Wondering how to make the most of your tax refund? Look no further! In this article, we’ll explore some smart ways to use your tax refund that can help you achieve financial stability and reach your goals. Whether you want to pay off debts, build an emergency fund, or invest for the future, there are practical strategies that can make a real difference. So, let’s dive in and discover the power of using your tax refund wisely. By implementing these tips, you can take control of your finances and make every dollar count.

Smart Ways to Use Your Tax Refund

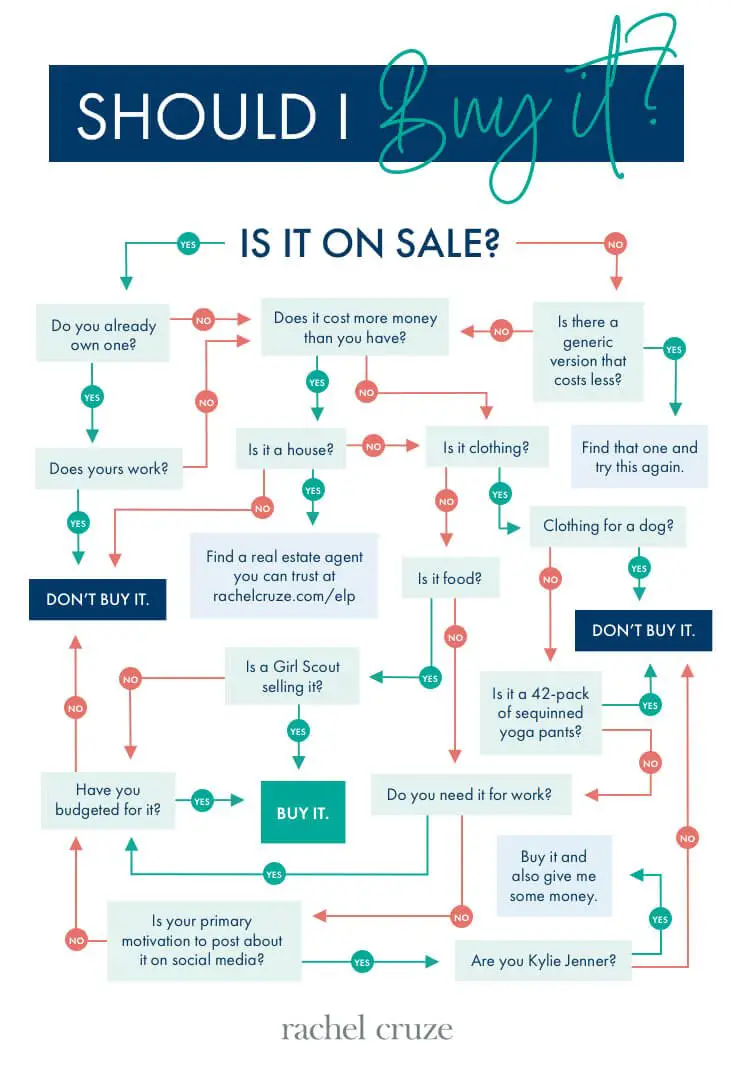

Getting a tax refund can be an exciting time, as it presents an opportunity to use that extra cash wisely. Instead of splurging on luxury items or frivolous purchases, consider some smart ways to make the most of your tax refund. Whether you choose to save, invest, or pay off debts, there are several strategies you can employ to achieve your financial goals. In this article, we will explore some practical and effective ways to leverage your tax refund for long-term financial success.

Create an Emergency Fund

One of the first things you should consider doing with your tax refund is building or replenishing an emergency fund. An emergency fund acts as a safety net, providing you with financial stability in case of unexpected expenses, job loss, or medical emergencies. Without an emergency fund, you may find yourself relying on credit cards or loans to cover these unexpected costs, which can lead to debt and financial stress.

Here are some steps to help you create or boost your emergency fund:

- Designate a separate savings account specifically for your emergency fund.

- Set a savings goal based on your monthly expenses. Aim to save at least three to six months’ worth of living expenses.

- Automate your savings by setting up automatic transfers from your checking account to your emergency fund savings account.

- Look for high-yield savings accounts or money market accounts that offer competitive interest rates.

By prioritizing an emergency fund, you can have peace of mind knowing that you are prepared for unexpected financial challenges.

