Are you looking for effective strategies to improve financial literacy among today’s youth? Look no further! In this article, we will provide you with practical tips for equipping young individuals with the skills and knowledge they need to make sound financial decisions. By empowering the younger generation to understand budgeting, saving, investing, and financial planning, we can set them on a path to a more secure and prosperous future. So, let’s dive right into these valuable insights on enhancing financial literacy among youth.

Tips for Improving Financial Literacy Among Youth

Introduction

In today’s ever-changing and complex financial landscape, it is crucial for youth to develop strong financial literacy skills. By understanding the concepts of budgeting, saving, investing, and managing debt, young individuals can set themselves up for a future of financial success and independence. This article aims to provide valuable tips and guidance on how to improve financial literacy among youth, empowering them to make informed decisions regarding their money.

The Importance of Financial Literacy for Youth

Why is financial literacy important for young individuals?

Having a solid foundation in financial literacy is crucial for young individuals as it provides them with the necessary knowledge and skills to navigate the financial challenges of adulthood. Here are some reasons highlighting the importance of financial literacy for youth:

1. Empowerment: Financial literacy empowers young individuals to take control of their financial future. With knowledge about basic financial concepts, they can make informed decisions about saving, investing, and spending.

2. Building Wealth: By understanding the importance of saving and investing, young individuals can start building wealth early in life. This financial security eliminates the stress of living paycheck to paycheck and provides opportunities for future financial growth.

3. Debt Management: With financial literacy, youth can make informed decisions about managing debt and avoiding unnecessary financial burdens. Understanding interest rates, credit scores, and borrowing responsibly helps them avoid falling into debt traps.

4. Financial Goal Setting: Financial literacy equips young individuals with the tools to set and achieve financial goals. Whether it’s saving for college, starting a business, or buying a home, they can plan effectively and make informed decisions to reach these goals.

5. Financial Independence: Teaching financial literacy to youth encourages independence and self-sufficiency. It equips them with skills to make their own financial decisions, reducing dependence on others for financial support.

Challenges to Financial Literacy Among Youth

While the importance of financial literacy for youth is evident, several challenges hinder their ability to develop these important skills. Some of the common challenges include:

