Looking for tips on navigating financial aid for college? We’ve got you covered! College expenses can be daunting, but with the right information and strategies, you can make the process much more manageable. In this article, we’ll share practical tips for securing financial aid, finding scholarships, and making the most of your resources. Whether you’re a student or a parent, understanding the ins and outs of financial aid is crucial in ensuring that you can pursue your education without breaking the bank. So, let’s dive in and explore these valuable tips for navigating financial aid for college.

Tips for Navigating Financial Aid for College

Understanding the Importance of Financial Aid

When it comes to pursuing higher education, the rising cost of college tuition can be a major obstacle for many students and their families. This is where financial aid plays a crucial role. Financial aid refers to various types of funding – scholarships, grants, loans, and work-study programs – that help students cover the cost of tuition, fees, books, and living expenses. Navigating the financial aid process can be overwhelming, but with some strategic planning and knowledge, you can make the most of the available resources to finance your college education.

Start Early and Research Thoroughly

To effectively navigate the financial aid process, it’s essential to start early and dedicate enough time to research. Here are some tips to kickstart your journey:

- Begin researching financial aid options at least a year before you plan to start college.

- Explore different types of financial aid, including scholarships, grants, federal student loans, and work-study programs.

- Familiarize yourself with the financial aid policies and deadlines of the colleges you are considering.

- Make use of reputable online resources, such as the U.S. Department of Education’s Federal Student Aid website, to gather comprehensive information on financial aid programs.

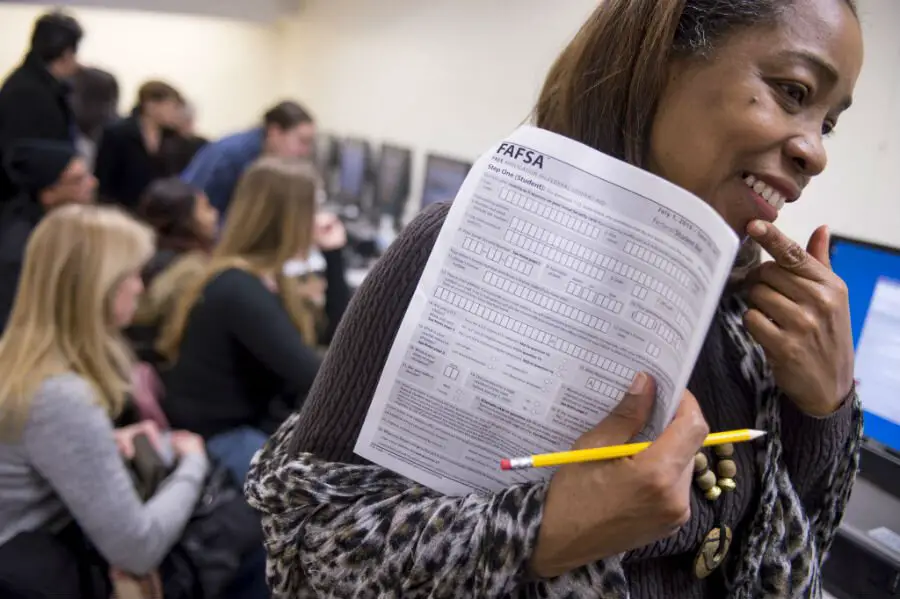

Submit the FAFSA

One of the key steps in the financial aid process is completing the Free Application for Federal Student Aid (FAFSA). The FAFSA determines your eligibility for federal and state financial aid programs. Consider the following when submitting your FAFSA:

- Submit your FAFSA as early as possible, as some aid programs operate on a first-come, first-served basis.

- Gather all the necessary documents beforehand, including your Social Security Number, federal tax returns, and other income-related information.

- Double-check for accuracy and completeness before submitting the FAFSA to avoid delays or errors in processing.

- Remember to update your FAFSA each year, as your financial situation may change, affecting your eligibility for aid.

Explore Scholarships and Grants

Scholarships and grants are a great way to secure financial aid that doesn’t need to be repaid. Here’s how you can maximize your chances of receiving scholarships and grants:

- Research and apply for scholarships early. Start by checking out scholarships offered by colleges, local organizations, and national scholarship databases.

- Pay attention to eligibility criteria, deadlines, and application requirements for each scholarship or grant opportunity.

- Write compelling essays and personalize your application to stand out from other applicants.

- Consider applying for scholarships specific to your field of study, ethnicity, or other personal attributes that may qualify you for specialized scholarships.

