Understanding financial ratios for investing can be a daunting task for many. However, worry not! In this article, we will dive into the world of financial ratios and demystify their significance in the realm of investing. From liquidity ratios to profitability ratios, we’ll explore how these metrics provide valuable insights into a company’s financial health and performance. So, if you’ve ever wondered how to make informed investment decisions or wanted to enhance your analytical skills, join us on this journey of understanding financial ratios for investing. Let’s get started!

Understanding Financial Ratios for Investing

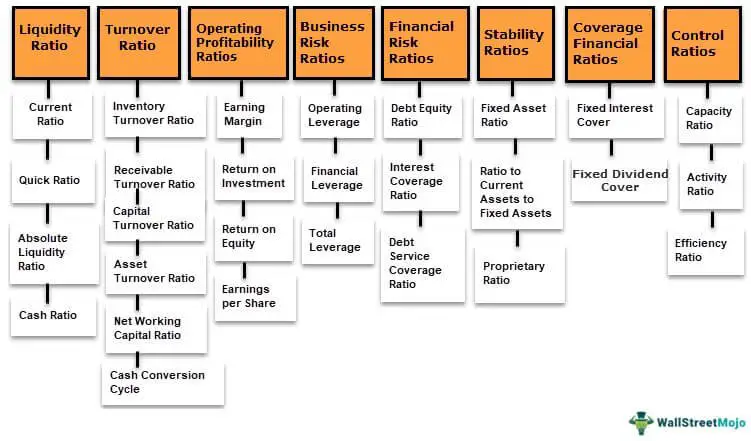

Financial ratios are crucial tools that help investors assess the financial health and performance of a company. By analyzing these ratios, investors can gauge a company’s profitability, liquidity, solvency, and overall efficiency. Understanding financial ratios is essential for making informed investment decisions and mitigating risks. In this article, we will delve into the world of financial ratios, exploring their significance and how to interpret them accurately.

Profitability Ratios

Profitability ratios provide insights into a company’s ability to generate profits in relation to its sales, assets, and investments. These ratios help investors identify if a company is efficiently utilizing its resources to generate returns. Here are some key profitability ratios to consider:

Gross Profit Margin

The gross profit margin ratio measures the percentage of sales revenue that remains after deducting the cost of goods sold (COGS). It indicates the company’s ability to control production costs. A higher gross profit margin is generally preferred, as it suggests efficient cost management.

Net Profit Margin

The net profit margin ratio indicates the percentage of sales revenue that remains as net profit after accounting for all expenses, including COGS, operating expenses, interest, and taxes. This ratio provides insights into a company’s overall profitability and efficiency in managing expenses.

Return on Assets (ROA)

Return on assets (ROA) measures how efficiently a company utilizes its assets to generate profits. It is calculated by dividing the net income by the average total assets. A higher ROA indicates better utilization of assets and higher profitability.

Liquidity Ratios

Liquidity ratios assess a company’s ability to meet its short-term obligations and manage its operational cash flow effectively. These ratios are crucial for understanding a company’s financial stability and its ability to handle unexpected financial challenges. Let’s explore some essential liquidity ratios:

Current Ratio

The current ratio measures a company’s ability to cover its short-term obligations using its current assets. It is calculated by dividing current assets by current liabilities. Investors generally prefer a current ratio of at least 1.5, as it suggests the company is in a good position to meet its short-term liabilities.

Quick Ratio

The quick ratio, also known as the acid-test ratio, is a more conservative measure of liquidity. It indicates a company’s ability to cover its immediate liabilities using its most liquid assets, excluding inventory. A higher quick ratio is generally desired, as it implies better financial stability.

Cash Ratio

The cash ratio evaluates a company’s ability to cover its short-term liabilities solely with its cash and cash equivalents. It provides insights into a company’s immediate liquidity position. A higher cash ratio signifies a stronger ability to meet obligations without relying on other assets.