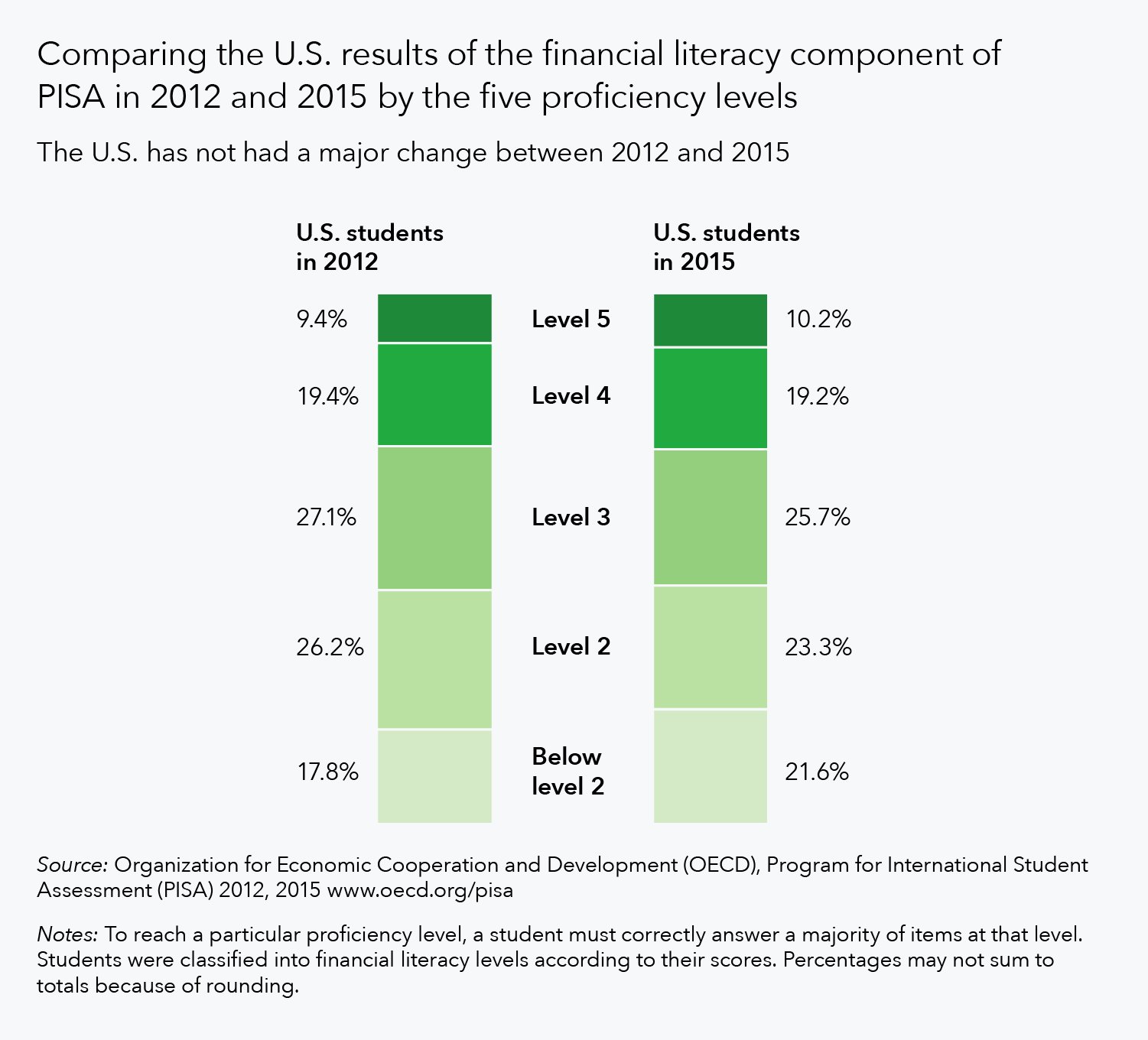

1. Lack of Education: Financial literacy is not adequately taught in schools, leaving many young individuals without a solid foundation in personal finance.

2. Peer Pressure and Consumer Culture: The influence of peer pressure and consumer culture can lead young individuals to engage in impulsive spending and unhealthy financial habits.

3. Complex Financial Products: The financial industry offers a wide range of complex products and services. Without proper education and guidance, youth may struggle to understand the implications and make sound financial decisions.

Tips for Improving Financial Literacy Among Youth

1. Start Early

One of the most effective ways to improve financial literacy among youth is to start early. Introduce basic financial concepts and skills at an early age, tailoring the education to their developmental level. Here are some strategies:

- Teach them the value of money and the importance of saving from a young age.

- Introduce the concept of budgeting by giving them an allowance and encouraging them to allocate it wisely.

- Play educational games that involve money, such as Monopoly or online financial literacy games.

2. Incorporate Financial Education in School Curricula

To address the lack of financial education in schools, advocate for the inclusion of personal finance courses in the curriculum. Financial education should cover topics such as budgeting, saving, investing, credit management, and basic economic principles. By incorporating financial education early on, students can develop a strong foundation in financial literacy.

3. Engage Parents and Guardians

Parents and guardians play a crucial role in shaping the financial habits of youth. Here are some ways they can support the development of financial literacy:

- Lead by example: Demonstrate responsible financial behavior, such as budgeting, saving, and investing.

- Involve youth in financial discussions: Engage them in conversations about household finances and explain financial decisions.

- Encourage savings: Help children open a savings account and teach them the importance of setting aside money regularly.

- Empower them with financial responsibility: Give youth opportunities to manage their own money, such as paying for their expenses or saving for a desired purchase.

4. Utilize Technology

Harness the power of technology to engage youth in learning about finance. Here are some ways technology can aid in improving financial literacy:

- Mobile apps: Many apps offer financial literacy resources, budgeting tools, and even virtual banking experiences tailored for youth.

- Online courses and videos: Accessible online courses and videos can provide interactive and engaging financial education.

- Financial literacy games: Engage youth in educational games focused on personal finance, making learning enjoyable and interactive.

5. Promote Savings and Investing

Encourage youth to develop a habit of saving and investing early on. Here are some strategies to promote savings and investing:

- Set up a savings account: Help youth open a savings account and teach them about compound interest and the benefits of long-term savings.

- Introduce investing: Teach them about different investment options, such as stocks, bonds, and mutual funds, emphasizing the importance of diversification and long-term growth.

- Encourage goal-based savings: Help youth set financial goals and track their progress. This can include saving for a new gadget, college tuition, or a future business.

