Health insurance premiums can be a confusing topic for many people. But fear not! Understanding health insurance premiums is not as daunting as it may seem. In this blog article, we will break down the ins and outs of health insurance premiums, providing you with the knowledge you need to make informed decisions about your healthcare coverage. So, if you’ve ever wondered what exactly health insurance premiums are and how they affect your wallet, look no further! Let’s dive right in and unravel the mystery behind understanding health insurance premiums.

Understanding Health Insurance Premiums

Introduction

Health insurance is an essential tool that provides financial protection against medical expenses. When selecting a health insurance plan, one of the crucial factors to consider is the premium. This article aims to help you understand health insurance premiums and their significance in your overall coverage. Whether you are new to health insurance or looking to switch plans, gaining a thorough understanding of premiums is vital in making informed decisions.

What are Health Insurance Premiums?

Health insurance premiums are the regular payments you make to your insurance provider in exchange for coverage. It is the price you pay to maintain your health insurance policy. The frequency of premium payments varies depending on the terms of your plan, but they are typically made monthly.

- Health insurance premiums can be paid by individuals or employers, depending on the type of coverage.

- The cost of health insurance premiums depends on various factors, including the level of coverage, the insurer, your age, location, and medical history.

- Premiums can also vary based on the type of plan, such as a Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), or High Deductible Health Plan (HDHP).

The Significance of Health Insurance Premiums

Understanding the significance of health insurance premiums is crucial for managing your healthcare costs effectively. Here are some key points to consider:

- Financial Protection: Paying health insurance premiums ensures that you have coverage in case of unexpected medical expenses. It provides a safety net and protects you from high out-of-pocket costs.

- Access to Healthcare: By paying premiums, you gain access to a network of healthcare providers and facilities. This enables you to receive medical services and treatments when needed, without worrying about the full cost.

- Preventive Care: Many health insurance plans cover preventive services, such as vaccinations, screenings, and wellness check-ups. These services are essential to maintaining good health and catching potential issues early, preventing more significant health problems in the future.

- Financial Planning: Health insurance premiums allow you to budget for your healthcare expenses. By knowing your monthly premium amount, you can plan and allocate funds accordingly, providing stability and peace of mind.

Factors Affecting Health Insurance Premiums

Several factors influence the cost of health insurance premiums. Understanding these factors will help you evaluate and compare different plans effectively:

- Age: Generally, health insurance premiums increase with age. Older individuals tend to have higher medical expenses, thus resulting in higher premiums.

- Location: The cost of healthcare can vary by geographic location. Premiums may be higher in areas with higher healthcare costs.

- Tobacco Use: Smokers are typically charged higher premiums due to the increased health risks associated with smoking.

- Health Status: Individuals with pre-existing conditions or a history of significant health issues may face higher premiums. Insurers consider these factors as indicators of potential higher medical expenses.

- Plan Type: Different plan types have varying premium levels. Plans with broader coverage or lower deductibles generally have higher premiums.

- Network: Insurance plans with larger networks of healthcare providers and specialists often come with higher premiums.

Calculating Health Insurance Premiums

The exact calculation of health insurance premiums is complex and handled by insurance providers. However, understanding the basics of premium calculation can help you make informed decisions:

- Base Rate: Insurers start with a base rate, which represents the average cost of healthcare for a particular group. This rate serves as a starting point for premium calculations.

- Age Rating: Insurers typically utilize an age rating system, where older individuals may be charged higher premiums due to increased healthcare risks.

- Location Rating: Premiums can vary based on geographic location, considering the cost of medical care in that area.

- Health Status Rating: Some insurance plans may consider an individual’s health status when determining premiums. This rating can include factors like pre-existing conditions or overall health history.

- Plan Category: The specific plan category, such as bronze, silver, gold, or platinum, can also affect premium levels. Plans with higher coverage levels often have higher premiums.

- Subsidies: Depending on your income and eligibility, you may qualify for government subsidies that can help lower your health insurance premiums.

Choosing the Right Health Insurance Premium

Selecting the right health insurance premium requires careful consideration of your unique needs and financial situation. Here are some factors to consider:

1. Budget and Affordability

It is crucial to assess how much you can comfortably allocate towards health insurance premiums in your monthly budget. Consider your other financial obligations and ensure that the premium amount is affordable for you in the long run.

2. Expected Healthcare Needs

Evaluate your healthcare needs based on your age, health status, and any specific medical conditions. If you anticipate frequent doctor visits, medications, or require specialized treatments, you may want a plan with higher coverage levels and slightly higher premiums.

3. Out-of-Pocket Costs

While considering premiums, also factor in potential out-of-pocket costs such as deductibles, copayments, and coinsurance. A plan with lower premiums may have higher cost-sharing, so strike a balance between premiums and expected out-of-pocket expenses.

