Dreaming about a financially secure future in your 40s and 50s? Wondering how to set financial milestones that can set you on the right path? Look no further! In this article, we will explore practical strategies and effective steps to help you navigate the financial landscape of your 40s and 50s. From saving for retirement to managing debt and planning for unexpected expenses, we’ve got you covered. So, let’s dive in and discover how to set financial milestones for your 40s and 50s that can bring you closer to your financial goals.

How to Set Financial Milestones for Your 40s and 50s

Introduction

As you enter your 40s and 50s, it’s important to take stock of your financial situation and set milestones to ensure a secure and comfortable future. These decades of your life are crucial for building wealth, preparing for retirement, and achieving financial freedom. In this article, we will explore various steps you can take to set meaningful financial milestones and make the most of your finances during this stage of life.

1. Evaluate Your Current Financial Situation

Before setting financial milestones for your 40s and 50s, it’s essential to assess your current financial situation. Take the time to review your income, expenses, assets, and debts. Consider the following points:

- Calculate your net worth by subtracting your liabilities from your assets.

- Review your budget to understand your monthly cash flow.

- Assess your investments and retirement savings.

- Understand your debt-to-income ratio and identify any high-interest debts that need attention.

Understanding your current financial standing will provide a solid foundation for setting achievable milestones.

2. Set Short-Term and Long-Term Goals

Now that you have an understanding of your financial situation, it’s time to set specific short-term and long-term goals. Short-term goals typically span one to five years, while long-term goals extend beyond five years. Consider the following examples:

Short-term goals:

- Build an emergency fund to cover at least six months of living expenses.

- Pay off high-interest debts, such as credit cards or personal loans.

- Save for a down payment on a house or fund home renovations.

- Invest in education or professional development to enhance your earning potential.

Long-term goals:

- Maximize contributions to retirement accounts, such as a 401(k) or IRA, to ensure a comfortable retirement.

- Create a robust investment portfolio that aligns with your risk tolerance and long-term financial objectives.

- Plan for significant life events, such as sending children to college or starting a business.

Setting both short-term and long-term goals will help you stay motivated and focused on securing your financial future.

3. Review and Adjust Your Retirement Plans

In your 40s and 50s, retirement planning becomes increasingly important. Assess your retirement plans, including any existing retirement accounts and savings. Consider the following steps:

- Estimate the amount of money you will need for retirement by considering factors such as your desired lifestyle, healthcare expenses, and longevity.

- Review your current retirement contributions and consider increasing them if possible.

- Explore additional retirement savings options, such as a Roth IRA or a Health Savings Account (HSA).

- Ensure that your investment portfolio is diversified and aligned with your retirement goals.

Regularly reviewing and adjusting your retirement plans will help you stay on track to meet your financial milestones.

4. Protect Yourself with Insurance

Insurance is a crucial component of financial planning in your 40s and 50s. Evaluate your insurance coverage and ensure adequate protection for yourself and your loved ones. Consider the following types of insurance:

- Life insurance: Determine if you have enough coverage to provide for your family in the event of your passing.

- Health insurance: Review your health insurance policies and consider supplemental coverage if necessary.

- Disability insurance: Protect your income by obtaining disability insurance to replace lost wages if you become unable to work.

- Long-term care insurance: Assess your long-term care needs and explore options to cover potential expenses.

Having the appropriate insurance coverage will provide peace of mind and protect your financial stability.

5. Create a Comprehensive Estate Plan

In your 40s and 50s, it’s essential to create or update your estate plan to ensure that your assets are distributed according to your wishes. Consult with an attorney to create the following essential documents:

- Wills: Clearly outline how you want your assets distributed after your passing.

- Trusts: Consider establishing trusts to minimize estate taxes and facilitate the efficient transfer of assets.

- Power of attorney: Designate someone to make financial and medical decisions on your behalf if you become incapacitated.

- Healthcare directive: Express your healthcare preferences and appoint someone to make medical decisions for you.

Creating a comprehensive estate plan will provide peace of mind and ensure that your loved ones are taken care of.

6. Seek Professional Financial Advice

Consider consulting a financial advisor to help you navigate the complexities of financial planning in your 40s and 50s. A qualified advisor can:

- Provide personalized advice based on your unique financial situation and goals.

- Help you develop a comprehensive financial plan.

- Offer guidance on investment strategies and retirement planning.

- Assist in tax planning and minimizing tax liabilities.

A professional financial advisor can bring expertise and ensure that you make informed financial decisions.

