Dealing with surprise medical bills can be a daunting and overwhelming experience. But fret not, as we’ve got some valuable tips to help you navigate this challenging situation with ease. Whether it’s an unexpected procedure, a denied insurance claim, or out-of-network charges, understanding your options is the first step towards resolving these financial surprises. So, how can you tackle those surprise medical bills? Let’s dive in and explore some practical strategies that can help alleviate the stress and ensure you’re armed with the knowledge you need to effectively handle this situation. After all, knowledge is power when it comes to managing your healthcare expenses. So, let’s uncover these valuable tips for dealing with surprise medical bills.

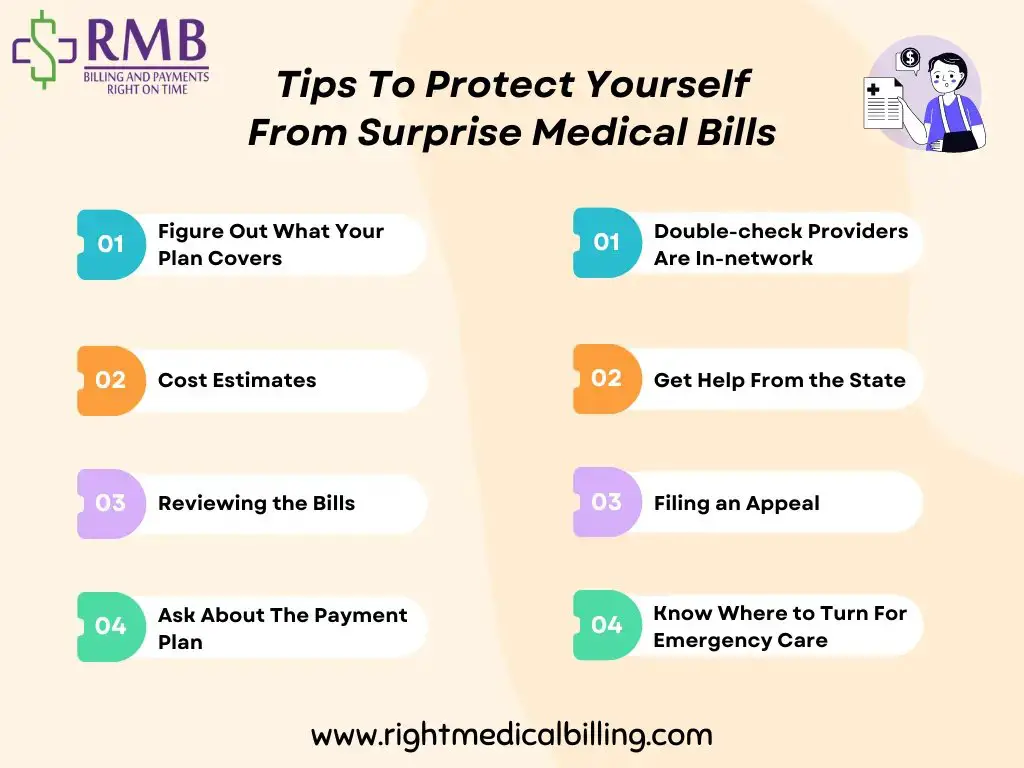

Tips for Dealing with Surprise Medical Bills

Unexpected medical bills can be a source of stress and financial burden for many individuals and families. Whether it’s due to an emergency room visit, an out-of-network provider, or a procedure that wasn’t fully covered by insurance, surprise medical bills can quickly add up. In this article, we will discuss various tips and strategies to help you effectively deal with and navigate the challenges of surprise medical bills.

1. Verify Your Insurance Coverage

One of the first steps in dealing with surprise medical bills is to verify your insurance coverage. Many individuals assume that a particular service or provider is covered by their insurance, only to find out later that it isn’t. To avoid any surprises, take the following actions:

- Contact your insurance company’s customer service to confirm coverage for the specific service or provider.

- Ask about any limitations, such as out-of-network costs or pre-authorization requirements.

- Keep a record of your conversation, including the date, time, and the name of the representative you spoke with.

2. Review Your Medical Bills

It’s essential to carefully review all your medical bills for errors or discrepancies. Medical billing errors are more common than you might think, and they can result in overcharges or insurance denials. Here’s what you should do:

- Compare your medical bills with the services you received and the explanations of benefits (EOBs) from your insurance company.

- Double-check that the billed amounts, dates, and CPT codes (procedure codes) are accurate.

- Contact the provider’s billing department if you notice any errors or have questions about the charges.

3. Negotiate with Your Healthcare Provider

If you receive a surprise medical bill that you believe is unfair or excessive, don’t hesitate to negotiate with your healthcare provider. Many providers are willing to work with patients to find a mutually acceptable solution. Consider the following tips for successful negotiations:

- Be polite but firm in your communication with the provider’s billing department.