Understand and Manage Student Loans

While scholarships and grants are ideal forms of financial aid, student loans are also an option to consider. When it comes to managing student loans, keep the following tips in mind:

- Borrow only what you need and carefully consider the repayment terms and interest rates of different loan options.

- Prioritize federal student loans over private loans, as federal loans often offer more favorable terms and repayment options.

- Explore loan forgiveness programs, which can help reduce or eliminate your student loan debt if you meet specific criteria, such as working in public service or certain industries.

- Create a budget and plan for loan repayment after graduation to ensure you can comfortably manage your financial obligations.

Consider Work-Study Programs and Part-Time Jobs

Work-study programs and part-time jobs offer an opportunity to earn money while studying. Here’s how you can use these options effectively:

- Research work-study programs offered by your college or university and find out if you qualify.

- Apply for part-time jobs on or near campus that offer flexibility to accommodate your class schedule.

- Consider jobs related to your field of study or ones that provide valuable skills and experience for your resume.

- Balance your work commitments with your academic workload to ensure you can manage both effectively.

Seek Professional Help and Guidance

Navigating the financial aid process can be complex, so don’t hesitate to seek help from professionals who specialize in this area. Consider the following options for guidance:

- Consult your high school guidance counselor, who can provide valuable information and assistance in the financial aid application process.

- Reach out to college financial aid offices for personalized guidance and support.

- Explore local organizations or non-profit agencies that offer free financial aid counseling to help you make informed decisions.

- Attend financial aid workshops or webinars in your community to learn more about the process and get expert advice.

Stay Informed and Stay Organized

Throughout your college journey, staying informed and organized is key. Here are some tips to keep in mind:

- Regularly check your email and mailbox for important updates and communications from colleges and financial aid offices.

- Keep track of deadlines, requirements, and any additional documentation you may need to submit.

- Create a filing system for all your financial aid paperwork, ensuring easy access when needed.

- Stay up-to-date with changes in financial aid policies and regulations that may affect your eligibility or application process.

Remember, navigating financial aid for college requires patience, persistence, and planning. By starting early, researching thoroughly, and seeking professional guidance when needed, you can make the most of financial aid opportunities available to you.

How to Pay for College | Crash Course | How to College

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What types of financial aid are available for college?

There are various types of financial aid available for college, including scholarships, grants, loans, and work-study programs.

How can I find scholarships for college?

To find scholarships for college, you can search online scholarship databases, check with your school’s financial aid office, and explore opportunities offered by organizations and community foundations.

What is the difference between scholarships and grants?

Scholarships are typically awarded based on merit or specific criteria, such as academic achievement, athletic ability, or community involvement. Grants, on the other hand, are often need-based and provided by the government or educational institutions.

What should I consider when comparing student loans?

When comparing student loans, you should consider the interest rates, repayment options, fees, and terms of each loan. It’s important to understand the total amount you will repay over the life of the loan and the potential impact on your future finances.

How can I reduce the cost of college?

You can reduce the cost of college by applying for scholarships and grants, considering community college or in-state schools, living off-campus, and working part-time to contribute towards your expenses.

What is the Free Application for Federal Student Aid (FAFSA) and how do I complete it?

The Free Application for Federal Student Aid (FAFSA) is a form that determines your eligibility for federal financial aid programs. To complete it, you will need to gather your financial information, such as tax returns, and submit the application online through the official FAFSA website.

What is a work-study program and how can I participate?

A work-study program allows students to work part-time on or off-campus while enrolled in college to earn money for educational expenses. To participate, you need to indicate your interest in work-study when completing the FAFSA, and if eligible, you will be offered work-study as part of your financial aid package.

Can I negotiate my financial aid award?

In some cases, you may be able to negotiate your financial aid award by contacting the school’s financial aid office and providing them with additional information that may affect your ability to pay for college. It is worth exploring this option if you believe your initial award does not accurately reflect your financial situation.

Final Thoughts

In conclusion, navigating financial aid for college can be a complex process, but with the right approach, it can be manageable. Start by understanding the different types of aid available, such as scholarships, grants, and loans. Research and apply for as many scholarships as possible to maximize your chances of receiving financial assistance. Don’t forget to complete the Free Application for Federal Student Aid (FAFSA) as it is crucial for accessing various forms of aid. Additionally, consider reaching out to the college’s financial aid office for guidance and clarification. By following these tips for navigating financial aid for college, you can make informed decisions and potentially reduce the financial burden of higher education.