Welcome to our blog article on understanding the Capital Asset Pricing Model (CAPM). If you’ve ever wondered about the inner workings of this financial model or are seeking a clear explanation, you’ve come to the right place. In this article, we will delve into the intricacies of the CAPM, breaking it down into easily digestible sections. Whether you’re a seasoned investor or just starting your journey in finance, this guide will equip you with the knowledge to navigate the world of asset pricing. So let’s dive right in and explore the fascinating world of CAPM together!

Understanding Capital Asset Pricing Model (CAPM)

Introduction:

The field of finance is vast and ever-evolving, offering various theories and models to help investors make informed decisions. One such model is the Capital Asset Pricing Model (CAPM), which plays a crucial role in determining the expected return on an investment based on its risk. In this article, we will delve into the details of CAPM and explore its components, assumptions, and applications. By the end, you will have a comprehensive understanding of how CAPM works and its significance in the world of finance.

Components of CAPM:

1. Systematic Risk:

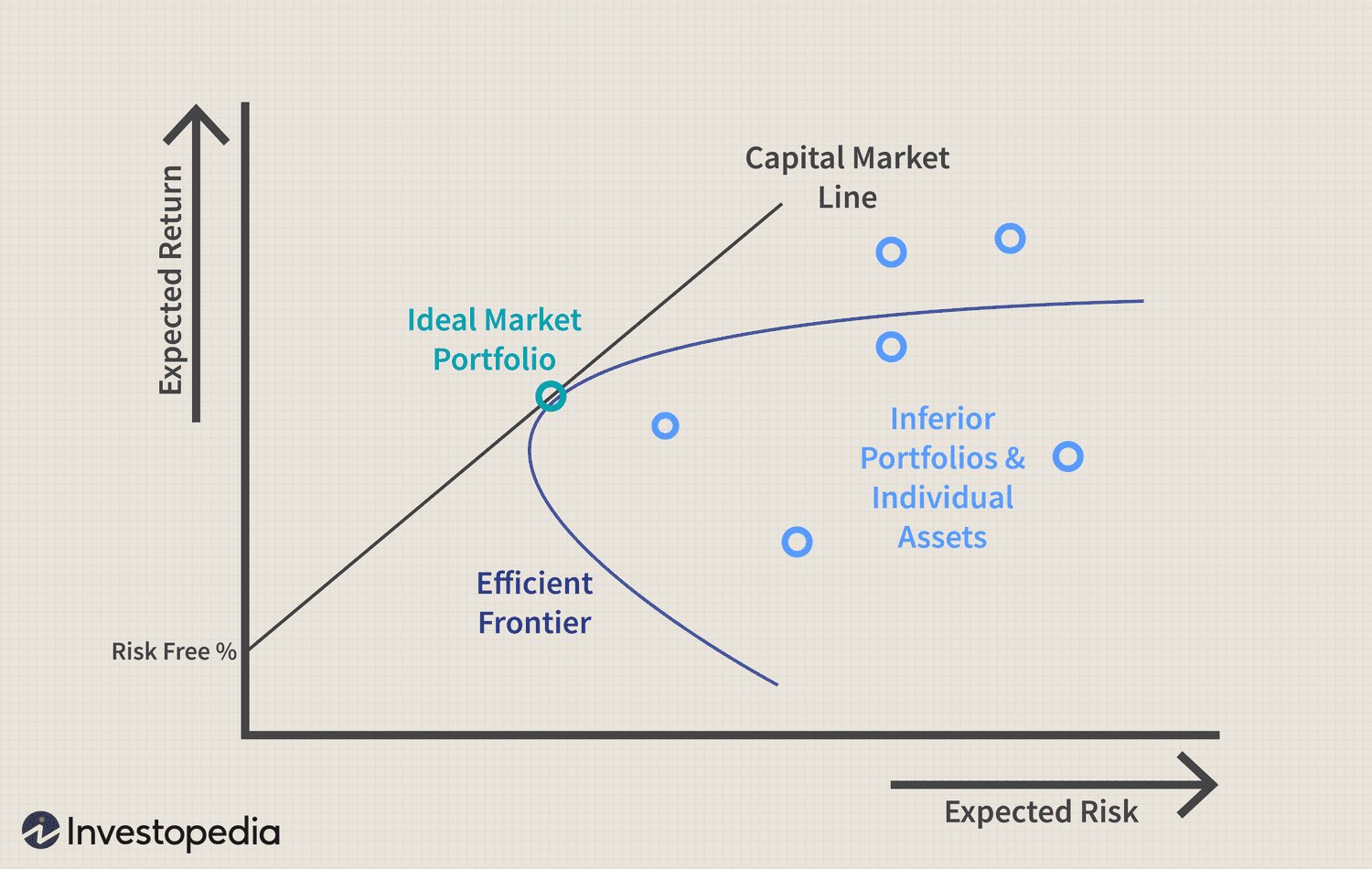

– CAPM is built on the premise that investors are mainly concerned with systematic risk, which cannot be diversified away. Systematic risk refers to the fluctuations in the overall market that affect all investments.

– This risk is often measured by beta (β), a metric that quantifies an asset’s sensitivity to market movements. A beta value greater than 1 indicates that the asset is more volatile than the market, while a beta value less than 1 suggests lower volatility.

2. Risk-Free Rate:

– The risk-free rate serves as the baseline for evaluating the return on any investment. It represents the hypothetical return an investor would expect from a risk-free asset, such as a treasury bill.

– In CAPM, the risk-free rate is denoted by the symbol “Rf” and acts as the starting point for determining an investment’s expected return.

3. Market Risk Premium:

– The market risk premium represents the additional return that investors demand for taking on the risk of investing in the market. It is the excess return an investor expects over and above the risk-free rate.

– The market risk premium is influenced by multiple factors, such as economic conditions, market sentiment, and investor expectations.

4. Expected Return:

– By combining the risk-free rate, market risk premium, and an asset’s beta, CAPM calculates the expected return of an investment. The formula for expected return is as follows:

Expected Return = Risk-Free Rate + (Beta × Market Risk Premium)

Assumptions of CAPM:

1. Efficient Market:

– CAPM assumes that markets are efficient, meaning that all available information is fully reflected in an asset’s price.