Solvency Ratios

Solvency ratios help investors assess a company’s long-term financial stability and its ability to meet its long-term debt obligations. These ratios are especially important for evaluating the risk associated with investing in a company. Let’s explore some key solvency ratios:

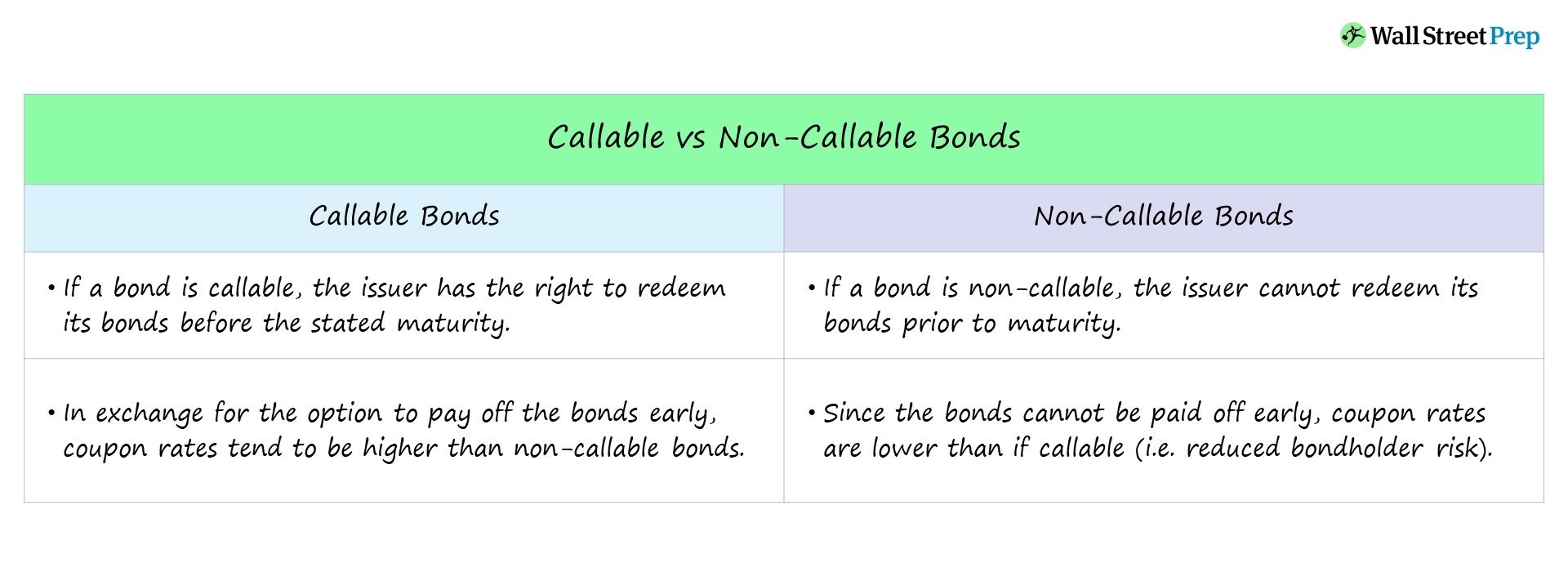

Debt-to-Equity Ratio

The debt-to-equity ratio compares a company’s total debt to its shareholders’ equity. It indicates the proportion of debt financing relative to equity financing, providing insights into a company’s financial leverage. A lower debt-to-equity ratio signifies lower financial risk.

Interest Coverage Ratio

The interest coverage ratio measures a company’s ability to cover its interest expenses using its operating income. This ratio is crucial for assessing a company’s ability to meet its interest payments on outstanding debt. Higher interest coverage ratios indicate greater financial stability.

Debt Ratio

The debt ratio evaluates the proportion of a company’s assets financed by debt. It measures the level of financial risk associated with a company’s capital structure. A lower debt ratio indicates a more conservative financial position, as the company relies less on debt financing.

Efficiency Ratios

Efficiency ratios assess how effectively a company manages its assets and liabilities to generate sales and profits. These ratios help investors understand a company’s operational efficiency and effectiveness. Let’s explore some key efficiency ratios:

Inventory Turnover Ratio

The inventory turnover ratio measures how quickly a company sells its inventory. It indicates the efficiency of inventory management. A higher inventory turnover ratio suggests efficient inventory control and sales, whereas a lower ratio may indicate slow-moving or obsolete inventory.

