Are you ready to take control of your finances? Conducting your own financial audit is an essential step towards achieving financial stability and peace of mind. In this blog article, we’ll guide you through the simple yet crucial steps for conducting your own financial audit. You’ll learn how to assess your income, expenses, and debts, identify areas of improvement, and set realistic financial goals. So, if you’re looking to gain a clear understanding of your financial situation and make informed decisions, keep reading!

Steps for Conducting Your Own Financial Audit

Introduction

Financial audits are essential for individuals and businesses to assess their financial health, identify any discrepancies or issues, and make informed decisions based on accurate information. While many people hire professionals to conduct financial audits, it is also possible to perform your own audit with careful planning and attention to detail. This comprehensive guide will walk you through the necessary steps to conduct your own financial audit effectively.

Step 1: Set Clear Objectives

Before starting your financial audit, it’s crucial to define clear objectives. Determine the specific areas or aspects you want to assess, such as income, expenses, assets, liabilities, or overall financial performance. This clarity will help you focus your efforts and ensure you cover all necessary aspects of your financial situation.

Step 2: Gather Relevant Financial Documents

To conduct a thorough financial audit, you need to gather all relevant financial documents. These documents may include bank statements, credit card statements, loan agreements, tax returns, investment records, invoices, receipts, and any other financial records you have. Organize these documents in a systematic manner so that you can easily access and reference them throughout the audit process.

Step 3: Review Income and Expenses

Once you have your financial documents in order, start by reviewing your income and expenses. Analyze your sources of income and ensure they are accurately reflected in your records. Compare your expenses against your income to determine if there are any discrepancies or areas where you can make adjustments for better financial management. This step will help you gain a clear understanding of your cash flow and identify any potential issues.

Step 4: Assess Assets and Liabilities

Next, evaluate your assets and liabilities. List down all your assets, such as properties, investments, vehicles, or any valuable possessions. Assign values to each asset based on current market prices or appraisals. On the other hand, identify and list your liabilities, which may include loans, mortgages, credit card debts, or any other financial obligations. Calculate your net worth by subtracting your liabilities from your assets to determine your financial position.

Step 5: Scrutinize Financial Statements

Review your financial statements, including balance sheets, income statements, and cash flow statements. Analyze these statements to ensure accuracy and consistency. Look for any discrepancies, errors, or irregularities that might indicate potential fraud or financial mismanagement. Compare your current financial statements with previous periods to identify trends and patterns that can provide valuable insights into your financial performance.

Step 6: Check Compliance with Financial Regulations

If you are conducting a financial audit for a business or organization, make sure to check for compliance with relevant financial regulations and standards. Ensure that your financial practices adhere to accounting principles, tax laws, and any industry-specific regulations. Identify any areas where you may need to improve compliance to mitigate legal or financial risks.

