Are you feeling overwhelmed by the financial challenges that often accompany a mid-life crisis? Worry not, for we have some valuable tips to help you manage your finances during this transitional phase. It’s natural to experience a wave of emotions during this time, but by taking charge of your financial situation, you can gain a sense of control and steer your way towards a more stable future. Let’s delve into some practical strategies and effective techniques for managing finances during a mid-life crisis, so that you can navigate this period with confidence and clarity.

Tips for Managing Finances During a Mid-Life Crisis

Understanding the Mid-Life Crisis

Before we delve into tips for managing finances during a mid-life crisis, let’s first understand what a mid-life crisis is. It is a period of self-reflection and assessment that often occurs in middle-aged individuals, typically between the ages of 40 and 60. During this phase, individuals may experience feelings of dissatisfaction, restlessness, and a desire for change. While it can manifest differently for each person, it often involves questioning one’s life choices, goals, and overall happiness.

For many, this stage can also coincide with significant financial challenges. As you navigate through this mid-life crisis, it becomes crucial to take control of your finances and make smart decisions to secure your financial future. Here are some tips to help you manage your finances effectively during this period:

Evaluate Your Financial Situation

Assessing your current financial standing is an essential first step in managing your finances during a mid-life crisis. Take the time to gather all your financial documents, such as bank statements, investment portfolios, and debts. This evaluation will provide you with a clear picture of your assets, liabilities, and overall financial health.

Here are some key factors to consider during your evaluation:

- Income: Determine your current income sources and evaluate if they are sufficient to meet your financial obligations and goals.

- Expenses: Review your monthly expenses and identify areas where you can cut back or make adjustments to align with your financial priorities.

