Have you ever found yourself scratching your head when it comes to understanding income tax brackets in the US? Well, look no further! In this blog article, we will demystify the complexities of income tax brackets and provide you with a clear understanding of how they work. Whether you’re a seasoned taxpayer or just starting your journey, this article will help you grasp the ins and outs of income tax brackets in the US. So, let’s dive in and shed some light on this often confusing topic.

Understanding Income Tax Brackets in the US

Introduction

Income tax is an essential aspect of the United States’ tax system, providing the necessary revenue for the government to function effectively. Understanding income tax brackets is key to managing your finances and ensuring you pay the correct amount of taxes. In this article, we will delve into the intricacies of income tax brackets, exploring how they work, how to calculate your tax liability, and providing helpful tips for optimizing your tax situation.

How Income Tax Brackets Work

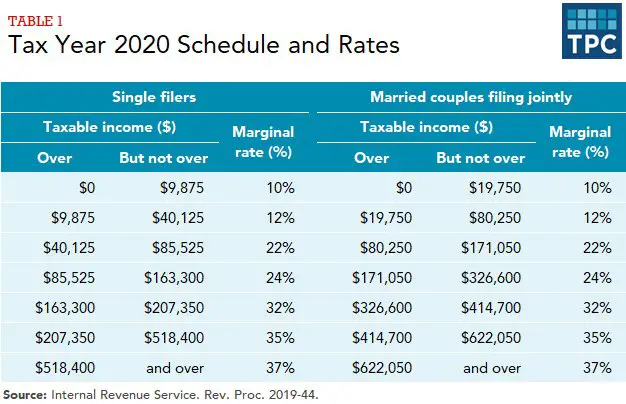

Income tax brackets are the ranges of income that determine the percentage of tax you owe to the government. The United States operates on a progressive tax system, which means that the higher your income, the higher the tax rate you will pay. Here’s how income tax brackets work:

1. Taxable Income: Your taxable income is the amount of money you earn each year after considering deductions, exemptions, and credits.

2. Marginal Tax Rate: The marginal tax rate is the tax rate applied to the last dollar of your taxable income within a specific tax bracket.

3. Tax Bracket Thresholds: Each tax bracket has an income range with corresponding tax rates. As your income surpasses the threshold of one bracket, the higher tax rate applies only to the portion of your income within that bracket.

For example, let’s consider the following tax brackets for the year 2021:

- 10% on income up to $9,950

- 12% on income between $9,951 and $40,525

- 22% on income between $40,526 and $86,375

- 24% on income between $86,376 and $164,925

- 32% on income between $164,926 and $209,425

- 35% on income between $209,426 and $523,600

- 37% on income over $523,600

If your taxable income for the year is $60,000, you would be subject to the following tax calculation:

- The first $9,950 is taxed at 10% = $995

- The remaining $50,050 ($60,000 – $9,950) is taxed at 12% = $6,006

- Total tax liability = $995 + $6,006 = $6,001

Strategies for Optimizing Your Tax Situation

Understanding income tax brackets empowers you to make informed decisions and potentially lower your tax liability. Here are some strategies to optimize your tax situation:

1. Maximize Deductions and Credits

- Deductions: Deductions reduce your taxable income, lowering the amount of income subject to tax. Common deductions include mortgage interest, state and local taxes, student loan interest, and medical expenses.

- Credits: Tax credits directly reduce your tax liability, providing a dollar-for-dollar reduction. Take advantage of credits such as the Child Tax Credit, Earned Income Credit, and Education Credits to lower your overall tax bill.

2. Contribute to Retirement Accounts

Retirement contributions to accounts like Individual Retirement Accounts (IRA) and 401(k) plans can help lower your taxable income. These contributions are often tax-deductible, meaning they reduce your taxable income and potentially move you into a lower tax bracket. Additionally, growth within these accounts is tax-deferred until withdrawal.

3. Timing of Income and Expenses

Controlling the timing of your income and expenses can impact your tax liability. Consider strategies such as:

- Income: If you expect a significant increase in income in the coming year, it might be beneficial to delay receiving the income until the following year to keep yourself in a lower tax bracket.