Step 7: Identify Risks and Opportunities

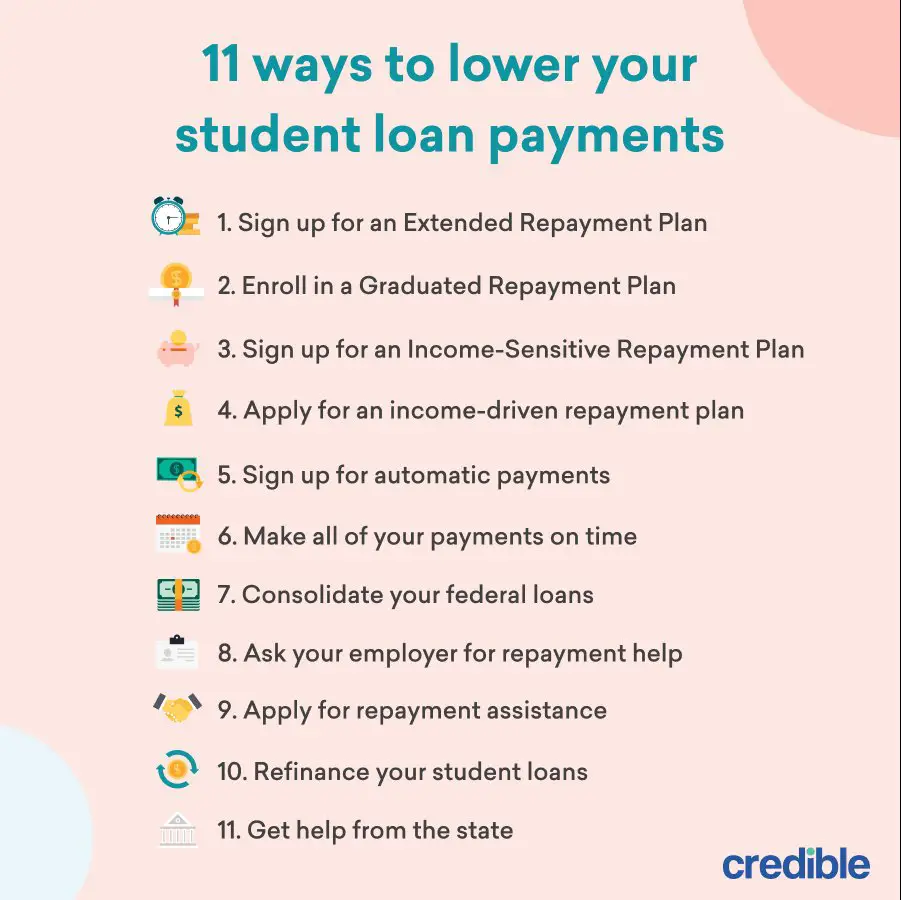

During your financial audit, it’s important to identify potential risks and opportunities. Assess any financial risks that could impact your long-term financial stability, such as market volatility, debt levels, or insufficient insurance coverage. Additionally, look for opportunities to optimize your financial situation, such as investment opportunities, cost-saving measures, or debt consolidation options. By identifying these risks and opportunities, you can make informed decisions to safeguard and enhance your financial well-being.

Step 8: Implement Corrective Actions

Based on the findings from your financial audit, develop a plan of action to address any issues or weaknesses identified. This may include implementing stronger financial controls, improving record-keeping practices, adjusting budget allocations, or seeking professional advice in areas where you lack expertise. Take proactive steps to correct any deficiencies and optimize your financial management processes.

Step 9: Monitor Progress and Review Regularly

Once you have implemented corrective actions, regularly monitor your financial progress and review your financial position. Track key financial metrics, such as revenue, expenses, savings, debt reduction, or investment returns. Conduct periodic reviews to assess the effectiveness of your corrective measures and make adjustments as needed. Ongoing monitoring and review will ensure that your financial health remains on track and help you identify any new issues that may arise.

Conducting your own financial audit can provide valuable insights into your financial health and empower you to make informed decisions. By following the steps outlined in this guide, you can perform a comprehensive financial audit and gain a clear understanding of your income, expenses, assets, liabilities, and overall financial well-being. Remember, a financial audit is not a one-time activity but rather an ongoing process to continuously improve your financial management practices and secure your financial future.

CHANGE your financial future | How to do your own financial audit

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are the steps for conducting your own financial audit?

Conducting your own financial audit involves a series of steps that help you assess and analyze your financial records. Here are the key steps to follow:

1. Where do I start when conducting a financial audit?

To start conducting a financial audit, review your financial statements, including balance sheets, income statements, and cash flow statements. Gather all relevant documents, such as bank statements, invoices, and receipts.

2. How do I ensure accuracy in my financial audit?

To ensure accuracy, reconcile your bank statements with your financial records. Double-check all calculations, verify the accuracy of entries, and ensure that all transactions are properly recorded.

3. What should I look for when examining financial documentation?

When examining financial documentation, pay attention to any inconsistencies, errors, or discrepancies. Look for missing or incomplete information, unauthorized transactions, or any signs of fraud.

4. How can I evaluate my revenue and expenses during a financial audit?

During a financial audit, evaluate your revenue and expenses by comparing them to previous periods or industry benchmarks. Analyze any significant variations or trends and investigate the reasons behind them.

5. How do I assess the effectiveness of my internal controls?

To assess the effectiveness of your internal controls, review your company’s policies and procedures. Evaluate how well they are implemented and whether they mitigate risks effectively.

6. What role does documentation play in a financial audit?

Documentation plays a crucial role in a financial audit as it provides evidence of transactions and financial activities. Proper documentation helps support the accuracy and validity of your financial records.

7. How can I identify potential areas of improvement during a financial audit?

Identify potential areas of improvement during a financial audit by analyzing inefficiencies, bottlenecks, or areas where costs can be reduced. Look for opportunities to streamline processes or implement better financial management practices.

8. Do I need professional assistance for a financial audit?

While conducting your own financial audit is possible, seeking professional assistance can provide valuable expertise and ensure a more thorough and accurate assessment. Consider consulting with a certified public accountant or financial advisor.

Final Thoughts

In conclusion, conducting your own financial audit can be a valuable exercise in assessing your financial health and identifying areas for improvement. By following these steps: gather all relevant financial documents, review and categorize your expenses, analyze your income and savings, compare your financial goals with your current financial situation, and seek professional advice when needed, you can gain a clear understanding of your financial position and take necessary steps to improve it. Taking control of your personal finances is essential for achieving your financial goals and securing a better future. Start conducting your own financial audit today to ensure a strong financial foundation.