Are you curious about understanding and using secured loans effectively? Well, you’ve come to the right place. In this article, we will delve into the world of secured loans, exploring how they work and how you can make the most of them. Whether you’re considering a secured loan or simply want to expand your financial knowledge, this comprehensive guide will equip you with the essential information you need. So, let’s dive in and explore the ins and outs of understanding and using secured loans effectively.

Understanding and Using Secured Loans Effectively

Introduction

Secured loans can be a valuable financial tool for individuals and businesses alike. By understanding how secured loans work and using them effectively, you can access the funds you need while minimizing risk and maximizing benefits. In this article, we will explore the ins and outs of secured loans, covering important topics such as types of collateral, loan terms, interest rates, and repayment options. Whether you’re considering taking out a secured loan or simply want to expand your financial knowledge, this guide will provide you with the essential information you need to make informed decisions.

Types of Collateral

A crucial aspect of secured loans is the collateral required to secure the loan. Collateral serves as a guarantee for the lender, reducing their risk in case of non-payment. Here are some common types of collateral used in secured loans:

Real Estate

Real estate, such as a home or commercial property, is one of the most frequently used forms of collateral. Lenders typically consider the appraised value of the property and may require a specific loan-to-value ratio. It’s important to note that using real estate as collateral puts your property at risk in the event of default.

Automobiles

If you’re purchasing a car, you can often secure an auto loan by using the vehicle as collateral. Like real estate, the value of the car plays a significant role in determining the loan amount. Lenders may also consider factors such as the car’s age, condition, and mileage.

Savings or Investments

Some lenders allow borrowers to use their savings accounts, certificates of deposit (CDs), or other investment assets as collateral. By pledging these assets, borrowers can access loans while still earning interest on their savings. However, keep in mind that these assets may be frozen or liquidated in the event of default.

Loan Terms and Interest Rates

When evaluating secured loans, it’s essential to understand the loan terms and interest rates involved. Here’s what you need to know:

Loan Amount

The loan amount represents the total sum of money you can borrow. The collateral’s value often determines the loan amount, although lenders may consider other factors such as income and credit history.

Loan Duration

The loan duration refers to the length of time you have to repay the loan. Secured loans typically have longer repayment periods compared to unsecured loans. The duration can range from a few months to several years, depending on the lender and the loan’s purpose.

Interest Rates

Interest rates play a significant role in the overall cost of a secured loan. Lenders consider factors such as creditworthiness, loan term, and the prevailing market rates when determining the interest rate. Secured loans generally have lower interest rates compared to unsecured loans due to the collateral provided.

Fixed vs. Variable Interest Rates

Secured loans may offer either fixed or variable interest rates. With a fixed-rate loan, the interest rate remains constant throughout the loan term, providing predictable monthly payments. On the other hand, variable-rate loans have interest rates that can fluctuate based on market conditions, potentially leading to changes in monthly payments.

Repayment Options

Understanding the available repayment options is crucial for effectively utilizing secured loans. Let’s explore some common repayment options:

Standard Repayment

Under the standard repayment option, borrowers make fixed monthly payments for the loan’s duration. Each payment includes both principal and interest, with the goal of fully paying off the loan by the end of the term.

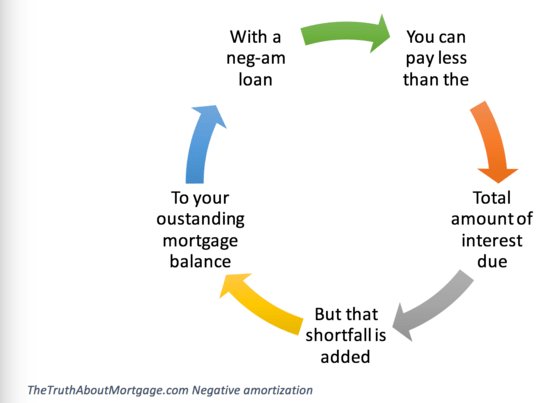

Interest-Only Payments

With interest-only payments, borrowers only pay the accrued interest for a specific period, typically at the beginning of the loan term. This option provides temporary relief by reducing initial payment amounts but usually leads to higher overall interest costs.

