Looking for tips on financing a home renovation project? You’re in the right place! Planning to give your home a fresh new look can be an exciting endeavor, but it can also come with its fair share of financial challenges. So, how can you ensure that your dream renovation doesn’t break the bank? In this article, we’ll explore some practical and effective strategies to help you secure the funds you need to turn your home improvement dreams into reality. Whether you’re looking to upgrade your kitchen, renovate your bathroom, or add some much-needed space, these tips for financing a home renovation project will empower you to make informed decisions and achieve the home of your dreams without unnecessary financial stress.

Tips for Financing a Home Renovation Project

Introduction

Undertaking a home renovation project can be exciting, but it can also be financially challenging. Whether you’re planning a small cosmetic upgrade or a major overhaul, having a solid financial plan in place is crucial. In this article, we will provide you with valuable tips for financing your home renovation project. From exploring different funding options to managing your budget effectively, we’ve got you covered. Let’s dive in!

1. Evaluate Your Project Scope and Set a Budget

Before diving into financing options, it’s important to assess the scope of your renovation project. Take the time to evaluate what exactly needs to be done and prioritize your renovation goals. This will help you determine the estimated costs and set a realistic budget.

1.1 Assess the Scope of Your Project

Start by making a comprehensive list of all the areas you want to renovate or remodel. Consider both cosmetic upgrades and structural changes. Then, categorize them into must-haves and nice-to-haves. This will help you stay focused on the essentials and avoid overspending.

1.2 Determine Your Budget

Once you have a clear idea of your renovation goals, it’s time to determine your budget. Research the average costs for materials, labor, permits, and any other expenses associated with your project. Set a budget range that aligns with your financial capabilities.

1.3 Consider Contingency Funds

It’s essential to set aside a contingency fund for unexpected surprises or additional expenses that may arise during the renovation process. Aim for at least 10% of your total budget to cover any unforeseen costs, ensuring financial stability throughout the project.

2. Explore Different Financing Options

Now that you have a well-defined budget, let’s explore various financing options available for your home renovation project. Finding the right financing method can help you achieve your renovation goals without placing excessive strain on your finances.

2.1 Personal Savings

Using personal savings is the most straightforward and cost-effective way to finance your home renovation project. If you have a substantial amount of savings, it’s wise to use them to cover some or all of the expenses. However, ensure you retain an emergency fund even after allocating funds for the renovation.

