Are you considering a business acquisition? Evaluating a potential acquisition is crucial to ensure a successful outcome. But where do you start? In this article, we will dive into tips for evaluating a business acquisition that will guide you through the process. Whether you are a seasoned entrepreneur or new to the world of acquisitions, these tips will provide you with a solid foundation for making informed decisions. So, let’s get started and explore the key aspects to consider when assessing a business acquisition.

Tips for Evaluating a Business Acquisition

When it comes to business acquisitions, thorough evaluation is crucial. Whether you’re a seasoned investor or a first-time buyer, assessing the potential risks and benefits of acquiring a business is essential for making informed decisions. In this article, we will provide you with valuable tips for evaluating a business acquisition to ensure you are well-prepared and can make the right choices.

1. Understand the Industry and Market

Before diving into evaluating a business acquisition, it’s essential to gain a deep understanding of the industry and market in which the target company operates. This knowledge will help you assess the business’s position, competitive landscape, growth potential, and overall viability. Here are some steps to take:

- Conduct market research to identify industry trends, customer preferences, and potential market risks.

- Examine the competitive landscape, including key competitors, their market share, and any barriers to entry or expansion.

- Assess the market’s growth potential and long-term sustainability, considering factors such as changing consumer behaviors, technological advancements, and regulatory influences.

2. Analyze the Business’s Financial Health

Understanding the financial health of the target company is crucial for evaluating its value and potential profitability. Here are key financial aspects to consider:

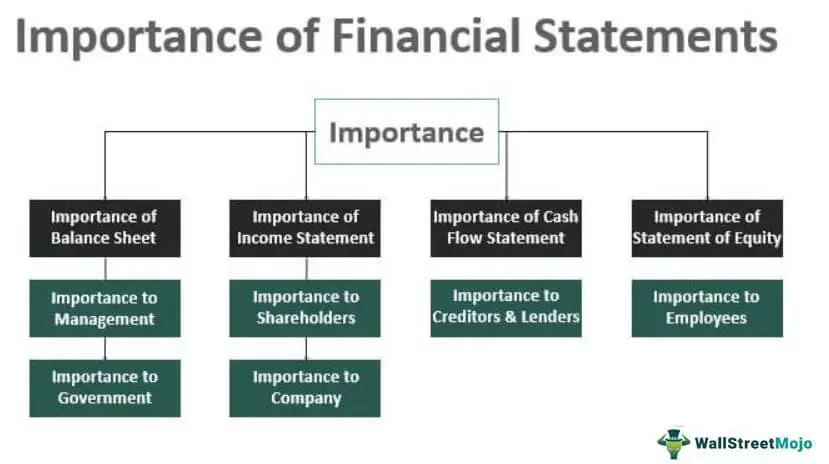

- Review the business’s financial statements, including income statements, balance sheets, and cash flow statements, for the past few years.

- Analyze the company’s revenue streams, profit margins, and expenses to identify any significant fluctuations or trends.

- Assess the business’s debt and liabilities, including outstanding loans, leases, and potential legal or regulatory obligations.

- Evaluate the company’s working capital, liquidity, and ability to generate consistent cash flow.

- Consider engaging a financial expert or accountant to perform a comprehensive financial analysis.

3. Assess the Business’s Assets and Liabilities

Understanding the target company’s assets and liabilities is crucial for determining its overall value and potential risks. Here are key points to evaluate:

- Identify and evaluate the business’s tangible and intangible assets, such as properties, inventory, intellectual property, patents, copyrights, or trademarks.

- Review the company’s legal documents, including contracts, leases, and licenses, to identify any potential legal or contractual obligations.

- Assess any existing litigation or pending legal issues that could impact the business’s operations or financial standing.

- Consider conducting a comprehensive due diligence process, including engaging legal experts, to ensure all assets and liabilities are thoroughly evaluated.

4. Evaluate the Business’s Operations and Management

Understanding the target company’s operations and management is crucial for evaluating its efficiency, scalability, and overall performance. Consider the following:

- Assess the business’s operational processes, including production, supply chain, distribution channels, and quality control measures.

- Evaluate the company’s management team, their experience, qualifications, and their ability to lead and execute the business strategies effectively.

- Consider conducting interviews or discussions with key employees to gain insights into the company’s culture, employee satisfaction, and potential challenges.

- Examine the business’s technology infrastructure, information systems, and any potential vulnerabilities or risks related to cybersecurity.

5. Consider Market Fit and Synergies

Assessing how the target company aligns with your existing business or investment portfolio is crucial for determining potential synergies and market fit. Consider the following:

- Identify potential synergies, such as complementary products or services, shared target customers, or economies of scale, that can enhance your business’s overall competitive advantage.

- Evaluate how acquiring the business can expand your market reach, diversify your customer base, or enhance your core offerings.

- Consider the benefits and challenges of integrating the target company’s operations, culture, and workforce into your existing business framework.

- Analyze the potential financial impact of the acquisition, including expected revenue growth, cost savings, or increased profitability.

6. Perform Legal and Regulatory Due Diligence

Ensuring compliance with applicable legal and regulatory requirements is crucial for a successful business acquisition. Consider the following:

- Engage legal experts to conduct a thorough review of the target company’s legal documents, contracts, permits, licenses, and any potential legal or regulatory risks.

- Assess the business’s compliance history, including any past or ongoing legal or regulatory issues, fines, or penalties.

- Evaluate the potential impact of changing regulations, industry standards, or environmental factors on the business’s operations or market potential.

- Consider obtaining warranties and indemnities from the seller to protect against any undisclosed legal or regulatory liabilities.

7. Seek Professional Advice

When evaluating a business acquisition, seeking professional advice can provide valuable insights and mitigate risks. Consider the following:

- Engage a qualified mergers and acquisitions (M&A) advisor, business broker, or investment banker who specializes in business acquisitions.

- Consult with industry experts, legal advisors, accountants, or financial analysts to gain a well-rounded perspective on the target company.

- Consider assembling a team of professionals, including lawyers, accountants, and HR consultants, to assist with due diligence, negotiations, and post-acquisition integration.

Remember, evaluating a business acquisition requires careful analysis, diligence, and expertise. By following these tips and seeking professional advice, you can make informed decisions and increase your chances of a successful business acquisition.

What You Should Know Before Buying A Business: Acquisition Criteria

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are some tips for evaluating a business acquisition?

1. What factors should I consider when evaluating a potential business acquisition?

2. How do I assess the financial health of the target company?

3. What due diligence should I conduct before acquiring a business?

4. How can I evaluate the growth potential of the target company?

5. What steps should I take to assess the market and industry landscape?

6. How do I evaluate the target company’s existing customer base?

7. What should I look for in terms of the target company’s intellectual property and assets?

8. How can I evaluate the compatibility of the target company with my own business?

Final Thoughts

In conclusion, when evaluating a business acquisition, it is crucial to follow certain tips for a well-informed decision. Firstly, conducting thorough due diligence is essential to understand the target company’s financial health, market position, and potential risks. Additionally, assessing the compatibility between the acquiring and target companies’ cultures, values, and goals can help ensure a successful integration. Moreover, seeking expert advice from professionals such as lawyers, accountants, and industry specialists can provide valuable insights and minimize potential pitfalls. By carefully considering these tips for evaluating a business acquisition, organizations can make informed and strategically sound decisions that align with their growth objectives.