Balloon Payments

Balloon payments involve making smaller monthly payments, typically covering only the interest, for the majority of the loan term. However, at the end of the term, a large final payment, known as a balloon payment, is due. This option is suitable for borrowers expecting a significant influx of cash or planning to refinance before the balloon payment comes due.

Early Repayment

Many secured loans allow borrowers to make early repayments without penalty. This option can save you money on interest and potentially shorten the loan term. However, always review the loan terms to ensure early repayment is permitted and understand any associated fees.

By understanding and using secured loans effectively, you can gain access to much-needed funds while managing risk and ensuring financial stability. When considering a secured loan, carefully review the types of collateral accepted, loan terms, interest rates, and repayment options. This knowledge will empower you to make informed decisions and take advantage of the opportunities secured loans offer. Remember to assess your financial situation, consider your ability to repay the loan, and consult with financial advisors or lenders to find the best options that align with your goals and needs. With prudence and planning, secured loans can be a valuable tool for achieving your financial objectives.

Secured Loans Explained – A quick guide to what you need to know before you borrow

Frequently Asked Questions

Understanding and Using Secured Loans Effectively

Frequently Asked Questions (FAQs)

What is a secured loan?

A secured loan is a type of loan that requires collateral, such as a property or vehicle, to secure the loan. The collateral acts as a guarantee for the lender that they will be repaid. If the borrower fails to repay the loan, the lender can seize the collateral to recover their losses.

How does a secured loan differ from an unsecured loan?

Unlike secured loans, unsecured loans do not require collateral. This means that the lender relies solely on the borrower’s creditworthiness to determine whether they will be approved for the loan. Secured loans typically have lower interest rates compared to unsecured loans since there is less risk for the lender.

What are the advantages of using a secured loan?

Secured loans offer several advantages, including lower interest rates, higher borrowing limits, and longer repayment periods. Additionally, they may be easier to qualify for, especially for individuals with less-than-perfect credit. Using a secured loan can also help build or improve credit history if payments are made consistently and on time.

What are the common types of assets used as collateral for secured loans?

Common types of assets used as collateral for secured loans include real estate properties, vehicles, savings accounts, and valuable personal belongings such as jewelry or artwork. The type of collateral required will depend on the lender and the specific loan requirements.

How much can I borrow with a secured loan?

The amount you can borrow with a secured loan will depend on various factors, including the value of the collateral you are providing, your creditworthiness, and the lender’s policies. Typically, lenders will provide loans up to a certain percentage of the collateral’s appraised value.

Can I use a secured loan for any purpose?

Yes, secured loans can be used for various purposes, including home renovations, debt consolidation, purchasing a vehicle, or financing education expenses. However, it is important to carefully consider your financial situation and ensure that you will be able to repay the loan according to the terms.

What happens if I default on a secured loan?

If you default on a secured loan, the lender has the right to seize the collateral used to secure the loan. They can sell the asset to recover their losses. Additionally, a default on a secured loan can negatively impact your credit score and make it more difficult to obtain loans or credit in the future.

Can I pay off a secured loan early?

Yes, in most cases, you can pay off a secured loan early. However, it is important to review the terms and conditions of the loan agreement. Some lenders may charge prepayment penalties, while others may allow early repayment without any additional fees. It is advisable to contact your lender to understand their policies regarding early loan repayment.

Final Thoughts

Understanding and using secured loans effectively is crucial for managing your finances and achieving your goals. By leveraging your assets as collateral, secured loans offer lower interest rates and higher borrowing limits compared to unsecured loans. To maximize the benefits, it is important to thoroughly comprehend the terms and conditions, evaluate your repayment capacity, and choose the right lender. By conducting proper research and being proactive in managing your repayments, you can effectively utilize secured loans to fund significant purchases, consolidate debts, or invest in opportunities. Prioritize financial literacy, consult professionals when needed, and utilize secured loans responsibly to strengthen your financial position.