Struggling to make your college budget stretch? Don’t worry, we’ve got you covered with some essential tips for budgeting as a college student. We understand that managing your finances while studying can be a daunting task, but with a little guidance, you can achieve financial stability and focus on what really matters – your education. From smart spending habits to creative saving strategies, we’ll show you how to navigate the world of budgeting without breaking the bank. So, if you’re ready to take control of your finances and make the most out of your college experience, keep reading!

Tips for Budgeting as a College Student

Introduction

Being a college student can be an exciting time filled with new experiences, friendships, and learning opportunities. However, it can also come with financial challenges. Budgeting is an essential skill that every college student should develop to manage their expenses and make the most of their limited funds. In this article, we will provide you with practical tips and strategies to help you budget effectively as a college student. From tracking your expenses to saving money on textbooks, we’ve got you covered.

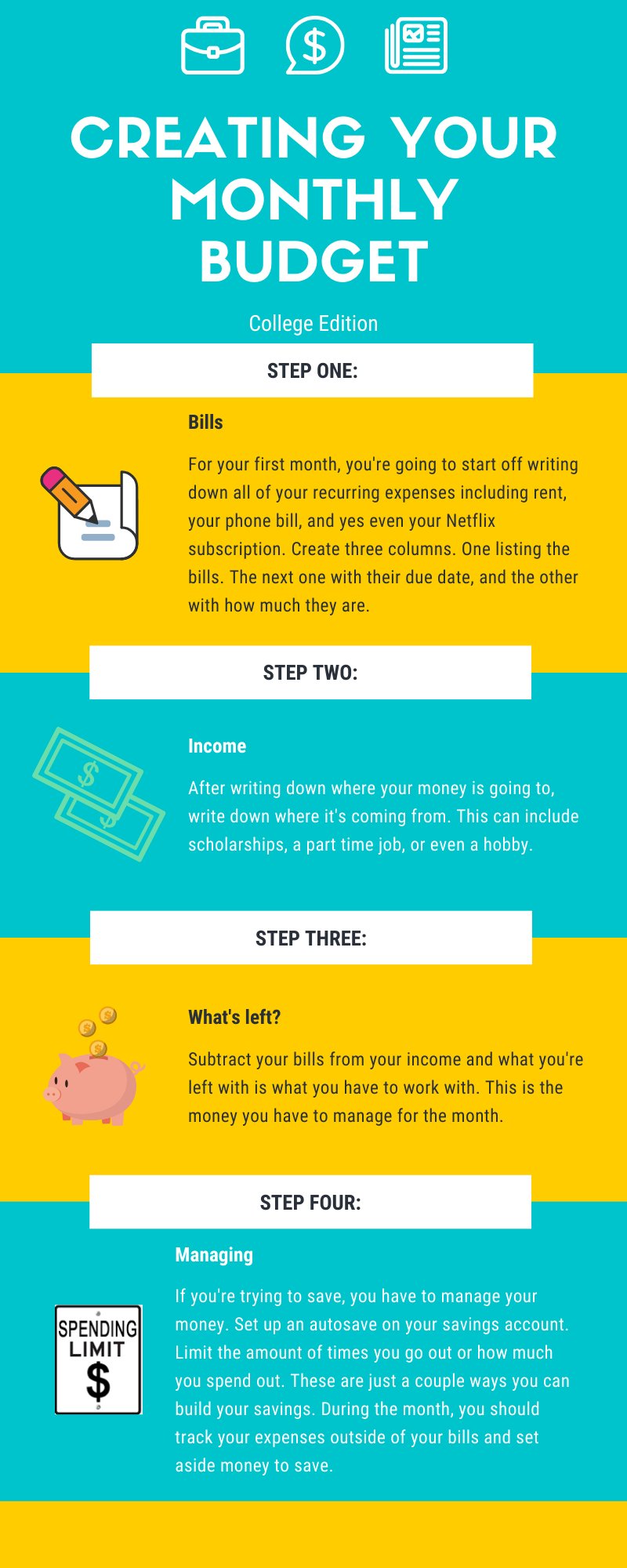

Create a Budget

One of the first steps to successful budgeting is creating a budget. A budget is a financial plan that outlines your income and expenses. It helps you prioritize your spending and ensures you have enough money for essential needs. Here are some steps to create a budget:

- Calculate Your Income: Start by calculating your monthly income, including any scholarships, grants, part-time job earnings, or allowance from your parents.

