Are you looking for practical ways to secure your financial future? You’re not alone. In today’s uncertain world, it’s essential to take proactive steps to protect your financial well-being. Fortunately, you don’t have to be a financial expert to start building a solid foundation for your future. By implementing simple strategies and making informed decisions, you can set yourself up for long-term financial security. In this article, we will explore practical tips and smart practices on how to secure your financial future, providing you with the knowledge and tools to achieve your financial goals. Let’s dive in!

How to Secure Your Financial Future

When it comes to securing your financial future, there are a lot of factors to consider. From managing your budget and saving for emergencies to investing wisely and planning for retirement, the choices you make now can have a significant impact on your long-term financial security. In this article, we will explore various strategies and steps you can take to ensure a strong and stable financial future for yourself and your loved ones.

1. Establish a Solid Budget

Creating a budget is an essential first step in securing your financial future. It helps you understand your income, expenses, and how much you can comfortably save. Here’s how you can establish a solid budget:

- List all your sources of income, including salary, side jobs, and passive income.

- Track your expenses for a month to get a clear picture of where your money is going.

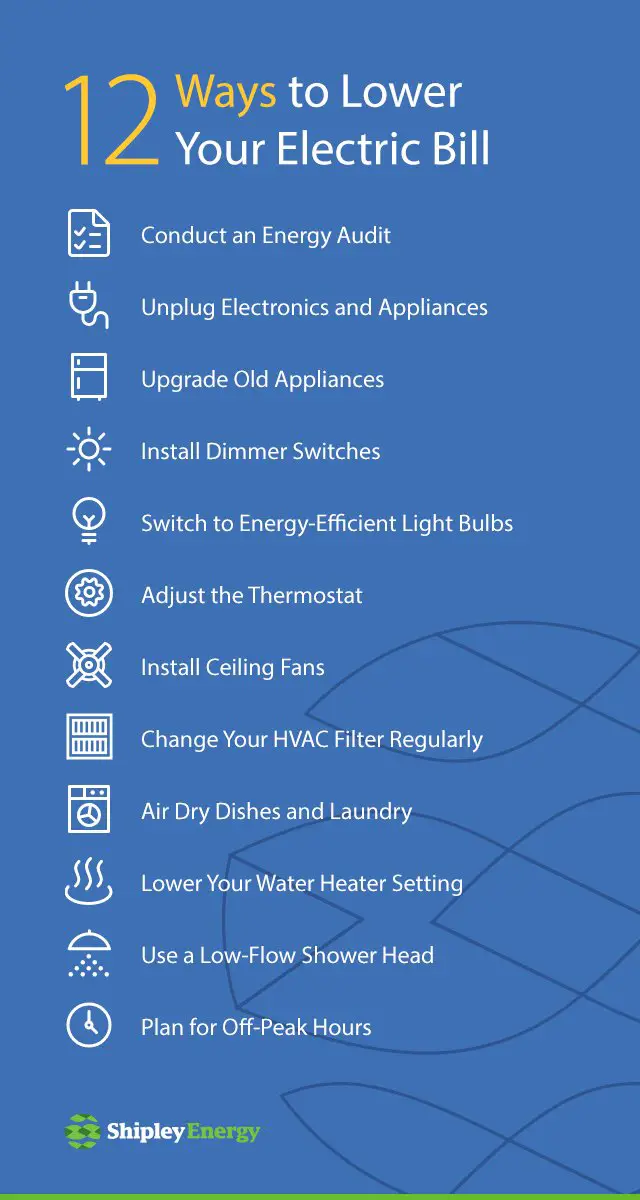

- Categorize your expenses into fixed (e.g., rent, utilities) and variable (e.g., groceries, entertainment).

- Identify areas where you can reduce spending and allocate more towards savings.

- Set realistic financial goals, such as paying off debt or saving for a down payment.

- Regularly review and adjust your budget as your circumstances change.

