Looking to consolidate your debt and regain control of your financial situation? If so, you might be wondering how to use home equity for debt consolidation. Well, you’re in the right place! In this article, we’ll guide you through the process of utilizing the equity in your home to consolidate and manage your debts effectively. By the end, you’ll have a clear understanding of how this strategy can help you achieve financial stability and peace of mind. So, let’s dive in and explore the benefits of using home equity for debt consolidation!

How to Use Home Equity for Debt Consolidation

Debt consolidation is a popular strategy to simplify finances and pay off multiple debts. It involves combining several debts into a single loan with a lower interest rate. One effective way to consolidate debt is by utilizing the equity in your home. In this article, we will explore how you can use home equity for debt consolidation and achieve financial freedom.

Understanding Home Equity

Before delving into the specifics of debt consolidation with home equity, it’s essential to understand what home equity is. Home equity refers to the difference between the market value of your home and the outstanding mortgage balance. Put simply, it is the portion of your property that you own outright.

For example, if your home is valued at $300,000 and you still owe $150,000 on your mortgage, your home equity would be $150,000.

The Benefits of Using Home Equity for Debt Consolidation

Utilizing home equity for debt consolidation offers several advantages:

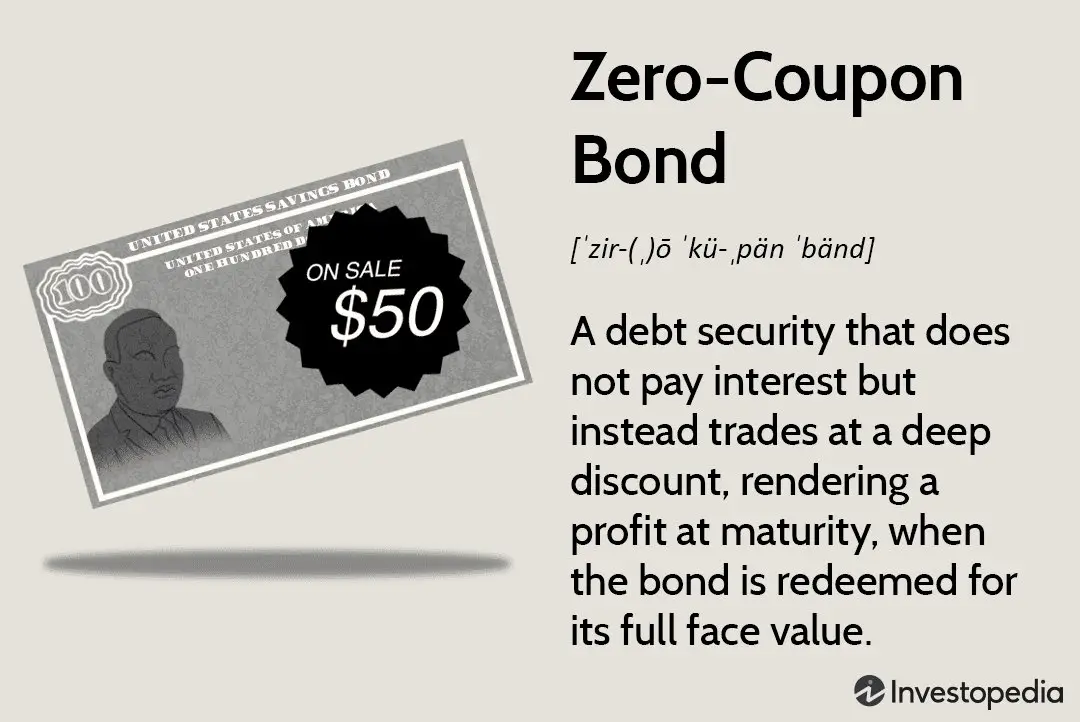

- Lower interest rates: Home equity loans typically offer lower interest rates compared to credit cards and personal loans. By consolidating your debts into a single loan with a lower interest rate, you can save money in the long run.

- One monthly payment: Instead of juggling multiple payments and due dates, consolidating your debts allows you to make just one monthly payment. This simplifies your finances and reduces the risk of missing payments.

- Extended repayment terms: Home equity loans often come with longer repayment terms compared to other types of debt. This can lower your monthly payments and provide more breathing room in your budget.

- Potential tax benefits: In some cases, the interest paid on a home equity loan may be tax-deductible, providing an additional financial advantage. However, it’s crucial to consult with a tax professional to understand the specifics of your situation.

Types of Home Equity Loans

When considering using home equity for debt consolidation, you have two primary options:

1. Home Equity Loan (HEL)

A home equity loan, also known as a second mortgage, is a lump-sum loan that allows you to borrow against the equity in your home. The loan is repaid over a fixed term, usually with a fixed interest rate.

With a home equity loan, you receive the loan amount upfront and repay it in equal monthly installments. This type of loan is suitable for those who need a specific amount of money for debt consolidation.

2. Home Equity Line of Credit (HELOC)

A home equity line of credit (HELOC) works more like a credit card. It provides you with a revolving line of credit that you can draw money from as needed, up to a certain limit, during a specified draw period.

During the draw period, you can borrow and repay funds multiple times. The interest rates for HELOCs are typically variable. This type of loan is ideal for those who have varying debt amounts or need to finance ongoing expenses.

