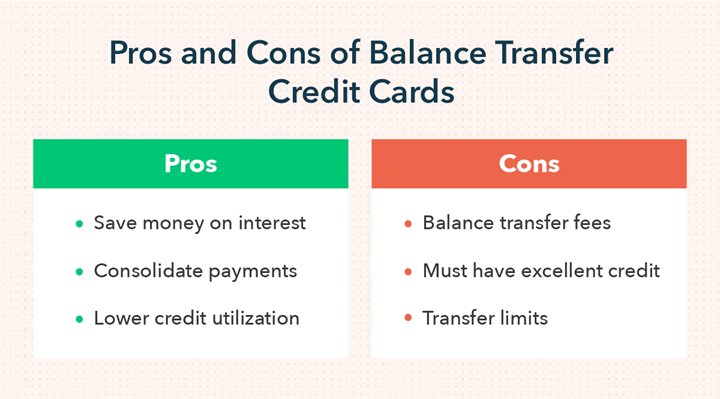

Balance transfer credit cards can be a valuable tool in managing and reducing credit card debt. Wondering whether they are the right choice for you? Well, let’s dive into the pros and cons of balance transfer credit cards. On the positive side, these cards offer a potential solution for consolidating multiple credit card balances into one manageable payment. By transferring your balances to a card with a lower interest rate, you can save money on finance charges and pay off your debt faster. However, it’s essential to weigh the drawbacks too. There may be balance transfer fees, limited time periods for promotional interest rates, and potential damage to your credit score. So, before making a decision, let’s explore the various aspects of balance transfer credit cards and find out if they are the right fit for you.

Pros and Cons of Balance Transfer Credit Cards

Introduction

Balance transfer credit cards have become a popular tool for individuals who want to reduce their credit card debt. These cards allow you to transfer your existing credit card balances to a new card with a lower interest rate, potentially saving you money in interest charges. While balance transfer credit cards can be beneficial, it’s important to weigh the pros and cons before making a decision. In this article, we will explore the advantages and disadvantages of using a balance transfer credit card, helping you make an informed choice.

Pros

1. Lower interest rates

One of the main attractions of balance transfer credit cards is the opportunity to take advantage of lower interest rates. Many credit card issuers offer promotional rates as low as 0% for an introductory period, which can range from a few months to over a year. By transferring your balance to a card with a lower interest rate, you can save a significant amount of money on interest charges and pay off your debt faster.

2. Debt consolidation

Balance transfer credit cards provide a convenient way to consolidate your credit card debt. Instead of juggling multiple credit card payments with different due dates and interest rates, you can transfer all your balances to a single card. This simplifies your finances and makes it easier to keep track of your payments. It also allows you to focus on paying off the debt without worrying about multiple credit card bills.

3. Financial planning and control

Using a balance transfer credit card can help you organize your finances and gain better control over your debt. With a clear payment schedule and a fixed interest rate, you can create a budget and plan your repayments more effectively. This can lead to improved financial discipline and help you develop healthy money management habits.

4. Potential savings

If you have a large credit card balance and high-interest rates, transferring your debt to a balance transfer credit card can result in substantial savings. By taking advantage of a lower interest rate, you can reduce the amount of interest you pay each month, freeing up more funds to pay down your principal balance. This can accelerate your debt repayment and save you a significant amount of money in the long run.

5. Rewards and perks

Balance transfer credit cards often come with additional perks and rewards programs. Some cards offer cashback on purchases, travel rewards, or even introductory bonuses. If you use your balance transfer credit card for everyday expenses and pay off your balance in full each month, you can earn rewards and enjoy additional benefits.

Cons

1. Balance transfer fees

While balance transfer credit cards can save you money on interest charges, it’s important to consider the balance transfer fees associated with these cards. Most credit card issuers charge a fee, typically around 3% to 5% of the transferred balance. This fee can eat into your potential savings, especially if you have a large amount of debt to transfer. It’s essential to calculate whether the potential interest savings outweigh the balance transfer fee.

