Are you in your 20s or 30s and wondering how to set financial goals that will pave the way for a successful future? Well, look no further! In this blog article, we will explore the importance of setting financial goals for your 20s and 30s and provide practical steps to help you achieve them. Whether you’re just starting your career or already have some financial milestones in mind, this guide will empower you to take control of your financial well-being and set yourself up for long-term success. So, let’s dive in and discover the power of setting financial goals for your 20s and 30s.

Setting Financial Goals for Your 20s and 30s

Introduction

In your 20s and 30s, you have the perfect opportunity to lay a strong foundation for your future financial success. This is a time when you can develop good habits, establish a solid understanding of money management, and set achievable financial goals that can propel you forward in life. Whether you’re just starting your career or already well into it, setting financial goals that align with your long-term objectives is essential. This article will guide you through the process of setting financial goals for your 20s and 30s, providing insights and strategies to help you make the most of your financial journey.

Understanding the Importance of Setting Financial Goals

Before diving into the specifics of setting financial goals, it’s crucial to understand the importance of doing so. Here are a few compelling reasons why setting financial goals is essential:

1. Direction and Focus: Setting financial goals gives you a sense of purpose and direction. It helps you prioritize your spending, savings, and investments, ensuring that your actions align with your long-term aspirations.

2. Financial Independence: By setting financial goals, you actively work towards achieving financial independence. This means having the freedom to make choices based on your personal preferences rather than being bound by financial constraints.

3. Peace of Mind: Having well-defined financial goals brings peace of mind, knowing that you have a plan in place to secure your financial future. It reduces stress and allows you to focus on other aspects of life.

Types of Financial Goals to Consider

When setting financial goals for your 20s and 30s, it’s essential to consider a wide range of objectives that align with your personal circumstances and aspirations. Here are some key types of financial goals you may want to consider:

1. Savings Goals

Saving money is an essential aspect of financial planning. It provides you with a safety net, allows you to seize opportunities, and ensures a stable financial future. Here are a few savings goals you might want to set:

- Emergency Fund: Aim to save at least three to six months’ worth of living expenses to cover unforeseen circumstances like job loss or medical emergencies.

- Down Payment: If you plan to buy a home, setting a savings goal for a down payment can help you achieve homeownership faster.

- Travel Fund: If you enjoy traveling, setting a savings goal specifically for travel can help you explore the world without derailing your overall financial plans.

2. Debt Repayment Goals

Debt can hinder your financial progress and limit your ability to achieve your goals. Setting debt repayment goals can help you regain control of your finances and accelerate your journey towards financial freedom. Consider the following debt repayment goals:

