Looking to make some smart investment moves? One strategy to consider is investing in small-cap companies. These companies, with market capitalizations typically under $2 billion, can offer significant growth potential for savvy investors. In this article, we will delve into the strategies for investing in small-cap companies, exploring the key factors to consider and the potential rewards and risks involved. So if you’re ready to explore the exciting world of small-cap investing, keep reading!

Strategies for Investing in Small-Cap Companies

Investing in small-cap companies can be a lucrative endeavor for investors looking to diversify their portfolio and take advantage of growth potential. While small-cap stocks are often associated with higher volatility, they also offer the opportunity for substantial returns. However, investing in these companies requires careful consideration and strategy. In this article, we will explore various strategies for investing in small-cap companies, providing insights and tips to help you make informed investment decisions.

1. Understand the Basics of Small-Cap Companies

Before diving into the strategies, it’s essential to have a clear understanding of what small-cap companies are. Small-cap stocks typically refer to companies with a market capitalization between $300 million and $2 billion. These companies are often in the early stages of growth and can provide substantial upside potential.

When investing in small-cap companies, it’s crucial to recognize their unique characteristics:

- Higher volatility: Small-cap stocks tend to be more volatile compared to their large-cap counterparts. Price fluctuations can be more significant, highlighting the need for a long-term investment perspective.

- Greater growth potential: Small-cap companies have room to grow and expand, which can lead to robust returns if successful. They may operate in niche markets or be disruptors in their industries.

- Limited analyst coverage: Small-cap stocks often receive less analyst coverage, which can result in greater inefficiencies and opportunities for investors who conduct thorough research.

Now that we have a solid understanding of the basics, let’s explore some effective strategies for investing in small-cap companies.

2. Conduct Thorough Research and Due Diligence

One of the most critical aspects of investing in small-cap companies is conducting comprehensive research and due diligence. Small-cap stocks can be riskier investments, so it’s essential to understand the company’s fundamentals, industry dynamics, and growth prospects.

To conduct thorough research:

- Read annual reports, quarterly earnings releases, and company presentations to gain insights into the company’s financial health and performance.

- Examine the competitive landscape and understand the company’s position within its industry. Look for unique selling propositions, competitive advantages, and potential catalysts for growth.

- Assess the management team’s track record, experience, and their ability to execute the company’s growth strategy.

- Consider the company’s balance sheet, cash flow, and debt levels to evaluate its financial stability and ability to navigate challenging market conditions.

By conducting thorough research, you can gain a deeper understanding of the potential risks and rewards associated with investing in a small-cap company.

3. Diversify Your Portfolio

Diversification is a key strategy for any investor, and it becomes even more crucial when investing in small-cap companies. Small-cap stocks can be more volatile, and individual company-specific risks may arise. By diversifying your portfolio across different industries, sectors, and market capitalizations, you can mitigate the risk associated with investing in small-cap stocks.

Consider the following diversification strategies for small-cap investments:

- Sector diversification: Invest in small-cap companies across various sectors such as technology, healthcare, consumer goods, or industrials. This approach ensures your portfolio is not overly concentrated in one industry.

- Market capitalization diversification: Combine small-cap stocks with mid-cap and large-cap stocks. This diversifies your portfolio and provides exposure to different growth opportunities.

- Geographical diversification: Consider investing in small-cap companies from different countries or regions to reduce exposure to any particular market or economic conditions.

By diversifying your portfolio, you can spread risks and potentially capitalize on growth opportunities across various small-cap companies.

4. Long-Term Investment Horizon

Investing in small-cap companies often requires a long-term perspective. These companies might take time to grow, and their stock prices can experience significant fluctuations in the short term. By adopting a long-term investment horizon, you give your investments the opportunity to realize their growth potential and overcome short-term market volatility.

Some reasons to consider a long-term investment horizon:

- Compound growth: Small-cap companies have the potential to compound growth at a higher rate over the long term, generating substantial returns.

- Lower trading costs: Frequent trading can lead to increased transaction costs, impacting your overall investment returns. By holding onto your small-cap investments for the long term, you can avoid unnecessary trading expenses.

- Reduce emotional decision-making: Short-term market fluctuations can trigger emotional decision-making. By maintaining a long-term focus, you can avoid making impulsive investment decisions based on short-term market sentiment.

A long-term investment horizon allows you to ride out short-term volatility and potentially benefit from the growth trajectory of small-cap companies.

5. Keep an Eye on Market and Economic Trends

Monitoring market and economic trends is essential for any investor, and it holds true for investing in small-cap companies as well. Understanding broader market trends and economic conditions can help you identify potential opportunities and risks associated with small-cap stocks.

Consider the following when analyzing market and economic trends:

- Economic indicators: Track indicators such as GDP growth, inflation rates, interest rates, and consumer sentiment. These factors can influence the performance of small-cap companies.

- Market sentiment: Monitor investor sentiment and broader market trends. Positive market sentiment can drive increased interest in small-cap stocks, potentially leading to price appreciation.