– As a result, it is believed that investors cannot consistently earn excess returns by exploiting mispriced assets. This assumption allows CAPM to focus on systematic risk rather than specific investment opportunities.

2. Homogeneous Expectations:

– CAPM assumes that all investors have the same expectations regarding future returns and risks. This implies that everyone analyzes the market and its components in the same way.

– Homogeneous expectations facilitate the calculation of market risk premium and beta values, as they are based on consensus views.

3. No Transaction Costs:

– CAPM assumes the absence of transaction costs, such as brokerage fees or taxes.

– Ignoring these costs simplifies the model and allows for easier calculations and comparisons.

Applications of CAPM:

1. Cost of Capital:

– CAPM plays a vital role in determining the cost of capital for companies. The cost of capital represents the required rate of return an investor expects to receive for investing in a particular company.

– By using CAPM, companies can evaluate their projects and investments by comparing the expected return to the cost of capital. This analysis helps in making sound financial decisions and allocating resources appropriately.

2. Capital Budgeting:

– CAPM aids in the process of capital budgeting, wherein companies assess potential investment opportunities.

– By calculating the expected return using CAPM, companies can prioritize projects based on their risk-return profile. This ensures that investments align with the company’s financial goals and risk appetite.

3. Portfolio Management:

– CAPM is widely used in portfolio management to evaluate the risk and return of various assets.

– Investors often construct diversified portfolios based on CAPM, aiming to optimize returns for a given level of risk. CAPM helps in selecting assets that provide a desirable risk-return tradeoff and align with the investor’s investment objectives.

Critiques and Limitations of CAPM:

1. Reliance on Assumptions:

– CAPM relies heavily on assumptions, such as market efficiency and homogeneous expectations. Critics argue that these assumptions do not always hold true in real-world scenarios, leading to potential inaccuracies in the model’s predictions.

2. Beta Estimation Challenges:

– Calculating an asset’s beta can be challenging, as it requires historical data and assumptions about the asset’s correlation with the market.

– Estimating beta accurately becomes difficult for assets that do not have sufficient historical data or exhibit non-linear relationships with the market.

3. Ignores Other Factors:

– CAPM focuses solely on market risk and overlooks other factors that may affect an asset’s returns, such as company-specific events or changes in the industry landscape.

– Critics argue that CAPM’s simplicity limits its ability to capture the full complexity of the investment world.

