Looking to understand the concept of the time value of money? You’ve come to the right place! In this beginner’s guide, we’ll dive into the fundamental principles that govern the relationship between time and money. But first, let’s address the question at hand: What exactly is the time value of money? Simply put, it’s the idea that the value of a sum of money today is different from its value in the future. Throughout this article, we’ll explore why this is the case and how you can apply this knowledge to make more informed financial decisions. So, without further ado, let’s get started with our time value of money beginners guide.

Time Value of Money Beginners Guide

Introduction

Understanding the concept of time value of money is crucial in personal finance and investing. It helps individuals make informed decisions about their money by considering the impact of time on the value of money. In this beginner’s guide, we will explore the ins and outs of time value of money, including the basic principles, formulas, and practical applications. Let’s dive in!

What is Time Value of Money?

Time value of money (TVM) is a financial concept that recognizes the idea that the value of money changes over time. It acknowledges that a dollar today is worth more than a dollar in the future due to various factors such as inflation, the potential for investment returns, and the opportunity cost of not having money available for other uses. Simply put, money has a time value because it can grow or decrease in worth over time.

The Time Value of Money Equation

The time value of money equation forms the basis for understanding and calculating the value of money at different points in time. The equation is:

FV = PV * (1 + r)^n

Where:

– FV represents the future value of money

– PV represents the present value of money

– r represents the interest rate or rate of return

– n represents the number of time periods

The equation allows us to calculate the future value of an investment or the present value of a future cash flow. It helps individuals make financial decisions by comparing the value of money at different points in time.

Key Concepts of Time Value of Money

1. Compounding

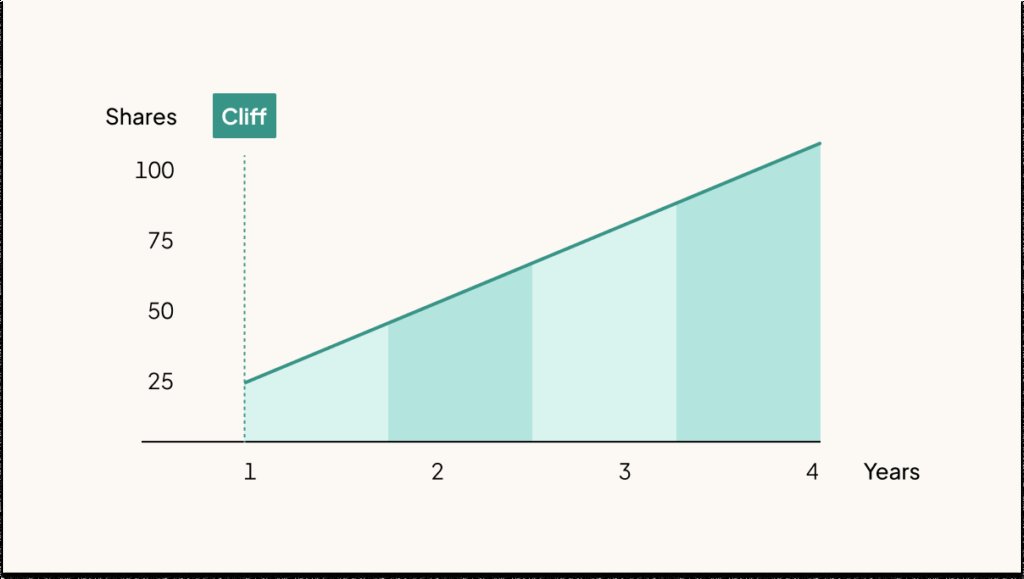

Compounding is the process of earning interest or returns on an initial investment, and it plays a vital role in the time value of money. When you invest money, the returns you earn are added to the initial investment, and they can generate additional returns in the future. This compounding effect allows your money to grow exponentially over time.

2. Discounting

Discounting is the opposite of compounding and refers to the process of determining the present value of a future cash flow. It involves reducing the value of future cash flows to reflect their worth in today’s dollars. By discounting future cash flows, you can understand the value of those cash flows in today’s terms and make better financial decisions.

3. Time Periods

Time periods are a critical component in the time value of money calculation. The number of time periods affects both compounding and discounting. Longer time periods allow for greater compounding and potential growth of your investments. On the other hand, discounting over longer time periods reduces the present value of future cash flows.

Applications of Time Value of Money

1. Investing and Retirement Planning

Understanding the time value of money is essential for investing and retirement planning. By considering the potential returns and compounding effect, individuals can make informed investment decisions. They can also determine how much they need to save and invest to achieve their desired retirement goals.

