Are you wondering how to effectively manage your finances during paternity leave? Well, look no further! In this article, we will provide you with practical tips for navigating this crucial period in your life. Becoming a parent is a joyful and rewarding experience, but it can also bring significant financial challenges. From budgeting wisely to exploring financial assistance programs, we’ve got you covered. So, let’s dive into the world of managing finances during paternity leave and ensure your journey into fatherhood is financially secure.

Tips for Managing Finances During Paternity Leave

Preparing for the arrival of a new baby is an exciting time, but it can also bring financial challenges, especially when it comes to managing finances during paternity leave. While taking time off work to bond with your newborn is important, it’s essential to plan ahead to ensure your financial stability during this period. In this article, we’ll explore practical tips to help you navigate the financial aspects of paternity leave, so you can focus on enjoying this special time with your family.

Create a Budget

One of the first steps towards managing your finances during paternity leave is to create a comprehensive budget. A budget will help you track your income and expenses, making it easier to make informed financial decisions and ensure you’re spending within your means. Consider the following when creating your budget:

- List all your income sources: Include your regular salary, any paid leave, benefits, or other sources of income during your paternity leave.

- Track expenses: Record all your regular expenses, such as rent or mortgage payments, utilities, food, transportation, and healthcare costs. It’s important to also account for any additional baby-related expenses, such as diapers, formula, clothing, and medical expenses.

- Identify potential savings: Look for areas where you can cut back on expenses and save money. This might involve reducing discretionary spending, such as eating out or entertainment expenses, or finding ways to lower your utility bills.

Review Your Employee Benefits

Prior to taking paternity leave, review your employee benefits and policies to gain a clear understanding of what you’re entitled to during your time off. This includes paid leave, vacation days, sick leave, disability benefits, and any other benefits provided by your employer. Familiarize yourself with the duration and payment terms for each benefit and factor them into your budget. It’s also worth exploring if your company offers any paternity leave allowances or programs that can provide additional financial support during this period.

Explore Government Programs

In addition to employer-provided benefits, many countries have government programs in place to support new parents during leave. Investigate the various social security programs, parental leave schemes, or family benefits available in your country. These programs are designed to provide financial assistance during paternity leave and can help supplement your income during this time. Research the eligibility criteria, application process, and any documentation required to ensure you make the most of these programs.

Communicate with Your Partner

Open and honest communication with your partner is crucial when managing finances during paternity leave. Discuss your financial goals and expectations, and work together to create a joint budget that accommodates both your income and expenses. Consider the following points when having this conversation:

- Shared responsibilities: Clarify how you will divide household expenses and discuss any anticipated changes in your financial situation during paternity leave.

- Financial support: Determine if there are any additional income sources available to either or both of you, such as savings, investments, or side hustles.

- Emergency fund: Talk about the importance of having an emergency fund in case of unexpected expenses or a change in financial circumstances.

Reduce Non-Essential Expenses

When preparing for paternity leave, it’s wise to review your expenses and find areas where you can reduce non-essential spending. By cutting back on discretionary expenses, you can free up money to cover any unexpected costs that may arise during this period. Consider the following tips to help you reduce non-essential expenses:

- Evaluate subscriptions: Assess your monthly subscriptions and cancel those that you don’t use frequently or can live without during paternity leave.

- Meal planning: Plan your meals in advance and prepare home-cooked meals as much as possible. This can significantly reduce your food expenses.

- Energy-saving measures: Implement energy-saving practices at home, such as turning off lights when not in use, using energy-efficient appliances, and adjusting your thermostat settings.

- Second-hand baby items: Consider purchasing second-hand baby items, such as clothing, furniture, and toys, as they can be more budget-friendly compared to brand new items.

Explore Additional Sources of Income

If you find that your income during paternity leave falls short of your financial needs, it may be worth exploring additional sources of income to supplement your budget. Here are some ideas to consider:

- Freelancing or part-time work: Explore opportunities for remote or flexible work that can be done from home, allowing you to earn an income while still being available for your newborn.

- Selling unused items: Declutter your home and sell any items that you no longer need. Online marketplaces can be a convenient way to turn unused items into cash.

- Monetizing hobbies or skills: If you have a hobby or skill that can be monetized, consider offering your services or products to generate additional income.

