Are you baffled by the concept of understanding capital gains and losses? Don’t worry, you’re not alone. Many people find themselves scratching their heads when it comes to deciphering the ins and outs of this topic. If you’ve ever sold stocks, real estate, or other investments, you might have encountered these terms. But fear not! In this article, we’ll unravel the mysteries surrounding capital gains and losses, providing you with a clear understanding of how they work and what they mean for your financial future. So let’s dive right in and demystify this complex subject.

Understanding Capital Gains and Losses

Capital gains and losses are terms that are often associated with investments and taxes. Whether you are a seasoned investor or just starting out, understanding these concepts is crucial to making informed financial decisions. In this comprehensive guide, we will delve into the world of capital gains and losses, exploring what they are, how they are calculated, the different types, and their tax implications. Let’s dive in!

What are Capital Gains and Losses?

When you invest in assets such as stocks, real estate, or mutual funds, you hope to generate a profit over time. Capital gains and losses represent the increase or decrease in the value of these investments. If you sell an asset for more than you paid for it, you have a capital gain. Conversely, if you sell an asset for less than you paid for it, you have a capital loss. These gains and losses are not realized until the actual sale of the asset.

How are Capital Gains and Losses Calculated?

To calculate your capital gains or losses, you need to know the cost basis and the sale price of the asset. The cost basis is the original purchase price plus any additional expenses incurred during the purchase, such as brokerage fees or closing costs. The sale price is the amount you receive when you sell the asset.

The formula for calculating capital gains or losses is as follows:

Capital Gain/Loss = Sale Price – Cost Basis

Let’s look at an example for better understanding. Suppose you buy a stock for $1,000 and sell it later for $1,500. Your capital gain would be $500 ($1,500 – $1,000). Conversely, if you sell the stock for $800, your capital loss would be $200 ($800 – $1,000).

Types of Capital Gains

Capital gains can be categorized into two main types: short-term capital gains and long-term capital gains. The classification depends on the holding period of the asset.

1. Short-term Capital Gains: These are gains from the sale of assets held for less than one year. Short-term capital gains are taxed at ordinary income tax rates, which are usually higher than long-term rates. It’s important to note that short-term gains can significantly impact your overall tax liability.

2. Long-term Capital Gains: These are gains from the sale of assets held for more than one year. Long-term capital gains are usually taxed at lower rates, designed to incentivize long-term investing. The tax rates for long-term capital gains are generally more favorable than ordinary income tax rates.

Capital Losses and Their Impact

Just as capital gains generate tax implications, capital losses can also affect your tax situation. When you sell an asset at a loss, you can use that loss to offset capital gains and potentially reduce your overall tax liability. If your capital losses exceed your capital gains, you can even use the excess losses to offset other taxable income, up to certain limits.

It’s important to understand that capital losses can be carried forward or carried back. Carrying forward means you can use the losses in future tax years. Carrying back allows you to apply the losses to previous tax years and potentially receive a refund for taxes already paid. However, it’s crucial to consult with a tax professional to understand the specific rules and limitations regarding carrying forward or back capital losses.

Tax Implications of Capital Gains and Losses

Now that we have discussed the different types of capital gains and losses, let’s explore their tax implications in more detail.

1. Short-term Capital Gains Tax: As mentioned earlier, short-term capital gains are taxed at ordinary income tax rates. The exact rate depends on your income level and filing status. It’s essential to consult the current tax brackets and rates to determine your applicable tax rate.

2. Long-term Capital Gains Tax: The tax rates for long-term capital gains are generally more favorable than ordinary income tax rates. The exact rate you will pay depends on your income level and filing status. The tax rates for long-term capital gains are divided into three categories: 0%, 15%, and 20%. The rate you fall into depends on your taxable income.

3. Capital Losses Tax Deduction: As mentioned earlier, capital losses can be used to offset capital gains and potentially reduce your overall tax liability. If your capital losses exceed your capital gains, you can deduct up to $3,000 of the loss against other taxable income. Any remaining losses can be carried forward to future tax years.

It’s important to note that tax laws can change over time, so staying informed about the current tax rules and consulting with a tax professional is crucial for accurate tax planning and reporting.

Strategies for Managing Capital Gains and Losses

Now that you have a better understanding of capital gains and losses and their tax implications, it’s essential to explore strategies to manage them effectively. Here are some strategies to consider:

1. Tax-Loss Harvesting: This strategy involves strategically selling investments that have experienced losses to offset capital gains. By doing this, you can potentially reduce your overall tax liability. However, it’s crucial to be mindful of the wash-sale rule, which prohibits repurchasing a substantially identical asset within 30 days of the sale to claim the loss.

2. Holding Period: Consider the holding period of your investments. If you hold an asset for more than one year, you may benefit from the lower tax rates associated with long-term capital gains. However, if you are in need of immediate funds, selling assets with short-term gains may be necessary.

3. Asset Allocation: Diversify your investment portfolio to include both assets with potential for capital gains and those that generate regular income, such as dividends or interest. This way, you can balance your tax liability by offsetting gains with losses or income.

4. Consult a Tax Professional: Taxes can be complex, and the rules surrounding capital gains and losses vary based on individual circumstances. Working with a tax professional can help you navigate the complexities and ensure you optimize your tax strategy.