- Industry trends: Stay informed about industry-specific trends that can impact small-cap companies. Technological advancements, regulatory changes, or shifts in consumer behavior can significantly affect industry dynamics.

By keeping an eye on market and economic trends, you can make more informed investment decisions and align your small-cap investments with favorable market conditions.

6. Regularly Review and Rebalance Your Portfolio

Regularly reviewing and rebalancing your portfolio is a sound investment practice, regardless of the asset class. For small-cap investments, it’s crucial to assess your portfolio’s performance, make necessary adjustments, and ensure that your investments align with your investment goals.

Consider the following when reviewing and rebalancing your portfolio:

- Monitor company performance: Keep track of the small-cap companies in your portfolio, analyzing their financials, industry position, and growth prospects. If a company’s fundamentals deteriorate or its growth prospects diminish, consider trimming or selling the position.

- Rebalance based on your risk tolerance: Assess your risk tolerance periodically and adjust your small-cap holdings accordingly. If your risk tolerance decreases, consider reallocating some of your small-cap investments to safer asset classes.

- Stay informed about market conditions: Regularly assess the overall market condition and make adjustments if necessary. If market conditions deteriorate significantly, it may be prudent to reduce exposure to small-cap stocks temporarily.

Regularly reviewing and rebalancing your portfolio ensures that your investments align with your risk tolerance and investment goals while capturing potential growth opportunities.

In Conclusion,

Investing in small-cap companies requires careful consideration and a well-defined strategy. By understanding the unique characteristics of small-cap stocks, conducting thorough research, diversifying your portfolio, adopting a long-term investment perspective, staying informed about market trends, and regularly reviewing your portfolio, you can position yourself for success in small-cap investing. Remember, small-cap investing carries inherent risks, and it’s crucial to consult with financial professionals and consider your individual circumstances before making any investment decisions. Happy investing!

FORMULA: How To Find Small Cap Stocks To Buy That Will 8x

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are small-cap companies?

