Do you want to stay ahead in the world of finance? Then look no further! In this blog article, we will provide you with valuable tips for identifying financial market trends. Understanding market trends is essential for making informed investment decisions and maximizing your returns. By keeping a keen eye on the market and analyzing key indicators, you can gain valuable insights into market trends and make smarter investment choices. So, let’s dive right in and explore the tips for identifying financial market trends that will help you navigate the complex world of finance with confidence.

Tips for Identifying Financial Market Trends

Financial market trends play a crucial role in shaping investment decisions and maximizing returns. Being able to identify and understand these trends is essential for individuals and businesses in the world of finance. In this article, we will explore a range of tips and strategies that can help you effectively identify financial market trends and make informed investment choices. From conducting thorough research and analysis to staying informed about the latest news and developments, these tips will empower you to navigate the complex world of finance with confidence.

The Importance of Identifying Financial Market Trends

Before diving into the tips, let’s first understand why it is important to identify financial market trends. Here are a few key reasons:

1. Decision-making: Identifying market trends allows investors to make well-informed investment decisions. It helps in selecting investment opportunities that align with the prevailing market sentiments, reducing the risk of potential losses.

2. Risk management: Recognizing market trends helps in assessing the level of risk associated with different investment options. By identifying potential downturns or upswings, investors can adjust their strategies to mitigate risk and maximize returns.

3. Timing: Understanding market trends enables investors to optimize their entry and exit points in the market. By accurately spotting trends, investors can buy at low points and sell at high points, maximizing their profits.

4. Competitive advantage: Recognizing trends early can provide a competitive advantage by allowing investors to take positions ahead of the crowd. This can result in higher returns and better portfolio performance.

1. Conduct Thorough Research and Analysis

To identify financial market trends, you need to gather comprehensive data and perform thorough analysis. Here are some steps to guide you:

a) Analyze Historical Data:

Reviewing historical market data provides insights into past trends and patterns. Look for recurring patterns, such as seasonal trends or cyclical fluctuations, that can offer valuable information about future market movements.

b) Utilize Technical Analysis:

Technical analysis involves studying historical price charts, patterns, and indicators to predict future price movements. Common tools used in technical analysis include moving averages, trendlines, and oscillators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD).

c) Fundamental Analysis:

Fundamental analysis focuses on understanding the intrinsic value of an asset by analyzing economic factors, financial statements, industry trends, and company performance. This approach helps identify undervalued or overvalued assets and can uncover long-term trends.

d) Keep an Eye on Market Indicators:

Tracking market indicators such as interest rates, inflation rates, and employment data can provide valuable insights into the overall health of the economy. Changes in these indicators often precede shifts in market trends.

2. Stay Informed About News and Developments

Staying up-to-date with the latest news and developments is crucial for identifying financial market trends. Here’s how you can do it effectively:

a) Follow Financial News Outlets:

Subscribe to reputable financial news outlets and follow them on social media platforms. This will ensure you receive timely updates on market movements, economic indicators, and relevant news that might impact financial markets.

b) Monitor Company Earnings Reports:

Keep a close eye on earnings reports of companies in which you have an interest. Positive or negative surprises in earnings can significantly impact stock prices and indicate emerging trends.

c) Attend Industry Conferences and Webinars:

Participating in industry conferences and webinars allows you to gain insights from industry experts, network with professionals, and stay informed about the latest trends and developments in specific sectors.

d) Join Online Financial Communities:

Engaging in online financial communities and forums can provide access to diverse perspectives and insights. Interacting with experienced investors and professionals can help you better understand and identify emerging market trends.

3. Utilize Data Visualization Techniques

Data visualization techniques can help make complex market data more accessible and comprehensible. Consider the following approaches:

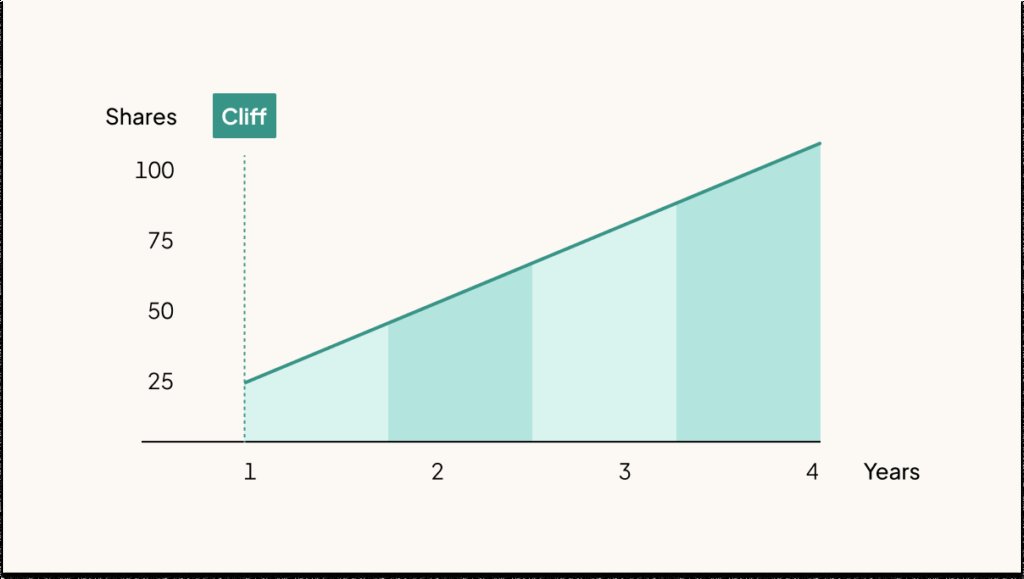

a) Use Charts and Graphs:

Representing market data visually through charts and graphs can help identify trends at a glance. Line charts, candlestick charts, and bar charts are commonly used to visualize price movements and patterns.

b) Employ Moving Averages:

Moving averages smooth out price fluctuations and provide a clearer picture of a trend’s direction. Plotting different moving averages (e.g., 50-day and 200-day moving averages) on a chart can help identify long-term trends.

c) Implement Heat Maps:

Heat maps depict data using color gradients, making it easier to identify patterns and trends. They can be particularly useful in analyzing the performance of a group of assets or sectors.

d) Explore Quantitative Models:

Utilize quantitative models like regression analysis or machine learning algorithms to identify patterns and forecast market trends based on historical data. These models can help uncover hidden relationships and predict future market movements.

