Building good credit from scratch can be a daunting task, but it’s not impossible. In fact, there are simple steps you can take starting today to establish a solid credit history. Wondering how? Well, the first step is to understand the importance of responsible financial habits. By making timely payments, keeping your credit utilization low, and diversifying your credit mix, you can gradually build a positive credit profile. So, if you’re ready to take control of your financial future and pave the way for better opportunities, keep reading to learn the steps to building good credit from scratch.

Steps to Building Good Credit From Scratch

Building good credit is an essential step towards financial stability and achieving your future goals. Whether you are just starting out or rebuilding your credit history, taking proactive steps can help you establish a strong credit foundation.

In this article, we will provide you with a comprehensive guide on how to build good credit from scratch. We will cover various aspects of credit-building, including understanding credit scores, establishing credit history, managing credit responsibly, and leveraging credit-building tools. So let’s dive into the steps that can set you on the path to a solid credit foundation.

1. Understand the Basics of Credit

Before diving into credit-building strategies, it’s important to grasp the fundamentals of credit. Here are a few key concepts to get you started:

- Credit Score: A numerical representation of your creditworthiness, ranging from 300 to 850. Higher scores indicate lower credit risk.

- Credit Report: A detailed record of your credit history, including information about your accounts, payment history, and public records.

- Credit Bureau: Agencies that collect and maintain credit information, such as Equifax, Experian, and TransUnion.

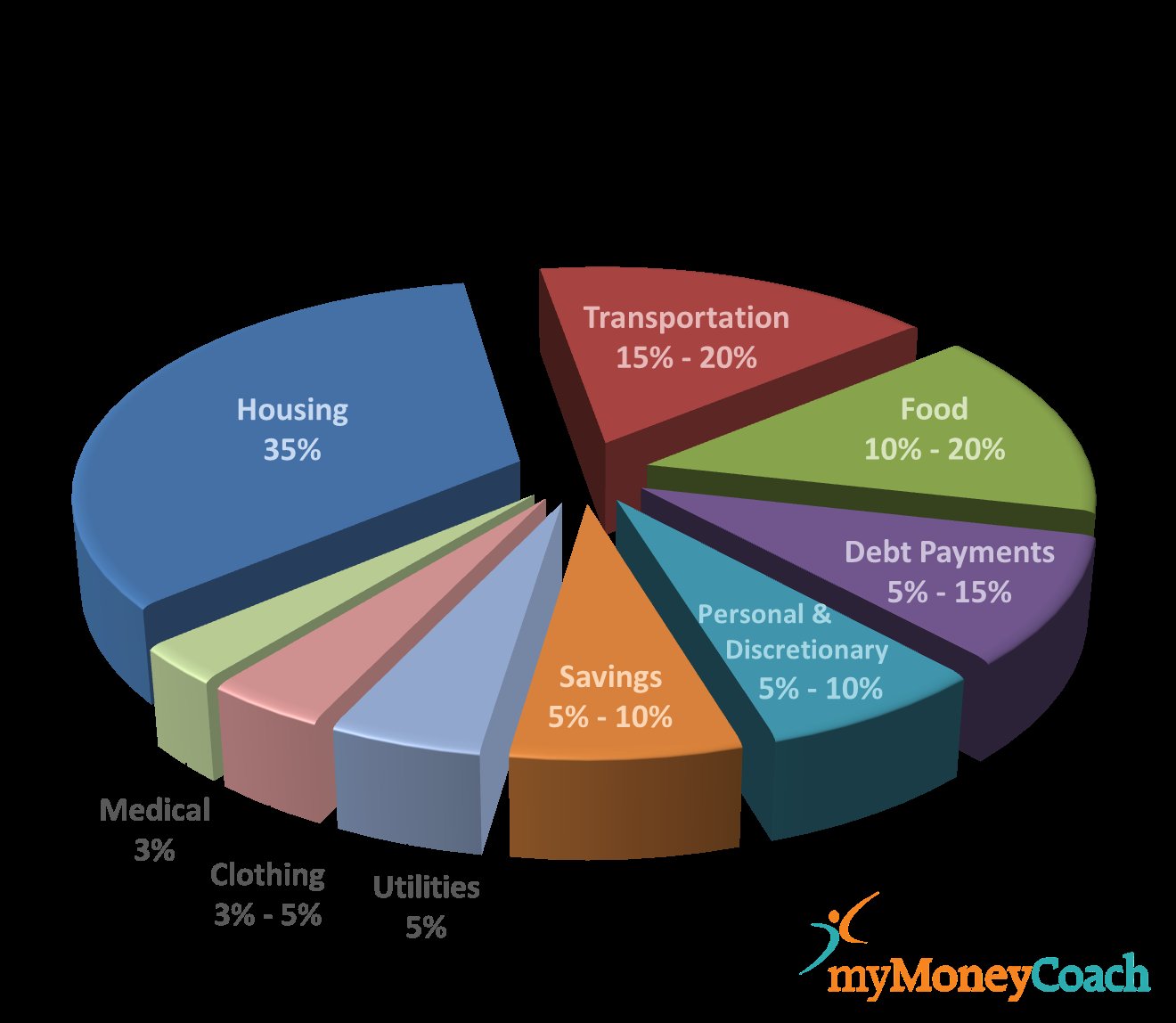

- Credit Utilization Ratio: The percentage of your available credit that you are currently using. It is recommended to keep this ratio below 30% to maintain a good credit score.

