Understanding employer stock options and their taxation can be complex, but it doesn’t have to be overwhelming. In this article, we’ll delve into the nitty-gritty details of how employer stock options work and how they are taxed. Whether you’re a new employee trying to make sense of your stock options or an employer looking to provide clarity to your staff, this guide will provide the answers you need. So, let’s dive right in and demystify the world of employer stock options and their taxation.

Understanding Employer Stock Options and Their Taxation

Introduction:

In today’s competitive job market, many employers offer stock options as part of their compensation packages. These stock options give employees the right to purchase company shares at a predetermined price, usually referred to as the exercise price. As employees exercise their stock options and potentially sell the shares, it’s important to understand the tax implications associated with such transactions. In this article, we will explore the ins and outs of employer stock options and their taxation to help you make informed decisions about your financial future.

1. What are Employer Stock Options?

Employer stock options are a type of employee benefit that allows employees to purchase company shares at a specific price within a certain period. They are often used as incentives to attract and retain talented employees. Here’s a closer look at the two main types of employer stock options:

a. Non-Qualified Stock Options (NQSOs):

Non-qualified stock options (NQSOs) are the most common type of employer stock options. With NQSOs, employees have the flexibility to exercise their options whenever they choose. The difference between the exercise price and the fair market value of the stock at the time of exercise is considered ordinary income and is subject to taxation.

b. Incentive Stock Options (ISOs):

Incentive stock options (ISOs) are typically offered to executives or key employees. Unlike NQSOs, ISOs offer potential tax benefits. When employees exercise ISOs, the difference between the exercise price and the fair market value of the stock is not subject to immediate taxation. Instead, it is taxed as a capital gain when the shares are sold.

2. Taxation of Employer Stock Options:

The taxation of employer stock options depends on various factors, including the type of options, the timing of their exercise, and the subsequent sale of the shares. Let’s delve into the tax implications associated with NQSOs and ISOs.

a. Taxation of Non-Qualified Stock Options (NQSOs):

When employees exercise their non-qualified stock options, the difference between the exercise price and the fair market value of the stock is treated as ordinary income. This amount is subject to income tax, Social Security tax, and Medicare tax. The employer typically withholds taxes from the employee’s paycheck to cover these obligations. It’s essential for employees to carefully plan their exercise of NQSOs to optimize tax outcomes.

b. Taxation of Incentive Stock Options (ISOs):

The taxation of incentive stock options (ISOs) is more favorable than that of non-qualified stock options. When employees exercise ISOs, they are not immediately subject to ordinary income tax. However, the spread between the exercise price and the fair market value of the stock is subject to the alternative minimum tax (AMT). It’s crucial for employees to understand the AMT rules and consult with a tax advisor to assess the potential implications.

3. Holding Periods and Tax Implications:

The timing of selling the stock acquired through exercising employer stock options can have an impact on the tax consequences. The two key holding periods to consider are the qualifying disposition period for ISOs and the short-term vs. long-term capital gains for NQSOs. Let’s explore each in more detail:

a. Qualifying Disposition Period for ISOs:

To receive favorable tax treatment for ISOs, employees must meet the qualifying disposition period. This period consists of two requirements: holding the stock for at least one year from the exercise date and at least two years from the grant date. If these requirements are met, the gain or loss from the sale is considered a long-term capital gain or loss, subject to lower tax rates.

b. Short-Term vs. Long-Term Capital Gains for NQSOs:

Non-qualified stock options are subject to short-term or long-term capital gains tax rates depending on the holding period. If the stock is sold within one year of exercise, any gain is considered a short-term capital gain, which is taxed at ordinary income tax rates. If the stock is held for longer than one year, the gain is considered a long-term capital gain, subject to more favorable tax rates.