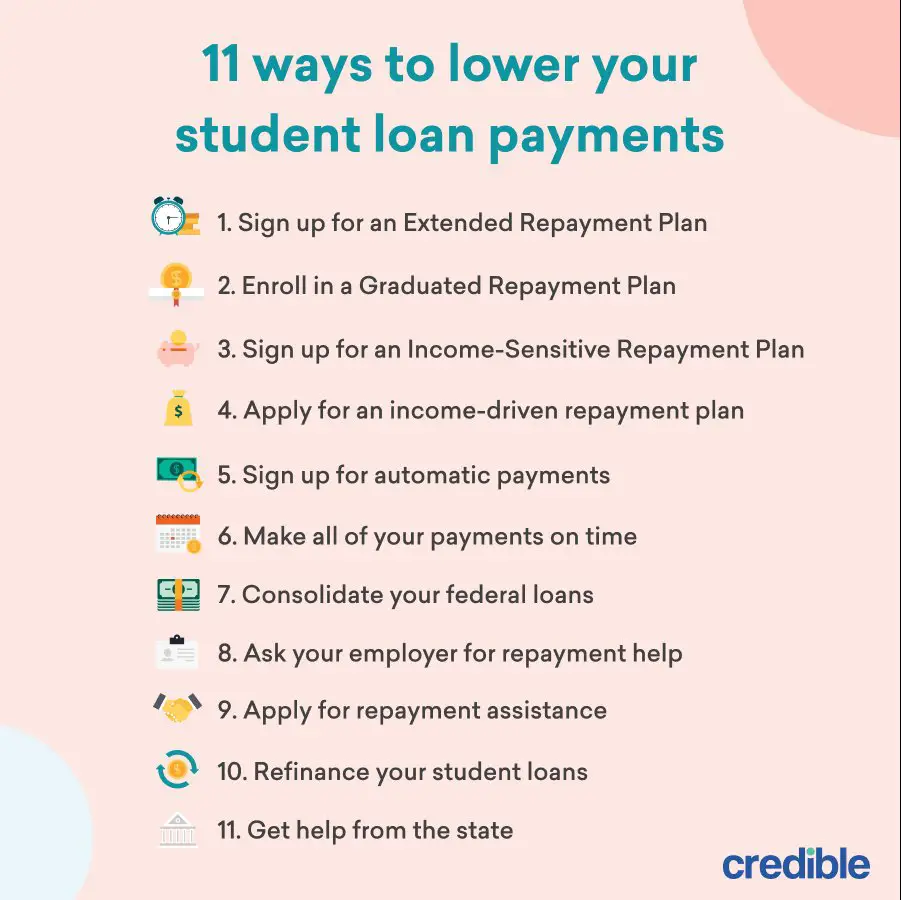

- Student Loans: If you have student loans, setting a goal to pay them off within a specific timeframe can help you save money on interest and free up your future income.

- Credit Cards: Aim to pay off your credit card debt in full each month or set a goal to eliminate existing credit card debt as quickly as possible.

- Car Loans: If you have a car loan, setting a goal to pay it off ahead of schedule can help you save on interest and increase your monthly cash flow.

3. Retirement Savings Goals

Retirement may seem far away when you’re in your 20s or 30s, but it’s crucial to start planning and saving early. Setting retirement savings goals can ensure a comfortable and secure retirement. Consider the following retirement savings goals:

- Contributions to Retirement Accounts: Aim to maximize your contributions to retirement accounts such as a 401(k) or IRA each year, taking full advantage of any employer matching programs.

- Retirement Age: Set a goal for the age at which you want to retire, keeping in mind factors such as lifestyle preferences, health, and financial obligations.

- Retirement Lifestyle: Determine the lifestyle you desire in retirement and set a savings goal that aligns with that vision.

4. Investment Goals

Investing can be an essential tool for growing your wealth over the long term. Setting investment goals can help you build a portfolio and work towards financial independence. Consider the following investment goals:

