Looking for tips on investing in utility stocks? You’ve come to the right place! Utility stocks can be a great addition to any investment portfolio, offering stability and steady returns. In this article, we’ll delve into some valuable strategies to help you make smarter investment decisions in the utility sector. Whether you’re a seasoned investor or just starting out, these tips will provide actionable insights to enhance your financial success. So, let’s get started on mastering the art of investing in utility stocks!

Tips for Investing in Utility Stocks

Investing in utility stocks can be a smart move for investors looking for stability and consistent returns. Utility companies are known for their steady cash flow and reliable dividends, making them attractive options for long-term investors. However, it’s important to approach utility stock investing with careful consideration and a well-informed strategy. In this article, we will explore some valuable tips to help you make informed decisions when investing in utility stocks.

1. Understand the Utility Sector

Before diving into utility stock investing, it’s crucial to have a solid understanding of the utility sector. Utilities are essential service providers that supply electricity, natural gas, and water to consumers and businesses. They operate in regulated markets, which means their rates and profitability are subject to government oversight. Understanding the regulatory environment, industry dynamics, and key players in the utility sector will give you a strong foundation for making investment decisions.

2. Evaluate Regulatory Environment

The regulatory environment plays a significant role in the utility sector. Regulators determine the rates utilities can charge, approve capital investment plans, and oversee the industry’s overall operations. When investing in utility stocks, it’s essential to evaluate the regulatory environment in the regions where the companies operate. Look for states or countries with favorable regulatory frameworks that promote fair returns on investments. This information can usually be found in annual reports, regulatory filings, or through discussions with industry experts.

3. Assess Financial Health

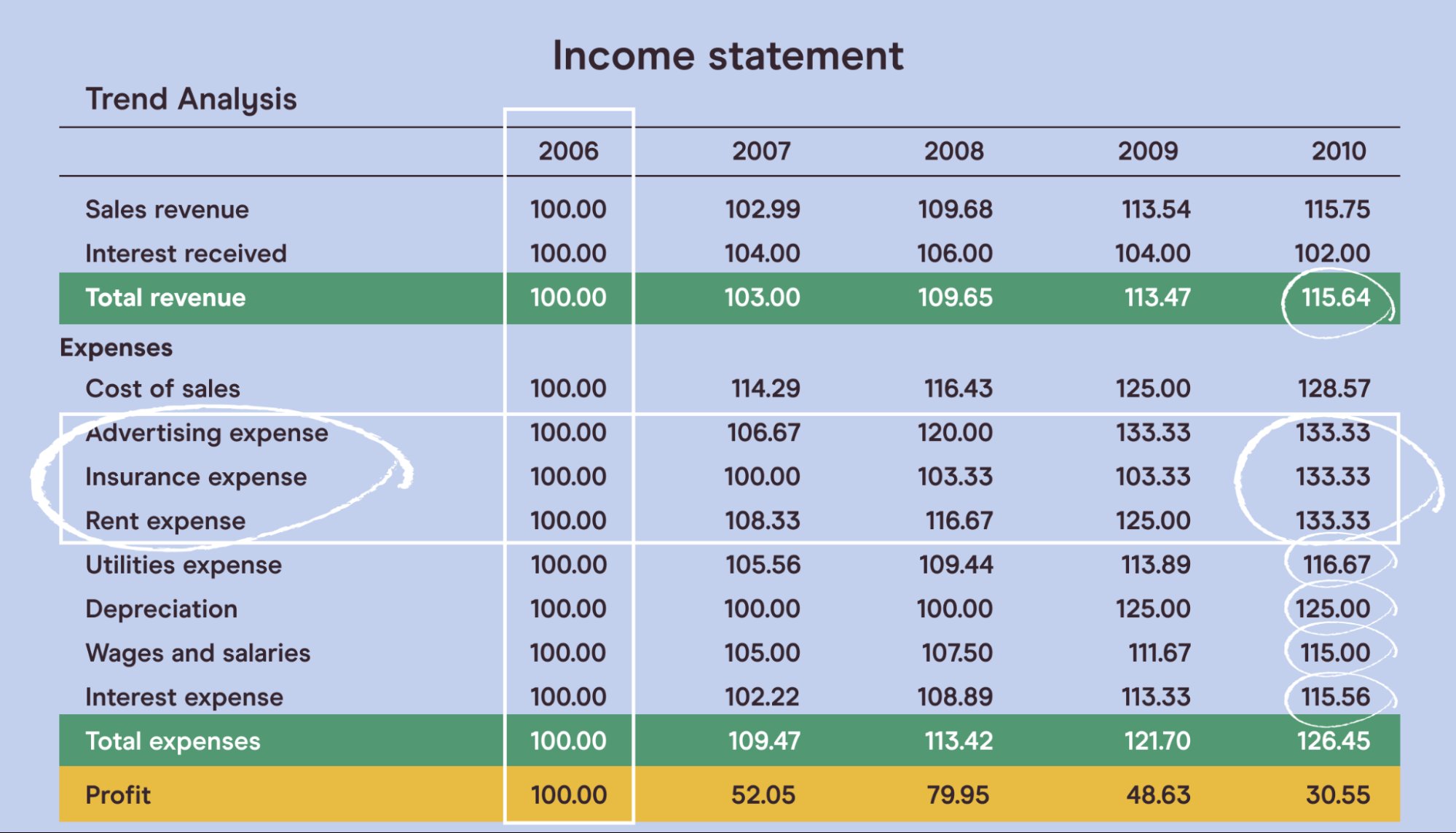

Examining the financial health of utility companies is crucial when considering an investment. Start by analyzing the company’s balance sheet, income statement, and cash flow statement. Look for indicators of financial stability, such as consistent revenue growth, strong operating margins, manageable debt levels, and solid cash flow generation. Additionally, assess the company’s credit rating to gauge its ability to access capital markets at favorable rates.