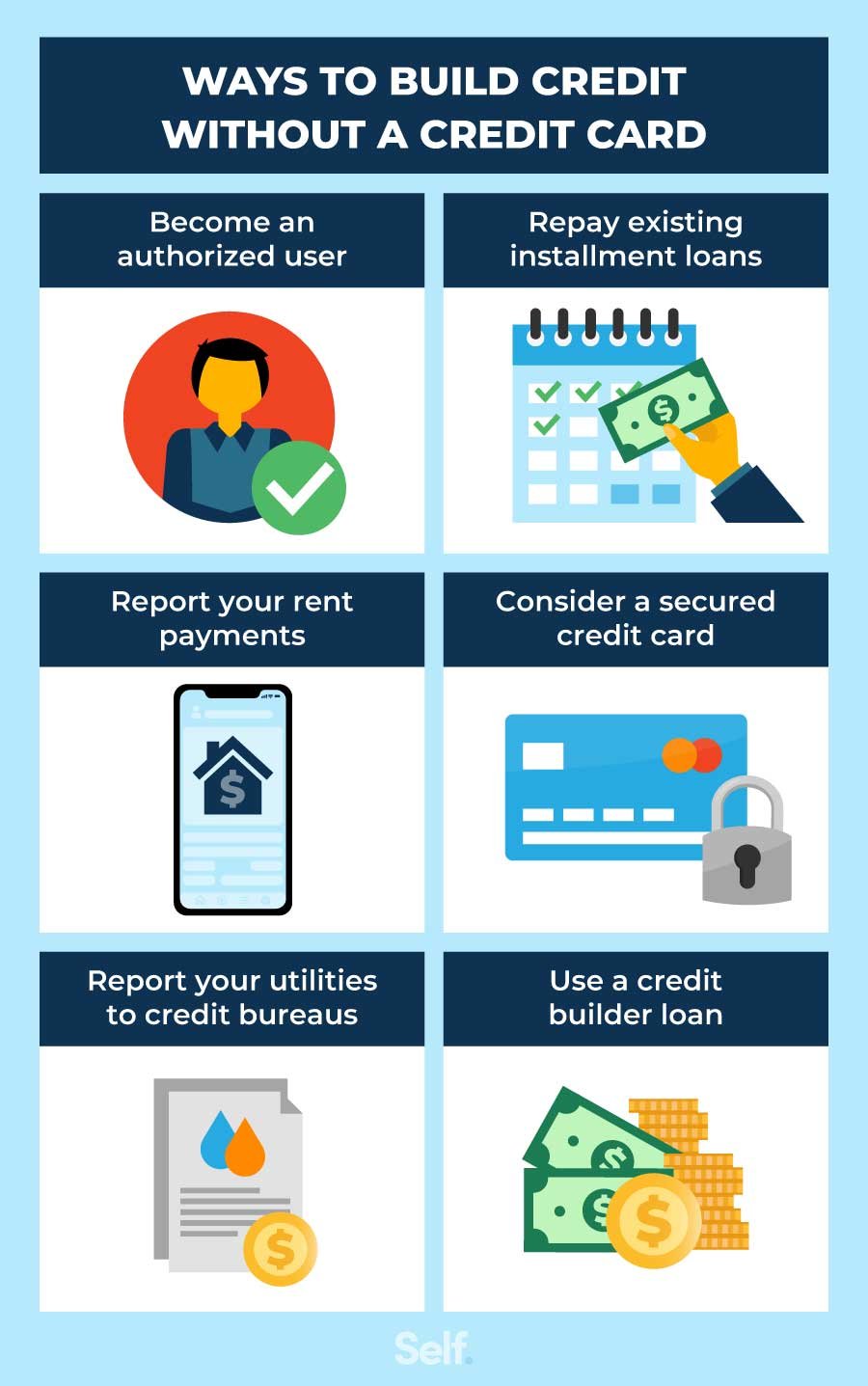

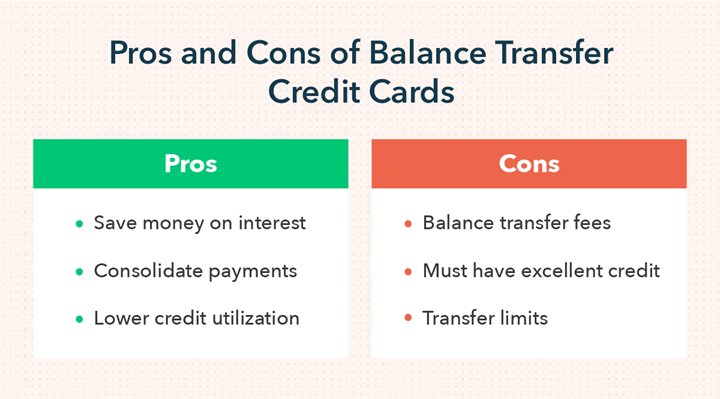

- Debts: Take stock of your outstanding debts, such as mortgages, credit cards, and loans. Develop a plan to manage and pay off these debts effectively.

- Savings: Evaluate your savings and emergency funds. Are they adequate to support you during unexpected financial hardships or career transitions?

- Investments: Assess the performance of your investments and make any necessary adjustments to align them with your long-term financial goals.

Reassess Your Financial Goals

A mid-life crisis often prompts individuals to reevaluate their life goals. Alongside these personal goals, it’s crucial to reassess your financial goals as well. Ask yourself what you want to achieve in the coming years and how your finances can support those aspirations.

Here are some financial goals to consider during a mid-life crisis:

- Retirement Planning: Determine whether your current retirement savings are on track to provide the lifestyle you desire after leaving the workforce. Consider consulting with a financial advisor to optimize your retirement planning strategy.

- Debt Reduction: If you have accumulated significant debts, make it a priority to devise a plan for reducing and eliminating them. This will provide financial relief and free up resources for other goals.

- Emergency Fund: Building or replenishing your emergency fund becomes crucial during this phase. Aim to have at least six to twelve months’ worth of living expenses saved in case of unexpected events like job loss or medical emergencies.

- Education and Career Development: Invest in your personal and professional growth by setting aside funds for further education or career development opportunities. This can help you adapt to the changing job market and increase your earning potential.

- Legacy Planning: Consider estate planning and the creation of a will or trust to ensure that your assets are distributed according to your wishes, and your loved ones are taken care of in the future.

Create a Budget

Once you have evaluated your financial situation and established your goals, creating a budget is essential to manage your finances effectively during a mid-life crisis. A budget helps you track your income and expenses, ensuring that your spending aligns with your priorities.

Here’s how to create an effective budget:

- List Your Income: Start by documenting all sources of income, including salaries, rental income, or dividends.

