Cryptocurrency has revolutionized the world of finance, offering a decentralized and secure alternative to traditional forms of currency. However, with this new frontier comes a myriad of questions and complexities, particularly when it comes to understanding cryptocurrency taxation. How are cryptocurrencies taxed? How can individuals navigate this evolving landscape? In this article, we will delve into the intricacies of cryptocurrency taxation, shedding light on the key principles and providing clarity to those seeking to comprehend the ins and outs of this complex domain. So, whether you dabble in Bitcoin, Ethereum, or any other digital asset, read on to demystify the realm of understanding cryptocurrency taxation.

Understanding Cryptocurrency Taxation

Cryptocurrency has gained significant popularity in recent years. As more individuals and businesses embrace digital currencies, it becomes crucial to understand the tax implications associated with cryptocurrency transactions. In this comprehensive guide, we will delve into the world of cryptocurrency taxation, providing you with a clear understanding of how taxes are applied, what the reporting requirements are, and how to remain compliant. So, let’s dive in and demystify the complexities of cryptocurrency taxation!

The Basics of Cryptocurrency Taxation

Cryptocurrency taxation refers to the process of determining the tax liabilities arising from the use, trading, mining, and investing in digital currencies. The tax treatment of cryptocurrencies varies from country to country, making it important to familiarize yourself with the regulations specific to your jurisdiction. While the tax laws surrounding cryptocurrencies are still evolving, several key aspects remain consistent globally:

Cryptocurrency as Property

In most jurisdictions, including the United States, cryptocurrencies are treated as property for tax purposes. This means that any gains or losses realized from the sale, exchange, or use of cryptocurrencies are subject to capital gains tax. The taxation of cryptocurrencies as property can lead to complex reporting requirements, as each transaction must be tracked and reported separately.

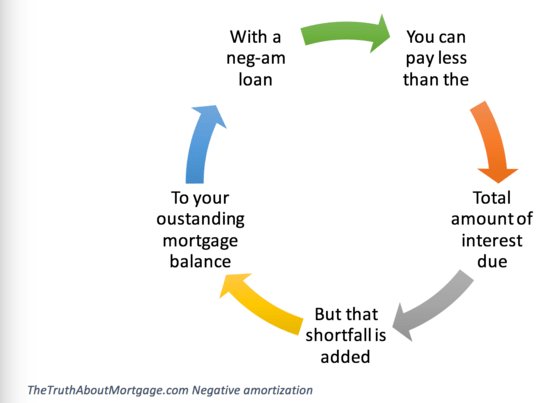

Taxable Events

Taxable events are specific actions or transactions that trigger a tax obligation. In the context of cryptocurrencies, some common taxable events include:

- Selling or exchanging cryptocurrencies for fiat currency (e.g., USD, EUR)

- Using cryptocurrencies to purchase goods or services

- Receiving cryptocurrencies as compensation

- Earning cryptocurrencies through mining or staking

Each taxable event may have different tax implications, such as short-term or long-term capital gains, depending on the holding period and the type of transaction.

Capital Gains Tax

Capital gains tax is the tax applied to the profit realized from the sale or exchange of assets, including cryptocurrencies. It is categorized into two types: short-term and long-term capital gains. The classification depends on the holding period of the cryptocurrency:

- Short-term capital gains: If you hold a cryptocurrency for less than a year before selling or exchanging it, the resulting profit is considered a short-term capital gain. Short-term capital gains are typically taxed at higher rates than long-term gains.

- Long-term capital gains: If you hold a cryptocurrency for more than a year before selling or exchanging it, the resulting profit is considered a long-term capital gain. Long-term capital gains often benefit from lower tax rates.

It is essential to keep track of the purchase date, sale date, and cost basis (the amount you initially paid for the cryptocurrency) for accurate capital gains calculations.

Reporting and Compliance

To ensure compliance with tax regulations, it is crucial to accurately report your cryptocurrency transactions. While the specific reporting requirements vary by jurisdiction, some common practices include:

- Keeping detailed records of all cryptocurrency transactions, including purchase prices, sale prices, and dates of acquisition and disposition.

- Using reputable cryptocurrency tax software to automate the tracking and reporting process.

- Filing the appropriate tax forms, such as the IRS Form 8949 in the United States, to report gains and losses from cryptocurrency transactions.

- Understanding any additional reporting obligations, such as the Foreign Account Tax Compliance Act (FATCA) requirements for U.S. taxpayers holding cryptocurrencies in foreign exchanges.

Maintaining accurate records and staying informed about your tax obligations will help ensure a smooth tax filing process and mitigate the risk of penalties or audits.

Minimizing Tax Liabilities

While cryptocurrency taxation is a legal obligation, there are strategies you can employ to minimize your tax liabilities. However, always consult with a tax professional before implementing any tax-minimization strategies. Some common approaches include:

- Holding cryptocurrencies for more than a year to qualify for long-term capital gains tax rates, which are often lower than short-term rates.

- Utilizing tax loss harvesting techniques to offset capital gains with capital losses from other investments.

- Consider donating appreciated cryptocurrencies to eligible charitable organizations to potentially receive a tax deduction equal to the fair market value of the donated assets.

- Exploring jurisdictions with favorable tax regulations for cryptocurrencies, such as countries with zero or low capital gains tax rates.

Remember, tax minimization strategies are subject to applicable laws and regulations. Always seek professional advice to ensure compliance with the tax code.

