Looking to effectively manage your finances? Want to stay on top of your expenses and savings with ease? Look no further! In this article, we will guide you on how to set up a financial tracking spreadsheet, providing a simple yet powerful solution to your financial management needs. By following our step-by-step instructions, you’ll be equipped with the tools to take control of your finances and make informed decisions. So, let’s jump right in and explore how to set up a financial tracking spreadsheet that works for you.

How to Set Up a Financial Tracking Spreadsheet

Setting up a financial tracking spreadsheet can be an empowering and practical tool to help you gain control of your finances. By organizing and analyzing your income, expenses, and savings, you can make informed decisions and work towards your financial goals. In this guide, we’ll walk you through the step-by-step process of creating a financial tracking spreadsheet. Whether you’re a budgeting novice or looking to revamp your existing system, this comprehensive tutorial will equip you with the knowledge and tools you need to take charge of your financial future.

Step 1: Choose a Spreadsheet Software

To begin, you’ll need to select the spreadsheet software that works best for your needs. Popular options include Microsoft Excel, Google Sheets, and Apple Numbers. Consider factors such as your familiarity with the software, availability of features, and compatibility with your device.

Step 2: Define Your Financial Goals

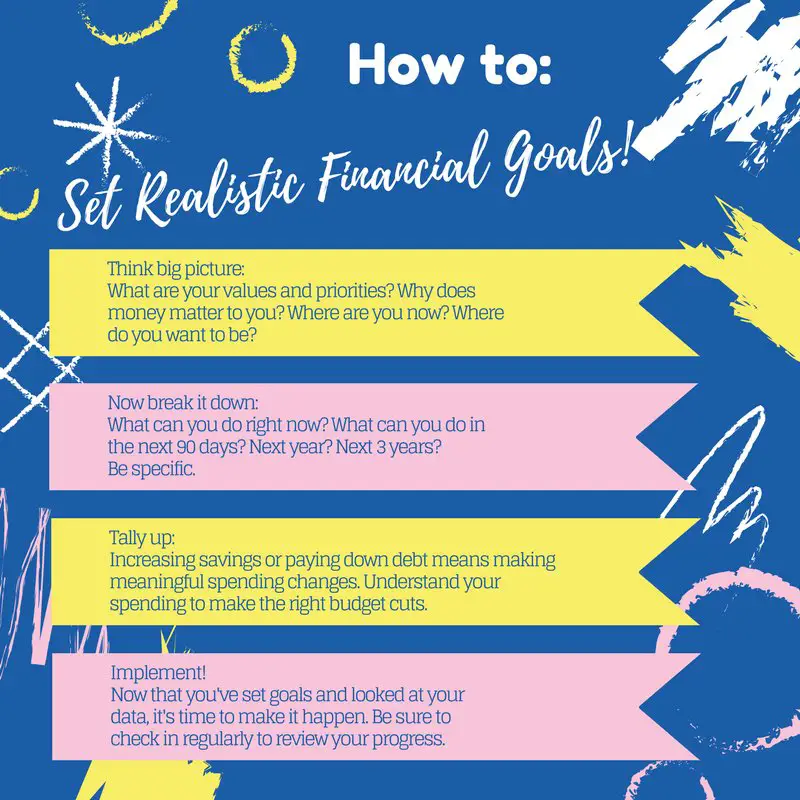

Before diving into the technical aspects of setting up your financial tracking spreadsheet, take a moment to define your financial goals. Are you saving for a specific purchase, paying off debt, or planning for retirement? Understanding your objectives will help shape the structure and categories within your spreadsheet.