4. Consider Dividend History and Yield

One of the key attractions of utility stocks is their ability to generate consistent income through dividends. When evaluating utility companies, consider their dividend history and yield. Look for companies that have a track record of increasing dividends over time. A higher dividend yield indicates a higher income potential for investors. However, it’s important to strike a balance between high yield and sustainable dividend payouts, ensuring the company has enough funds to support its dividend program.

5. Analyze Growth Opportunities

While utility stocks are generally considered stable investments, it’s still essential to analyze the growth opportunities available to the company. Look for utilities that are expanding their operations, entering new markets, or investing in renewable energy sources. These factors can contribute to long-term growth and may increase the value of your investment over time. Stay updated on industry trends and news to identify utility companies with growth potential.

6. Diversify Your Portfolio

As with any investment strategy, diversification is key. Don’t put all your eggs in one basket by solely investing in utility stocks. Consider building a well-diversified portfolio that includes stocks from various sectors and asset classes. Diversification helps mitigate risk and smoothens overall portfolio performance. By spreading your investments across different industries and assets, you reduce the impact of any single investment’s performance on your overall portfolio.

7. Monitor Interest Rates

Interest rates can have a significant impact on utility stocks. As interest rates rise, the appeal of utility stocks as income-generating assets can decline. This is because higher interest rates make alternative fixed-income investments more attractive, potentially leading investors to move away from utility stocks. Stay informed about changes in interest rates and assess their potential impact on your utility stock investments.

8. Stay Informed and Monitor Performance

To successfully invest in utility stocks, it’s crucial to stay informed about the industry and monitor the performance of your investments. Keep up with industry news, regulatory developments, and company-specific updates. Regularly review the performance of your utility stocks and assess whether they align with your investment objectives. Consider using online tools or working with a financial advisor to track and analyze your portfolio.

In conclusion, investing in utility stocks can be a wise choice for those seeking stability and consistent returns. By understanding the utility sector, evaluating the regulatory environment, assessing financial health, considering dividend history and yield, analyzing growth opportunities, diversifying your portfolio, monitoring interest rates, and staying informed, you can make well-informed investment decisions. Remember, investing always carries some level of risk, so it’s essential to conduct thorough research and consult with professionals before making any investment decisions.

How to invest in Utilities around the world!

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are utility stocks and why should I consider investing in them?

Utility stocks represent shares in companies that provide essential services such as electricity, gas, or water. Investing in utility stocks can be attractive for investors seeking stable and consistent returns. These companies typically have established market positions and generate steady cash flows, making them a relatively safe investment option.

What are the key factors to consider when investing in utility stocks?

When investing in utility stocks, it is important to evaluate factors such as the company’s financial health, regulatory environment, dividend history, and growth prospects. Additionally, understanding the utility industry’s specific dynamics, such as demand patterns and regulatory changes, can help you make informed investment decisions.

Are utility stocks suitable for long-term investments?

Yes, utility stocks are often considered suitable for long-term investments. Their stable cash flow generation, dividend payments, and relatively low volatility can make them suitable for investors looking to build a long-term portfolio. However, it is essential to conduct thorough research and evaluate the specific factors that influence each utility company’s long-term prospects.

How can I assess the financial health of a utility company?

To assess the financial health of a utility company, you can examine key financial indicators such as revenue growth, profit margins, debt levels, and cash flow stability. Additionally, analyzing the company’s credit ratings and regulatory filings can provide valuable insights into its financial position and overall stability.

What role does regulation play in the utility industry?

Regulation plays a significant role in the utility industry. Government regulatory bodies often control pricing, infrastructure investments, and quality of service for utility companies. Understanding the regulatory environment and how it affects the profitability and growth potential of the utility stocks you are considering can help you make informed investment decisions.

Do utility stocks pay dividends, and what should I consider when evaluating them?

Yes, utility stocks are known for their consistent dividend payments. When evaluating utility stocks for their dividends, consider factors such as dividend yield, payout ratio, dividend history, and the company’s ability to sustain dividend payments. It is important to assess the company’s financial health and cash flow stability to ensure the sustainability of the dividend.

What risks are associated with investing in utility stocks?

While utility stocks are generally considered less risky compared to other sectors, they still face certain risks. Some common risks include interest rate fluctuations, regulatory changes, environmental regulations, and potential shifts in consumer demand patterns. It is important to evaluate these risks and assess how they may impact the financial performance of the utility companies you are considering for investment.

How can I diversify my utility stock portfolio?

Diversifying your utility stock portfolio involves investing in a range of utility companies across different geographical areas or focusing on specific segments of the utility industry. By diversifying, you can mitigate the risks associated with investing in a single company or segment and increase the potential for overall portfolio stability and growth.

Final Thoughts

In summary, when it comes to investing in utility stocks, there are several key tips to keep in mind. First, consider the stability and track record of the utility company you are interested in. Look for established companies with a strong history of consistent performance. Additionally, pay attention to the regulatory environment and any potential risks or uncertainties that could impact the industry. Diversification is also crucial, as it helps mitigate risk and allows for a balanced portfolio. Finally, stay informed and regularly monitor your investments to ensure they align with your long-term financial goals. By following these tips for investing in utility stocks, you can make informed decisions and potentially achieve solid returns.