- Expenses: Conversely, consider accelerating deductible expenses, such as mortgage payments or charitable contributions, into the current tax year to maximize their impact on reducing your taxable income.

4. Utilize Tax-Advantaged Accounts

Exploring tax-advantaged accounts like Health Savings Accounts (HSA) or Flexible Spending Accounts (FSA) can provide opportunities to save on taxes. Contributions to HSAs are tax-deductible, and withdrawals used for qualified medical expenses are tax-free. FSAs offer pre-tax contributions that can be used for eligible medical or dependent care expenses.

Calculating Your Income Tax

To calculate your income tax liability, follow these steps:

1. Determine Your Taxable Income: Calculate your taxable income by subtracting deductions, exemptions, and credits from your total income.

2. Identify the Applicable Tax Bracket: Refer to the IRS tax brackets for the corresponding tax rates based on your taxable income.

3. Apply the Marginal Tax Rates: Calculate the tax owed within each bracket by applying the respective marginal tax rate to the income within that bracket.

4. Sum the Tax Owed in Each Bracket: Add up the tax owed within each bracket to arrive at your total tax liability.

Understanding income tax brackets in the US is crucial for managing your financial responsibilities effectively. By knowing how these brackets work, you can make informed decisions to optimize your tax situation and potentially reduce your overall tax liability. Remember to consult with a tax professional for personalized advice tailored to your unique circumstances. Take control of your taxes, make strategic decisions, and ensure you comply with the tax laws while minimizing your tax burden.

Tax Brackets Explained For Beginners

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What are income tax brackets in the US?

Income tax brackets in the US are ranges of income levels that determine the tax rate applied to individuals or households. The tax rates increase as the income level rises, and individuals are required to pay taxes based on their specific bracket.

How do income tax brackets work?

Income tax brackets work by dividing taxable income into different ranges. Each range represents a different tax rate, and the applicable tax rate is applied only to the portion of income within that specific bracket.

How are income tax brackets determined?

Income tax brackets are determined by federal legislation. The US government periodically adjusts the brackets to account for inflation and changes in tax policy. The IRS publishes the current tax brackets annually, and they are based on filing status (single, married filing jointly, head of household, etc.) and income level.

What is marginal tax rate?

The marginal tax rate is the tax rate applied to the last dollar of income earned within a particular tax bracket. It is the highest tax rate individuals pay on their income. It’s important to note that the marginal tax rate does not apply to all of an individual’s income, only the portion that exceeds the previous bracket.

Can I be in multiple tax brackets at the same time?

No, you cannot be in multiple tax brackets simultaneously. Your income falls into a specific bracket based on your taxable income, and you are subject to the tax rate applicable to that bracket.

Do tax brackets change every year?

Yes, tax brackets can change annually based on tax legislation and adjustments made by the government to account for inflation and other economic factors. It’s important to stay updated on the current tax brackets each year.

How can I determine my taxable income?

To determine your taxable income, you need to subtract any deductions or exemptions you qualify for from your total income. The resulting amount is your taxable income, which is used to determine the tax bracket you fall into.

What happens if I fall into a higher tax bracket?

If your income exceeds the threshold of your current tax bracket and enters a higher tax bracket, only the portion of income that exceeds the lower bracket’s limit will be taxed at the higher rate. The remaining income within the lower bracket continues to be taxed at its original rate.

Are income tax brackets the same for all states in the US?

No, income tax brackets can vary from state to state. Some states have a progressive tax system similar to the federal government, while others may have a flat tax rate or no income tax at all. It is important to research the tax laws specific to your state.

Final Thoughts

Understanding income tax brackets in the US is crucial for managing personal finances. By familiarizing ourselves with these brackets, we can make informed decisions about how we earn, spend, and save our money. Knowing which income tax bracket we fall into helps us understand our tax liability and allows us to plan accordingly. By understanding the different tax rates associated with each bracket, we can strategize our income and deductions to maximize our tax savings. Keeping track of changes in tax laws and staying informed about current tax brackets ensures that we are well-prepared to navigate our financial responsibilities effectively.