Taxation Considerations for Various Cryptocurrency Activities

Cryptocurrency Mining and Staking

Cryptocurrency mining and staking involve the process of validating transactions and maintaining the blockchain network. While these activities can be lucrative, they also have tax implications:

- Income Tax: Mining or staking rewards are typically treated as ordinary income and must be reported accordingly. The fair market value of the cryptocurrency at the time of receipt is used to determine the taxable income.

- Self-Employment Tax: If mining or staking is your primary source of income, you may be subject to self-employment taxes, similar to any other self-employed individual.

- Business Expenses: Miners and stakers may be able to deduct certain expenses related to their activities, such as electricity costs, mining hardware purchases, and maintenance expenses.

Cryptocurrency Trading and Investing

Trading and investing in cryptocurrencies can be highly profitable, but it is important to understand the tax implications of these activities:

- Capital Gains Tax: Every time you sell or exchange a cryptocurrency, you may be subject to capital gains tax on the profit or loss realized. Keep track of your transactions and consult a tax professional to determine the applicable tax rates.

- Cost Basis: Calculating the cost basis of each cryptocurrency transaction is crucial for accurate reporting. The cost basis is generally the purchase price of the cryptocurrency, including any fees or commissions paid.

- Partial Dispositions: If you sell only a portion of your cryptocurrency holdings, you may need to determine the specific cost basis of the units sold. Common methods for calculating the cost basis in such scenarios include First-In-First-Out (FIFO), Last-In-First-Out (LIFO), or specific identification.

Cryptocurrency Payments and Salary

As cryptocurrencies become more widely accepted as a form of payment, it is essential to understand the tax implications of using digital currencies for transactions:

- Barter Transactions: Using cryptocurrencies to purchase goods or services is generally treated as a barter transaction for tax purposes. The fair market value of the cryptocurrency at the time of the transaction is used to determine the value of the transaction.

- Employer Compensation: If you receive cryptocurrency as part of your salary, it is subject to regular income tax withholding and must be reported as ordinary income.

Understanding the tax consequences of using cryptocurrencies for payments or compensation will help ensure accurate reporting and compliance with tax regulations.

In conclusion, navigating cryptocurrency taxation can be complex, but with a clear understanding of the basic principles and requirements, you can confidently manage your tax obligations. Remember to keep detailed records of your transactions, consult with a tax professional, and utilize reputable cryptocurrency tax software to streamline the reporting process. By staying informed and remaining compliant, you can focus on enjoying the benefits of digital currencies while minimizing any potential tax liabilities.

Crypto Taxes Explained For Beginners | Cryptocurrency Taxes

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is cryptocurrency taxation?

Cryptocurrency taxation refers to the process of reporting and paying taxes on income generated from cryptocurrency transactions, including buying, selling, trading, or earning cryptocurrency.

Why is it important to understand cryptocurrency taxation?

Understanding cryptocurrency taxation is crucial to ensure compliance with tax laws and avoid penalties or legal consequences. It helps individuals and businesses accurately report their cryptocurrency activities and calculate the taxes owed.

How are cryptocurrencies taxed?

Cryptocurrencies are typically taxed as property by tax authorities. This means that capital gains taxes may apply when you sell, trade, or dispose of cryptocurrencies. Additionally, income tax may be applicable if you receive cryptocurrencies as payment for goods or services.

What information do I need for cryptocurrency tax reporting?

For cryptocurrency tax reporting, you will need records of all your cryptocurrency transactions, including dates, amounts, cost basis, and fair market values. It is essential to keep track of this information to accurately calculate your gains or losses.

Are there any tax exemptions for cryptocurrency transactions?

Tax exemptions for cryptocurrency transactions vary depending on the jurisdiction. In some cases, small transactions or transactions below a certain threshold may be exempt from taxation. However, it is crucial to consult with a tax professional or refer to your local tax regulations for specific exemptions applicable to your situation.

Do I need to report cryptocurrency held in offshore exchanges?

Yes, in most cases, cryptocurrency held in offshore exchanges needs to be reported for tax purposes. Many countries require their residents to report worldwide income, including income generated from offshore sources such as cryptocurrency exchanges. Non-compliance can have serious legal consequences.

What are the penalties for non-compliance with cryptocurrency tax regulations?

Penalties for non-compliance with cryptocurrency tax regulations can vary depending on the jurisdiction and the severity of the violation. They may include fines, interest charges, audits, and even criminal charges in some cases. It is important to fully understand and comply with cryptocurrency tax obligations to avoid these penalties.

Should I consult a tax professional for cryptocurrency taxation?

It is highly recommended to consult a tax professional or accountant who specializes in cryptocurrency taxation. They can help you navigate the complexities of cryptocurrency tax regulations, ensure accurate reporting, and maximize any available deductions or exemptions.

Note: The answers provided are for informational purposes only and should not be considered as legal or tax advice. Please consult with a qualified tax professional for specific guidance tailored to your individual situation.

Final Thoughts

Understanding cryptocurrency taxation is crucial for anyone involved in the cryptocurrency market. As governments around the world work to regulate this burgeoning industry, it is essential to be aware of the tax implications. Cryptocurrencies are treated as property by tax authorities, which means that capital gains tax may be applicable when buying, selling, or trading digital assets. Additionally, income tax may be levied on cryptocurrencies received as payment for goods or services. By familiarizing themselves with the intricacies of cryptocurrency taxation, individuals can ensure compliance and avoid any potential legal issues in the future.