Pay off High-Interest Debts

If you have outstanding debts with high-interest rates, such as credit card debt or personal loans, using your tax refund to pay them off can be a smart financial move. High-interest debts can quickly accumulate, making it challenging to get ahead and potentially damaging your credit score.

Consider the following steps to tackle your debts:

- Create a list of all your debts, including the outstanding balance and interest rates.

- Identify the debts with the highest interest rates and prioritize paying them off first.

- Allocate a significant portion of your tax refund towards paying off these high-interest debts.

- Consider utilizing the debt avalanche method, where you focus on paying off the debt with the highest interest rate while making minimum payments on other debts.

By paying off high-interest debts, you can save a significant amount of money on interest payments while improving your overall financial well-being.

Invest in Your Future

Investing your tax refund is an excellent way to grow your wealth and secure your financial future. When done wisely, investing can generate passive income, build long-term wealth, and help you achieve your financial goals.

Here are some investment options to consider:

- Stocks: Investing in individual stocks or exchange-traded funds (ETFs) can provide potential growth over the long term. It’s essential to research and diversify your portfolio to manage risk.

- Bonds: Bonds offer a more stable investment option with fixed interest payments over a specific period. They can be a reliable source of income and a way to preserve capital.

- Mutual Funds: Mutual funds pool money from various investors to invest in a diversified portfolio of stocks, bonds, or other securities. They offer a convenient way to access a diverse range of investments.

- Real Estate: Investing in real estate, either through rental properties or real estate investment trusts (REITs), can provide consistent rental income and potential appreciation.

Before investing, it’s important to educate yourself, seek professional advice if necessary, and assess your risk tolerance. Investing in the stock market involves risks, and past performance is not indicative of future results.

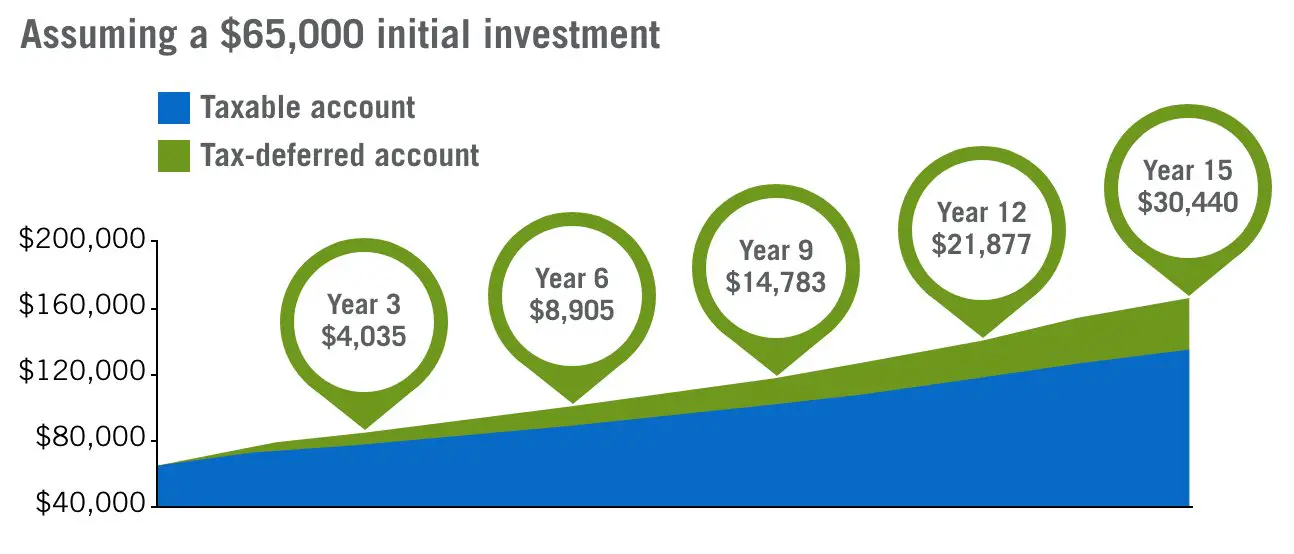

Fund Your Retirement Account

Using your tax refund to contribute to a retirement account is an excellent way to secure your financial future. By maximizing your retirement savings, you can enjoy a comfortable lifestyle during your retirement years.