- Provide any evidence or documentation that supports your case, such as prior authorization or evidence of in-network referrals.

- Explain your financial situation and offer to set up a payment plan if necessary.

- Suggest a reasonable and fair settlement amount based on your research of local pricing and insurance coverage.

4. File an Appeal with Your Insurance Company

If your insurance company denies coverage for a medical service or procedure, you have the right to appeal their decision. The appeals process allows you to present additional information or evidence to support your case. Here are some helpful tips for filing a successful appeal:

- Carefully review the denial letter from your insurance company to understand the reasons for denial.

- Gather all relevant documentation, such as medical records, test results, or letters of medical necessity from your healthcare provider.

- Compose a detailed appeal letter that clearly explains why the service should be covered based on your policy’s guidelines.

- Submit your appeal within the specified timeframe and keep copies of all correspondence for your records.

5. Seek Professional Help

If you’re overwhelmed or struggling to navigate the complexities of surprise medical bills, it may be beneficial to seek professional assistance. There are organizations and professionals specializing in medical billing advocacy and negotiation who can help you understand your rights and options. Some helpful resources include:

- Consumer assistance programs offered by your state’s insurance department.

- Medical billing advocates or professionals who can guide you through the process and negotiate on your behalf.

- Non-profit organizations that offer free or low-cost assistance to individuals facing medical debt.

6. Be Proactive in Preventing Surprise Medical Bills

While it may not always be possible to avoid unexpected medical bills, there are steps you can take to minimize the risks. Consider the following preventive measures:

- Choose in-network healthcare providers whenever possible, and confirm their network status before receiving any services.

- Ask your healthcare provider to obtain pre-authorization from your insurance company for any major procedures or services.

- Make sure you understand your insurance policy and coverage limits.

- Keep organized records of all medical bills, explanations of benefits, and correspondence with healthcare providers and insurance companies.

Dealing with surprise medical bills can be challenging, but with the right knowledge and proactive approach, you can navigate the situation more effectively. Remember to verify your insurance coverage, review your medical bills for errors, negotiate with your healthcare provider when necessary, and file an appeal if needed. If you’re feeling overwhelmed, don’t hesitate to seek professional help. By being proactive and informed, you can minimize the impact of surprise medical bills on your finances.

Surprise Medical Bill? What to Do about It

Frequently Asked Questions

Frequently Asked Questions (FAQs)

Q: How can I deal with surprise medical bills?

A: Here are some helpful tips for dealing with surprise medical bills:

Q: What should I do when I receive a surprise medical bill?

A: When you receive a surprise medical bill, the first step is to review it carefully. Make sure the bill is accurate and check if it is covered by your insurance.

Q: Can I negotiate with the healthcare provider to lower the bill?

A: Yes, you can try to negotiate with the healthcare provider. Contact them and explain your situation. Often, they are willing to work out a payment plan or reduce the bill amount.

Q: Is it necessary to contact my insurance company after receiving a surprise medical bill?

A: Yes, it is important to contact your insurance company. They can provide guidance on what steps to take and may be able to assist in resolving the billing issue.

Q: What if my insurance denies coverage for the surprise medical bill?

A: If your insurance denies coverage, you can appeal their decision. Gather any necessary documentation or evidence to support your case and submit an appeal following your insurance company’s guidelines.

Q: Is it advisable to seek legal assistance for dealing with surprise medical bills?

A: In some cases, seeking legal assistance may be beneficial, especially if you believe you have been wrongly billed or treated. Consult with a healthcare attorney to understand your rights and options.

Q: How can I prevent surprise medical bills in the future?

A: To help prevent surprise medical bills, be proactive. Before receiving any medical treatment, verify that all providers involved are in-network, understand your insurance coverage, and ask for cost estimates in advance.

Q: Can I set up a payment plan for a surprise medical bill?

A: Yes, many healthcare providers offer payment plans to help patients manage unexpected medical bills. Contact the billing department and inquire about setting up a payment arrangement that fits your budget.

Q: Are there any resources available to assist individuals dealing with surprise medical bills?

A: Yes, there are resources available. Government websites, consumer protection agencies, and nonprofit organizations often provide guidance and resources for individuals facing surprise medical bills. Research and reach out for assistance.

Final Thoughts

In conclusion, dealing with surprise medical bills can be overwhelming, but there are steps you can take to navigate this challenging situation. First, familiarize yourself with your insurance coverage and understand your rights as a patient. Keep track of all medical expenses and review bills carefully for any errors or discrepancies. If you receive an unexpected bill, don’t hesitate to negotiate or request a payment plan. Additionally, consider seeking assistance from patient advocacy organizations or reaching out to your healthcare provider directly for resolution. By following these tips for dealing with surprise medical bills, you can better manage your finances and protect your health.