2. Establish a Solid Credit History

Building credit from scratch requires establishing a credit history. Here are the steps to get started:

Open a Secured Credit Card

A secured credit card is an excellent tool for building credit when you have limited or no credit history. To open a secured card, you’ll need to provide a security deposit, which serves as collateral. Use the card responsibly, making timely payments and keeping your credit utilization low.

Become an Authorized User

If you have a family member or close friend with good credit, ask them to add you as an authorized user on their credit card. Their positive credit behavior will be reflected on your credit report, helping you establish a credit history.

Apply for a Credit Builder Loan

Credit builder loans are specifically designed to help individuals build credit. These loans typically have lower borrowing amounts and are secured with the loan proceeds held in an account or certificate of deposit. Make regular payments, and once the loan is paid off, you’ll have a positive credit history.

3. Utilize Your Credit Responsibly

Now that you’ve established a credit history, it’s crucial to manage your credit responsibly. Follow these tips to maintain a positive credit profile:

Make Timely Payments

Consistently paying your bills on time is one of the most critical factors in building good credit. Late payments can negatively impact your credit score and stay on your credit report for up to seven years.

Keep Credit Utilization Low

Maintain a low credit utilization ratio by using only a small portion of your available credit. High credit utilization suggests a greater risk of default, which can adversely affect your credit score. Regularly monitor your credit card balances and aim to keep them below 30% of your credit limit.

Minimize New Credit Applications

Avoid applying for multiple credit cards or loans within a short period. Each application generates a hard inquiry on your credit report, which can temporarily lower your credit score. Be selective and apply for credit only when you genuinely need it.

Don’t Close Old Credit Accounts

Closing old credit accounts may seem like a good idea, but it can affect your credit history. Length of credit history is a crucial factor in credit scoring, so keep your oldest accounts open, even if you’re not actively using them.

4. Monitor Your Credit Regularly

Keeping a close eye on your credit can help you identify any errors or fraudulent activities that may impact your credit score. Consider these monitoring practices:

Review Your Credit Reports

Request a free copy of your credit report from each of the three major credit bureaus annually—Equifax, Experian, and TransUnion. Review them for inaccuracies, such as incorrect account information or unauthorized inquiries.

Monitor Your Credit Score

Several online tools and financial institutions offer free credit score monitoring. Regularly check your credit score to track your progress and detect any significant changes.

Set Up Credit Alerts

Enable credit alerts or notifications with your financial institutions. These alerts can help you stay on top of any unusual activities, such as large purchases or account balance changes.

5. Explore Credit-Building Tools

In addition to the steps mentioned above, several credit-building tools can assist you in strengthening your credit profile:

Secured Credit Cards with Graduation

Some secured credit card issuers offer a graduation feature that allows you to transition to an unsecured card after a specific period of responsible credit usage. Look for secured cards with graduation options to build credit and potentially upgrade to a better card in the future.

Credit Builder Loans

Aside from helping establish credit history, credit builder loans can also provide an opportunity to save money. These loans typically hold the borrowed funds in a separate account or certificate of deposit, which you can access once the loan is paid off.

Experian Boost

Experian Boost is a free tool that allows you to add positive utility and telecommunications payment history to your credit report. This may help increase your credit score, especially if you have limited credit history.

Use Credit Monitoring Apps

Various credit monitoring apps, such as Credit Karma or CreditWise, provide insights into your credit health, personalized recommendations, and access to credit scores. These tools can help you stay informed and manage your credit more effectively.

Building good credit from scratch requires patience, commitment, and responsible financial behavior. By understanding the basics of credit, establishing a solid credit history, utilizing credit responsibly, monitoring your credit regularly, and exploring credit-building tools, you can set yourself on a path towards a strong credit profile.

Remember, building credit takes time, so be consistent with your efforts, and don’t get discouraged by setbacks. With dedicated focus and responsible financial management, you can build a solid credit foundation that opens doors to various financial opportunities in the future.

How to Start Building Credit from Scratch

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are the initial steps to building good credit from scratch?

Starting from scratch to build good credit requires a few essential steps. Here’s what you need to do:

How can I establish a credit history?

To establish a credit history, consider applying for a secured credit card or becoming an authorized user on someone else’s credit card.

What is a secured credit card?

A secured credit card requires a cash deposit that serves as collateral. It helps individuals with limited or no credit history build good credit.

How can I use a secured credit card effectively?

Using a secured credit card effectively involves making small purchases and paying the balance in full and on time each month.

What is the significance of paying bills on time?

Paying bills on time demonstrates your responsible financial behavior and contributes positively to your credit score.

How can I manage my credit utilization ratio?

It is recommended to keep your credit utilization ratio below 30%. Paying off credit card balances in full each month can help you manage this ratio effectively.

Should I open multiple credit accounts simultaneously?

It is advisable to start with a single credit account and gradually add more accounts over time. Opening multiple accounts at once can negatively affect your credit score.

How long does it take to build good credit from scratch?

Building good credit takes time and consistent effort. It usually takes at least six months of responsible credit behavior to establish a solid credit history.

How can I monitor my credit progress?

You can monitor your credit progress by checking your credit report regularly. Several credit monitoring services are available that provide free access to your credit report.

Final Thoughts

In conclusion, building good credit from scratch requires a systematic approach. Begin by understanding your current financial situation and setting realistic goals. Next, open a secured credit card or become an authorized user on someone else’s account to start establishing a positive credit history. Make regular, on-time payments and keep your credit utilization low. Additionally, consider diversifying your credit mix by taking on different types of credit, such as a personal loan or auto loan. Finally, regularly monitor your credit report and address any mistakes or discrepancies promptly. By following these steps to building good credit from scratch, you can improve your financial standing and access better borrowing opportunities in the future.