By establishing and sticking to a budget, you gain control over your finances and make informed decisions about how to allocate your money.

2. Build an Emergency Fund

Unexpected expenses can quickly derail your financial plans. That’s why it’s crucial to have an emergency fund in place. An emergency fund acts as a safety net, providing financial stability during challenging times. Here’s how you can build an emergency fund:

- Start by setting a realistic savings goal, such as three to six months’ worth of living expenses.

- Open a separate savings account dedicated to your emergency fund.

- Automate regular contributions to your emergency fund.

- Keep your emergency fund separate from your daily spending account to avoid temptation.

- Only use the funds for genuine emergencies, such as medical expenses or unexpected job loss.

Having an emergency fund provides peace of mind, allowing you to tackle unexpected expenses without resorting to high-interest debt or compromising other financial goals.

3. Pay Down Debt Strategically

Debt can be a major obstacle to securing your financial future. High-interest debt, such as credit card balances, can drain your resources and hinder your ability to save and invest. Follow these strategies to pay down your debt more effectively:

- Organize your debts by interest rate, starting with the highest.

- Create a debt repayment plan, focusing on paying off high-interest debts first.

- Consider debt consolidation or balance transfers to reduce interest charges.

- Allocate extra funds towards debt payments whenever possible.

- Avoid taking on new debt unless necessary and manageable.

- Seek professional advice from credit counselors or financial advisors if needed.

Reducing your debt burden not only frees up more money for saving and investing but also improves your credit score, which can positively impact your financial future.

4. Save and Invest for the Long Term

Building wealth and securing your financial future requires more than just saving money. Investing allows your money to grow over time, outpacing inflation and increasing your net worth. Consider the following steps when saving and investing for the long term:

- Set specific financial goals, such as retirement or buying a home.

- Understand your risk tolerance and investment time horizon.

- Diversify your investments across different asset classes to manage risk.

