decorating your first apartment can quickly become expensive. However, there are ways to save money in this area:

- Consider purchasing second-hand furniture. Thrift stores, online marketplaces, and garage sales often have affordable options.

- Ask friends or family if they have any furniture they no longer need. You might be surprised by what you can find for free.

- Repurpose items you already own. Get creative and give new life to old furniture or decor by refurbishing or repainting them.

- DIY your decorations. Instead of buying expensive artwork or decor, create your own using inexpensive materials.

Remember, your first apartment doesn’t need to be fully furnished and perfectly decorated from day one. Take your time, prioritize essential pieces, and gradually add to your collection as your budget allows.

Cook at Home and Meal Prep

Eating out can quickly drain your finances, especially if you do it regularly. By cooking at home and meal prepping, you can save a significant amount of money. Consider the following tips:

- Plan your meals for the week and create a grocery list. Stick to the list when you go shopping to avoid impulse purchases.

- Cook in bulk and freeze leftovers for quick and convenient meals later in the week.

- Bring your lunch to work or school instead of eating out.

- Explore inexpensive and nutritious recipes. There are plenty of resources online that provide budget-friendly meal ideas.

By adopting a mindful approach to your food expenses, you can save money while still enjoying delicious and healthy meals.

Save on Internet and Cable

Internet and cable bills can be significant monthly expenses. Here are some strategies to reduce these costs:

- Consider bundling your internet and cable services with the same provider. Many companies offer discounts for bundled packages.

- Research and compare prices from different providers to ensure you’re getting the best deal.

- Explore streaming services as an alternative to cable. They often offer a variety of entertainment options at a lower cost.

- Negotiate with your current provider. Call and inquire about any promotions or discounts they may have available.

Remember that it’s essential to assess your needs before committing to any contracts. You may find that you can live comfortably with internet-only services or opt for a lower-cost plan that suits your usage.

Transportation Savings

Transportation costs can quickly add up, especially if you rely on a car. Consider these tips to save money on transportation:

- Use public transportation whenever possible. It’s often more affordable than maintaining a car.

- If you need a car, consider carpooling or ridesharing with friends or colleagues to split the costs.

- Optimize your car’s fuel efficiency by ensuring proper tire pressure, regular maintenance, and avoiding excessive idling.

- Explore alternative transportation methods such as biking or walking for short distances.

Reducing your transportation expenses not only saves you money but also contributes to a greener and more sustainable lifestyle.

Make Smart Shopping Choices

When it comes to shopping for groceries, household items, and other necessities, making smart choices can help you save money. Consider these strategies:

- Create a shopping list and stick to it. Impulse purchases can quickly derail your budget.

- Compare prices and shop around for the best deals. Online shopping platforms and grocery store apps often offer discounts and coupons.

- Buy in bulk for non-perishable items that you use frequently.

- Consider generic or store-brand products instead of name brands. They are often cheaper and of comparable quality.

By adopting these shopping habits, you can stretch your budget and reduce unnecessary expenses.

Moving into your first apartment should be an exciting and memorable experience, not a financial burden. By following the money-saving tips outlined in this article, you can take control of your finances, reduce expenses, and enjoy the freedom and independence that comes with having your own place. Remember, saving money is not about deprivation but making mindful choices that align with your long-term goals. With careful planning, budgeting, and a bit of creativity, you can successfully navigate the world of first apartment living while keeping your finances in check.

How to Save Money for Your First Apartment (Moving Out)

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. How can I save money on my first apartment?

One way to save money on your first apartment is by creating a budget and sticking to it. This will help you keep track of your expenses and identify areas where you can cut back. Additionally, consider finding a roommate to split the rent and other expenses. Saving on utilities by being mindful of your energy usage and shopping smart for household items can also contribute to saving money.

2. Are there any upfront costs I should be aware of when renting my first apartment?

Yes, when renting your first apartment, you should be prepared for upfront costs such as a security deposit, first and last month’s rent, and possibly application fees. It’s essential to factor these expenses into your budget to ensure you have enough funds available.

3. What are some tips for finding affordable rental options?

To find affordable rental options, consider looking for apartments in less expensive neighborhoods or areas that are further away from city centers. It’s also helpful to be flexible with your move-in date, as some landlords offer lower rents for immediate occupancy. Don’t forget to utilize online rental listing platforms and utilize word-of-mouth referrals to discover hidden gems.

4. How can I reduce my utility bills in my first apartment?

To minimize utility bills, you can start by turning off lights and unplugging devices when not in use. Installing energy-efficient light bulbs and using power strips can also help. Additionally, consider adjusting your thermostat to save on heating and cooling costs, and be mindful of your water usage by taking shorter showers and fixing any leaks promptly.

5. What are some cost-effective ways to furnish my first apartment?

You can find affordable furniture and decor for your first apartment by checking out thrift stores, yard sales, and online marketplaces. Another option is to ask family and friends if they have any items they no longer need. Don’t forget to compare prices and look for sales when shopping for new items.

6. Are there any hidden expenses I should be aware of when renting my first apartment?

When renting your first apartment, apart from the monthly rent and utilities, you should also consider additional expenses such as renter’s insurance, parking fees, and potential pet fees. It’s crucial to factor in these costs to determine if a particular apartment fits within your budget.

7. How can I save on grocery expenses while living in my first apartment?

To save on grocery expenses, make a shopping list before going to the store and stick to it. Buying generic or store-brand products rather than name brands can also help reduce your grocery bill. Take advantage of sales, coupons, and loyalty programs, and consider cooking at home instead of eating out frequently.

8. What are some cost-cutting measures for transportation costs in my first apartment?

To cut transportation costs, consider using public transportation or cycling instead of owning a car, as this can save you money on fuel, parking fees, and vehicle maintenance. Carpooling with friends or colleagues who live nearby is another option to consider. If you do need a car, explore options like car-sharing services or purchasing a used vehicle instead of buying a new one.

Final Thoughts

In conclusion, saving money on your first apartment is an essential part of managing your finances responsibly. By considering factors such as location, size, and amenities, you can find a more affordable option that suits your needs. Additionally, adopting cost-saving habits like cooking at home, minimizing energy usage, and shopping smartly can significantly reduce your expenses. Roommates and shared expenses also offer a great opportunity to cut costs. So, when searching for your first apartment, keep these tips in mind to save money and make your financial journey smoother.