- Track Your Expenses: Closely monitor your expenses for a month or two to understand where your money is going. Categorize your expenses into essential and discretionary to identify areas where you can reduce spending.

- Set Financial Priorities: Allocate your income towards your financial goals and prioritize saving and debt repayment. Ensure that your budget reflects your reassessed goals and aligns with your long-term financial plan.

- Trim Unnecessary Expenses: Identify expenses that are not contributing to your overall well-being or financial goals. Cut back on discretionary spending like dining out, entertainment, or luxury purchases.

- Automate Savings: Set up automatic transfers to your savings and investment accounts. This ensures that a portion of your income is consistently allocated towards your future financial security.

- Regularly Review and Adjust: Review your budget regularly to track your progress and make any necessary adjustments. Life circumstances and financial goals may change, requiring modifications to your budget.

Seek Professional Financial Advice

During a mid-life crisis, seeking professional financial advice can be valuable. A financial advisor can provide guidance tailored to your specific situation and help you make informed decisions to manage your finances effectively.

Consider the following when selecting a financial advisor:

- Qualifications and Credentials: Look for a certified financial planner (CFP) who has the appropriate qualifications and credentials.

- Experience: Choose an advisor with experience in handling situations similar to yours, specifically related to mid-life financial transitions.

- Communication Style: Ensure that the advisor’s communication style aligns with your preferences. You should feel comfortable discussing personal financial matters with them.

- Fee Structure: Understand the advisor’s fee structure and ensure it aligns with your budget and financial goals. Some advisors charge a commission on investment products, while others opt for a fee-only structure.

Explore Career Opportunities

A mid-life crisis often involves questioning one’s career choices and seeking new opportunities for personal and professional growth. Exploring career options can have a significant impact on your finances during this phase.

Consider the following when exploring new career opportunities:

- Assess Skills and Interests: Evaluate your skills, interests, and passions. Determine if your current career aligns with them or if there are alternative paths that could provide greater satisfaction.

- Consider Education or Training: Identify any gaps in your knowledge or skills that could hinder your career progression. Investing in education or training programs can make you more marketable and open doors to new opportunities.

- Networking: Expand your professional network by attending industry events, joining online communities, or participating in relevant workshops. Networking can lead to valuable connections and potential career opportunities.

- Side Hustles or Freelancing: Consider taking on side hustles or freelance work to supplement your income or explore new career paths. This can provide additional financial stability during a career transition.

- Financial Risk Assessment: Before making any drastic career changes, carefully assess the financial risks involved. Evaluate whether you have sufficient savings to support yourself during a potential period of reduced income.

Embrace a Healthy Lifestyle

Taking care of your physical and mental health is crucial during a mid-life crisis. A healthy lifestyle can positively impact your finances by reducing healthcare costs and improving overall well-being.

Consider the following tips for maintaining a healthy lifestyle:

- Exercise Regularly: Incorporate physical activity into your daily routine. This can be as simple as going for a walk, joining a gym, or practicing yoga. Regular exercise improves overall health and reduces the risk of chronic diseases.

- Eat Well: Focus on a balanced diet rich in fruits, vegetables, lean proteins, and whole grains. Adopting healthy eating habits can improve your energy levels and reduce medical expenses in the long run.

- Mental Health: Prioritize your mental well-being by practicing self-care activities such as meditation, mindfulness, or seeking therapy. A healthy mind helps you make sound financial decisions and cope with the challenges of a mid-life crisis.

- Health Insurance: Ensure you have adequate health insurance coverage to protect yourself and your family from unexpected medical expenses.

Monitor Your Progress and Stay Motivated

Tracking your progress is crucial to stay motivated and make adjustments when necessary. Regularly review your financial situation, revisit your goals, and celebrate milestones achieved along the way.

Here are some tips to help you stay motivated:

- Use Financial Tracking Tools: Utilize financial tracking tools or apps to monitor your income, expenses, and savings progress. These tools can provide visual representations of your financial journey and keep you motivated.

- Celebrate Small Wins: Recognize and celebrate small achievements as you progress towards your goals. This will keep you motivated and make the journey more enjoyable.

- Stay Informed: Read books, blogs, or attend webinars related to personal finance and mid-life transitions. Continuous learning will empower you to make informed decisions and stay motivated.

