As a freelancer, setting up a financial buffer is crucial for your peace of mind and long-term success. Wondering how to set up a financial buffer for freelancers? Well, you’ve come to the right place! In this blog article, we’ll guide you through the steps to create a solid financial cushion that will help you navigate through the ups and downs of freelancing. Whether you’re just starting out or looking to strengthen your existing buffer, we’ve got you covered. Let’s delve into the practical strategies that can provide stability and security in your freelance journey.

How to Set Up a Financial Buffer for Freelancers

As a freelancer, having a financial buffer is crucial for maintaining stability and peace of mind. A financial buffer acts as a safety net, providing you with funds to cover unexpected expenses, periods of low income, or emergencies. In this article, we will explore the steps you can take to set up a robust financial buffer, ensuring financial security and resilience in your freelance career.

Create a Realistic Budget

The first step in setting up a financial buffer is to create a realistic budget. This involves assessing your income and expenses to determine how much you can save each month. Consider the following:

- Track your income: Keep a record of your monthly income, including all freelance projects, clients, and sources of revenue.

- Monitor your expenses: Track all your expenses, such as rent, utilities, groceries, transportation, insurance, and any other recurring or discretionary costs.

- Identify areas for reduction: Look for areas where you can cut back on expenses. For example, you may consider reducing dining out or finding more affordable alternatives for certain services.

By understanding your income and expenses, you can create a budget that allows you to save a portion of your earnings towards your financial buffer.

Set Savings Goals

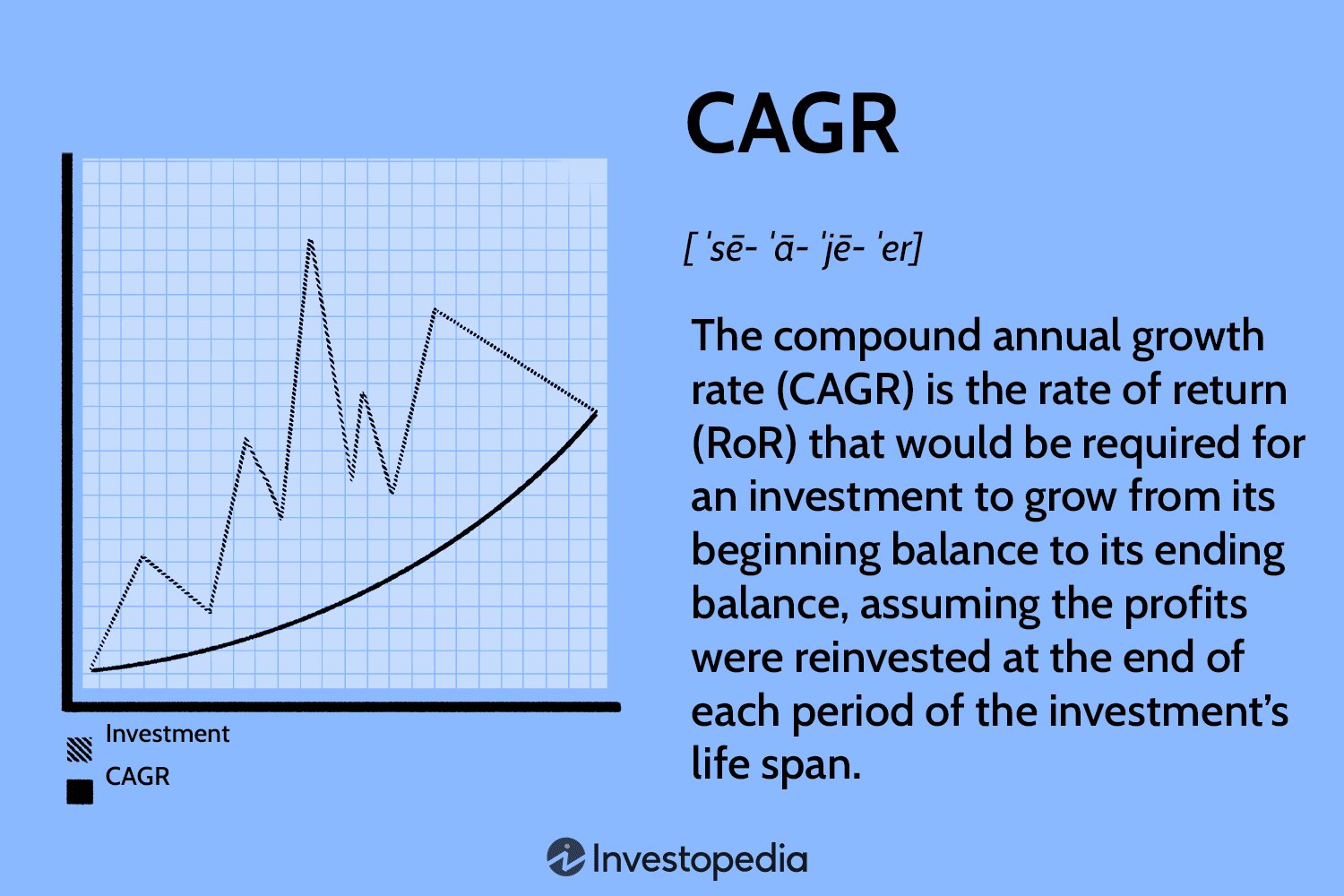

Once you have a clear picture of your income and expenses, it’s time to set savings goals. Determine how much you want to save each month and establish specific targets. These targets will depend on your financial situation and desired level of financial security.

