Are you burdened by student loan interest? Looking for practical tips to reduce it? Well, you’ve come to the right place! Student loan interest can be a major financial hurdle for many, but don’t worry, we’ve got you covered. In this article, we will share some valuable tips that can help you lower your student loan interest, saving you money in the long run. So, without further ado, let’s dive into these tips for reducing student loan interest and start taking control of your financial future.

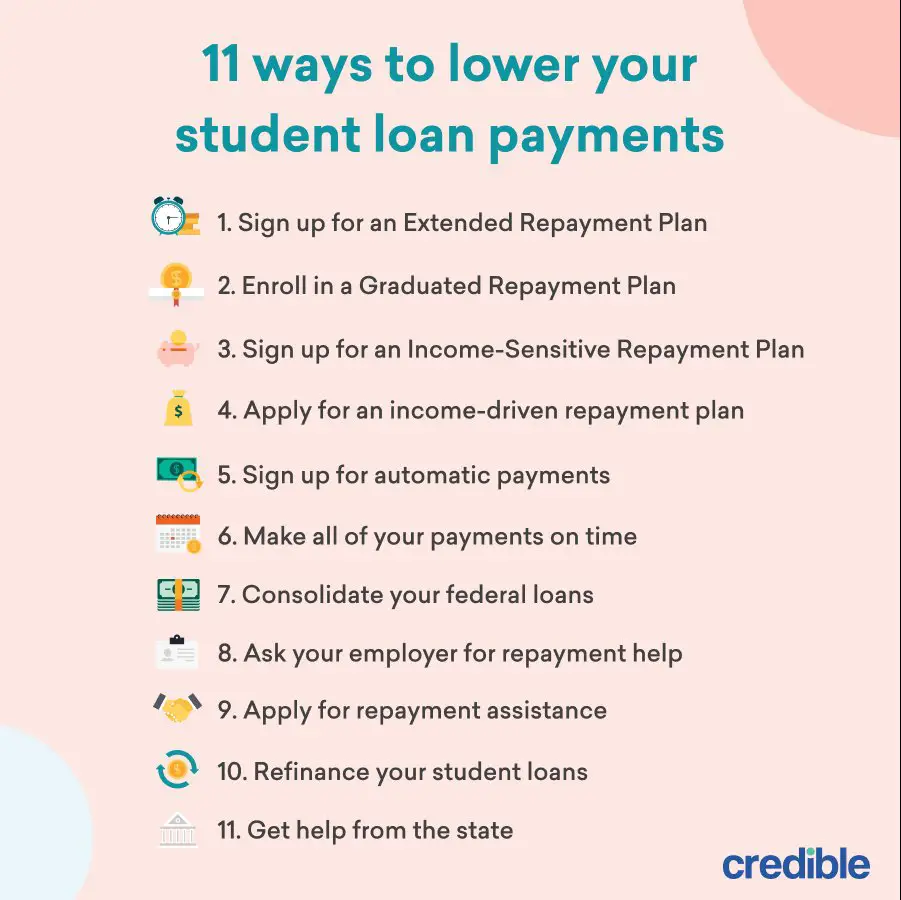

Tips for Reducing Student Loan Interest

Introduction

Student loans can be a significant burden for many graduates, with interest rates often adding up to substantial amounts over time. However, there are several strategies and actions you can take to reduce your student loan interest and potentially save thousands of dollars. In this article, we will explore a variety of tips and techniques that can help you minimize the impact of interest on your student loans.

1. Make Payments During Your Grace Period

Once you graduate, most student loans offer a grace period before you have to start making payments. Instead of waiting until the grace period ends, consider making payments during this time. By starting early, you can reduce the principal balance, and therefore, the amount of interest that will accrue over the life of your loan.

How to Do It:

- Calculate your monthly payment based on your loan amount and interest rate.

- Set up automatic payments or reminders to ensure you don’t miss any payments.

- Find extra money in your budget or consider taking on a part-time job to contribute toward your student loan payments.

2. Refinance Your Student Loans

Refinancing can be an effective strategy for reducing student loan interest rates. By refinancing, you can obtain a new loan with a lower interest rate, allowing you to save money on interest payments over time. However, it’s important to thoroughly research and compare refinancing options before proceeding.

How to Do It:

- Gather all your loan details, including interest rates and loan terms.

- Research different lenders and compare their refinancing options.

- Submit applications to potential lenders and carefully review the terms and conditions of the refinanced loan.

- If approved, use the new loan to pay off the existing student loans.

3. Make Biweekly or Extra Payments

Making biweekly or extra payments on your student loans can significantly reduce the amount of interest you pay over time. By dividing your monthly payment in half and paying that amount every two weeks, you will make 26 half-payments in a year instead of 12 full payments. This approach helps you pay off your loan faster and reduces the total interest paid.

How to Do It:

- Contact your loan servicer to confirm they accept biweekly payments.

- Divide your monthly payment in half and set up automatic payments to be made every two weeks.

- Ensure that the additional payments are applied towards the principal balance.

- Monitor your progress and adjust your strategy as necessary.

4. Take Advantage of Interest Rate Reduction Programs

Some lenders offer interest rate reduction programs that can help you lower your student loan interest rates. These programs are often available to borrowers who meet certain criteria, such as making consistent on-time payments or enrolling in automatic payment plans. These incentives can provide substantial savings over the life of your loan.

How to Do It:

- Contact your loan servicer to inquire about any interest rate reduction programs they offer.

- Determine the eligibility requirements for each program and evaluate if you qualify.