- Join Supportive Communities: Connect with others who are experiencing or have overcome similar challenges. Sharing experiences and tips can provide valuable support and motivation.

Remember, managing finances during a mid-life crisis requires patience, adaptability, and a proactive approach. By taking control of your financial situation and making thoughtful decisions, you can navigate this phase with confidence and secure your financial future.

How to Survive a Midlife Crisis – 10 Tips

Frequently Asked Questions

Tips for Managing Finances During a Mid-Life Crisis

1. How can I effectively budget during a mid-life crisis?

To effectively budget during a mid-life crisis, start by assessing your current financial situation, including income, expenses, debts, and savings. Identify areas where you can cut back or reduce expenses, and create a realistic budget that aligns with your financial goals. Track your spending and make adjustments as needed to stay on track.

2. Should I consider seeking professional financial advice?

Seeking professional financial advice can be beneficial during a mid-life crisis. Financial advisors can provide personalized guidance tailored to your specific situation and help you navigate through financial challenges. They can assist in creating a comprehensive financial plan, making investment decisions, and ensuring you’re on the right track to meet your goals.

3. What steps can I take to reduce my debt during a mid-life crisis?

Reducing debt during a mid-life crisis requires careful planning and discipline. Start by prioritizing high-interest debts and creating a repayment strategy. Consider consolidating debts or negotiating with creditors for better terms. Cut back on unnecessary expenses and use any surplus income to make extra payments towards your debts. Explore opportunities to increase your income, such as taking on a side gig or pursuing additional education/training.

4. How can I save for retirement during a mid-life crisis?

Although it may be challenging, saving for retirement during a mid-life crisis is crucial. Review your retirement savings accounts and assess whether you are on track to meet your goals. Consider maximizing contributions to retirement plans and take advantage of any employer matching programs. If possible, delay retirement if you need more time to accumulate sufficient savings. Explore options like opening a separate retirement account or investing in retirement-focused funds.

5. What are some effective ways to generate additional income during a mid-life crisis?

Generating additional income during a mid-life crisis may involve exploring new opportunities or utilizing existing skills. Consider taking on part-time work, freelancing, or starting a small business based on your interests or expertise. Monetize hobbies or talents, such as tutoring, consulting, or selling handmade products online. Explore the gig economy or online platforms that allow you to offer services and earn extra income.

6. How should I prioritize my financial goals during a mid-life crisis?

Prioritizing financial goals during a mid-life crisis is essential to allocate your resources effectively. Start by identifying your short-term and long-term objectives, such as paying off debts, saving for retirement, or funding children’s education. Rank them based on urgency and importance, and allocate your available resources accordingly. Regularly review and adjust your priorities as needed to stay focused on your financial goals.

7. What are some strategies for maintaining financial stability during a mid-life crisis?

To maintain financial stability during a mid-life crisis, establish an emergency fund to cover unexpected expenses. Build a diverse investment portfolio that balances risk and return. Regularly review your insurance coverage to ensure it adequately protects your assets and family. Continuously educate yourself about personal finance and stay updated on market trends. Finally, avoid impulsive financial decisions and seek advice when needed.

8. How can I protect my financial future during a mid-life crisis?

Protecting your financial future during a mid-life crisis involves taking various measures. Continuously invest in yourself and upgrade your skills to remain employable in a changing job market. Review and update your estate plan, including your will, power of attorney, and beneficiary designations. Ensure you have adequate health and disability insurance coverage. Regularly review and optimize your investment and retirement plans to align with your changing goals and risk tolerance.

Final Thoughts

In conclusion, managing finances during a mid-life crisis can be challenging, but with some practical strategies, it is possible to navigate this period effectively. Firstly, it is crucial to assess your financial situation, including income, expenses, and debts, to gain a clear understanding of your current financial standing. Secondly, prioritize your financial goals, such as saving for retirement or paying off debts, and create a budget to align your spending with these objectives. Additionally, consider seeking professional advice, such as consulting a financial planner, to gain expert guidance and support. Finally, cultivate healthy financial habits like saving regularly, avoiding impulsive purchases, and staying informed about investment opportunities. By implementing these tips for managing finances during a mid-life crisis, individuals can gain control over their financial future and achieve long-term stability.