- Emergency fund: Start by focusing on building an emergency fund that covers at least three to six months of your essential expenses. This fund will provide a safety net in case of unexpected events, such as a sudden loss of clients or a medical emergency.

- Long-term buffer: Once you have established your emergency fund, you can work towards building a long-term buffer. This buffer should ideally cover up to a year’s worth of expenses and provide additional financial security.

Setting savings goals will help you stay motivated and disciplined in your saving efforts.

Automate Your Savings

To ensure consistent progress towards your savings goals, consider automating your savings. Set up automatic transfers from your main income account to a separate savings account designated for your financial buffer. This way, a portion of your income will be automatically saved without relying on your willpower alone.

- Regular transfers: Schedule regular transfers on a monthly or bi-monthly basis, aligning with your income cycle. This will help you consistently contribute to your financial buffer without the temptation to spend the money.

- Percentage-based transfers: Instead of setting a fixed amount, consider setting a percentage of your income to be automatically transferred. As your income fluctuates, this method ensures that your savings remain proportional.

Automating your savings takes away the burden of manual transfers and makes it easier to stick to your savings plan.

Diversify Your Income Streams

Freelancers often rely on multiple clients and projects for income. To enhance your financial stability and buffer, diversify your income streams. By having multiple sources of income, you reduce the risk of relying too heavily on a single client or industry.

- Expand your client base: Continually seek new clients and projects to broaden your portfolio. This not only increases your earning potential but also reduces the impact if one client or project falls through.

- Create passive income: Explore opportunities for passive income, such as creating and selling digital products, writing e-books, or generating passive revenue through affiliate marketing or advertising.

- Invest in your skills: Regularly invest in upgrading and expanding your skills to increase your marketability and attract diverse clients and higher-paying projects.

Diversifying your income streams provides a cushion against income fluctuations and strengthens your financial buffer.

Manage your Tax Obligations

As a freelancer, it is essential to manage your tax obligations effectively. Failure to do so can lead to unexpected tax bills, impacting your financial buffer. Here are a few tax management strategies:

- Set aside estimated taxes: Depending on your jurisdiction, you may need to pay quarterly estimated taxes. Allocate a portion of your income to a separate account specifically for estimated taxes to avoid any surprises at tax time.

- Consult with a tax professional: Seek guidance from a tax professional who specializes in freelance taxes. They can provide advice on deductible expenses, tax planning strategies, and help ensure compliance with tax laws.

By effectively managing your tax obligations, you can avoid unnecessary tax burdens and protect your financial buffer.

Regularly Review and Adjust

Setting up a financial buffer is not a one-time task. It requires regular review and adjustment to adapt to changes in your income, expenses, and financial goals. Set aside time every few months to assess your progress and make necessary adjustments.

- Review your budget: Evaluate your income and expenses to ensure your budget is still realistic and aligned with your goals.

- Track your savings: Monitor your savings progress and ensure you are on track to meet your targets. Adjust your savings contributions if necessary.

- Assess your income streams: Regularly evaluate your client base and income sources. Identify any areas that require attention and make necessary adjustments to maintain a diverse income portfolio.

Regularly reviewing and adjusting your financial buffer strategy will help you stay on top of your financial goals and adapt to any changes in your freelance career.

In conclusion, setting up a financial buffer is essential for freelancers to provide stability and security in their careers. By creating a realistic budget, setting savings goals, automating savings, diversifying income streams, managing tax obligations, and regularly reviewing and adjusting your strategy, you can establish a strong financial buffer. Remember, it takes discipline and consistency, but the peace of mind and financial resilience it provides are well worth the effort.

Managing Freelance Finance

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. How can I set up a financial buffer as a freelancer?

Setting up a financial buffer as a freelancer is essential for financial stability. Start by creating a separate savings account specifically for your business. Allocate a percentage of your income to this account regularly to build up your buffer. It’s also important to track your expenses and create a monthly budget to ensure you’re living within your means.

