Are you curious about understanding dividends and how they work? Look no further! Dividends play a crucial role in the world of investing, providing an opportunity for investors to earn a share of a company’s profits. But what exactly are dividends, and how do they function? In this blog article, we will delve into the fascinating world of dividends, demystifying their purpose and shedding light on how they can benefit investors like you. So, let’s dive in and explore the ins and outs of understanding dividends and how they work.

Understanding Dividends and How They Work

Investing in the stock market can be an excellent way to grow your wealth and secure your financial future. As you embark on your investment journey, it’s crucial to have a solid understanding of various investment strategies and vehicles. One such aspect of investing that you should be familiar with is dividends. In this article, we’ll delve into the world of dividends and explore how they work.

What are Dividends?

Dividends are a distribution of a company’s earnings to its shareholders, typically in the form of cash or additional shares of stock. When you own shares in a company that pays dividends, you become entitled to a portion of the company’s profits. Dividends are usually paid on a regular basis, such as quarterly or annually, and are often seen as a way for companies to reward their shareholders for their investment.

The Purpose of Dividends

Dividends serve several purposes for both companies and investors:

1. Income Generation: Dividends provide investors with a regular income stream. This can be particularly beneficial for retirees or those seeking passive income.

2. Attracting Investors: Companies that consistently pay dividends are often seen as more stable and attractive to investors, as they demonstrate a certain level of financial health.

3. Profit Distribution: Dividends allow companies to distribute profits to shareholders rather than retaining all earnings for reinvestment or debt reduction.

How Do Dividends Work?

Now that we have a basic understanding of dividends, let’s dive deeper into how they work and what factors influence them.

Dividend Yield

When evaluating dividends, one essential metric to consider is the dividend yield. The dividend yield represents the annual dividend payment relative to the stock price. It is calculated by dividing the annual dividend per share by the stock’s current market price.

| Company | Annual Dividend per Share | Stock Price | Dividend Yield |

|---|---|---|---|

| Company A | $4.00 | $100.00 | 4% |

| Company B | $2.50 | $50.00 | 5% |

In the example above, Company A has an annual dividend per share of $4.00 and a stock price of $100.00, resulting in a dividend yield of 4%. On the other hand, Company B has an annual dividend per share of $2.50 and a stock price of $50.00, leading to a higher dividend yield of 5%.

Investors often compare dividend yields across different companies to assess the potential returns they can expect from their investments.

Dividend Payout Ratio

Another crucial measure of dividends is the dividend payout ratio. This ratio reflects the proportion of a company’s earnings paid out as dividends and is calculated by dividing dividends per share by earnings per share.

A high dividend payout ratio indicates that a company is distributing a significant portion of its earnings to shareholders. However, excessively high payout ratios may limit a company’s ability to reinvest in its growth or handle unexpected financial challenges.

On the other hand, a low dividend payout ratio suggests that the company retains a larger portion of its earnings for internal purposes. This can give the company more flexibility to invest in research and development, acquisitions, or debt reduction.

Dividend Growth

Dividend growth is another critical factor to consider. While some companies pay a consistent dividend amount, others may increase their dividends over time.

Investors often seek companies with a history of consistent dividend growth. Companies that consistently raise dividends typically signal financial stability and a commitment to rewarding shareholders. Investors may view such companies as attractive long-term investments.

Types of Dividends

Now that we understand how dividends work, let’s explore the different types of dividends that companies may offer.

Cash Dividends

Cash dividends are the most common type of dividend. As the name suggests, cash dividends are paid out in the form of cash to shareholders’ brokerage accounts. Shareholders can either choose to cash out the dividends or reinvest them by purchasing additional shares.

Stock Dividends

Stock dividends, also known as bonus shares or scrip dividends, are issued in the form of additional shares of stock. Rather than distributing cash, companies allocate a certain number of shares to existing shareholders based on the number of shares they already own.

For example, if a company declares a stock dividend of 5%, shareholders will receive an additional 5 shares for every 100 shares they own. Stock dividends are often used when a company wants to reward its shareholders without depleting its cash reserves.

Property Dividends

Property dividends, although less common, involve distributing physical assets or property to shareholders. This type of dividend is typically issued when a company wants to dispose of excess assets or spin off a subsidiary.

Property dividends may include products, equipment, land, or any other tangible assets owned by the company. Shareholders then have the option to either sell the received property or retain it as part of their investment portfolio.

Dividends and Taxes

When it comes to dividends, it’s crucial to understand the tax implications associated with them. The tax treatment of dividends may vary based on the country and the specific tax laws in place. However, there are some general concepts to keep in mind.

In many countries, dividends are subject to taxation. The tax rate applied to dividends might differ from the tax rate on ordinary income. Some countries offer preferential tax rates for dividends to encourage investment and stimulate economic growth.

It’s essential to consult with a tax professional or review the tax regulations in your jurisdiction to understand how dividends will impact your personal tax situation.

Understanding dividends is vital for any investor looking to maximize their returns and build long-term wealth. Dividends provide a regular income stream, reward shareholders, and indicate a company’s financial health. By considering factors such as dividend yield, payout ratio, and dividend growth, investors can make more informed investment decisions.

Remember, investing in dividend-paying companies is just one strategy among many. It’s important to conduct thorough research, assess your risk tolerance, and diversify your investment portfolio to align with your financial goals.

Dividend Basics

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. What are dividends?

Dividends are a distribution of a company’s earnings to its shareholders, usually in the form of cash or additional stock shares.