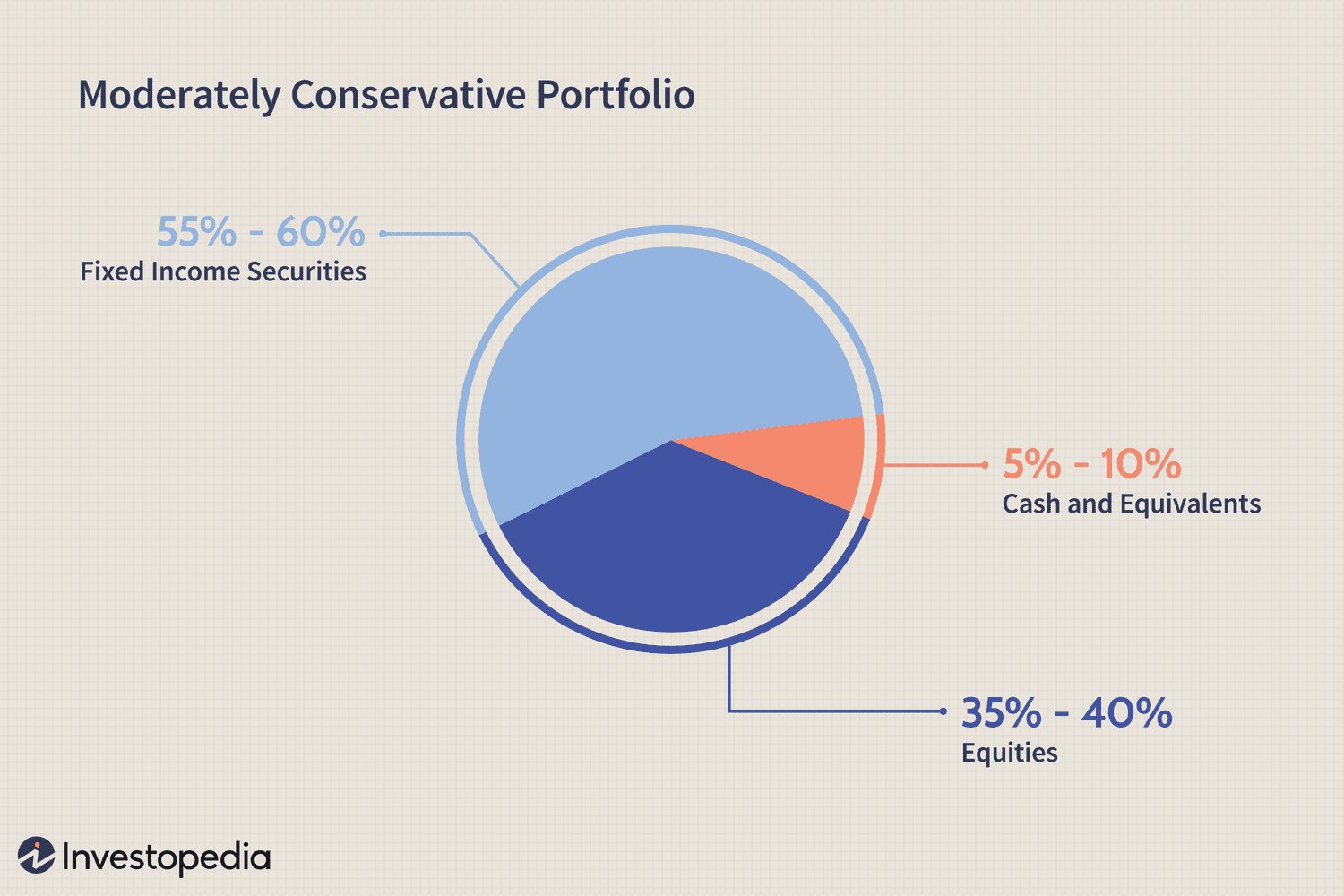

- Portfolio Diversification: Set a goal to diversify your investment portfolio across different asset classes, such as stocks, bonds, real estate, and mutual funds.

- Targeted Investment Returns: Define specific annualized return goals for your investments, aligning them with your risk tolerance and time horizon.

- Investment Knowledge: Set a goal to continuously enhance your investment knowledge and skills to make informed decisions.

Setting Realistic and Achievable Financial Goals

While it’s important to dream big, setting realistic and achievable financial goals is equally crucial. Here are some strategies to help you set effective goals:

1. S.M.A.R.T. Goals: Use the S.M.A.R.T. (Specific, Measurable, Achievable, Relevant, Time-bound) framework to define your goals in a way that makes them clear and attainable. For example, instead of setting a vague goal to “save more,” specify a target amount and a deadline.

2. Break It Down: Break your larger financial goals into smaller, manageable milestones. This makes the process less overwhelming and allows you to celebrate your progress along the way.

3. Consider Time Horizon: Assess the time horizon for each goal and set realistic deadlines. Short-term goals may be achievable within a few months or years, while long-term goals may require several decades of planning and saving.

4. Be Flexible: Life is full of unexpected twists and turns, so it’s important to be flexible with your financial goals. Review and adjust them periodically to ensure they remain relevant and achievable.

Tracking Your Progress and Staying Motivated

Setting financial goals is just the beginning; tracking your progress and staying motivated is crucial to ensure success. Here are some strategies to help you stay on track:

1. Regular Check-Ins: Schedule regular check-ins to review your progress towards your financial goals. This can be on a monthly or quarterly basis, allowing you to course-correct if needed.

2. Automate Savings and Investments: Set up automatic transfers to your savings and investment accounts. This ensures consistent progress towards your goals without relying on willpower alone.

3. Celebrate Milestones: Celebrate reaching milestones along your financial journey. Recognize the progress you’ve made and treat yourself occasionally as a reward for your hard work.

4. Stay Educated: Continuously educate yourself about personal finance and investment strategies. Knowledge empowers you to make informed decisions and stay motivated.

Setting financial goals in your 20s and 30s is a powerful step towards securing financial freedom and setting yourself up for a fulfilling future. By understanding the different types of financial goals, setting them realistically, and tracking your progress, you can make significant strides towards achieving financial success. Remember, the key is to start early, be consistent, and adapt as you navigate through life. With determination, discipline, and the right mindset, you can unlock a world of financial opportunities and build a solid foundation for the rest of your life.

The 5 Financial Goals To Achieve In Your 20s

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are some important financial goals to set in your 20s and 30s?

Setting financial goals in your 20s and 30s is crucial for building a solid foundation for your future. Here are some important goals to consider:

– Establishing an emergency fund

– Paying off high-interest debts

– Saving for retirement

– Investing in your education or skills

– Saving for a down payment on a house or car

– Starting a business or building a side income stream

– Traveling and experiencing new things

– Supporting charitable causes or giving back to the community

How can I prioritize my financial goals?

Prioritizing your financial goals helps you allocate your resources effectively. Here are some steps to consider:

1. Evaluate your goals: Determine which goals are most important to you and align with your values.

2. Assess timelines: Consider the urgency and timeline associated with each goal.

3. Focus on the essentials: Allocate resources to your most critical goals, such as building an emergency fund and paying off debts.