Step 3: Determine Your Tracking Categories

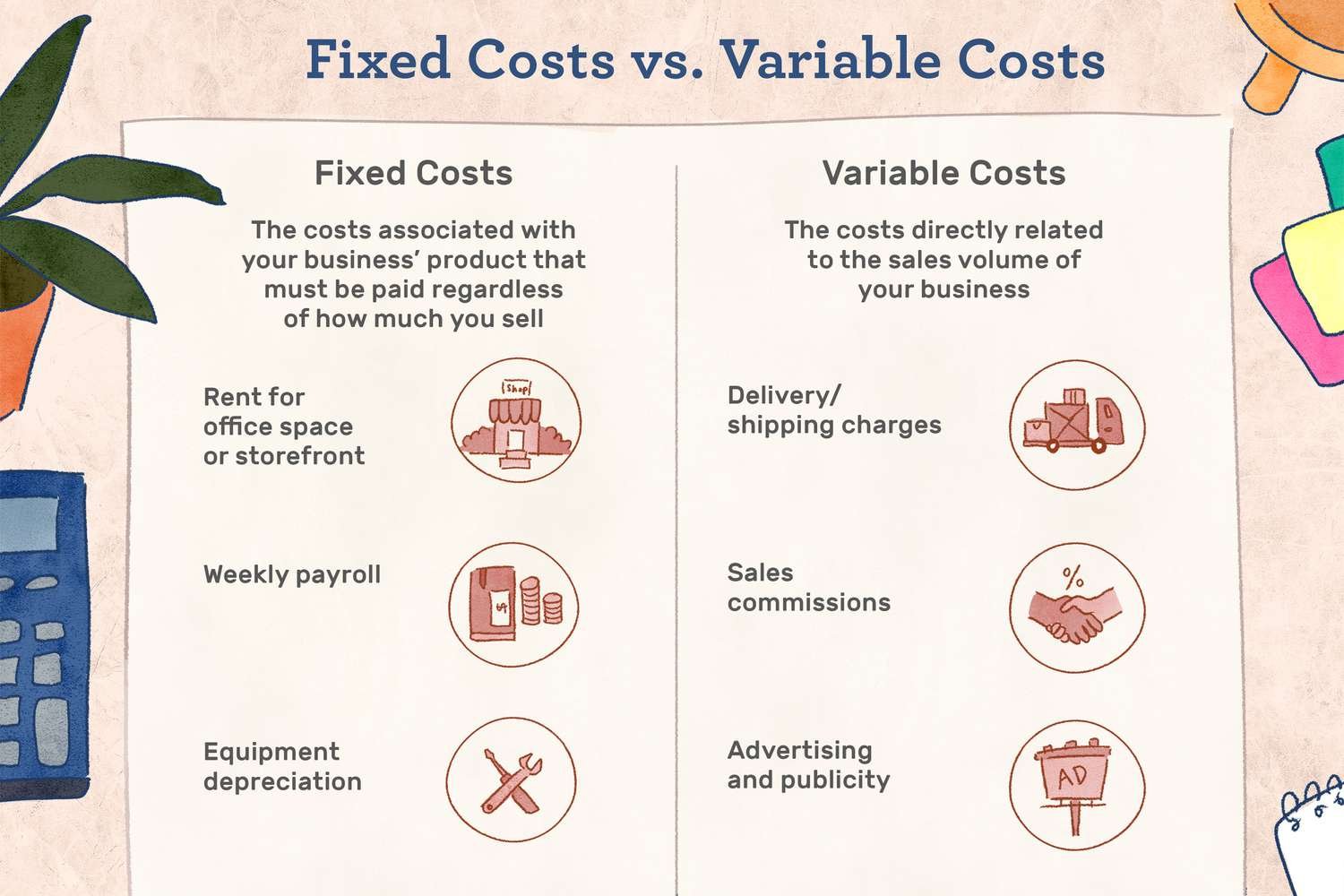

To effectively track your finances, it’s crucial to categorize your income and expenses. Start by brainstorming all possible categories and subcategories that apply to your financial situation. Common categories include:

- Income: Wages, freelance earnings, rental income, etc.

- Expenses: Rent/mortgage, utilities, groceries, transportation, entertainment, etc.

- Savings: Emergency fund, retirement accounts, investment portfolios, etc.

- Debt: Loans, credit cards, student loans, etc.

Step 4: Create Your Spreadsheet Structure

Now it’s time to create the foundation of your financial tracking spreadsheet. Follow these steps to set up the structure:

- Open your chosen spreadsheet software and create a new document.

- Create a tab for each month of the year or use a single tab for all months, whichever format suits you best.

- Name each tab with the corresponding month or a descriptive title.

- In the first row, label the columns with your chosen categories. Add a column for the date, description, and amount as well.

- Consider including a summary tab where you can consolidate data from all months to get an overview of your finances.

Step 5: Enter Your Starting Balances

To accurately track your finances, it’s important to begin with accurate starting balances. This includes your current account balances, debts, and any existing savings or investments. Enter these balances into the appropriate cells on your spreadsheet, ensuring they are reflected accurately.