2. How do dividends work?

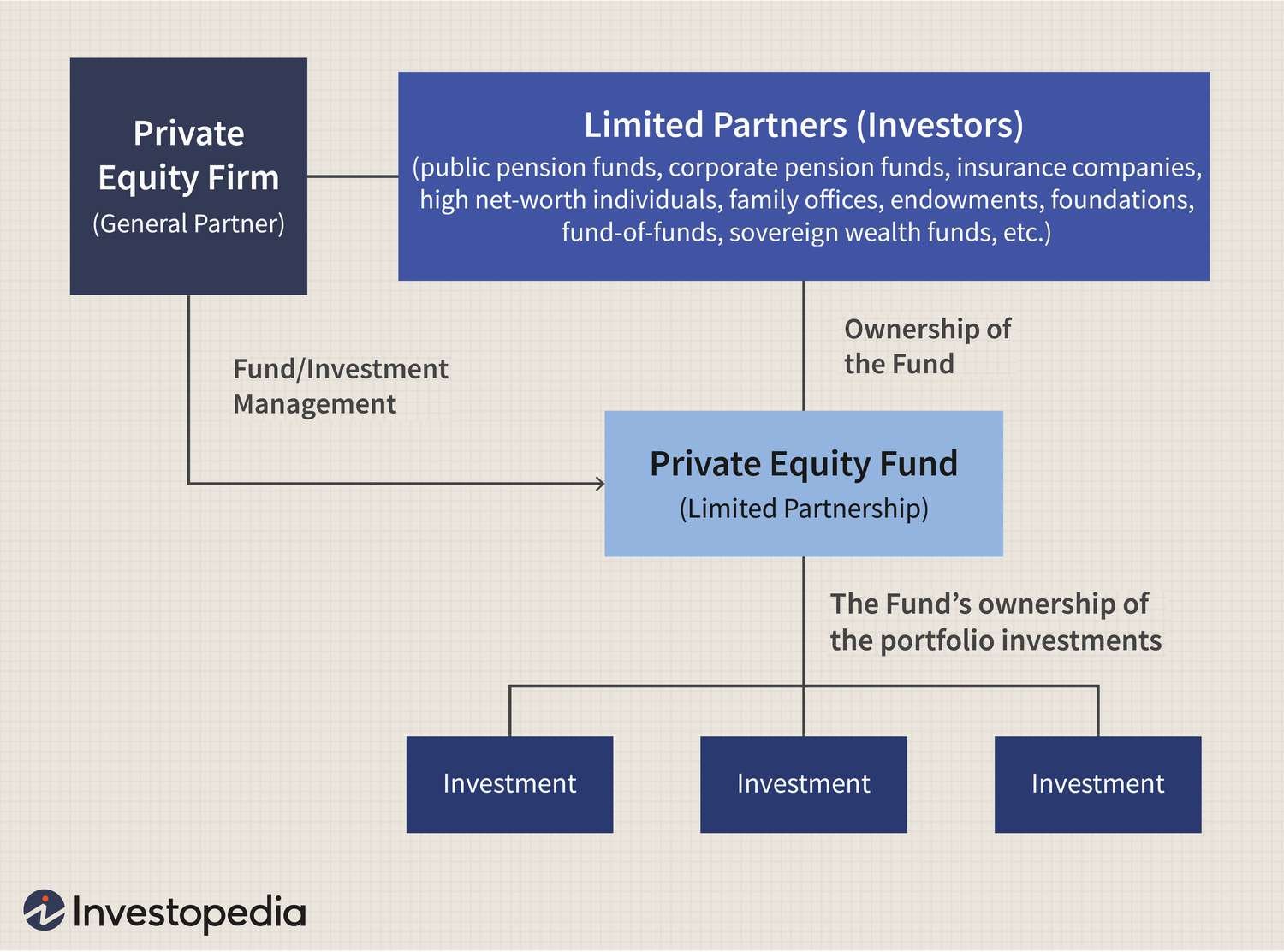

Dividends are typically paid out by profitable companies as a way to share their success with shareholders. The amount and frequency of dividends are determined by the company’s board of directors.

3. Who is eligible to receive dividends?

Shareholders who own company stocks on the dividend record date are eligible to receive dividends. The record date is usually set a few days or weeks before the dividend payment date.

4. How are dividend amounts determined?

The board of directors decides the dividend amounts based on the company’s profitability, financial health, and other factors. Dividends can be paid at a fixed rate or a percentage of the stock’s price, known as a dividend yield.

5. Are dividends guaranteed?

Dividends are not guaranteed. Companies may choose to reduce or eliminate dividends if they face financial difficulties or decide to reinvest more profits into the business. It’s important to research a company’s dividend history and financial stability before investing.

6. How are dividends taxed?

Dividends are generally taxed as income, either at ordinary income tax rates or at a lower tax rate for qualified dividends. The tax treatment may vary depending on the country and individual circumstances, so it’s advisable to consult a tax professional.

7. Can dividends be reinvested?

Yes, some companies offer dividend reinvestment plans (DRIPs) that allow shareholders to automatically reinvest their dividends to purchase additional shares of the company’s stock. This can potentially increase the overall value of the investment over time.

8. What is the ex-dividend date?

The ex-dividend date is the date on which a stock starts trading without the upcoming dividend. If you buy shares on or after the ex-dividend date, you will not be eligible to receive the current dividend.

Final Thoughts

Understanding dividends and how they work is essential for investors seeking to grow their wealth through stock market investments. Dividends are periodic distributions of profits made by companies to their shareholders, usually in the form of cash or additional shares. They serve as a reward for shareholders and can provide a steady income stream. By investing in dividend-paying stocks, individuals can benefit from both capital appreciation and regular dividend payments. It is important to research and analyze companies’ financial health, dividend history, and payout ratios to make informed investment decisions. Overall, comprehending dividends and their workings is crucial for successful investing.