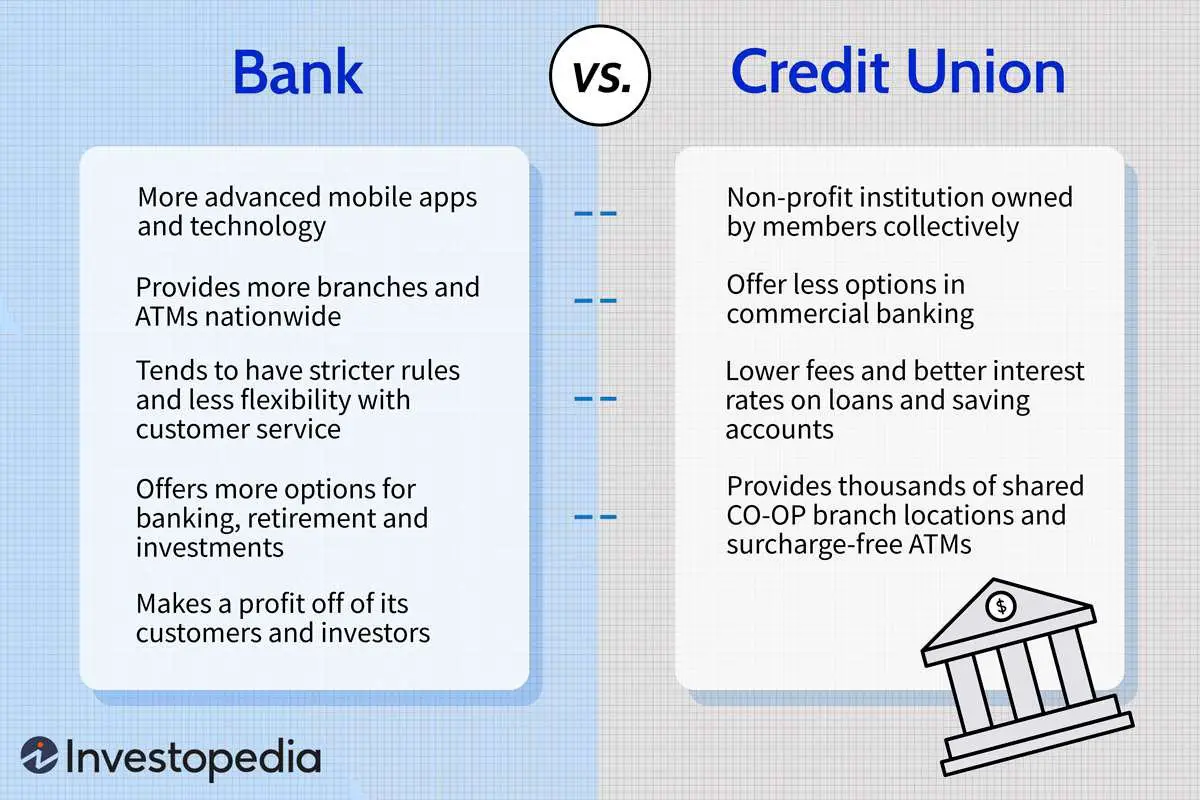

- Contribute regularly to retirement accounts, such as 401(k)s or IRAs.

- Consider seeking professional advice from a financial advisor.

- Monitor and review your investment portfolio regularly.

Saving and investing with a long-term perspective can provide you with financial stability and help you achieve your goals, whether it’s retiring comfortably or funding your dream project.

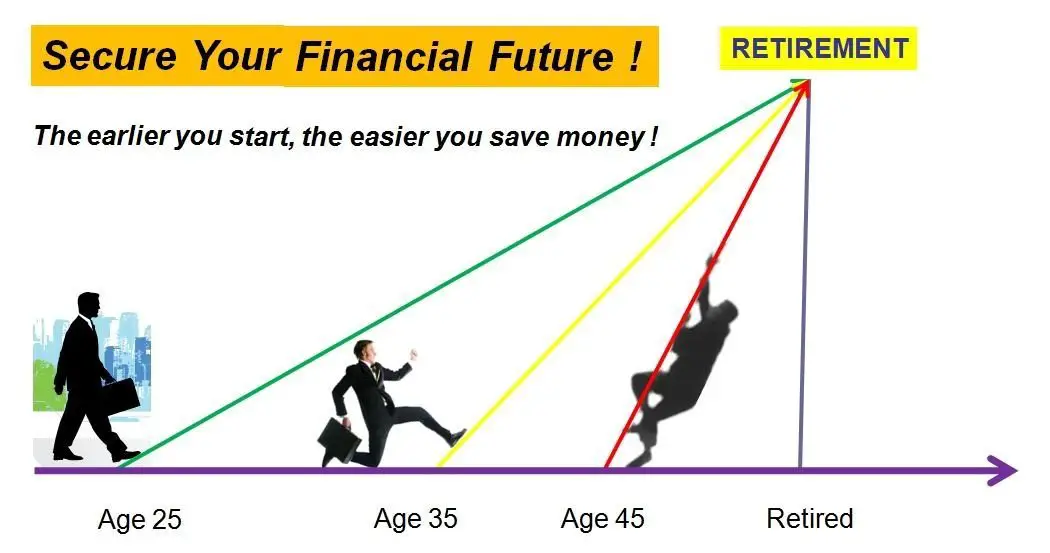

5. Plan for Retirement Early

Retirement may seem far away, but the sooner you start planning, the better off you’ll be. In addition to contributing to retirement accounts, consider the following strategies to secure your retirement:

- Calculate how much you’ll need for retirement by considering your desired lifestyle and expected expenses.

- Take advantage of employer-sponsored retirement plans and matching contributions.

- Explore additional retirement savings options, such as individual retirement accounts (IRAs) or annuities.

- Consider delaying Social Security benefits to maximize your monthly payments.