Conclusion:

The Capital Asset Pricing Model (CAPM) provides a framework for understanding the relationship between risk and expected return in the world of finance. By considering systematic risk, the risk-free rate, and the market risk premium, CAPM offers insights into how investors can assess investment opportunities and construct portfolios. However, it is important to recognize the assumptions and limitations of the model, as they can impact the accuracy of its predictions. Nevertheless, CAPM remains a valuable tool in finance, helping investors make informed decisions and navigate the complexities of the market.

FAQs:

Q: Can CAPM be used as the only tool for investment decision-making?

A: While CAPM provides valuable insights, it is not the sole determinant for investment decision-making. Other factors, such as fundamental analysis, qualitative assessments, and market conditions, should also be considered.

Q: Can CAPM be applied to all types of assets?

A: CAPM is most suitable for assets that have a high degree of market correlation and can be easily traded. It may not be as effective for illiquid assets or those with unique risk characteristics.

Q: What are some alternatives to CAPM?

A: Alternatives to CAPM include the Arbitrage Pricing Theory (APT) and Multi-Factor Models. These models incorporate additional factors beyond market beta to explain asset returns.

Q: How frequently should beta values be updated?

A: Beta values should be updated periodically to reflect changes in market conditions and the underlying asset’s risk profile. The frequency of updates depends on the asset’s volatility and the availability of new data.

Q: Is CAPM suitable for long-term investment planning?

A: CAPM can provide a starting point for long-term investment planning. However, it is important to consider other factors and perform comprehensive analysis to account for changing market conditions and evolving investment goals.

CAPM – What is the Capital Asset Pricing Model

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is the Capital Asset Pricing Model (CAPM)?

The Capital Asset Pricing Model (CAPM) is a financial model that calculates the expected return on an investment based on its risk and the overall market conditions. It provides a framework for investors to assess the appropriate compensation for the risk associated with an investment.

How does the CAPM work?

The CAPM calculates the expected return on an investment by considering the risk-free rate of return, the beta of the investment, and the expected market return. It uses these factors to determine the required rate of return for the specific investment, taking into account the investment’s systematic risk.

What is the risk-free rate of return in the CAPM?

The risk-free rate of return in the CAPM represents the return an investor can expect to earn from an investment that carries no risk. It is typically based on the yield of a government bond, such as a Treasury bill, with a similar maturity as the investment being evaluated.

What is beta in the CAPM?

Beta is a measure of a stock’s or an investment’s sensitivity to market movements. It indicates how much the investment’s price is expected to move in relation to the overall market. A beta of 1 means the investment moves in line with the market, while a beta greater than 1 signifies higher volatility, and a beta less than 1 denotes lower volatility.

How is the beta of an investment determined?

The beta of an investment is determined by analyzing historical data and measuring the investment’s price movements in relation to the overall market. Regression analysis is commonly used to calculate the beta by comparing the investment’s returns to those of a representative market benchmark, such as an index like the S&P 500.

What is the expected market return in the CAPM?

The expected market return in the CAPM refers to the anticipated return an investor expects to earn from the overall market. It is typically based on long-term average returns of the market or market index and takes into consideration factors such as economic conditions, industry trends, and market sentiment.

Is the CAPM a reliable model for determining expected returns?

The CAPM is a widely used model for estimating expected returns, but it has its limitations. One key assumption is that the model assumes investors are rational and risk-averse, which may not always hold true. Additionally, the CAPM relies on historical market data, and future market conditions may deviate from historical patterns.

Can the CAPM be used to compare different investment opportunities?

Yes, the CAPM can be used to compare different investment opportunities by calculating the required rate of return for each investment based on their respective risk and expected market returns. By comparing these required rates of return, investors can evaluate the relative attractiveness of different investments in terms of their expected returns.

Are there alternative models to the CAPM?

Yes, there are alternative models to the CAPM, such as the Fama-French three-factor model and the Arbitrage Pricing Theory (APT). These models take into account additional risk factors beyond just market risk and provide a more comprehensive approach to pricing assets. However, the CAPM remains a widely used and accepted model in finance.

Final Thoughts

The Capital Asset Pricing Model (CAPM) is a valuable tool for investors to understand and evaluate investment opportunities. By considering the risk and return relationship of an investment, CAPM helps determine whether the potential returns are worth the risk involved. Through its formula, investors can estimate the expected return on a specific asset or portfolio based on its beta, risk-free rate, and market risk premium. Understanding CAPM enables investors to make informed decisions, allocate their resources effectively, and optimize their investment portfolios. By utilizing CAPM, investors can enhance their understanding of market dynamics and tailor their investment strategies accordingly.