4. Plan for the long term: Invest in retirement savings early to take advantage of compounding interest.

5. Review and adjust: Regularly reassess your goals and make adjustments as needed.

How can I create a budget to achieve my financial goals?

Creating a budget is essential for managing your finances and reaching your goals. Here’s a step-by-step approach:

1. Track your income and expenses: Determine your monthly income and track where your money is going.

2. Set realistic goals: Define specific financial objectives that align with your overall goals.

3. Categorize your expenses: Divide your expenses into categories such as housing, transportation, food, and entertainment.

4. Identify areas to cut back: Analyze your expenses and identify areas where you can reduce spending.

5. Allocate resources: Adjust your budget to allocate a portion of your income towards achieving your financial goals.

6. Monitor and adjust: Regularly review your budget, track your progress, and make necessary adjustments.

Should I focus on saving or investing in my 20s and 30s?

Both saving and investing are important in your 20s and 30s. Saving allows you to build an emergency fund and meet short-term goals, while investing enables you to grow your wealth over the long term. It’s advisable to strike a balance between the two, allocating a portion of your income to savings and another portion to investments based on your risk tolerance and financial goals.

How can I start investing in my 20s and 30s?

Starting to invest in your 20s and 30s can set you up for financial success. Consider the following steps:

1. Educate yourself: Learn about different investment options, such as stocks, bonds, mutual funds, and real estate.

2. Set clear goals: Define your investment objectives, whether it’s saving for retirement, buying a house, or other long-term goals.

3. Assess risk tolerance: Determine how much risk you are comfortable with and adjust your investments accordingly.

4. Start small: Begin with affordable investments, such as index funds or exchange-traded funds (ETFs).

5. Diversify your portfolio: Spread your investments across different asset classes to minimize risks.

6. Regularly review and adjust: Monitor your investments, stay informed about market trends, and make adjustments as needed.

What are some strategies for paying off debts in your 20s and 30s?

Effectively managing and paying off debts can provide a strong financial foundation. Consider these debt-repayment strategies:

1. Create a repayment plan: List all your debts, prioritize them based on interest rates, and determine how much you can afford to pay each month.

2. Snowball method: Start by paying off the smallest debt first, then work your way up to larger debts. This approach provides a sense of accomplishment and motivation.

3. Avalanche method: Prioritize debts with the highest interest rates to save on interest payments in the long run.

4. Cut unnecessary expenses: Reduce discretionary spending to free up more money for debt repayment.

5. Increase income: Seek opportunities to boost your income, such as taking on a side job or freelance work.

6. Consider debt consolidation: Explore options to combine multiple debts into a single payment with a lower interest rate.

Is it better to rent or buy a house in your 20s and 30s?

Deciding whether to rent or buy a house depends on various factors. Consider the following:

1. Financial stability: Assess your financial situation, considering your income, stability, and ability to save for a down payment.

2. Long-term plans: Evaluate your plans for the next 5-10 years. If you anticipate moving or changing jobs frequently, renting might be a better option.

3. Real estate market: Research the local real estate market, mortgage rates, and property prices to make an informed decision.

4. Rent affordability: Compare the cost of renting vs. buying in your area, factoring in additional expenses like maintenance and property taxes.

5. Flexibility and responsibilities: Determine whether you prefer the flexibility of renting or if you’re ready to handle the responsibilities of homeownership.

6. Seek professional advice: Consult with a financial advisor or real estate expert to evaluate your situation and make an informed decision.

How can I save for retirement in my 20s and 30s?

Saving for retirement early in your 20s and 30s can significantly impact your future financial security. Follow these steps:

1. Start now: Begin saving for retirement as early as possible to take advantage of compounding returns over time.

2. Contribute to retirement accounts: Take advantage of employer-sponsored retirement plans like 401(k)s or individual retirement accounts (IRAs).

3. Aim for maximum contributions: Contribute the maximum amount allowed by your retirement plans to maximize tax advantages and potential employer matches.

4. Diversify your investments: Allocate your retirement savings across different asset classes to spread risk and potentially increase returns.

5. Regularly review and adjust: Monitor your retirement savings, reassess your goals, and adjust your contributions as your income and financial situation change.

Final Thoughts

In conclusion, setting financial goals for your 20s and 30s is crucial for securing a stable future. By having a clear vision of your financial targets and developing a plan to achieve them, you can pave the way for long-term financial success. Whether it’s saving for emergencies, paying off debt, or investing for retirement, setting achievable goals will help you stay focused and motivated. Remember to consistently reassess and adjust your goals as your circumstances change. By taking control of your finances now, you can set yourself up for financial stability and freedom in the years to come.