- Regularly reassess your retirement plan and adjust your contributions as needed.

- Work with a financial advisor or retirement specialist to ensure you’re on track.

By starting early and consistently saving for retirement, you can build a substantial nest egg that supports you during your golden years.

6. Protect Yourself and Your Loved Ones

Securing your financial future also involves protecting yourself and your loved ones from unexpected events that could derail your plans. Consider the following essential protections:

- Obtain adequate health, life, and disability insurance coverage.

- Create or update your will and establish a healthcare proxy or power of attorney.

- Consider purchasing long-term care insurance to cover potential future care needs.

- Regularly review your insurance coverage to ensure it aligns with your current situation.

- Establish an emergency contact list and share it with trusted individuals.

Having the right insurance coverage and estate planning documents in place safeguards your financial well-being and provides peace of mind for you and your loved ones.

7. Continuously Educate Yourself

The financial landscape is constantly evolving, so it’s crucial to stay informed and continuously educate yourself about personal finance. Here are some ways you can expand your financial knowledge:

- Read books, blogs, and reputable financial publications.

- Attend financial literacy workshops or seminars.

- Take online courses or webinars related to personal finance.

- Join local or online communities focused on personal finance discussions.

- Consider working with a financial advisor who can provide personalized guidance.

By investing time and effort into expanding your financial knowledge, you’ll become better equipped to make informed decisions and navigate the ever-changing financial landscape.

Securing your financial future requires a combination of careful planning, disciplined saving, strategic investing, and protecting yourself and your loved ones. By following the steps outlined in this article, you can take control of your financial life and create a strong foundation for a financially secure future. Remember, the earlier you start, the more time your money has to grow and work for you. So take that first step today towards securing your financial future!

Securing Your Financial Future

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How can I secure my financial future?

Earning and saving money is just the first step towards securing your financial future. Here are some key strategies:

What is the importance of budgeting?

Budgeting is crucial for securing your financial future as it helps you track your income and expenses, prioritize your spending, and ensure you have enough money for savings and investments.

How should I start saving for retirement?

To start saving for retirement, consider opening a retirement account such as a 401(k) or an individual retirement account (IRA). Contribute regularly and take advantage of any employer matching programs to maximize your savings.

What are the benefits of diversifying investments?

Diversifying your investments helps reduce the risk of losing money. By spreading your funds across different asset classes such as stocks, bonds, and real estate, you can potentially earn higher returns and protect your portfolio against market volatility.

Is it important to have an emergency fund?

Yes, having an emergency fund is essential for financial security. Aim to save at least three to six months’ worth of living expenses in a separate account to cover unforeseen circumstances like job loss or medical emergencies.

What are some effective ways to reduce debt?

To reduce debt, start by creating a budget and allocating extra funds towards debt repayment. Consider strategies such as the snowball method (paying off small debts first) or the avalanche method (paying off debts with the highest interest rates first).