- List Your Expenses: Make a list of all your expenses, including rent, utilities, groceries, transportation, textbooks, and entertainment.

- Track Your Spending: Keep track of your spending for a month to get an accurate idea of where your money is going. You can use budgeting apps or simply keep a record in a notebook.

- Set Priorities: After tracking your spending, identify areas where you can cut back and prioritize your expenses accordingly. Make sure to allocate enough funds for essential needs like bills and groceries.

- Review and Adjust: Review your budget regularly and make adjustments as needed. As your circumstances change, you may need to update your budget to reflect new expenses or income sources.

Creating a budget may seem overwhelming at first, but it is a valuable tool that will help you stay on track financially.

Track Your Expenses

Once you have a budget in place, it’s crucial to track your expenses to ensure you’re sticking to your financial plan. Here are some tips to help you track your expenses effectively:

- Use Budgeting Apps: There are numerous budgeting apps available that can help you track your expenses effortlessly. These apps categorize your spending, provide visual representations of your financials, and send you alerts when you exceed your budget.

- Maintain a Spreadsheet: If you prefer a more hands-on approach, create a spreadsheet to track your expenses manually. You can categorize your expenses and add up the totals at the end of each month.

- Save Receipts: Keep all your receipts in one place so that you can easily refer to them when tracking your expenses. This can be a physical folder or a digital folder on your computer.

- Review Your Bank Statements: Regularly review your bank statements to ensure all your expenses are accounted for. This will also help you identify any unauthorized transactions.

By tracking your expenses, you will have a clear understanding of where your money is going and where you can make adjustments if needed.

Save on Textbooks

Textbooks can be a significant expense for college students, but there are several ways to save money on them. Here are some tips:

- Buy Used Textbooks: Consider buying used textbooks instead of brand new ones. Many college bookstores offer used textbooks at a lower price, and you can also check online marketplaces or student forums for used book listings.

- Rent Textbooks: If you only need a textbook for a specific semester, renting can be a cost-effective option. Several online platforms offer textbook rentals at a fraction of the purchase price.

- Share with Classmates: Coordinate with your classmates and see if you can share textbooks. This way, you can split the cost and save money.

- Utilize the Library: Check if your college library has copies of the textbooks you need. You may be able to borrow them for the entire semester or use them within the library premises.

- Look for Digital Alternatives: Digital textbooks often cost less than their physical counterparts. Check if the textbooks you need are available in digital format.

By exploring these options, you can significantly reduce your textbook expenses and allocate those savings to other essential needs.

Save on Food

Food expenses can quickly add up, but there are several strategies you can use to save money on your meals. Here are some tips:

- Cook at Home: Eating out frequently can be costly. Try to cook your meals at home as often as possible. This way, you have control over the ingredients and portion sizes, and it’s usually more affordable.

- Meal Prep: Set aside some time each week to meal prep. Plan your meals in advance, buy groceries accordingly, and prepare multiple meals at once. This saves time and money in the long run.

- Pack Lunch: Instead of buying lunch on campus, pack your own. Invest in a good lunch box and pack nutritious and cost-effective meals.

- Shop Smart: Look for sales, use coupons, and compare prices at different grocery stores. Consider buying non-perishable items in bulk to save money in the long term.

- Utilize Student Discounts: Many restaurants and grocery stores offer student discounts. Always carry your student ID with you and inquire about available discounts.

By applying these tips, you can enjoy delicious and budget-friendly meals throughout your college journey.

Save on Transportation

Transportation costs can eat up a significant portion of your budget, but there are ways to minimize these expenses. Consider the following tips:

- Walk or Bike: If possible, opt for walking or biking instead of using public transportation or driving. This not only saves money but also promotes a healthy and sustainable lifestyle.