Accounts Receivable Turnover Ratio

The accounts receivable turnover ratio evaluates how efficiently a company collects its receivables from customers. It indicates how quickly a company converts its credit sales into cash. A higher turnover ratio implies effective credit management and timely collection of receivables.

Asset Turnover Ratio

The asset turnover ratio assesses how efficiently a company utilizes its assets to generate revenue. It calculates the sales generated per dollar of assets. A higher asset turnover ratio indicates better asset utilization and operational efficiency.

Understanding financial ratios is crucial for investors seeking to make informed investment decisions. These ratios provide valuable insights into a company’s financial health, profitability, liquidity, solvency, and efficiency. By analyzing and interpreting these ratios accurately, investors can assess the potential risks and rewards associated with investing in a particular company. It is important to note that financial ratios should not be considered in isolation but rather in conjunction with other relevant factors, such as industry trends and company-specific analysis. By combining these insights, investors can make more informed investment choices, increasing their chances of success in the ever-evolving world of finance.

FINANCIAL RATIOS: How to Analyze Financial Statements

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are financial ratios?

Financial ratios are analytical tools used to assess the performance and financial health of a company. They provide a quantitative way to measure the relationship between different elements of a company’s financial statements, such as profitability, liquidity, solvency, and efficiency.

Why are financial ratios important for investing?

Financial ratios provide valuable insights into a company’s financial strength and help investors make informed decisions. They allow investors to evaluate a company’s financial performance, compare it with competitors, identify trends, and assess the risks associated with an investment.

What are the common financial ratios used for investing?

Some common financial ratios used for investing include the price-to-earnings (P/E) ratio, return on investment (ROI), debt-to-equity ratio, current ratio, and gross profit margin. These ratios provide different perspectives on a company’s profitability, cash flow, leverage, and overall financial stability.

How can I interpret financial ratios?

Interpreting financial ratios involves comparing them to industry benchmarks, historical data, and competitors’ ratios. A ratio’s value alone may not provide meaningful insights, but when analyzed in relation to other ratios or industry averages, it can help identify strengths, weaknesses, and potential areas of concern.

What is the significance of the price-to-earnings (P/E) ratio?

The price-to-earnings (P/E) ratio is a widely used ratio to assess a company’s valuation. It compares the price of a company’s stock to the earnings per share (EPS). A high P/E ratio suggests that investors have high expectations for future growth, while a low P/E ratio may indicate undervaluation or potential investment opportunities.

How can financial ratios help identify a company’s profitability?

Financial ratios such as the gross profit margin, net profit margin, and return on investment (ROI) provide insights into a company’s profitability. These ratios measure how efficiently a company generates profits from its operations and can help investors evaluate the company’s ability to generate sustainable earnings.

What do liquidity ratios indicate?

Liquidity ratios, such as the current ratio and quick ratio, measure a company’s ability to meet short-term obligations and manage its working capital effectively. These ratios provide insights into a company’s liquidity position and its capacity to handle financial challenges, pay off debts, and cover day-to-day operational expenses.

How does the debt-to-equity ratio impact investment decisions?

The debt-to-equity ratio compares a company’s total debt to its shareholders’ equity and indicates the proportion of a company’s financing that comes from debt. A high debt-to-equity ratio suggests a higher level of financial risk, as the company relies more on borrowed funds. Investors typically consider a lower debt-to-equity ratio less risky and more attractive for investment.

Can financial ratios predict the future performance of a company?

Financial ratios provide insights into a company’s past and current financial performance, but they cannot predict the future with certainty. While financial ratios assist in assessing a company’s strengths and weaknesses, other factors such as economic conditions, industry trends, management decisions, and competitive landscape also play vital roles in determining future performance.

Final Thoughts

Understanding financial ratios for investing is crucial for making informed decisions in the stock market. These ratios provide valuable insights into a company’s financial health and performance, allowing investors to gauge its profitability, liquidity, and solvency. By analyzing ratios such as price-to-earnings (P/E), debt-to-equity (D/E), and return on investment (ROI), investors can assess a company’s valuation, leverage, and efficiency. This knowledge enables them to identify potential investment opportunities and manage risk effectively. Therefore, familiarizing oneself with financial ratios is essential for anyone looking to navigate the complex world of investing.