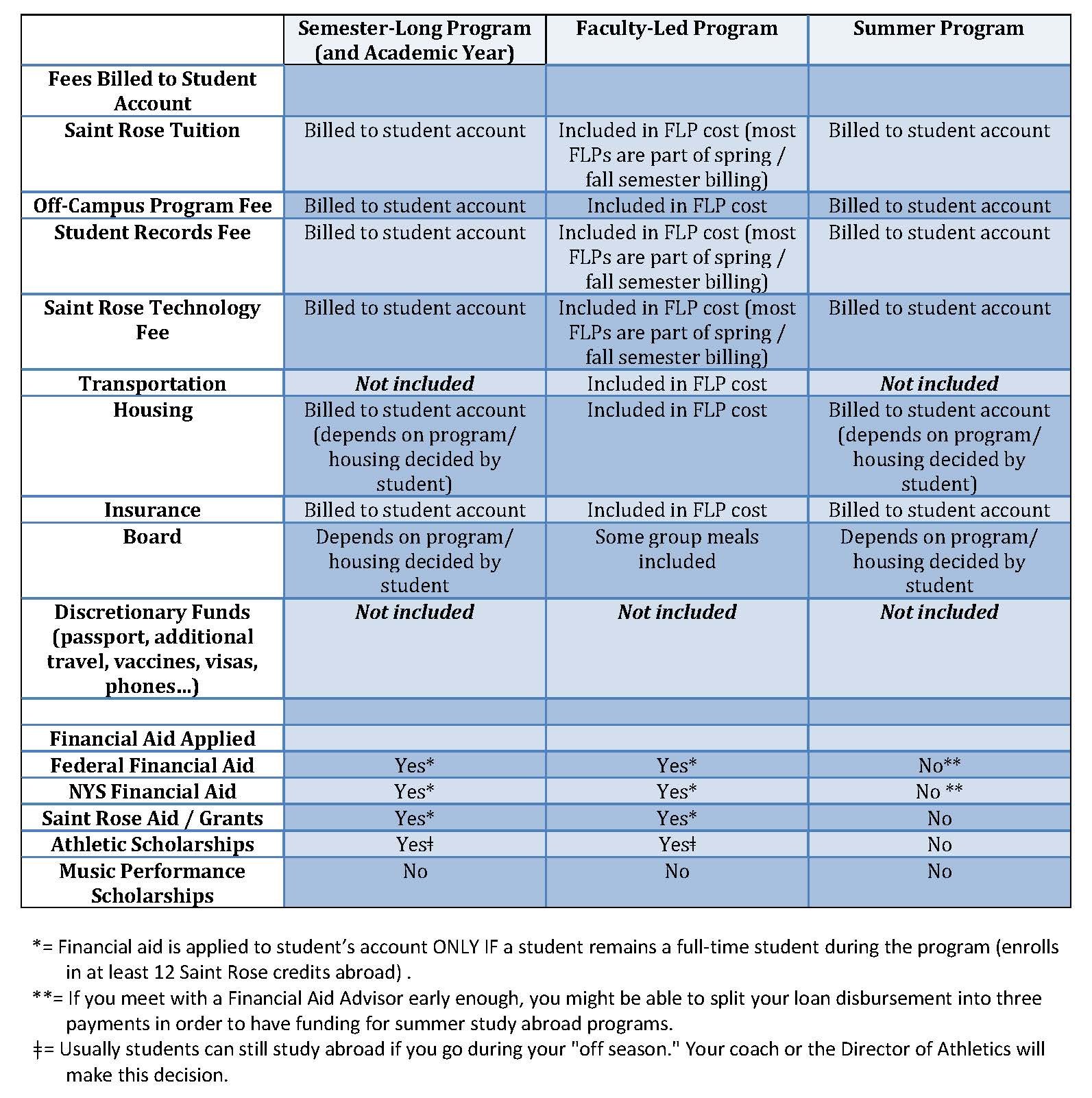

2.2 Home Equity Loan

A home equity loan allows you to borrow against the equity you’ve built in your home. It provides a lump sum of money that you can use to finance your renovation project. This option is suitable for homeowners who have a significant amount of equity and prefer a stable monthly payment.

2.3 Home Equity Line of Credit (HELOC)

Similar to a home equity loan, a HELOC allows you to borrow against your home’s equity. However, instead of receiving a lump sum, you’re provided with a line of credit that you can draw upon as needed. HELOCs offer flexibility, as you only pay interest on the amount you borrow.

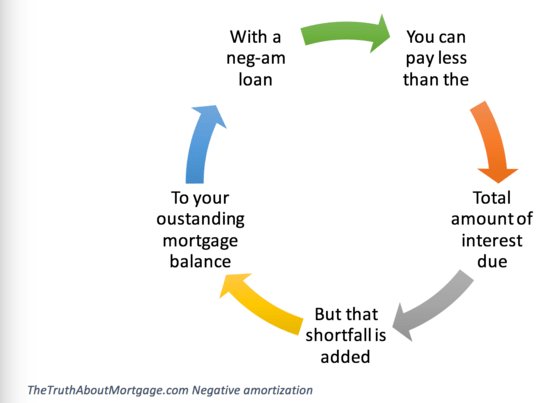

2.4 Cash-Out Refinancing

Cash-out refinancing involves replacing your existing mortgage with a new loan that has a higher balance. The difference between the old and new loan amount is given to you in cash, which can be used for your renovation project. This option is suitable if you have built substantial equity and want to take advantage of lower interest rates.

2.5 Personal Loan

If you don’t have substantial home equity or prefer not to use it as collateral, a personal loan can be a viable financing option. Personal loans are unsecured loans that can be used for various purposes, including home renovations. They typically have higher interest rates but offer a quicker and simpler application process.

3. Research Government Programs and Grants

In addition to conventional financing options, there are government programs and grants available that can help homeowners finance their renovation projects. These programs vary by location and eligibility criteria. It’s worth researching if you qualify for any of these opportunities to reduce your financial burden.

3.1 Federal Housing Administration (FHA) Loans

The Federal Housing Administration offers loans specifically designed for home improvements. FHA 203(k) loans provide financing for both the purchase and renovation of a home, while the Title I Property Improvement Loan Program focuses solely on renovation projects. These loans often have more lenient credit requirements.

3.2 Energy-Efficient Mortgage (EEM)

If you’re planning to incorporate energy-efficient upgrades into your renovation, an Energy-Efficient Mortgage can be a great option. EEMs provide additional funds for energy-saving improvements, such as insulation, solar panels, or energy-efficient appliances. These loans are insured by the FHA or VA and can help save on utility costs in the long run.