- Use Public Transportation: If walking or biking is not feasible, utilize public transportation options like buses or trains. Many colleges offer discounted student passes, which can help you save.

- Carpool: If you live off-campus and have classmates or friends who live nearby, consider carpooling. Sharing the cost of fuel and parking can significantly reduce your transportation expenses.

- Minimize Vehicle Usage: If you have a car, try to minimize its usage. Combine errands into one trip, carpool with friends, and maintain proper tire pressure to improve fuel efficiency.

By implementing these transportation-saving strategies, you can allocate more of your budget to other essential areas.

Entertainment on a Budget

College life is not all about studying; it’s also about having fun and enjoying your social life. Here are some tips to help you have a great time while staying within your budget:

- Look for Free Events: Many colleges organize free events and activities for students. Keep an eye out for concerts, movie nights, and workshops happening on campus.

- Utilize Student Discounts: Many theaters, museums, and other entertainment venues offer student discounts. Always ask about available discounts and bring your student ID with you.

- Host Potluck Parties: Instead of going out to expensive restaurants, consider hosting potluck parties with your friends. Each person can contribute a dish, making it a fun and cost-effective way to socialize.

- Explore Nature: Nature provides endless opportunities for free or low-cost entertainment. Go for hikes, have picnics in local parks, or explore nearby beaches or lakes.

- Take Advantage of College Facilities: Many colleges have facilities like gyms, swimming pools, and recreational centers that are accessible to students for free or at a reduced fee. Make the most of these resources.

Remember, having fun doesn’t have to break the bank. With a little creativity, you can enjoy a fulfilling college experience without overspending.

Budgeting as a college student is all about making smart financial decisions and prioritizing your spending. By creating a budget, tracking your expenses, and implementing money-saving strategies, you can successfully manage your finances and ensure you have enough funds for all your needs. It may require some discipline and conscious effort, but the long-term benefits are worth it. Start implementing these tips today and set yourself up for a financially secure future as a college student.

How to Budget in College

Frequently Asked Questions

Tips for Budgeting as a College Student

How can I create a budget as a college student?