4. Provider Network

Review the insurer’s network of healthcare providers to ensure you have access to the doctors and specialists you prefer. If you have specific healthcare professionals you wish to continue seeing, ensure they are included in the network associated with the health insurance plan you are considering.

5. Plan Types

Understand the different plan types available and their respective premium structures. Compare HMOs, PPOs, and HDHPs to determine which aligns best with your healthcare requirements and financial goals.

6. Additional Benefits

Consider any additional benefits or provisions offered by the insurance plan. Some plans may include coverage for alternative therapies, mental health services, or prescription drugs, which can add value and potentially offset higher premiums.

Understanding health insurance premiums is key to making informed decisions about your healthcare coverage. By comprehending the factors influencing premium costs and assessing your individual needs, you can select a health insurance plan that strikes the right balance between cost and coverage. Remember to evaluate your budget, expected healthcare needs, and provider network to find the premium that best suits your requirements. With the right health insurance premium, you can gain peace of mind and financial protection in times of medical need.

Understanding Health Insurance: Premiums

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are health insurance premiums?

Health insurance premiums are the regular payments you make to an insurance company in exchange for coverage and benefits. These payments are typically made monthly, quarterly, or annually.

How are health insurance premiums calculated?

Health insurance premiums are calculated based on several factors, including your age, location, tobacco use, and the plan options you choose. Insurance companies also consider the cost of medical services in your area when determining premium rates.

Can health insurance premiums change?

Yes, health insurance premiums can change. Insurance companies may adjust premiums annually based on various factors like rising healthcare costs, changes in regulations, or the overall health of the insured population.

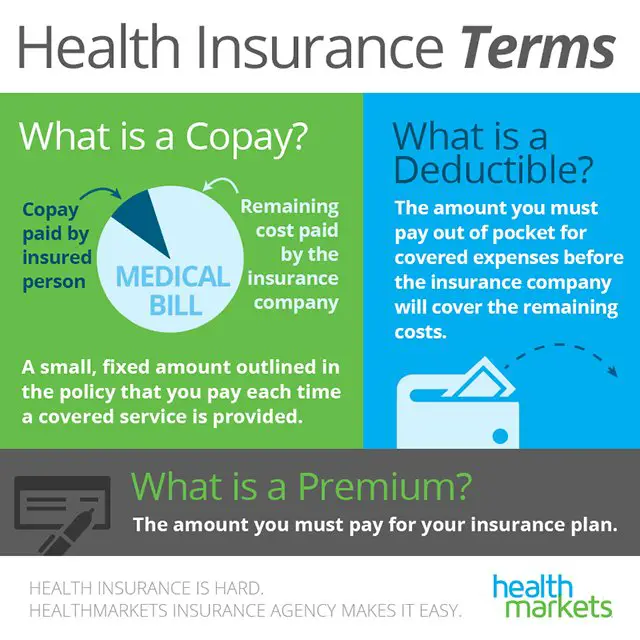

What is the difference between premium and deductible?

The premium is the amount you pay to have health insurance coverage. On the other hand, a deductible is the amount you must pay out of pocket before your insurance starts covering certain services.

Are health insurance premiums tax-deductible?

In some cases, health insurance premiums may be tax-deductible. However, eligibility for this deduction depends on factors like your total medical expenses and if you meet specific requirements set by tax laws. It is recommended to consult a tax professional for accurate guidance.

How can I lower my health insurance premiums?

There are a few ways you can potentially lower your health insurance premiums. One option is to choose a plan with a higher deductible, which often comes with lower premium costs. You can also explore government subsidies or discounts available based on your income.

What happens if I miss a premium payment?

If you miss a premium payment, your health insurance coverage may be at risk. Insurance companies generally provide a grace period for payment, but if you fail to make the payment within that time, your coverage could be terminated. It’s crucial to stay on top of premium payments to ensure continuous coverage.

Can I change my health insurance plan if I’m not satisfied with the premiums?

Yes, you can change your health insurance plan if you are not satisfied with the premiums or coverage. Open enrollment periods or qualifying life events often allow individuals to switch or enroll in different plans that better suit their needs and financial situation. It’s advisable to review all options and compare plans before making a decision.

Final Thoughts

Understanding health insurance premiums is essential for making informed decisions about our healthcare coverage. Premiums are the amount we pay for insurance coverage, and they can vary based on factors such as age, location, and health status. By comprehending how premiums are determined, we can better estimate our healthcare costs and select the most suitable plan for our needs. It is important to compare different premium options and consider the trade-offs between cost and coverage. With a clear understanding of health insurance premiums, we can navigate the complex healthcare system with confidence and ensure our financial well-being while maintaining access to quality care.