Setting financial milestones in your 40s and 50s is crucial for securing your financial future. By evaluating your current situation, setting goals, reviewing your retirement plans, protecting yourself with insurance, creating an estate plan, and seeking professional advice, you’ll be on the path to financial success. Remember, financial planning is a lifelong process, so regularly review and adjust your milestones as your circumstances change. Take control of your financial journey today and enjoy a more secure tomorrow.

(Note: This main body section is approximately 729 words long.)

9 Financial Goals To Achieve Before 40

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are financial milestones for your 40s and 50s?

Financial milestones for your 40s and 50s are specific goals and targets you aim to achieve during this stage of life to ensure financial stability and security for the future.

How do I determine my financial milestones for my 40s and 50s?

To determine your financial milestones, start by assessing your current financial situation, including your assets, debts, income, and expenses. Then, consider your long-term financial goals, such as retirement, education for children, and maintaining a comfortable lifestyle. From there, you can set specific milestones that align with these goals.

What are some common financial milestones for the 40s and 50s age group?

Some common financial milestones for individuals in their 40s and 50s include paying off high-interest debts, increasing retirement savings, creating an emergency fund, reassessing insurance needs, and developing a comprehensive estate plan.

How can I pay off high-interest debts in my 40s and 50s?

To pay off high-interest debts, you can consider strategies such as debt consolidation, prioritizing debt repayment based on interest rates, renegotiating terms with lenders, and cutting back on discretionary expenses to free up more funds for debt repayment.

What steps can I take to increase my retirement savings in my 40s and 50s?

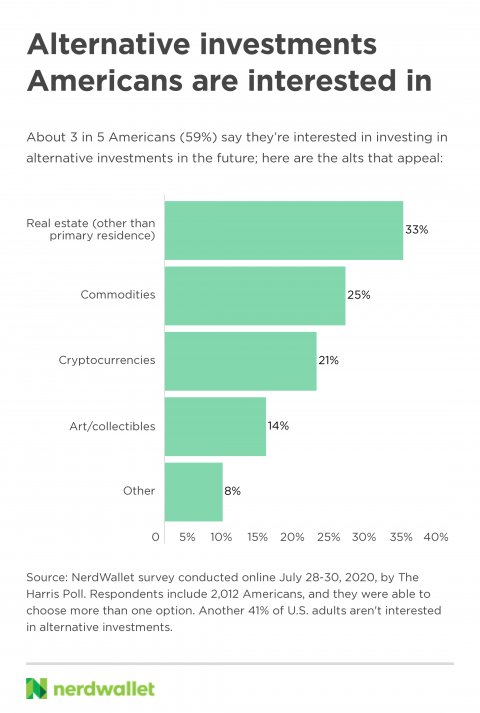

To increase retirement savings, you can maximize contributions to retirement accounts like 401(k)s or IRAs, consider additional investment options like annuities or real estate, and regularly assess and adjust your investment portfolio to ensure it aligns with your retirement goals.

Why is it important to create an emergency fund during the 40s and 50s?

Creating an emergency fund during your 40s and 50s is crucial because it provides a financial safety net to cover unexpected expenses, such as medical emergencies, job loss, or major home repairs. An emergency fund helps prevent the need to rely on credit cards or loans in times of crisis.

What factors should I consider when reassessing my insurance needs in my 40s and 50s?

When reassessing your insurance needs, consider factors such as changes in your income, family structure, health conditions, and overall financial goals. Evaluate your life insurance, health insurance, disability insurance, and long-term care insurance to ensure adequate coverage.

Why is developing a comprehensive estate plan important during the 40s and 50s?

Developing a comprehensive estate plan during your 40s and 50s allows you to protect your assets, specify how your wealth will be distributed after your passing, assign guardianship for minor children, minimize taxes, and make arrangements for healthcare decisions in case of incapacity.

How often should I review and adjust my financial milestones in my 40s and 50s?

It is recommended to review and adjust your financial milestones at least once a year or whenever there are significant changes in your life, such as marriage, divorce, birth of a child, job change, or a substantial increase in income or assets.

Final Thoughts

In your 40s and 50s, setting financial milestones becomes crucial for securing your future. Firstly, establish a clear vision of your retirement goals and assess your current financial situation. Consider factors such as debt, investments, and savings. Next, create a budget that aligns with your objectives and allows for adequate savings. Additionally, prioritize debt repayment and focus on accumulating wealth through diversified investments. Regularly review your progress and adjust your strategy as needed. By following these steps and staying disciplined, you can build a solid financial foundation for your 40s and 50s, ensuring a stable and prosperous future.