6. Volunteer Programs and Community Initiatives

Engage youth in volunteer programs and community initiatives that focus on financial literacy. Join or support organizations that offer financial literacy workshops, mentorship programs, or entrepreneurship camps. These experiences provide hands-on learning and valuable exposure to real-world financial situations.

7. Use Real-Life Examples

Make financial literacy relatable by using real-life examples that resonate with youth. Illustrate the importance of budgeting using examples from their daily lives, such as saving for a desired toy or planning a fun outing with friends. This approach helps them understand the practical application of financial concepts.

8. Teach Responsible Borrowing

Address the concept of borrowing responsibly to prevent young individuals from falling into debt traps. Explain the importance of credit scores, borrowing limits, and interest rates. Teach them how to evaluate loan terms, avoid unnecessary debt, and use credit responsibly.

9. Foster Entrepreneurial Skills

Encourage youth to develop entrepreneurial skills and explore ways to earn money beyond traditional employment. Teach them about starting a small business, freelancing, or selling products online. This entrepreneurial mindset can shape their financial independence and encourage critical thinking about money.

10. Continuous Learning and Mentoring

Financial literacy is a lifelong journey, and the learning process should never stop. Encourage youth to continue expanding their financial knowledge through reading books, attending workshops, and seeking mentoring relationships with financial experts or successful individuals. Ongoing learning ensures they stay informed about changing financial landscapes and opportunities.

Improving financial literacy among youth is essential for their future financial well-being. By implementing the tips outlined in this article, such as starting early, incorporating financial education in school curricula, involving parents and guardians, utilizing technology, and promoting savings and investing, young individuals can develop the necessary skills to make informed financial decisions. Financial literacy empowers youth to take control of their financial future and sets them on a path towards financial independence and success.

Financial Education | The 4 Rules Of Being Financially Literate

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. What are some effective tips for improving financial literacy among youth?

Understanding the importance of financial literacy is crucial for today’s youth. Here are some practical tips to enhance their financial knowledge and skills:

2. How can I encourage young people to develop good money management habits?

To instill good money management habits in young people, it’s important to lead by example and provide opportunities for hands-on experience. Encourage them to set goals, budget their expenses, and save regularly.

3. Are there any specific resources or tools available to teach financial literacy to youth?

Yes, there are various resources and tools available to teach financial literacy to youth. Some examples include online courses, mobile apps, interactive games, and workshops conducted by financial institutions or organizations.

4. What role can schools play in improving financial literacy among students?

Schools can play a significant role in improving financial literacy among students. By integrating personal finance education into the curriculum, introducing practical activities, and inviting guest speakers, schools can provide a foundation for financial knowledge.

5. How can parents and guardians contribute to the financial education of their children?

Parents and guardians can contribute to their children’s financial education by discussing money-related topics, involving them in family financial decisions, and encouraging savings habits. Providing opportunities for part-time jobs or entrepreneurial endeavors can also enhance their understanding of financial responsibility.

6. Are there any community programs or organizations dedicated to improving financial literacy among youth?

Yes, there are numerous community programs and organizations dedicated to improving financial literacy among youth. These programs often offer workshops, mentorship opportunities, and resources tailored to different age groups.

7. How can I help young people understand the concepts of debt and credit responsibly?

Avoiding excessive debt and understanding responsible credit usage are crucial aspects of financial literacy. To help young people grasp these concepts, explain the differences between good and bad debt, discuss interest rates and credit scores, and emphasize the importance of making timely payments.

8. Why is it important for youth to learn about investing and saving for the future?

Learning about investing and saving for the future empowers youth to secure their financial well-being. It helps them understand concepts such as compound interest, long-term financial goals, and the potential benefits of starting early. This knowledge prepares them to make informed decisions regarding investments and retirement planning.

Final Thoughts

In conclusion, improving financial literacy among youth is crucial for their future success. To achieve this, one tip is to start early by teaching basic financial concepts at home and in school. Another tip is to encourage practical experience, such as through part-time jobs or internships, to help young people develop real-world money management skills. Additionally, incorporating financial education into the curriculum and providing accessible resources, like online courses or workshops, can empower youth to make informed financial decisions. By implementing these strategies and emphasizing the importance of financial literacy, we can equip young individuals with the knowledge and skills they need to navigate and thrive in the complex financial landscape. Overall, it is essential to prioritize and invest in initiatives that promote financial literacy among youth.