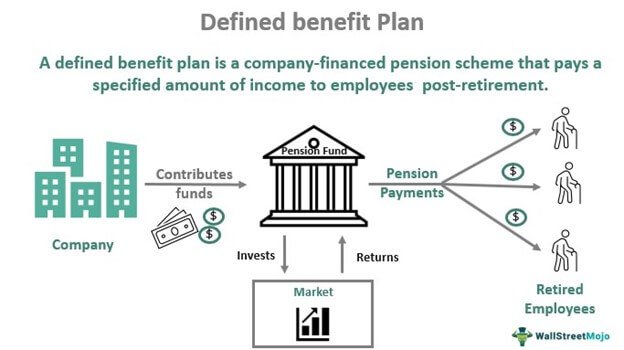

4. Employee Stock Purchase Plans (ESPPs) and Taxation:

Employee stock purchase plans (ESPPs) are another type of stock-based compensation offered by employers. ESPPs allow employees to buy company shares at a discounted price. The discount received on the purchase of stock through an ESPP is generally considered ordinary income and is subject to income tax, Social Security tax, and Medicare tax. The tax treatment of gains or losses from selling the ESPP shares depends on the holding period.

a. Qualifying Disposition for ESPPs:

To qualify for favorable tax treatment, employees must hold the ESPP shares for at least two years from the beginning of the offering period and one year from the purchase date. If the holding period requirements are met, any gain from the sale is considered a long-term capital gain and is taxed at lower rates.

b. Disqualifying Disposition for ESPPs:

If employees sell their ESPP shares before meeting the holding period requirements, the gain is subject to ordinary income tax rates. Any gain or loss above the discount received is treated as a short-term or long-term capital gain, depending on the holding period.

Conclusion:

Understanding employer stock options and their taxation is essential for making informed financial decisions. Whether you have non-qualified stock options, incentive stock options, or participate in employee stock purchase plans, knowing the tax implications can help you maximize your benefits. It’s advisable to consult with a tax advisor or financial planner to ensure you make the most of your stock options while minimizing any tax burdens. With careful planning and knowledge of the tax rules, you can navigate the world of employer stock options confidently.

Taxation of Employee Stock Options

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are employer stock options?

Employer stock options are a form of employee compensation that grants employees the right to purchase company shares at a predetermined price within a specific timeframe.

How do employer stock options work?

When employees are granted stock options, they have the opportunity to buy a specific number of shares at a set price, known as the exercise price or strike price. These options often come with a vesting period – a timeframe during which the employee must remain with the company to be eligible to exercise the options.

How are employer stock options taxed?

The taxation of employer stock options depends on various factors, including the type of options (incentive stock options or non-qualified stock options), the exercise price, and the holding period. Generally, the difference between the exercise price and the fair market value of the stock at exercise is considered taxable income to the employee.

What is the difference between incentive stock options (ISOs) and non-qualified stock options (NSOs)?

Incentive stock options (ISOs) are typically reserved for key employees and often come with tax advantages. They are subject to special tax treatment, including potential capital gains tax rates upon sale. Non-qualified stock options (NSOs) are more common and may be offered to employees at all levels. NSOs are subject to ordinary income tax rates upon exercise.

When should I exercise my employer stock options?

The decision of when to exercise stock options depends on various factors, including the stock price, tax implications, and personal financial goals. It is advisable to consult with a financial advisor or tax professional to evaluate the optimal timing and potential risks associated with exercising your options.

What happens if I leave the company before my stock options vest?

If you leave the company before your stock options fully vest, you may lose the unvested portion of your options. However, some employers offer a partial vesting schedule, allowing you to retain a percentage of your options based on the duration of your employment.

Can employer stock options be transferred or sold?

In most cases, employer stock options are non-transferable and cannot be sold. However, once exercised, the acquired shares may be subject to certain holding periods or other restrictions on their sale.

Are there any risks associated with employer stock options?

Yes, employer stock options come with inherent risks. The value of the stock may fluctuate, and there is no guarantee that the stock will appreciate in value over time. Additionally, there may be tax implications and potential financial loss if the stock price declines after exercising the options.

Please note that the information provided here is for general guidance only, and it is recommended to seek professional advice tailored to your specific circumstances.

Final Thoughts

Understanding employer stock options and their taxation is crucial for individuals to make informed financial decisions. By comprehending the workings of stock options and their tax implications, employees can take full advantage of the benefits offered by their employers. It is essential to recognize the potential tax liabilities associated with exercising stock options and selling the acquired shares. Being aware of the tax rules and regulations will enable individuals to plan effectively and optimize their financial outcomes. Educating oneself about employer stock options and taxation is a prudent step towards financial success.