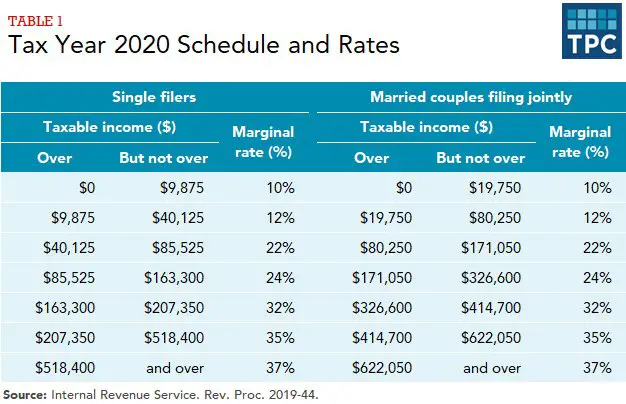

Stay Informed about Tax Benefits

During paternity leave, it’s essential to stay informed about any tax benefits or credits that may be available to you as a new parent. These benefits can help reduce your overall tax liability and provide additional financial relief. Research the tax regulations in your country or seek advice from a tax professional to ensure you take advantage of any available deductions or credits related to paternity leave, childcare expenses, or other applicable categories.

Connect with Support Networks

Managing finances during paternity leave can be overwhelming, but you’re not alone. Reach out to support networks, parenting groups, or online communities to connect with other parents who have gone through similar experiences. These communities can provide valuable insights, practical tips, and emotional support to help you navigate the financial challenges of paternity leave.

Preparing for paternity leave involves careful financial planning. By creating a budget, reviewing your employee benefits, exploring government programs, reducing non-essential expenses, exploring additional sources of income, staying informed about tax benefits, and connecting with support networks, you can better manage your finances during this important time in your life. Remember, while financial stability is crucial, it’s equally important to cherish the precious moments with your newborn. By following these tips, you can enjoy the journey of fatherhood while ensuring your financial well-being.

Three Ways to Still Take a Paycheck During Maternity Leave

Frequently Asked Questions

Frequently Asked Questions (FAQs)

Question 1: How can I manage my finances during paternity leave?

During paternity leave, you can manage your finances by creating a budget, tracking your expenses, prioritizing essential expenses, and considering temporary income sources like government benefits or part-time jobs if needed.

Question 2: Should I save money before going on paternity leave?

Yes, it is advisable to save money before going on paternity leave. Saving in advance can help you cover expenses during the leave period and provide a financial safety net for unexpected costs.

Question 3: What should I include in my budget during paternity leave?

In your budget during paternity leave, be sure to include essential expenses such as housing, utilities, groceries, transportation, and childcare if applicable. Also, consider any medical expenses or insurance premiums that may arise.

Question 4: How can I reduce my expenses during paternity leave?

To reduce expenses during paternity leave, consider cutting back on non-essential costs such as dining out, entertainment, and unnecessary subscriptions. Additionally, explore opportunities for discounts or cheaper alternatives for essential expenses.

Question 5: Are there any government benefits or programs available during paternity leave?

Yes, there might be government benefits or programs available during paternity leave. Research and inquire about any paternity or parental leave benefits, tax credits, or financial assistance programs offered by your country or state.

Question 6: Can I take up part-time work during paternity leave?

Yes, you can consider taking up part-time work during paternity leave to supplement your income. However, make sure it does not interfere with your bonding time with your newborn and comply with any legal restrictions or regulations related to your leave.

Question 7: Is it a good idea to review my insurance coverage during paternity leave?

Yes, it is a good idea to review your insurance coverage during paternity leave. Ensure that you have adequate coverage for yourself and your family. Consider any changes in your financial situation or the need for additional coverage to protect your growing family.

Question 8: What resources or financial planning tools can help me manage my finances during paternity leave?

There are various resources and financial planning tools available to help you manage your finances during paternity leave. You can use budgeting apps, online calculators, or consult with financial advisors to establish a solid financial plan and track your progress.

Final Thoughts

Managing finances during paternity leave can be a challenging task, but with the right approach and some careful planning, it is possible to navigate this period smoothly. First and foremost, creating a budget can help you track your expenses and ensure that you are living within your means. Secondly, exploring additional sources of income, such as freelance work or part-time jobs, can provide a financial cushion during this time. Additionally, taking advantage of any available government benefits or paternity leave policies can help alleviate some of the financial burden. Finally, communicating openly and honestly with your partner about your financial situation and finding ways to support each other can make the journey easier. By implementing these tips for managing finances during paternity leave, you can enjoy quality time with your newborn while maintaining financial stability.