Steps to Use Home Equity for Debt Consolidation

Now that you understand the concept of home equity and the benefits of using it for debt consolidation, let’s explore the steps involved:

1. Assess your financial situation

Before deciding to use home equity for debt consolidation, take stock of your financial situation. Consider the following:

- The total amount of debt you currently have

- The interest rates you are paying on each debt

- Your credit score

- Your monthly budget and ability to make loan payments

By assessing your financial situation, you can determine if debt consolidation is the right option for you and if using home equity is the best approach.

2. Calculate your home equity

Next, determine the amount of home equity you have available. To calculate your home equity, subtract your outstanding mortgage balance from the current market value of your home.

For example, if your home is valued at $300,000 and you still owe $150,000 on your mortgage, your home equity would be $150,000.

3. Research lenders and loan options

Now that you know your financial situation and how much home equity you have, research different lenders and loan options. Compare interest rates, repayment terms, and any fees associated with home equity loans.

Consider whether a home equity loan or HELOC suits your needs best. Additionally, explore any special programs or offers that lenders may have for debt consolidation purposes.

4. Apply for a home equity loan

Once you have chosen a lender and loan option, it’s time to apply for a home equity loan. The application process may vary depending on the lender, but generally, you will need to provide:

- Proof of income (pay stubs, tax returns)

- Documentation of your home’s value (appraisal or market analysis)

- Information about your existing mortgage

- Details of your other debts to be consolidated

Be prepared to submit the necessary paperwork and meet any credit requirements set by the lender.

5. Use the funds to consolidate your debts

Once your home equity loan is approved and funded, you can use the funds to pay off your existing debts. Contact your creditors and arrange for the payoff using the proceeds from the home equity loan.

Ensure that you follow through with the debt consolidation plan and make timely payments on your home equity loan.

Considerations and Risks

While using home equity for debt consolidation can be beneficial, there are some considerations and risks to keep in mind:

- Defaulting on a home equity loan could result in the loss of your home. Make sure you can comfortably afford the loan payments before proceeding.

- Using home equity for debt consolidation doesn’t guarantee that you won’t accumulate new debt. It’s crucial to address any underlying spending habits or financial behaviors that may have contributed to your initial debt.

- Interest rates on home equity loans can fluctuate with market conditions, potentially increasing your monthly payments in the future.

- Be cautious of any fees associated with home equity loans, such as origination fees or closing costs. These costs can impact the savings you expect to achieve through debt consolidation.

It’s essential to weigh the benefits and risks carefully and consult with a financial advisor to ensure debt consolidation through home equity is the right decision for your specific circumstances.

How To Use Home Equity To Pay Off Your Debt

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How can I use home equity for debt consolidation?

Using your home equity for debt consolidation involves taking out a loan or refinancing your mortgage to pay off high-interest debts. This allows you to consolidate multiple debts into one, potentially at a lower interest rate. It’s important to carefully consider the risks and benefits before proceeding.

Is using home equity for debt consolidation a good idea?

Using home equity for debt consolidation can be a good idea if it helps you lower your overall interest rates and streamline your debt payments. However, it’s crucial to assess your financial situation, consider the costs involved, and ensure you can comfortably afford the new loan terms.

What are the advantages of using home equity for debt consolidation?

The advantages of using home equity for debt consolidation include potentially lower interest rates, simplified monthly payments, and the ability to pay off high-interest debts faster. Home equity loans also offer tax benefits in some cases.

What are the risks of using home equity for debt consolidation?

The risks of using home equity for debt consolidation include the potential to lose your home if you default on the loan. Additionally, if you consolidate unsecured debts into a secured loan, you’re putting your home at risk. It’s important to assess your financial stability and only proceed if you can comfortably manage the new loan.

How do I determine if I have enough home equity for debt consolidation?

You can determine if you have enough home equity for debt consolidation by calculating your loan-to-value (LTV) ratio. This is done by dividing your current mortgage balance by your home’s appraised value. Most lenders require an LTV ratio below 80% to qualify for a home equity loan or line of credit.

Can I use home equity for debt consolidation if I have bad credit?

Having bad credit may make it more challenging to qualify for a home equity loan or line of credit. However, some lenders specialize in working with borrowers with bad credit. It’s important to do thorough research, compare terms and rates, and consider seeking professional advice.

What is the difference between a home equity loan and a home equity line of credit (HELOC) for debt consolidation?

A home equity loan allows you to borrow a lump sum of money upfront, while a HELOC provides you with a revolving line of credit. With a HELOC, you can borrow and repay multiple times, similar to a credit card. Both options can be used for debt consolidation, but they have different payment structures and interest rates.

Are there any alternatives to using home equity for debt consolidation?

Yes, there are alternatives to using home equity for debt consolidation. Some options include personal loans, balance transfer credit cards, or working with a non-profit credit counseling agency. Each alternative has its own benefits and considerations, so it’s important to research and compare them before making a decision.

Final Thoughts

Homeowners who are burdened with multiple debts can take advantage of their home equity to consolidate their debts effectively. By using home equity, individuals can access funds with lower interest rates and potentially save money on monthly payments. Debt consolidation through home equity allows borrowers to combine various debts into one, making it easier to manage and pay off. This method provides a viable solution for those seeking financial stability and freedom from debt. So, when considering debt consolidation options, look no further than leveraging home equity for consolidating debts. It can be a practical and efficient way to regain control of your finances.