3.3 State and Local Government Grants

Many state and local governments offer grants to homeowners for various renovation purposes. These grants are typically based on income, location, and the nature of the renovation project. Research your local government’s website or contact your housing department to explore grant opportunities in your area.

4. Consider Alternative Financing Methods

If traditional financing options don’t suit your needs or circumstances, there are alternative methods worth exploring. These methods can provide additional flexibility and creative solutions for financing your home renovation project.

4.1 Credit Cards

Using credit cards for home renovations may not be the most cost-effective option due to high-interest rates. However, if you can pay off the balance within a short period, utilizing a credit card with a 0% introductory APR can provide temporary financing without incurring interest charges.

4.2 Contractor Financing

Some contractors offer their own financing options to homeowners. While convenient, it’s essential to thoroughly review the terms and interest rates associated with these programs. Compare them with other financing options to ensure you’re getting the best deal.

4.3 Crowdfunding

Crowdfunding has gained popularity as a means of financing various projects, including home renovations. Platforms like Kickstarter and GoFundMe allow you to create a campaign and seek financial contributions from friends, family, or even strangers. However, success is not guaranteed, and it requires effective storytelling and marketing to attract donors.

5. Manage Your Renovation Budget Effectively

Once you’ve secured financing, it’s crucial to manage your renovation budget effectively to ensure your funds are allocated wisely. Here are some tips to help you stay on track with your finances throughout the renovation process.

5.1 Obtain Multiple Quotes

Before hiring contractors or purchasing materials, obtain multiple quotes from different suppliers or service providers. This allows you to compare prices and choose the most cost-effective options without compromising quality.

5.2 Set Realistic Expectations

While it’s natural to want the best materials and finishes, setting realistic expectations can help you avoid overspending. Consider alternative options that still meet your desired aesthetic while staying within your budget.

5.3 Prioritize Essential Renovations

If your budget doesn’t cover all the renovations you initially planned, prioritize the essential ones that will have the most significant impact on your home’s functionality, safety, or value. You can always tackle cosmetic upgrades in the future when your budget allows.

5.4 DIY When Possible

If you have the necessary skills and experience, consider tackling some aspects of the renovation project yourself. DIY tasks can save you money on labor costs, but be realistic about your capabilities to avoid costly mistakes that may require professional intervention.

Financing a home renovation project requires careful planning and consideration of available options. By evaluating the project scope, exploring various financing methods, and managing your budget effectively, you can successfully finance and complete your renovation. Remember to research government programs, compare quotes, and set realistic expectations to ensure a smooth and financially sound renovation journey. With the right approach, you can turn your dream home into a reality.

Finance Home Renovations or Pay With Cash?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. What are some tips for financing a home renovation project?

Pursue these strategies to finance your home renovation project:

2. How can I determine the budget for my home renovation?

To determine your budget for a home renovation, consider factors such as your income, savings, and potential financing options.

3. What are the different financing options available for a home renovation?

Various financing options for home renovations include personal loans, home equity loans, home equity lines of credit (HELOCs), and refinancing your mortgage.

4. What factors should I consider when choosing a financing option?

Consider factors such as interest rates, repayment terms, fees, and your financial situation to choose the most suitable financing option for your home renovation.

5. How can I improve my credit score before financing a home renovation project?

To improve your credit score, make timely payments, reduce debt, keep credit card balances low, and avoid applying for new credit.

6. Is it better to save money or finance a home renovation project?

The decision to save money or finance a home renovation project depends on your financial situation, the urgency of the renovation, and the potential return on investment.

7. Can I use a home equity loan or line of credit for other purposes besides home renovation?

Yes, home equity loans or lines of credit can also be used for other purposes such as debt consolidation, education expenses, or medical bills.

8. How long does the financing process usually take for a home renovation?

The duration of the financing process for a home renovation varies depending on the chosen financing option and the individual circumstances. It can range from a few days to several weeks.

Final Thoughts

When it comes to financing a home renovation project, there are several tips to keep in mind. First and foremost, it’s important to carefully evaluate your budget and determine how much you can afford to spend. Additionally, exploring different financing options such as home equity loans or personal loans can provide flexibility and help you meet your financial goals. Researching and comparing interest rates and terms from multiple lenders can also enable you to find the best deal. Finally, considering the potential return on investment and prioritizing renovations that add value to your home can be a wise strategy. By following these tips for financing a home renovation project, you can ensure a smooth and successful process.