Credit card skimming scams can spell trouble for anyone who falls victim to them. But fear not! In this article, we’ll share some valuable tips for avoiding credit card skimming scams that will help keep your hard-earned money where it belongs – in your pocket. By following these simple yet effective strategies, you can protect yourself from the sneaky tactics of fraudsters and maintain control over your financial security. So, without further ado, let’s dive into the essential tips for avoiding credit card skimming scams.

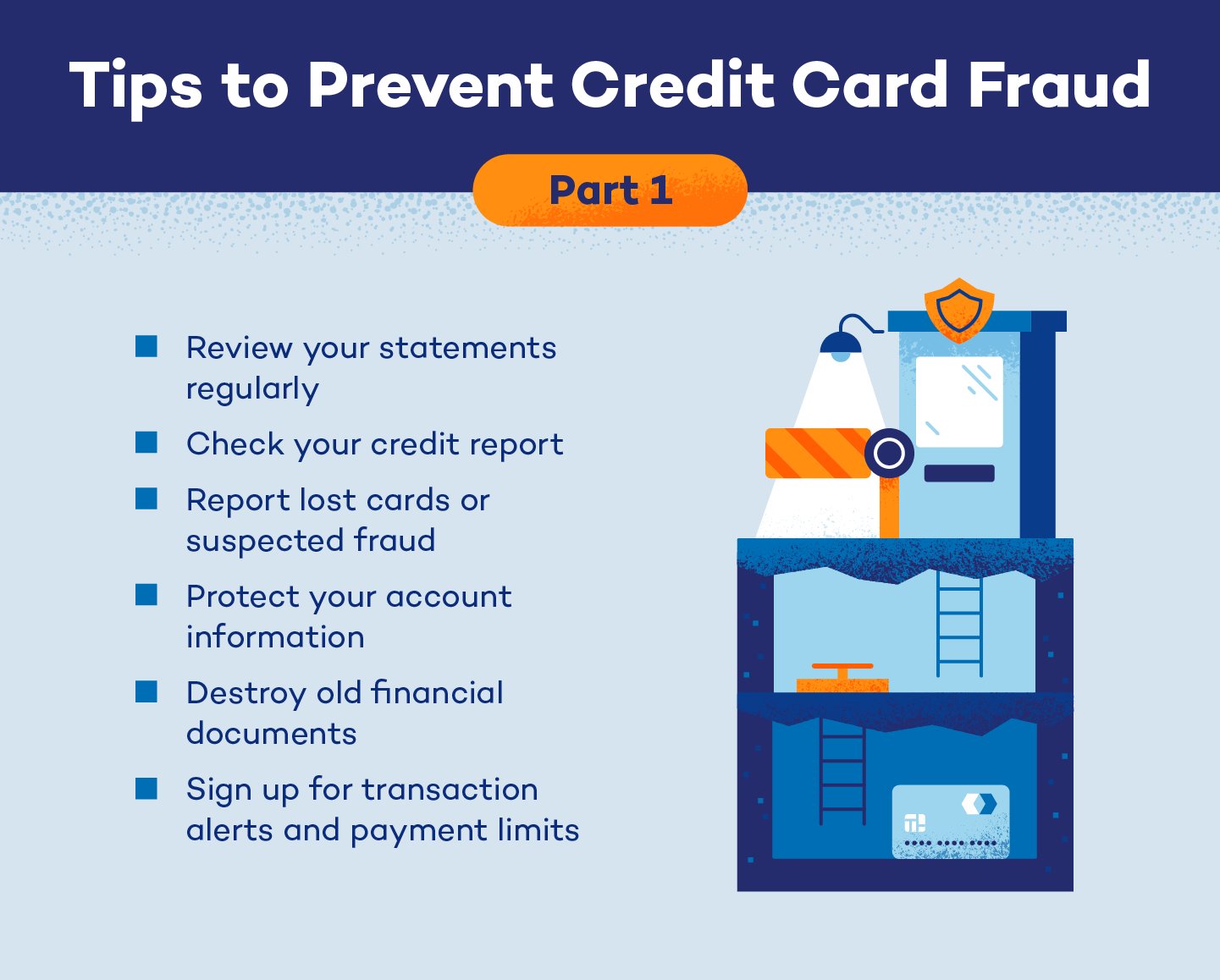

Tips for Avoiding Credit Card Skimming Scams

Credit card skimming scams are a growing concern in today’s digital age. Criminals use various techniques to steal credit card information and compromise the financial security of individuals. It is essential to be vigilant and take precautionary measures to protect yourself from falling victim to these scams. In this article, we will discuss valuable tips to help you avoid credit card skimming scams and keep your financial information safe.

1. Be Cautious at ATMs and Gas Stations

ATMs and gas stations are popular targets for credit card skimming scams. Follow these tips to minimize the risk:

- Inspect the ATM or gas pump for any signs of tampering, such as loose parts or unusual devices attached to the card slot or keypad.

- Use ATMs located in well-lit and well-populated areas to reduce the risk of being targeted by scammers.

- Cover the keypad with your hand or body while entering your PIN to protect it from hidden cameras.

- Avoid using ATMs or gas pumps that look old or outdated, as they may be more susceptible to skimming devices.