2. Budgeting and Cash Flow Management

The time value of money can also be applied to budgeting and cash flow management. By evaluating the present value of future expenses or income, individuals can better plan their finances. For example, discounting future expenses can help in determining the amount needed to set aside for a major purchase in the future.

3. Loan and Mortgage Calculations

The concept of time value of money is frequently used in loan and mortgage calculations. Lenders use it to determine the repayments and interest charges over time. Borrowers can also use it to compare loan offers and choose the most cost-effective option.

4. Business Decision-Making

Businesses use the time value of money to evaluate investment opportunities and potential projects. They assess the future cash flows and compare them to the present value or initial investment. This analysis helps in making informed decisions regarding business expansions, acquisitions, or capital expenditure.

Calculating Time Value of Money

1. Future Value

Calculating the future value (FV) of an investment involves determining the value of an investment at a future date, considering the compounding effect. The formula for calculating the future value is:

FV = PV * (1 + r)^n

Where PV is the present value, r is the interest rate, and n is the number of time periods.

2. Present Value

Determining the present value (PV) of a future cash flow involves discounting the future cash flow to its value in today’s dollars. The formula for calculating the present value is:

PV = FV / (1 + r)^n

Where FV is the future value, r is the interest rate, and n is the number of time periods.

Real-Life Example of Time Value of Money

Let’s consider a real-life example to understand the practical application of the time value of money. Suppose you have the option to receive $10,000 either today or five years from now. To make an informed decision, you need to calculate the present value of $10,000 five years from now, given an interest rate of 5%.

Using the present value formula:

PV = FV / (1 + r)^n

PV = 10,000 / (1 + 0.05)^5

PV = 10,000 / 1.27628

PV = $7,817.47

The present value of $10,000 five years from now, with a discount rate of 5%, is approximately $7,817.47. This means that if you had $7,817.47 today and invested it at a 5% interest rate, it would grow to $10,000 in five years.

Understanding the time value of money is fundamental for making sound financial decisions. By considering the impact of time on the value of money, individuals can plan for their future, make informed investment choices, and manage their cash flow effectively. Whether it’s investing for retirement, budgeting for major expenses, or evaluating business opportunities, the time value of money provides a valuable framework for decision-making. Take the time to grasp the concept and apply it to your financial journey.

Time Value of Money – Explained (Step by Step Beginner's Guide)

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is time value of money?

The concept of time value of money refers to the idea that a dollar today is worth more than a dollar in the future. This is because money can earn interest or be invested, thus increasing its value over time.

Why is understanding the time value of money important for beginners?

Understanding the time value of money is crucial for beginners because it helps them make informed financial decisions. It allows them to evaluate the potential returns and risks associated with different investment options and helps in planning for long-term financial goals.

How does compounding affect the time value of money?

Compounding is the process of earning interest on both the initial amount invested (principal) and the accumulated interest from previous periods. It enhances the time value of money by accelerating the growth of the investment over time.

What is the difference between present value and future value?

The present value is the current worth of a future sum of money, taking into account the time value of money. In contrast, the future value represents the value of an investment at a specific point in the future, including the interest it has earned or the growth it has experienced.

How can I calculate the future value of an investment?

To calculate the future value of an investment, you need to know the initial amount invested, the interest rate, and the time period over which the investment will grow. You can use formulas or financial calculators to determine the future value based on these variables.

What is the significance of discounting in the time value of money?

Discounting is the reverse process of compounding. It involves determining the present value of a future sum of money by taking into account the time value of money. Discounting helps in evaluating the worth of future cash flows in terms of their current value.

What are some practical applications of the time value of money?

The time value of money is applicable in various financial decisions, including investment analysis, retirement planning, loan amortization, evaluating business projects, and determining the affordability of major purchases such as houses or cars.

How does inflation impact the time value of money?

Inflation erodes the purchasing power of money over time. When calculating the time value of money, it is important to consider the inflation rate and adjust for it. Failure to account for inflation can result in inaccurate financial projections and decisions.

Final Thoughts

Understanding the concept of time value of money is essential for beginners in financial planning. By recognizing the principle that money today is worth more than the same amount in the future, individuals can make informed decisions about saving, investing, and borrowing. Time value of money calculations, such as present value and future value, provide a foundation for evaluating investment opportunities and assessing the impact of inflation. Being aware of the time value of money allows individuals to make better financial choices and maximize their wealth over time. In this time value of money beginners guide, we have explored the fundamentals of this concept and its significance in personal finance.