4. Monitor Social Media and Sentiment Analysis

In the digital age, social media platforms play a significant role in shaping market trends. Consider the following strategies:

a) Track Financial Influencers:

Follow influential figures in the financial industry on social media platforms. Analyze their insights, predictions, and sentiment to gauge the market’s direction.

b) Utilize Sentiment Analysis Tools:

Sentiment analysis tools monitor social media channels and news platforms to gauge public sentiment towards specific stocks, sectors, or markets. This can provide valuable insights into emerging market trends and investor sentiment.

c) Join Financial Communities and Forums:

Participating in financial communities and forums on social media platforms can provide access to real-time discussions about market trends. Engaging in conversations with like-minded individuals can help uncover valuable insights.

5. Use Diversification as a Risk Management Strategy

Diversification is a risk management strategy that involves spreading investments across different asset classes, sectors, and regions. Consider the following diversification tips:

a) Invest in Different Asset Classes:

Spread your investments across a mix of asset classes such as stocks, bonds, real estate, and commodities. Each asset class may respond differently to market trends, reducing the impact of any single trend on your overall portfolio.

b) Explore International Markets:

Investing in international markets can provide exposure to different economic cycles and reduce the risk of being overly reliant on a single market’s trends.

c) Sector Diversification:

Allocate your investments across various sectors to minimize the impact of industry-specific trends and mitigate risk. Sector rotation strategies involve adjusting your portfolio based on the relative strength of different sectors.

d) Regularly Rebalance Your Portfolio:

Review and rebalance your portfolio periodically to ensure it remains aligned with your risk tolerance and investment goals. This involves selling overperforming assets and reinvesting the proceeds into underperforming assets to maintain diversification.

In Conclusion

Identifying financial market trends is both an art and a science. It requires a combination of research, analysis, staying informed, and utilizing various tools and techniques. By following the tips outlined in this article, you can enhance your ability to identify market trends and make informed investment decisions. Remember, no single strategy guarantees success, and it is essential to adapt your approach based on changing market conditions. Continuously educating yourself and staying vigilant will help you navigate the ever-changing landscape of financial markets with confidence.

How To Identify Trends in Markets (Never Guess Again)

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. How can I identify financial market trends?

To identify financial market trends, it is important to analyze various indicators such as price movements, trading volume, and market sentiment. Additionally, keeping track of news and economic data that can impact the market can help in identifying trends.

2. What are some common indicators to look for when identifying market trends?

Some common indicators to look for when identifying market trends include moving averages, relative strength index (RSI), MACD, Bollinger Bands, and Fibonacci retracements. These indicators can provide insights into the direction and strength of the trend.

3. How can I use technical analysis to identify financial market trends?

Technical analysis involves studying historical price and volume data to predict future market trends. By analyzing chart patterns, trendlines, and support/resistance levels, traders can identify potential market trends and make informed trading decisions.

4. Is fundamental analysis important in identifying financial market trends?

Yes, fundamental analysis is important in identifying financial market trends. By analyzing economic indicators, company financials, and market news, traders can understand the underlying factors driving market trends and make more accurate predictions.

5. Are there any specific patterns or formations to look for when identifying market trends?

Yes, there are several patterns and formations that can indicate market trends, such as ascending/descending triangles, double tops/bottoms, head and shoulders patterns, and flag patterns. These patterns can provide insights into potential trend reversals or continuations.

6. How can I stay updated with market news and economic data?

You can stay updated with market news and economic data by following financial news websites, subscribing to newsletters, and setting up alerts for important economic indicators. Additionally, many trading platforms offer real-time news feeds and economic calendars.

7. Should I rely solely on technical analysis or combine it with fundamental analysis when identifying market trends?

It is often beneficial to combine both technical and fundamental analysis when identifying market trends. While technical analysis focuses on price and volume patterns, fundamental analysis provides insights into the underlying drivers of market trends. By considering both aspects, traders can make more informed trading decisions.

8. Are there any risks involved in identifying and trading based on market trends?

Yes, there are risks involved in identifying and trading based on market trends. Market trends are not guaranteed and can change unexpectedly. It is important to use proper risk management techniques, such as setting stop-loss orders and diversifying your portfolio, to mitigate potential losses.

Final Thoughts

Identifying financial market trends can be crucial for making informed investment decisions. By keeping an eye on market indicators and analyzing historical data, investors can gain valuable insights into potential opportunities and risks. Additionally, staying updated with relevant news and economic factors can aid in recognizing emerging trends. Implementing technical analysis techniques, such as studying charts and using indicators, can also provide valuable information. Finally, leveraging the power of technology and utilizing advanced tools can further enhance the accuracy and efficiency of trend identification. Remember, mastering the art of identifying financial market trends is an ongoing process that requires continuous research, analysis, and adaptability.