Consider the following retirement account options:

- Individual Retirement Account (IRA): An IRA allows you to contribute money on a tax-deferred basis (traditional IRA) or a tax-free basis (Roth IRA). Depending on your income level, you may be eligible for tax deductions or tax-free withdrawals during retirement.

- 401(k) or 403(b): If your employer offers a 401(k) or 403(b) plan, consider increasing your contributions with your tax refund. Many employers also offer matching contributions, which is essentially free money.

By prioritizing retirement savings, you are setting yourself up for a secure and financially independent future.

Invest in Yourself

Investing in yourself can have long-lasting benefits that go beyond financial gains. Using your tax refund to acquire new skills, further your education, or enhance your professional development can open doors to better career opportunities and personal growth.

Here are some ways you can invest in yourself:

- Take a course or enroll in a certification program related to your field of interest.

- Attend conferences or workshops to expand your knowledge and network.

- Invest in tools or equipment that can enhance your productivity or creativity in your personal or professional endeavors.

- Hire a coach or mentor to guide you towards achieving your personal or professional goals.

Investing in yourself not only improves your skills and knowledge but also increases your value in the job market, potentially leading to better career prospects and higher income.

Save for Future Goals

If you already have an emergency fund and are on track with your debt and retirement savings, consider using your tax refund to save for future goals. Whether it’s a down payment on a home, a dream vacation, or a new business venture, having dedicated savings can bring you closer to achieving your aspirations.

Here are some tips to help you save for future goals:

- Create separate savings accounts for each goal to track progress and avoid mixing funds.

- Set realistic timelines and amounts for each goal to ensure steady progress.

- Automate your savings by setting up recurring transfers from your checking account to each goal-specific savings account.

- Consider using high-yield savings accounts or other investment vehicles to earn potential interest or grow your savings.

By saving for future goals, you are taking proactive steps towards realizing your dreams and creating lasting financial success.

Give Back to Your Community

Using your tax refund to give back to your community can be a fulfilling way to make a positive impact. Charitable donations not only help those in need but also provide potential tax benefits, such as deductions on your next tax return.

Consider the following options for giving back:

- Donate to a local charity or nonprofit organization.

- Support a cause or organization that aligns with your values and interests.

- Participate in community service or volunteer activities.

By giving back, you are not only helping others but also contributing to the betterment of society.

Remember, the key to maximizing your tax refund is to be intentional and strategic with your financial decisions. By considering the smart ways mentioned above to use your tax refund, you can set yourself up for a more secure and prosperous financial future. Whether you choose to save, invest, pay off debts, or give back, make sure your choices align with your personal goals and values.

Smart ways to use your tax refund

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. What are some smart ways to use your tax refund?

When it comes to using your tax refund wisely, consider these strategies:

2. How can I prioritize my debt with my tax refund?

Using your tax refund to pay off high-interest debts can help you save money in the long run.

3. Is it a good idea to invest my tax refund?

Investing your tax refund can potentially grow your money over time, providing financial security and future opportunities.

4. Can I use my tax refund to start an emergency fund?

Using your tax refund to establish or boost an emergency fund can provide a safety net for unexpected expenses.

5. Should I consider saving for retirement with my tax refund?

Putting your tax refund into a retirement account can help secure your financial future and take advantage of compounding interest.

6. How can I use my tax refund to invest in my education?

Investing in education, such as taking a course or acquiring new skills, can enhance your career prospects and increase earning potential.

7. Can I use my tax refund to improve my home?

Using your tax refund for home improvements can increase the value of your property and enhance your living space.

8. Should I consider donating a portion of my tax refund?

Donating a portion of your tax refund to a charitable cause can make a positive impact on those in need and provide a sense of fulfillment.

Final Thoughts

With your tax refund in hand, it’s time to make some smart financial moves. One way to use your tax refund wisely is by paying off high-interest debts, such as credit cards or personal loans. This will help you save on interest payments and improve your overall financial health. Another smart option is to save or invest your refund for the future. Whether you choose to open a high-yield savings account or invest in stocks or bonds, putting your refund to work can help you achieve your long-term financial goals. Finally, consider using your tax refund to make improvements to your home or invest in your education or career. This can enhance your quality of life and open up new opportunities. Smart ways to use your tax refund are all about making strategic decisions that will benefit you in the long run. So whether you choose to pay off debt, save or invest, or invest in yourself, use your tax refund wisely to secure a brighter future.