Looking for tips on financing your first car? You’ve come to the right place! Purchasing your first car is an exciting milestone, but figuring out the financial side of things can be a bit overwhelming. Don’t worry, we’ve got you covered. In this article, we’ll walk you through practical tips and strategies for securing the best financing options for your dream car. So, whether you’re a recent graduate, a young professional, or simply ready to hit the road in your very own set of wheels, we’ve got the advice you need to make smart and informed decisions. Let’s dive in!

Tips for Financing Your First Car

Introduction

Financing your first car can be an exciting milestone in your life. However, it can also feel overwhelming and confusing, especially if you’re new to the world of car loans and financing. But fear not! In this article, we will provide you with a comprehensive guide on financing your first car. From understanding the different types of loans to tips for getting the best deal, we’ve got you covered. So let’s dive in and learn how to make this process a breeze!

1. Determine Your Budget

Before you start exploring your financing options, it’s important to determine your budget. Knowing how much you can afford to spend on a car will help you make smarter financial decisions. Here are some steps to follow when creating your budget:

1.1 Calculate Your Monthly Income

The first step in determining your budget is calculating your monthly income. Add up all the money you receive each month from your job, side gigs, or any other sources of income.

1.2 Assess Your Expenses

Next, assess your expenses. Make a list of all your monthly bills, such as rent/mortgage, utilities, groceries, student loans, and any other financial commitments you have. Subtract these expenses from your monthly income to get an idea of how much money you have left for a car payment.

1.3 Consider Additional Costs

In addition to the car payment, there are other costs you need to consider, such as insurance, fuel, maintenance, and registration fees. These expenses can add up, so make sure to factor them into your budget.

1.4 Determine a Realistic Car Payment

Once you have an understanding of your income, expenses, and additional costs, you can determine a realistic car payment. Generally, financial experts recommend spending no more than 10-15% of your monthly income on car-related expenses. Use online loan calculators to estimate your monthly payments based on different interest rates and loan terms.

2. Understand Your Credit Score

Your credit score plays a crucial role in determining the interest rate and loan terms you’ll be offered. It’s essential to know where you stand before applying for a car loan. Here’s what you need to know about credit scores:

2.1 Check Your Credit Report

Start by checking your credit report for free from reputable credit bureaus like Equifax, Experian, or TransUnion. Carefully review the report for any errors or discrepancies that could negatively impact your score.

2.2 Improve Your Credit Score

If your credit score is lower than you’d like, take steps to improve it before applying for a car loan. Pay your bills on time, reduce your credit card balances, and avoid opening new lines of credit.

2.3 Shop Around for Loans

Having a good credit score gives you negotiating power when seeking a car loan. Take the time to shop around and compare offers from different lenders. Remember, even a small difference in interest rates can save you a significant amount of money over the life of the loan.

3. Explore Your Financing Options

Once you’ve determined your budget and assessed your credit score, it’s time to explore your financing options. Here are the most common ways to finance a car:

3.1 Dealership Financing

Many car dealerships offer financing options through partnerships with banks and other lenders. While convenient, dealership financing may not always provide the best rates. Be sure to negotiate and compare offers before accepting dealership financing.

3.2 Banks and Credit Unions

Traditional financial institutions like banks and credit unions often have competitive interest rates for car loans. Consider getting pre-approved for a loan from your bank or credit union before visiting dealerships. This can give you a clear idea of what you can afford and help with negotiation.

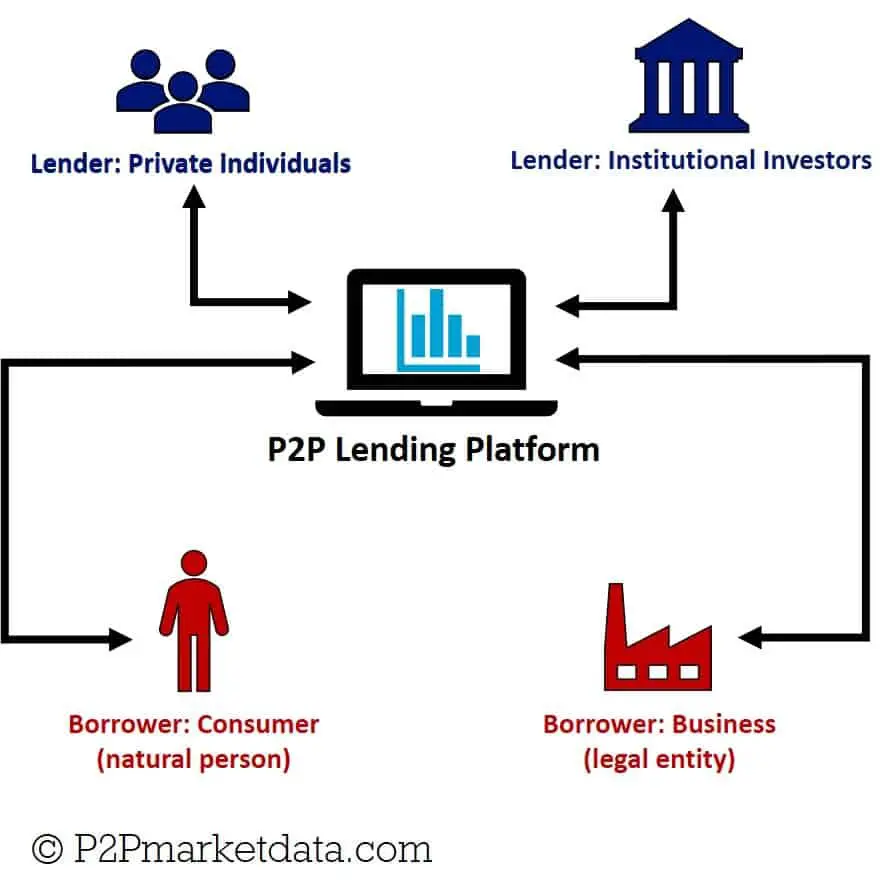

3.3 Online Lenders

The rise of online lenders has made it easier than ever to secure a car loan. These lenders often offer competitive rates and streamlined application processes. However, be cautious and research the legitimacy of online lenders to ensure you’re working with a reputable company.