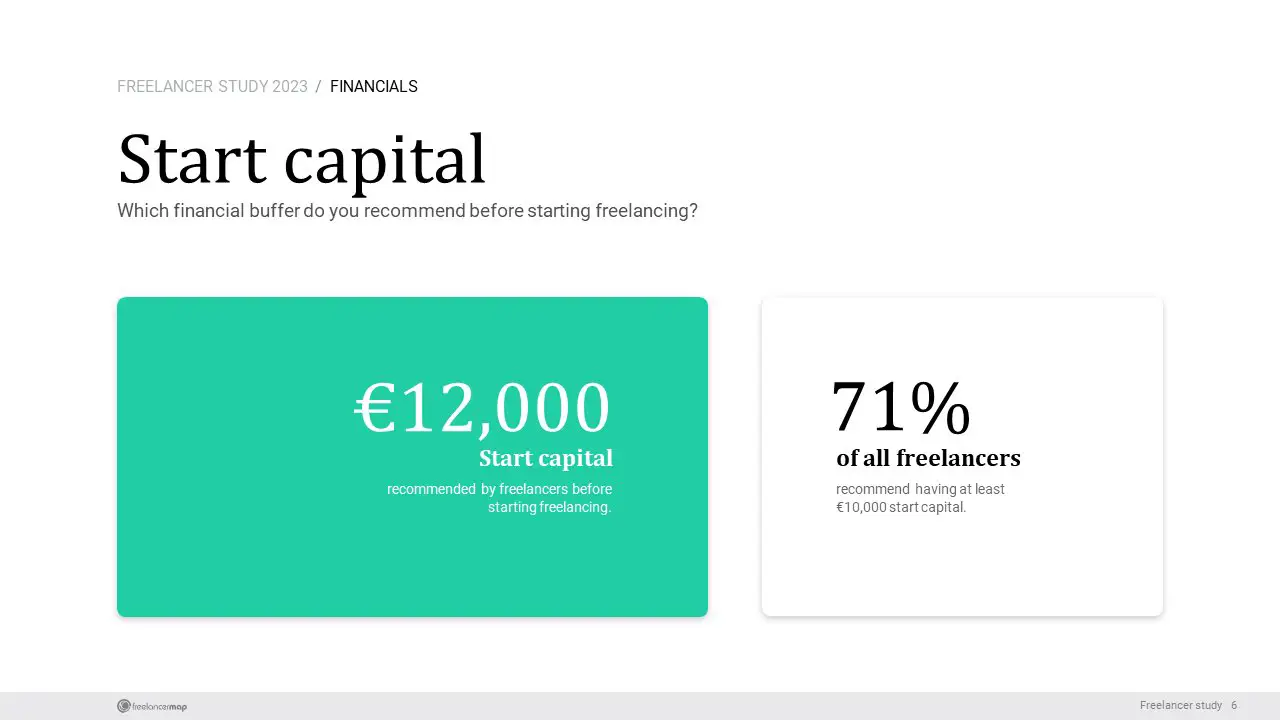

2. How much should I save for a financial buffer as a freelancer?

The amount you save for a financial buffer will vary depending on your personal circumstances. As a general rule, aim to have at least three to six months’ worth of living expenses saved. Consider factors such as your monthly expenses, any dependents, and the stability of your industry when determining how much to save.

3. Should I contribute to a retirement account or focus on a financial buffer as a freelancer?

While it’s important to prioritize your financial buffer, it’s also crucial to plan for your retirement. Ideally, you should aim to contribute to both your financial buffer and a retirement account simultaneously. Allocate a portion of your income to savings for emergencies and another portion towards long-term retirement savings.

4. What are some strategies for reducing expenses as a freelancer?

As a freelancer, reducing expenses can help you build your financial buffer more quickly. Consider strategies such as negotiating lower rates for essential services, minimizing discretionary spending, and exploring cost-effective alternatives. Additionally, track your expenses regularly to identify areas where you can cut back.

5. How can I ensure a steady income as a freelancer?

Ensuring a steady income can be challenging as a freelancer, but there are steps you can take to increase stability. Develop a strong network of clients and maintain good relationships with them. Consider diversifying your services or offering retainer packages to secure recurring income. Set realistic project timelines and communicate effectively with clients to avoid delays and payment issues.

6. Is it necessary to have insurance coverage as a freelancer?

Having insurance coverage is highly recommended for freelancers. It provides protection against unforeseen circumstances such as accidents, liability claims, or illness. Consider obtaining health insurance, professional liability insurance, and disability insurance to safeguard yourself and your business.

7. Should I hire an accountant to manage my finances as a freelancer?

Hiring an accountant can be beneficial for managing your finances as a freelancer, especially if you find it challenging to keep up with tax regulations and financial record-keeping. An accountant can help you maximize deductions, navigate tax obligations, and provide guidance on structuring your business for optimal financial management.

8. What steps can I take to handle irregular income as a freelancer?

Handling irregular income is a common challenge for freelancers. To manage this, establish a budget based on your average monthly income. Prioritize essential expenses and create a plan for allocating any surplus or unexpected funds. Consider setting aside a portion of each payment you receive to ensure a consistent flow of funds throughout the year.

Final Thoughts

Setting up a financial buffer is crucial for freelancers to ensure stability in their income. Start by calculating your monthly expenses and determining how many months’ worth of expenses you want to save as a buffer. Open a separate high-yield savings account dedicated to your buffer fund. Set up automatic transfers from your freelance income to this account. In addition, consider diversifying your income streams and creating an emergency fund. By following these steps, freelancers can establish a financial buffer that provides security and peace of mind during lean times. How to set up a financial buffer for freelancers is essential to maintain financial stability and navigate the uncertainties of freelancing successfully.