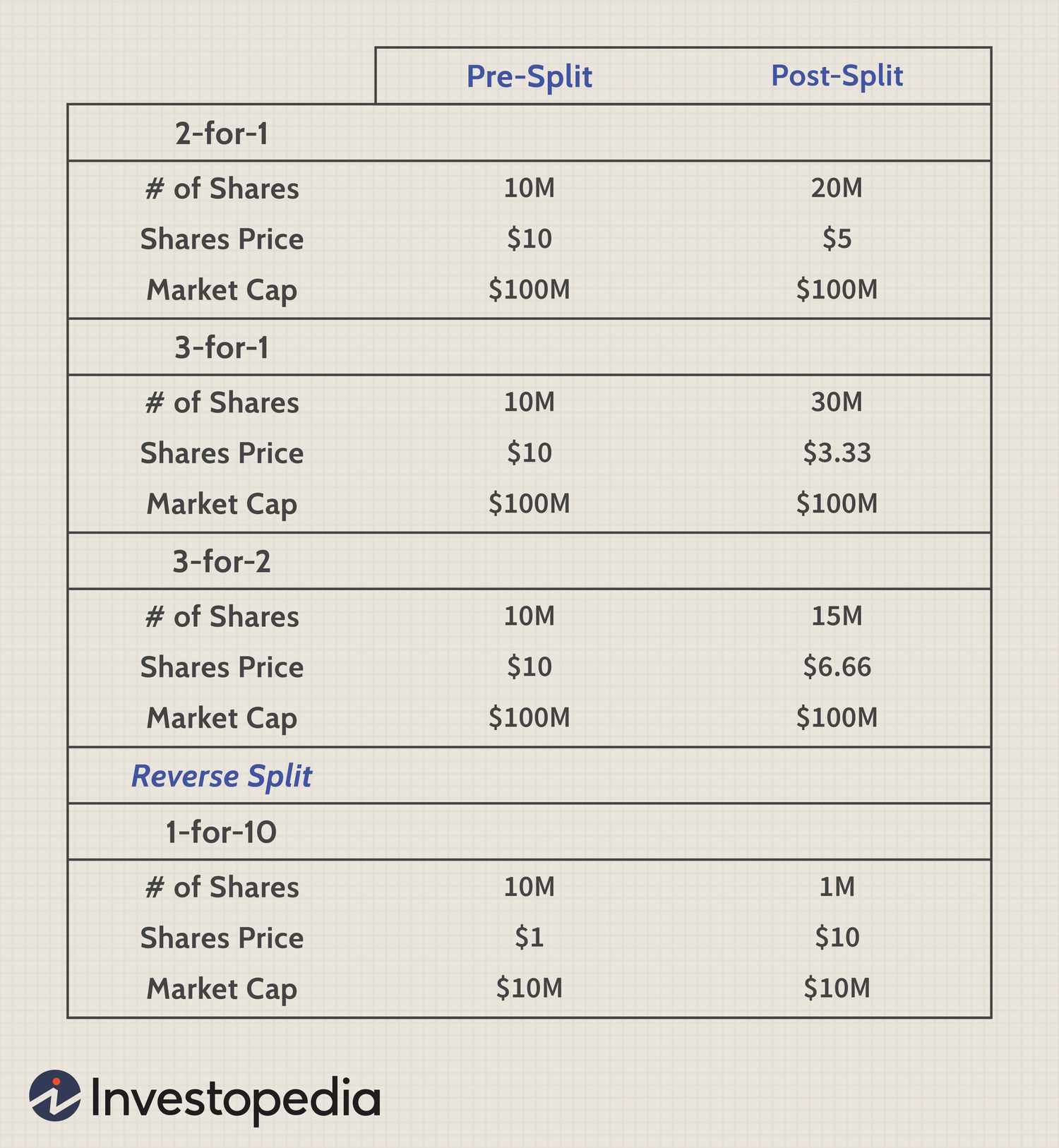

Small-cap companies refer to companies with a relatively small market capitalization. Market capitalization is calculated by multiplying the company’s current stock price by the total number of outstanding shares. These companies are typically less established and have a market capitalization that falls within a certain range, which may vary depending on the context.

Why invest in small-cap companies?

Investing in small-cap companies can offer several potential advantages. These companies often have greater growth potential compared to larger, more established companies. They may be able to adapt and innovate more quickly, leading to higher returns for investors. Additionally, small-cap stocks are sometimes overlooked by institutional investors, which could result in pricing inefficiencies and opportunities for investors.

What are some common strategies for investing in small-cap companies?

Several strategies can be utilized when investing in small-cap companies. Some common approaches include:

- Value Investing: Identifying small-cap companies with undervalued stocks based on fundamental analysis.

- Growth Investing: Focusing on small-cap companies with strong growth potential and investing in their future success.

- Contrarian Investing: Taking positions in small-cap companies that are out of favor with the market, with the belief that their fortunes will improve over time.

- Special Situations Investing: Capitalizing on specific events or opportunities that arise within small-cap companies, such as mergers, acquisitions, or restructuring.

What are the risks associated with investing in small-cap companies?

While investing in small-cap companies can offer attractive opportunities, it also comes with certain risks. These risks include:

- Higher Volatility: Small-cap stocks tend to be more volatile compared to larger, more established companies.

- Limited Resources: Smaller companies may have limited financial resources, making them more vulnerable to economic downturns or financing challenges.

- Lack of Liquidity: Small-cap stocks can have lower trading volumes, which may result in limited liquidity and difficulty selling shares at desired prices.

- Higher Risk of Failure: Small-cap companies are generally less established and have a higher risk of business failure compared to larger companies.

How can I evaluate the growth potential of a small-cap company?

When evaluating the growth potential of a small-cap company, you can consider several factors:

- Industry Trends: Assessing the future prospects of the industry in which the company operates.

- Competitive Advantage: Evaluating the company’s unique strengths and its ability to outperform competitors.

- Financial Health: Analyzing the company’s financial statements, including revenue growth, profitability, and debt levels.

- Management Team: Assessing the experience and track record of the company’s management team.

Should I diversify my investments in small-cap companies?

Diversification is an important strategy in any investment portfolio. By spreading your investments across different small-cap companies, industries, and asset classes, you can reduce the impact of any single investment’s performance on your overall portfolio. Diversification helps mitigate risk and allows you to potentially benefit from multiple investment opportunities.

What is the ideal time horizon for investing in small-cap companies?

Investing in small-cap companies generally requires a longer time horizon compared to investing in larger, more established companies. It may take time for small-cap companies to realize their full growth potential and for their stock prices to reflect their underlying value. Therefore, it is recommended to have a medium to long-term investment horizon when investing in small-cap companies.

How can I stay updated on small-cap companies?

Keeping yourself updated on small-cap companies can involve various strategies:

- Financial News: Regularly reading financial news sources that cover small-cap companies and their respective industries.

- Company Reports: Reviewing annual reports, quarterly earnings releases, and other relevant financial disclosures by small-cap companies.

- Research Reports: Utilizing research reports from reputable sources to gain insights and analysis on specific small-cap companies.

- Industry Events: Attending conferences, seminars, and webinars focused on small-cap companies or their respective industries.

Final Thoughts

In conclusion, when it comes to strategies for investing in small-cap companies, there are a few key factors to consider. Firstly, conducting thorough research and due diligence is essential to understand the company’s potential for growth and profitability. Secondly, diversifying your portfolio by investing in multiple small-cap companies can help mitigate risks. Thirdly, paying attention to industry trends and economic conditions can aid in making informed investment decisions. Additionally, staying updated with the company’s financial performance and management team is crucial. By following these strategies for investing in small-cap companies, investors can position themselves for potential long-term gains and capitalize on promising opportunities.