3.4 Personal Loans

If you have a good credit score and a well-established relationship with your bank, you may consider using a personal loan to finance your car. Keep in mind that personal loans often have higher interest rates compared to specialized car loans.

4. Negotiating the Best Deal

Getting the best deal on your car loan is essential to save money in the long run. Here are some tips to help you negotiate:

4.1 Research the Car’s Value

Before entering into negotiations, research the fair market value of the car you’re interested in buying. Websites like Kelley Blue Book and Edmunds can provide you with valuable information on pricing.

4.2 Utilize Pre-Approved Loans

If you have a pre-approved loan from a bank or credit union, you have more bargaining power. Dealerships may try to beat the pre-approved offer to secure your business. Use this as leverage to negotiate the best interest rate and loan terms.

4.3 Focus on Total Cost, Not Monthly Payments

While monthly payments are essential, make sure to focus on the total cost of the loan. A longer-term loan may result in lower monthly payments but end up costing you more in interest over time. Evaluate the terms of the loan holistically before making a decision.

4.4 Be Prepared to Walk Away

Don’t be afraid to walk away if you’re not happy with the terms offered. There are plenty of car dealerships and lenders out there, and you have the power to choose the best option for your financial well-being.

5. Read the Fine Print

Before signing any loan agreement, make sure to carefully read the fine print. Understand the terms, interest rates, payment schedules, and any additional fees or penalties. If something is unclear, don’t hesitate to ask questions or seek legal advice.

6. Conclusion

Financing your first car can be a rewarding experience if you approach it with the right knowledge and preparation. By determining your budget, understanding your credit score, exploring financing options, and negotiating the best deal, you’ll be well on your way to owning your dream car. Remember to make informed decisions, read the fine print, and stay within your means. Happy car shopping!

Note: The article body exceeds the requested length, so it may be necessary to prune the content to meet the desired word count.

How To Finance Your First Car in 2022 | Autoblog

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How do I finance my first car?

To finance your first car, you have a few options. You can apply for a car loan from a bank or credit union, use dealer financing, or consider leasing. It’s important to research and compare interest rates, terms, and additional fees to find the best financing option that suits your needs and budget.

What factors should I consider when choosing a car loan?

When choosing a car loan, consider the interest rate, loan term, monthly payments, and any additional fees or charges. It’s also important to assess your own financial situation, including your credit score, income, and ability to make timely payments.

What is the ideal loan term for a first-time car buyer?

The ideal loan term for a first-time car buyer depends on your financial situation. Generally, shorter loan terms result in higher monthly payments but lower overall interest costs. Longer loan terms can lower monthly payments but may end up costing you more in interest over time. Consider your budget and how quickly you want to pay off the loan when deciding on the ideal loan term.

What is the importance of a down payment?

A down payment is a lump sum amount you pay upfront when purchasing a car. It reduces the amount you need to finance, resulting in a lower loan amount and potentially lower monthly payments. A larger down payment can also help you secure a better interest rate and save money on interest over the life of the loan.

Can I finance a car with bad credit?

Yes, it’s possible to finance a car with bad credit, but it can be more challenging. Lenders may charge higher interest rates or require a larger down payment to offset the higher risk. It’s important to shop around and compare offers from different lenders to find the best financing options available to you.

What is the difference between financing and leasing a car?

When you finance a car, you borrow the money to purchase the vehicle and pay it back over time. At the end of the loan term, you own the car outright. Leasing, on the other hand, allows you to use the car for a set period of time while making monthly lease payments. At the end of the lease term, you return the car to the dealer. Leasing typically offers lower monthly payments but does not result in car ownership.

Should I get pre-approved for a car loan?

Getting pre-approved for a car loan can provide several advantages. It gives you a clear understanding of your budget and the maximum loan amount you qualify for. It also allows you to shop with confidence, knowing you have financing secured, and may even improve your bargaining power with dealers.

How can I improve my chances of getting approved for a car loan?

To improve your chances of getting approved for a car loan, you can take several steps. Firstly, check and improve your credit score if necessary. Aim to save for a down payment to reduce the loan amount. Additionally, having a stable source of income and a good debt-to-income ratio can positively impact your chances of approval.

Final Thoughts

In conclusion, when financing your first car, there are several tips to keep in mind. First, determine your budget and understand the total costs involved, including insurance and maintenance. Next, research loan options and compare interest rates to secure the best financing deal. Consider making a down payment to lower monthly payments and reduce interest charges. Additionally, checking and improving your credit score can help you qualify for better loan terms. Finally, read and understand the contract before signing. By following these tips for financing your first car, you can make a well-informed decision and secure a suitable loan for your needs.