2. Limited promotional period

Although balance transfer credit cards offer attractive low or 0% interest rates for a specified period, it’s crucial to be aware of the duration of the promotional offer. Once the introductory period ends, the interest rate will increase to the regular APR, which can be significantly higher. If you haven’t paid off your balance by then, you may find yourself back in a high-interest debt situation.

3. Impact on credit score

Opening a new credit card and transferring balances can have an impact on your credit score. When you apply for a new card, it may result in a hard inquiry on your credit report, which can temporarily lower your score. Additionally, closing old credit card accounts after transferring your balances can affect your credit utilization ratio, another factor that impacts your credit score. It’s important to consider these potential effects before making a decision.

4. Temptation to overspend

Transferring your credit card balances to a new card may provide temporary relief from high interest rates, but it can also tempt you to increase your credit card spending. Having a new credit card with a large available balance may give you a false sense of financial security, leading to overspending and accruing new debt. It’s vital to exercise discipline and avoid falling into this trap.

5. Not suitable for everyone

While balance transfer credit cards can be advantageous for many individuals, they may not be suitable for everyone. If you have a low credit score or a history of missed payments, it may be challenging to qualify for a balance transfer credit card with favorable terms. It’s essential to assess your financial situation and creditworthiness before applying for a balance transfer credit card.

Before deciding whether to use a balance transfer credit card, it’s crucial to carefully evaluate the pros and cons. While these cards offer the potential for lower interest rates, debt consolidation, and financial control, they also come with balance transfer fees, limited promotional periods, and the potential to impact your credit score. Understanding these factors will help you make an informed decision and determine whether a balance transfer credit card is the right choice for managing your credit card debt.

Should I Transfer My Credit Card Balance To A 0% Interest Account?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. What are the advantages of using balance transfer credit cards?

Using balance transfer credit cards can help you consolidate your debts into one manageable payment, potentially saving you money on interest rates. It can also provide you with the opportunity to pay off your debt faster.

2. Are there any fees associated with balance transfer credit cards?

Yes, balance transfer credit cards often come with fees, such as balance transfer fees and annual fees. It’s important to carefully consider these fees before deciding if a balance transfer is right for you.

3. How does a balance transfer affect my credit score?

When you transfer a balance to a new credit card, it can have both positive and negative impacts on your credit score. On one hand, it may lower your credit utilization ratio, which can be beneficial. However, opening a new credit account and closing the old one may also impact the average age of your credit accounts, which can potentially lower your score.

4. Can I transfer balances between cards from different banks?

Yes, it is possible to transfer balances between cards from different banks. However, it’s important to check with the specific credit card issuer to confirm if they allow transfers from other banks.

5. What is the typical duration of a balance transfer offer?

Balance transfer offers typically have promotional periods that can range from a few months to a couple of years. It’s important to review the terms and conditions of the offer to understand the exact duration and any applicable interest rates after the promotional period.

6. Are there any disadvantages of using balance transfer credit cards?

While balance transfer credit cards can be helpful, there are some potential disadvantages to consider. These may include balance transfer fees, potential impact on your credit score, and the temptation to accumulate new debt on the transferred card.

7. Can I transfer the entire balance on my existing credit card?

In most cases, you can transfer only a portion of your existing credit card balance, depending on the credit limit of the new balance transfer card. It’s important to check the terms and conditions to see if there are any limitations on the transfer amount.

8. Can I use a balance transfer credit card for new purchases?

Yes, you can often use a balance transfer credit card for new purchases. However, keep in mind that the terms and conditions may include different interest rates or promotional offers for balance transfers versus new purchases, so it’s important to understand these terms before using the card.

Final Thoughts

Balance transfer credit cards can be a valuable tool for managing debt, but they come with both pros and cons. On the positive side, these cards allow you to consolidate multiple debts into one, often with a lower interest rate. This can save you money and simplify your monthly payments. Additionally, balance transfer cards often come with introductory 0% APR offers, giving you time to pay off your balance without accruing more interest. However, there are drawbacks to consider. Some balance transfer cards charge a transfer fee, which can eat into potential savings. Furthermore, if you are not disciplined with your payments, you could end up with more debt due to the high interest rates that kick in after the introductory period. Balancing the pros and cons of balance transfer credit cards is essential to make an informed decision that aligns with your financial goals.