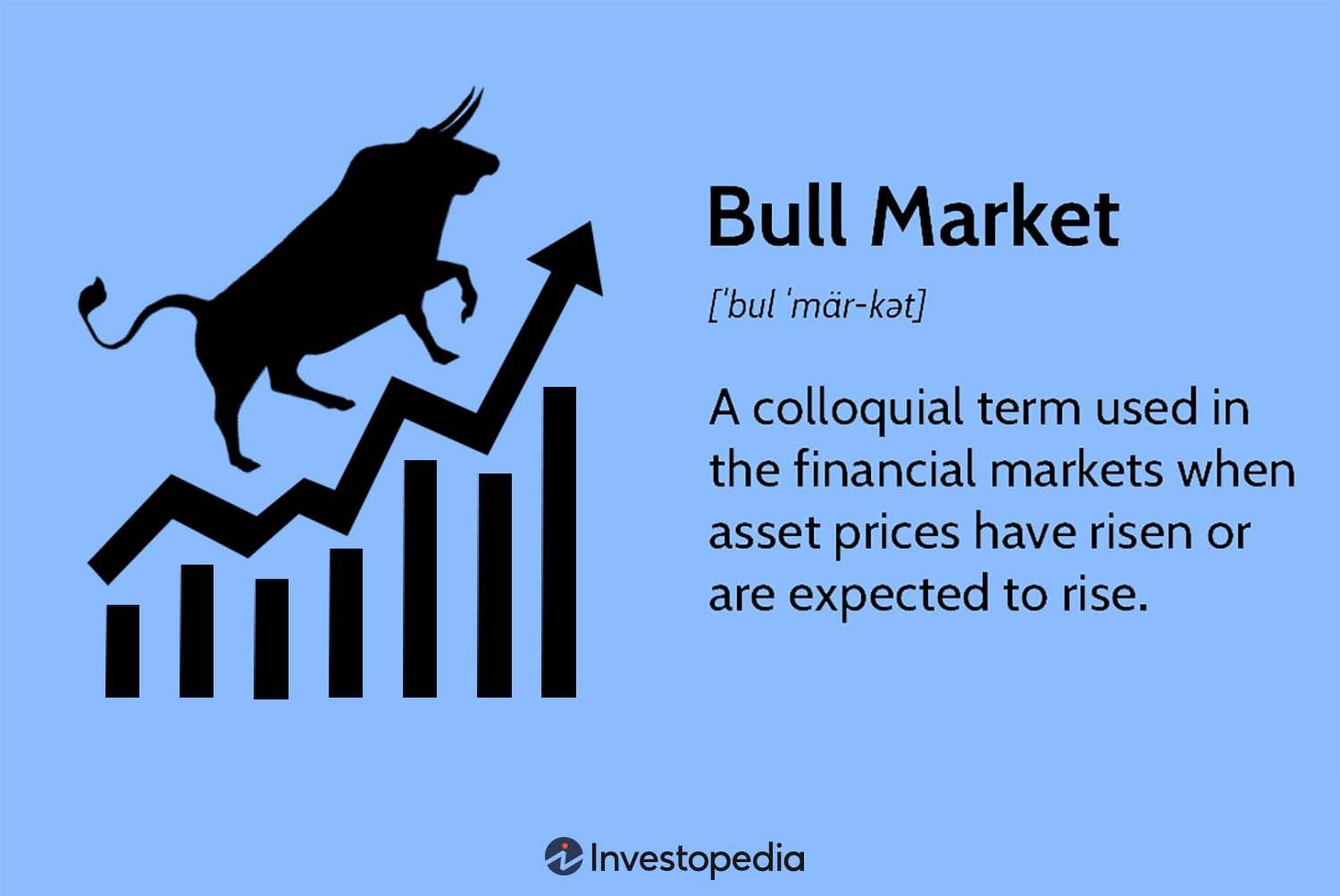

Should I invest in stocks or bonds?

Both stocks and bonds have their advantages. Stocks offer potential for higher returns but come with higher risk, while bonds provide stability and fixed income. Your investment decisions should align with your risk tolerance and long-term financial goals.

How can I protect my financial assets?

Protecting your financial assets involves various strategies, including regular monitoring of your accounts, using strong and unique passwords, being cautious of phishing attempts, and considering insurance options such as life insurance, health insurance, and property insurance.

Final Thoughts

To secure your financial future, it is essential to adopt smart money management strategies. Start by creating a budget to track your income and expenses, allowing you to identify areas where you can save and invest. Prioritize saving a portion of your income regularly and consider various investment options that match your risk tolerance and financial goals. Diversify your investments to mitigate risks and maximize potential returns. Additionally, ensure you have adequate insurance coverage to protect yourself and your family from unforeseen circumstances. Regularly review and adjust your financial plan as your circumstances and goals evolve. With these steps, you can take control and secure your financial future.