Understanding capital gains and losses is essential for every investor. By comprehending how these gains and losses are calculated, the different types, and their tax implications, you can make informed decisions and optimize your investment strategy. Remember to consult a tax professional for personalized guidance based on your individual circumstances. With this knowledge, you are now better equipped to navigate the world of investments and taxes.

Capital Gains Tax Explained 2021 (In Under 3 Minutes)

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are capital gains and losses?

Capital gains are the profits made from the sale of assets, such as stocks, real estate, or other investments. Capital losses, on the other hand, occur when the value of an asset decreases, resulting in a loss upon sale.

How are capital gains and losses calculated?

To calculate capital gains or losses, you subtract the cost basis (the original purchase price, including any fees or commissions) from the selling price of the asset. The result is the net gain or loss.

What is the difference between short-term and long-term capital gains?

Short-term capital gains are generated from the sale of assets held for one year or less. They are typically taxed at higher rates. Long-term capital gains, on the other hand, involve assets held for more than one year and are usually subject to lower tax rates.

Are capital gains and losses taxable?

Yes, capital gains and losses are generally taxable. However, the specific tax treatment depends on various factors, including the type of asset, how long it was held, and the individual’s income tax bracket.

Can capital losses be used to offset capital gains?

Yes, capital losses can be used to offset capital gains. If your capital losses exceed your capital gains in a given tax year, you can use the remaining losses to offset other taxable income, up to a certain limit.

What is the “wash-sale” rule?

The wash-sale rule is a regulation that prevents taxpayers from claiming a deduction for a capital loss on a security if they repurchase the same or a substantially identical security within 30 days before or after the sale. This rule is aimed at preventing individuals from generating artificial losses for tax purposes.

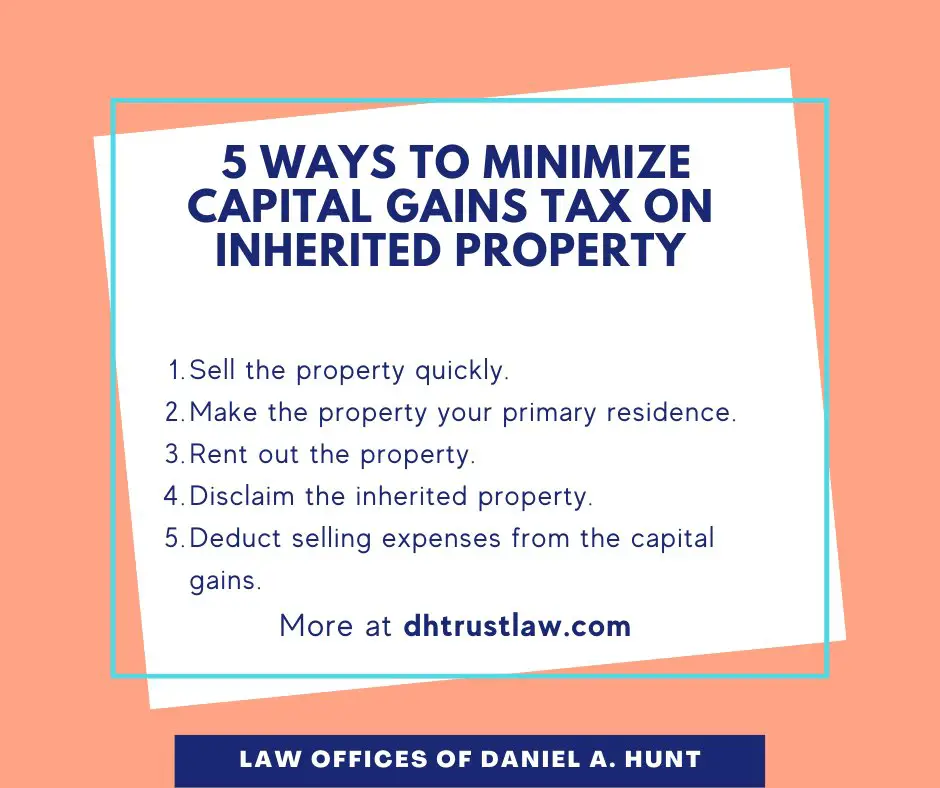

Are there any tax exemptions or exceptions for capital gains?

Yes, there are certain exemptions and exceptions for capital gains. For example, if you sell your primary residence, you may be eligible for a tax exemption on the capital gains up to a certain limit. Additionally, certain investments, such as those held in retirement accounts like a 401(k) or IRA, may have different tax treatment.

What are the implications of capital gains and losses for my tax return?

Capital gains and losses must be reported on your tax return. You will need to include the details of each transaction, including the purchase and sale dates, selling price, and cost basis. The net capital gains or losses will be taxed accordingly based on your tax filing status and income level.

Final Thoughts

Understanding capital gains and losses is essential for anyone looking to navigate the complexities of investing. Capital gains refer to the profits made from selling an asset at a higher price than the purchase price, while capital losses occur when an asset is sold for less than its purchase price. These gains and losses can have significant implications for tax purposes and overall investment strategy. By comprehending the intricacies of capital gains and losses, investors can make informed decisions, take advantage of tax-saving opportunities, and ultimately enhance their investment portfolios. With a solid understanding of these concepts, investors can confidently navigate the world of finance and make sound investment choices.