Step 6: Populate Your Spreadsheet

Now it’s time to start recording your financial transactions. Commit to consistently updating your spreadsheet with new income, expenses, savings, and debt payments. Be diligent about capturing all the relevant details such as the date, description, and amount. Regularly reviewing and updating your spreadsheet will give you a clear picture of your financial status and progress.

Step 7: Utilize Formulas and Functions

Spreadsheets offer powerful tools to automate calculations and streamline your financial tracking process. Take advantage of formulas and functions to save time and reduce errors. Here are some useful formulas to consider:

- SUM: Calculates the sum of a specific range of cells, such as your monthly income or expenses.

- AVERAGE: Computes the average of a set of values, helpful for analyzing spending patterns over time.

- IF: Allows you to set conditional statements, for example, to display a warning if expenses exceed a certain threshold.

- PMT: Helps to calculate loan payments, leveraging interest rates, and repayment terms.

Step 8: Customize Your Spreadsheet

Make your financial tracking spreadsheet work for you by customizing it to fit your specific needs. Consider the following customization options:

- Add conditional formatting to highlight specific cells or ranges based on predefined criteria, such as exceeding your budget.

- Create charts or graphs to visually represent your financial data and trends.

- Add additional tabs to track specific goals or metrics, such as debt reduction or savings targets.

- Experiment with different color schemes or layouts to make your spreadsheet visually appealing and easy to navigate.

Step 9: Regularly Review and Update

Setting up a financial tracking spreadsheet is just the first step. To derive the maximum benefit from your efforts, commit to regular reviews and updates. Schedule a recurring time each month to analyze your financial progress and make any necessary adjustments. Use the insights gained to refine your budget, adjust your savings goals, or identify areas where you can cut back on expenses.

By consistently tracking your finances and maintaining an up-to-date spreadsheet, you’ll be well on your way to achieving your financial goals and gaining greater control over your money.

In conclusion, creating a financial tracking spreadsheet can be a game-changer for your personal finance management. By following the steps outlined in this guide, you can establish a robust system that empowers you to make informed financial decisions and work towards your goals. Remember to customize your spreadsheet to meet your specific needs and consistently update it to maintain its accuracy and effectiveness. With diligence and commitment, you’ll be well on your way to financial success.

Excel Budget Template | Automate your budget in 15 minutes

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How do I set up a financial tracking spreadsheet?

To set up a financial tracking spreadsheet, follow these steps:

What software can I use to create a financial tracking spreadsheet?

There are a few options you can use to create a financial tracking spreadsheet, including Microsoft Excel, Google Sheets, and other spreadsheet software.

What are the essential columns I should include in a financial tracking spreadsheet?

Some essential columns to include in a financial tracking spreadsheet are income, expenses, date, category, description, and balance.

How do I categorize expenses in a financial tracking spreadsheet?

To categorize expenses in a financial tracking spreadsheet, create a column specifically for categories such as groceries, utilities, entertainment, etc., and assign each expense to the appropriate category.

What formulas should I use in a financial tracking spreadsheet?

Some useful formulas to include in a financial tracking spreadsheet are SUM, SUBTOTAL, AVERAGE, and IF statements to calculate totals, subtotals, averages, and conditional calculations.

How often should I update my financial tracking spreadsheet?

It is recommended to update your financial tracking spreadsheet regularly, ideally on a monthly basis. However, you can choose a frequency that suits your needs.

Can I import transactions into my financial tracking spreadsheet?

Yes, you can import transactions into your financial tracking spreadsheet by exporting them from your bank or financial institution’s website and then importing the file into your spreadsheet software.

How can I analyze my financial data in a spreadsheet?

To analyze your financial data in a spreadsheet, you can use charts, graphs, and pivot tables. These tools can help you visually understand your financial trends and make informed decisions.

Final Thoughts

Setting up a financial tracking spreadsheet is an essential step in managing your personal or business finances effectively. By following a few simple steps, you can create a spreadsheet that helps you stay organized and track your income and expenses efficiently. Start by determining the key categories for your finances, such as income sources and expense types. Then, create columns for each category and input the relevant data. Utilize formulas and functions to automate calculations and create a clear overview of your financial situation. Regularly update and review your spreadsheet for accurate tracking. With a well-organized financial tracking spreadsheet, you can gain valuable insights into your spending habits, make informed financial decisions, and achieve your financial goals.