- Submit any necessary documentation or applications to enroll in the program.

- Ensure that you meet the program requirements to continue enjoying the reduced interest rate.

5. Consider Loan Forgiveness or Repayment Assistance Programs

Loan forgiveness or repayment assistance programs can help reduce or eliminate your student loan debt altogether. These programs are often available to borrowers who work in specific professions or for qualifying non-profit organizations. By meeting the criteria, you may be eligible for partial or complete forgiveness of your student loans, reducing the overall interest you would have paid.

How to Do It:

- Research loan forgiveness and repayment assistance programs that apply to your situation.

- Determine the eligibility requirements and ensure you meet the criteria.

- Prepare and submit any necessary applications or documentation.

- Stay vigilant about meeting the program requirements to maintain eligibility.

6. Consolidate Your Loans

Loan consolidation involves combining multiple student loans into a single loan with one monthly payment. This can simplify your repayment process and potentially lead to a lower interest rate. By consolidating your loans, you can reduce the overall interest you pay and potentially lock in a fixed interest rate.

How to Do It:

- Gather information on all your existing student loans, including their balances and interest rates.

- Research different loan consolidation options and compare their terms and interest rates.

- Submit an application to the chosen lender and provide all necessary documentation.

- If approved, ensure that you understand the terms of the consolidated loan and review the new interest rate.

7. Seek Employer Assistance Programs

Some employers offer student loan repayment assistance as part of their benefits package. These programs provide financial support to employees with student loan debt and can help reduce the overall interest paid. Take advantage of such programs if your employer offers them.

How to Do It:

- Review your employee benefits package or speak with your employer’s HR department to determine if they offer student loan repayment assistance.

- Understand the eligibility requirements and any restrictions associated with the program.

- Enroll in the program and follow the necessary steps to receive the assistance.

- Continue making regular payments on your student loans while enjoying the benefits of employer assistance.

8. Stay Informed and Stay Proactive

Reducing student loan interest requires ongoing effort and vigilance. Stay informed about your loan terms, interest rates, and available repayment options. Be proactive in exploring opportunities to lower your interest rates or find alternative repayment solutions. By staying ahead of your student loan situation, you can make informed decisions that will minimize the impact of interest.

How to Do It:

- Regularly review your loan statements and notifications from your loan servicer.

- Stay up to date with changes in student loan policies and programs.

- Explore refinancing or loan consolidation options periodically to take advantage of lower interest rates.

- Consider seeking guidance from a financial advisor or student loan expert to make informed decisions.

Reducing student loan interest can help you save a significant amount of money over the life of your loan. By implementing the tips mentioned in this article, such as making payments during your grace period, refinancing, making extra payments, and taking advantage of available programs, you can reduce the financial burden of your student loans. Remember to stay proactive and stay informed about your options, as this will empower you to make the best decisions for your financial future.

How To Lower Student Loan Interest Rate

Frequently Asked Questions

Frequently Asked Questions (FAQs)

How can I reduce student loan interest?

By following these tips, you can effectively reduce your student loan interest:

1. Can I make extra payments towards my student loans to reduce interest?

Yes, making extra payments towards your student loans can significantly reduce the amount of interest you’ll pay over time. By paying more than the minimum monthly payment, you can shorten the loan term and save money on interest.

2. Is refinancing a good option for reducing student loan interest?

Refinancing your student loans can be a smart move if you can qualify for a lower interest rate. By refinancing, you can combine multiple loans into one and potentially lower your monthly payments and overall interest charges.

3. Are there any student loan forgiveness programs that can help reduce interest?

Yes, certain student loan forgiveness programs can alleviate your loan burden, potentially reducing or eliminating your interest altogether. These programs are typically available for individuals working in public service or certain professions such as teaching or nursing.

4. Can enrolling in automatic payments reduce my student loan interest?

Yes, many lenders offer interest rate deductions when you sign up for automatic payments. It’s a convenient way to ensure timely payments and often comes with a small interest rate reduction as an incentive.

5. Is it beneficial to make biweekly payments instead of monthly payments?

Making biweekly payments can be advantageous for reducing student loan interest. By spreading out your payments over a shorter period, you can effectively make an extra payment each year, resulting in significant savings on interest.

6. Does paying the interest while in school help in reducing overall interest?

Yes, if you have the means to make interest payments while still in school, it can help lower your overall interest charges. By paying off the accruing interest, you prevent it from capitalizing and compounding, resulting in less interest accrued over the life of the loan.

7. Are there any tax benefits related to student loan interest reduction?

Yes, depending on your income and circumstances, you may be eligible for a deduction on your federal income taxes for the interest paid on your student loans. Be sure to consult with a tax professional to understand how these deductions apply to your specific situation.

8. Can negotiating with lenders help in reducing student loan interest?

It’s worth exploring the option of negotiating with your lenders to reduce your student loan interest. Sometimes, lenders may be open to lowering the interest rate if you have a good repayment history or can demonstrate financial hardship.

Final Thoughts

In conclusion, implementing effective strategies can greatly reduce student loan interest. First, consider making extra payments whenever possible to decrease the principal balance, which in turn lowers the total interest paid over time. Secondly, refinancing your loan may lead to a lower interest rate, resulting in significant savings. Additionally, setting up automatic payments can help avoid late fees and potentially qualify for interest rate reductions. Finally, exploring loan forgiveness programs and scholarships can alleviate some financial burden. By implementing these tips for reducing student loan interest, borrowers can better manage their debt and save money in the long run.