2. Use Contactless Payment Methods

Contactless payment methods, such as mobile payment apps or contactless cards, can provide an extra layer of security against credit card skimming. Consider the following:

- Use mobile payment apps like Apple Pay, Samsung Pay, or Google Pay, which use tokenization to protect your credit card information.

- Opt for contactless cards that allow you to tap and pay instead of swiping or inserting your card into a terminal.

- Regularly monitor your mobile payment app or contactless card transactions to detect any unauthorized activity promptly.

3. Be Wary of Unsecured Wi-Fi Networks

Public Wi-Fi networks can be vulnerable to hackers attempting to steal sensitive information. Take these precautions when connecting to Wi-Fi networks:

- Avoid accessing sensitive information or making online purchases when connected to public Wi-Fi networks.

- If you must use public Wi-Fi, consider using a reliable virtual private network (VPN) to encrypt your internet connection and protect your data.

- Be cautious when entering credit card information or login credentials on websites while connected to an unfamiliar Wi-Fi network.

4. Regularly Check and Monitor Your Accounts

Monitoring your credit card and bank accounts is crucial in detecting any suspicious activity that may indicate credit card skimming. Follow these steps:

- Regularly review your account statements and transaction history to identify any unauthorized charges or unfamiliar transactions.

- Set up alerts and notifications from your financial institution to receive real-time updates on account activity.

- Consider using a credit monitoring service that can track your credit reports and alert you to any suspicious activity.

5. Keep Your Devices and Software Updated

Outdated software and devices can be vulnerable to security breaches. Protect yourself by following these guidelines:

- Keep your computer, smartphone, and other devices updated with the latest security patches and software updates.

- Enable automatic updates to ensure that you are always running the most recent versions of your operating system and applications.

- Use reputable and up-to-date antivirus and antimalware software to protect against malicious software.

6. Be Skeptical of Suspicious Emails and Phone Calls

Scammers often use phishing emails and phone calls to trick individuals into revealing their credit card information. Be cautious and take the following precautions:

- Be wary of emails or phone calls asking you to provide credit card information or personal details. Legitimate organizations will not request this information via email or phone.

- Double-check the email sender’s address and verify the legitimacy of the phone call by independently reaching out to the organization they claim to represent.

- Never click on suspicious links or download attachments from unknown senders in emails or text messages.

7. Secure Your Physical Credit Cards

Protecting your physical credit cards is just as important as safeguarding your digital information. Use these tips to keep your cards secure:

- Carry only the credit cards you need and leave the rest in a secure location, such as a locked drawer at home.

- Sign the back of your credit cards as soon as you receive them to help prevent unauthorized use.

- Keep your credit card information confidential and avoid sharing it with anyone unless absolutely necessary.

By following these tips, you can significantly reduce the risk of falling victim to credit card skimming scams. Stay vigilant, be cautious, and prioritize the security of your financial information. Remember, prevention is key when it comes to protecting yourself from scammers and fraudsters.

How To Prevent Credit Card Skimmer Fraud • Stopping Scammers Tip #1

Frequently Asked Questions

Frequently Asked Questions (FAQs)

Q: What is credit card skimming?

A: Credit card skimming is a type of scam where criminals steal your credit card information by using a device that secretly captures data when you use your card for payments.

Q: How can I protect myself from credit card skimming scams?

A: Here are some tips to help you avoid credit card skimming scams:

Q: What should I look for to detect a credit card skimming device?

A: Watch out for suspiciously placed or loose card readers, keypad overlays, or hidden cameras near ATMs, gas pumps, or other payment terminals.

Q: Is it safe to use my credit card at any ATM or gas pump?

A: It is safer to use ATMs and gas pumps in well-lit, busy areas and those that are regularly monitored. Choose ATMs located inside banks or trusted establishments whenever possible.

Q: Can I check if a payment terminal has been tampered with?

A: Yes, you can inspect the payment terminal before use. Look for any signs of tampering, such as broken seals, loose parts, or anything that appears unusual.

Q: Are there any additional security measures I can take when using my credit card?

A: Yes, you can protect yourself further by covering the keypad with your hand when entering your PIN and regularly monitoring your credit card statements for any suspicious transactions.

Q: Can someone steal my credit card information remotely?

A: While it’s unlikely for someone to steal your credit card information remotely, it’s always a good practice to be cautious when sharing your card details online or over the phone. Only provide information to trusted and secure websites or verified service providers.

Q: What should I do if I suspect my credit card has been compromised?

A: If you suspect your credit card has been compromised, immediately contact your credit card issuer or bank to report the unauthorized activity. They will guide you on the necessary steps to protect your account and investigate the matter.

Q: Can chip-enabled credit cards protect me from credit card skimming?

A: Chip-enabled credit cards provide an added layer of security, making it more difficult for scammers to clone your card. However, it’s still essential to remain vigilant and follow the above tips to minimize the risk of credit card skimming scams.

Final Thoughts

In conclusion, protecting yourself from credit card skimming scams is crucial in today’s digital age. To avoid falling victim to these scams, remember a few key tips. First, be vigilant and check for any suspicious devices attached to card readers when using an ATM or payment terminal. Secondly, cover your PIN while entering it and regularly review your bank statements for any unauthorized transactions. Additionally, consider using contactless payment methods or mobile wallets for added security. By following these tips for avoiding credit card skimming scams, you can ensure the safety of your personal and financial information.