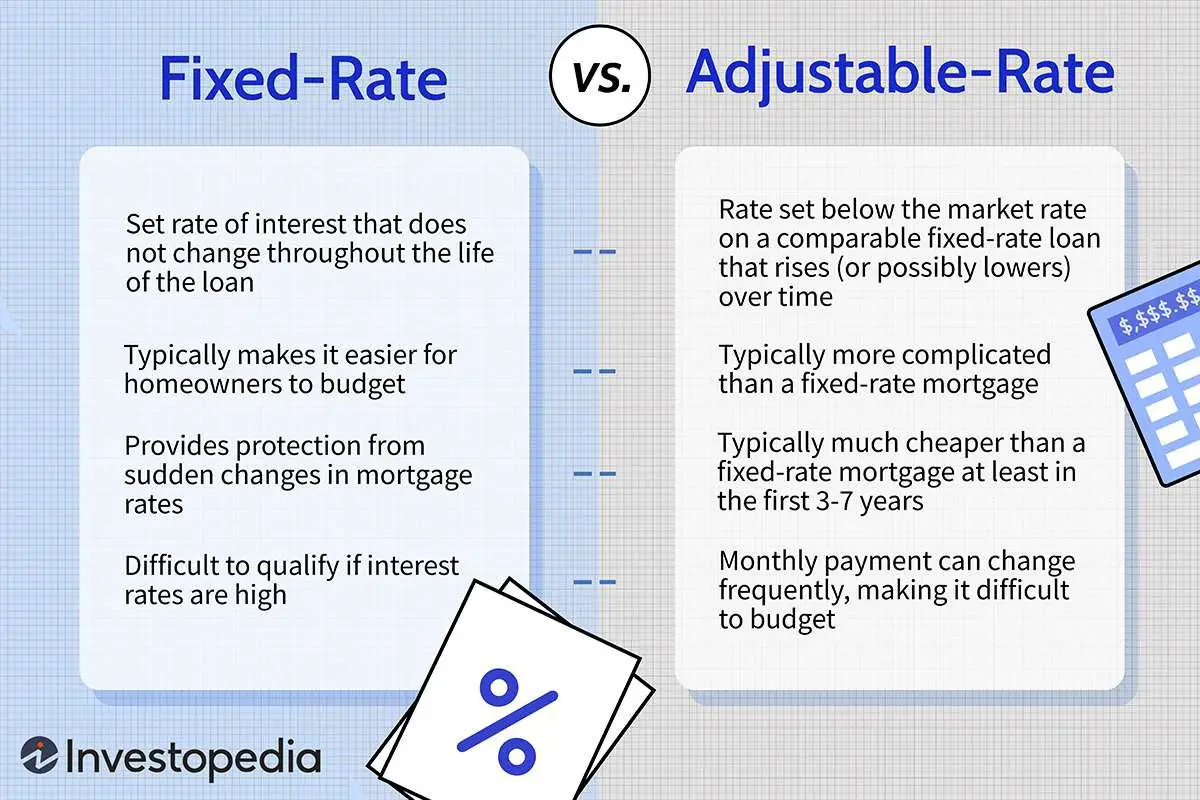

Creating a budget as a college student involves determining your income, tracking expenses, setting financial goals, and making necessary adjustments to your spending habits. Start by listing all your sources of income and then categorize your expenses into fixed (rent, utilities) and variable (food, entertainment) costs. Allocate a specific amount to each category and regularly monitor your spending to stay within budget.

What are some effective ways to save money as a college student?

To save money as a college student, consider buying used textbooks or renting instead of purchasing them. Prepare meals at home instead of eating out frequently and make use of student discounts wherever available. Opt for public transportation or carpooling to save on transportation costs, and avoid unnecessary expenses by prioritizing your needs over wants.

How can I prioritize my expenses as a college student?

Prioritizing expenses as a college student involves distinguishing between essential and non-essential items. Allocate a portion of your budget towards necessities like rent, groceries, utilities, and transportation. Once these essentials are covered, allocate remaining funds for discretionary expenses such as entertainment or dining out.

What are some common budgeting mistakes to avoid as a college student?

Some common budgeting mistakes to avoid include not tracking your expenses, overspending on discretionary items, relying heavily on credit cards, or not accounting for irregular expenses such as textbooks or medical emergencies. It is important to regularly review and adjust your budget to prevent these mistakes and ensure financial stability.

Should I consider getting a part-time job while in college to improve my budget?

Getting a part-time job while in college can be a great way to improve your budget. It provides an additional source of income that can help cover expenses, build savings, and reduce reliance on student loans. However, it is essential to balance work and academics to ensure that your studies are not negatively impacted.

How can I reduce my expenses on textbooks as a college student?

To reduce textbook expenses, consider purchasing used textbooks, renting them, or exploring digital alternatives. You can also check if your college library has copies of the required textbooks that you can borrow. Additionally, consider forming study groups with classmates, as sharing textbooks can further reduce costs.

Is it important to have an emergency fund as a college student?

Yes, having an emergency fund is crucial for college students. Unforeseen expenses such as medical emergencies, car repairs, or unexpected travel costs can disrupt your budget. Aim to save a portion of your income in an emergency fund to ensure financial security and avoid accumulating debt in times of unexpected financial challenges.

How can I avoid overspending on entertainment as a college student?

To avoid overspending on entertainment, set a specific entertainment budget and stick to it. Consider exploring free or low-cost entertainment options such as campus events, student clubs, or local community activities. Additionally, take advantage of student discounts offered by theaters, museums, or other recreational venues in your area.

Final Thoughts

Effective budgeting is crucial for college students to manage their finances responsibly. By following these simple tips, you can stay on top of your expenses and save money during your college years. Firstly, create a realistic budget by tracking your income and expenses regularly. This will help you prioritize essential items and identify areas where you can cut back. Secondly, be mindful of your spending habits and avoid unnecessary expenses. Consider buying used textbooks, cooking meals at home, and utilizing student discounts. Lastly, embrace a frugal lifestyle by seeking free or low-cost entertainment options and exploring resources available on campus. With these tips for budgeting as a college student, you can confidently navigate your financial journey and secure a stable future.